Market Overview

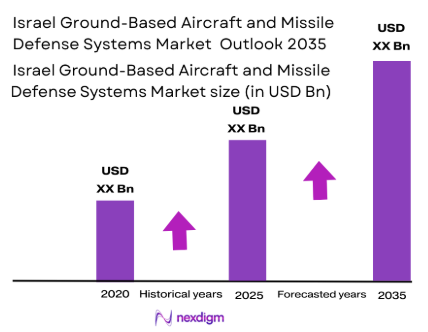

The Israel Ground-Based Aircraft and Missile Defense Systems market is a critical segment within the global defense industry. Valued at approximately USD ~ billion in 2025, the market is expanding due to Israel’s strategic defense needs and its continuous technological advancements. Driven by increased regional security threats, defense budget allocations, and the constant evolution of defense systems, Israel’s defense sector remains a global leader in missile defense innovation. The Israeli government’s consistent investment in research and development, particularly in missile defense systems like the Iron Dome, plays a pivotal role in maintaining this market’s growth trajectory.

Israel is at the forefront of the ground-based aircraft and missile defense systems market, with cities like Tel Aviv and Haifa playing significant roles due to their proximity to major defense research and development centres. Israel’s defense dominance can be attributed to its cutting-edge technology, extensive defense infrastructure, and partnerships with other countries for joint defense initiatives. The country’s geopolitical location, facing potential threats from neighboring regions, makes its defense systems essential for national security, which contributes to its leadership in missile defense technologies.

Market Segmentation

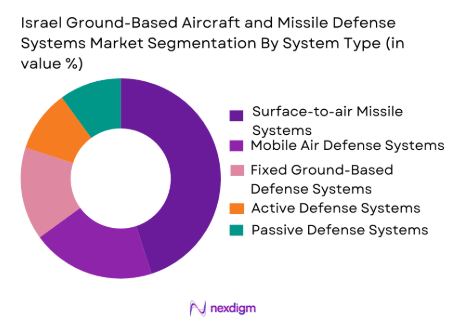

By System Type

The Israel Ground-Based Aircraft and Missile Defense Systems market is primarily segmented by system type into surface-to-air missile systems, mobile air defense systems, fixed ground-based defense systems, active defense systems, and passive defense systems. Among these, surface-to-air missile systems dominate the market. The growing threat of airborne attacks, combined with Israel’s advanced radar and interception technologies, has fuelled the demand for surface-to-air missile systems. These systems are integral to Israel’s national defense strategy, with a robust portfolio of systems such as the Iron Dome, David’s Sling, and Arrow systems.The surface-to-air missile systems offer high reliability and quick-response capabilities, making them the preferred choice for the Israeli Defense Forces (IDF). Their success in intercepting rockets and aircraft has ensured they remain a dominant segment in the market.

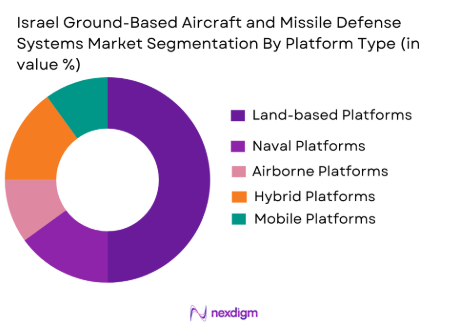

By Platform Type

Platform types in this market include land-based platforms, naval platforms, airborne platforms, hybrid platforms, and mobile platforms. Land-based platforms have the largest share due to Israel’s focus on securing its borders and strategic military sites against airborne threats. The robust demand for land-based defense systems is further supported by the country’s highly specialized defense infrastructure, which can quickly deploy missile defense systems across key land regions.

The increased focus on protecting critical infrastructure and military bases has led to the dominance of land-based platforms, which are highly effective in intercepting missiles from various sources, especially those launched by neighboring hostile entities. Moreover, Israel’s ongoing efforts to strengthen its defense architecture with advanced technologies have bolstered the demand for land-based missile defense systems.

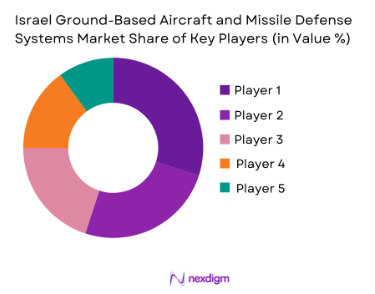

Competitive Landscape

The Israel Ground-Based Aircraft and Missile Defense Systems market is dominated by several key players that contribute significantly to the country’s defense capabilities. The market features both domestic companies, like Rafael Advanced Defense Systems and Israel Aerospace Industries, and international firms, such as Lockheed Martin and Raytheon, which collaborate with Israeli defense entities.

| Company Name | Established Year | Headquarters | Technology Innovation | Government Contracts | Global Partnerships | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | Advanced radar and missile interception | High | Strong | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | Space and missile defense systems | High | Strong | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | Multi-platform missile systems | High | Global | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | Advanced missile systems and defense technologies | High | Extensive | ~ | ~ | ~ | ~ |

Israel Ground-Based Aircraft and Missile Defense Systems Market Analysis

Growth Drivers

Escalating Regional Security Threats and Advanced Threat Environment

fundamental driver of the Israel ground‑based aircraft and missile defense systems market is the persistent and escalating security environment in the Middle East, compelling the Israeli government and military to invest heavily in multi‑tiered defense capabilities. Israel’s integrated defense architecture — including Iron Dome for short‑range threats, David’s Sling for medium range, and Arrow systems for long‑range ballistic missiles — has been repeatedly tested against real combat scenarios, proving effective in intercepting large salvos of rockets and ballistic threats. This operational validation underpins national defense procurement and attracts international interest, strengthening export demand. The surge in defense exports, with Israeli defense exports topping USD ~billion in 2025 — of which missiles and air‑defense systems comprised a significant portion — reflects global recognition of Israel’s protective technologies and further drives investment into the sector.

Technological Innovation and International Strategic Partnerships

Technological innovation is another major driver shaping the Israel missile defense market. Israel consistently advances next‑generation systems, demonstrated by the recent operational deployment of the Iron Beam high‑power laser defense system, designed to counter drones and low‑cost aerial threats while reducing per‑engagement costs. Such cutting‑edge developments stem from significant collaboration between defense firms like Rafael and Israel Aerospace Industries with international partners like the U.S. Missile Defense Agency, bolstering system capabilities and interoperability. These partnerships promote technology transfer and ensure access to broader global defense ecosystems. Additionally, strategic international contracts — such as the multibillion‑dollar expansion of the Arrow system with Germany — not only validate system effectiveness but also embed Israeli defense technologies into allied nations’ security infrastructures, thereby enhancing long‑term market growth and spurring further research and development investment.

Market Challenge

High Development Costs and Production Complexities

One of the most pressing challenges for the Israel ground‑based aircraft and missile defense systems market is the exceptionally high cost of developing, producing, and sustaining state‑of‑the‑art defense technologies. Advanced systems such as Iron Dome, David’s Sling, and the Arrow family require substantial investment in high‑end engineering, precision‑manufacturing infrastructure, and ongoing enhancements to remain effective against evolving threats. These costs can strain defense budgets and complicate procurement planning, especially as continuous modernization is necessary to maintain defense efficacy. Furthermore, the intricate nature of integrating multi‑layered systems, sensors, command‑and‑control networks, and interceptor technologies increases production complexity and time‑to‑deployment. Balancing technological superiority with cost efficiency remains a strategic challenge that requires robust fiscal planning and prioritization of key capability areas to ensure resources are dedicated effectively without undermining national defense readiness.

Regulatory Constraints and Export Controls

Another significant challenge for the Israel missile defense market is navigating rigid regulatory frameworks and export control mechanisms that govern international defense sales. Given the sensitive nature of missile defense technologies, Israel must comply with both domestic regulations and the stringent laws of importing countries, particularly those with strict oversight on advanced weapons technologies. Export license requirements, end‑use monitoring, and geopolitical considerations can delay or limit market access, especially in regions wary of sophisticated defense systems. Additionally, political shifts and diplomatic pressures — as seen in some contract cancellations or opposition to Israeli military technology in certain nations — can impede sales and long‑term partnerships. Overcoming these regulatory hurdles demands a coordinated diplomatic strategy, nuanced understanding of export laws, and proactive engagement with allied governments to secure market penetration while ensuring compliance and ethical defense cooperation.

Opportunities

Expansion into Emerging Global Defense Markets

A significant opportunity for the Israel ground‑based aircraft and missile defense systems market lies in expanding into emerging defense markets across Asia, Africa, and Europe, where countries are actively modernizing their military capabilities in response to regional security challenges. The demonstrated effectiveness of Israeli systems in real‑world conflicts offers a strong value proposition for nations seeking proven defensive solutions against ballistic missiles, artillery rockets, and UAV threats. With export revenues for Israeli defense technology reaching record highs, there is clear momentum to broaden international footprints by adapting systems to meet diverse geopolitical and tactical needs. Additionally, collaboration with local defense industries through co‑development or licensed production arrangements can accelerate market entry, build long‑term strategic ties, and enable technology transfer that aligns with buyer nations’ industrial objectives. This global demand surge represents a substantial growth avenue beyond Israel’s domestic requirements.

Integration of Next‑Generation Technologies and AI

The ongoing integration of next‑generation technologies such as artificial intelligence, machine learning, directed‑energy weapons, and advanced sensor networks presents a major opportunity for the Israel missile defense sector. AI‑driven targeting and threat‑prediction systems can significantly enhance interception accuracy and reduce response times, elevating defense performance against increasingly sophisticated aerial threats. Laser‑based systems like Iron Beam open new cost‑efficient engagement options for low‑altitude targets and continued technological evolution can redefine future defense paradigms. Embracing these technologies not only strengthens system capabilities but also unlocks new product lines and service offerings that appeal to both domestic and international customers. By positioning itself at the forefront of technological innovation, Israel can lead the global transition toward smarter, more responsive air defense ecosystems while capturing first‑mover advantages in emerging defense technology niches.

Future Outlook

Over the next decade, the Israel Ground-Based Aircraft and Missile Defense Systems market is expected to experience continued growth. This growth will be fueled by Israel’s ongoing security threats from neighboring regions, technological advancements in missile defense systems, and the global demand for advanced defense solutions. The market will likely see innovations in artificial intelligence, machine learning, and radar systems to further enhance defense capabilities. Additionally, international collaborations and defense agreements will play a significant role in expanding market opportunities.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- BAE Systems

- Leonardo

- Elbit Systems

- Saab

- Northrop Grumman

- Kongsberg Gruppen

- MBDA

- L3Harris Technologies

- General Dynamics

- Honeywell International

Key Target Audience

- Defense Contractors

- Government and Regulatory Bodies

- Military and Defense Agencies

- Investments and Venture Capitalist Firms

- Aerospace Manufacturers

- Missile Defense Operators

- International Defense Alliances

- Technology Solution Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical variables that impact the Israel Ground-Based Aircraft and Missile Defense Systems market. This includes understanding technological advancements, geopolitical factors, and defense requirements through secondary research and data from reputable sources.

Step 2: Market Analysis and Construction

We will collect and analyse historical data related to the market. This includes assessing defense expenditures, the evolution of missile defense technologies, and market trends. We will also evaluate service quality and system performance data, ensuring the data is reliable for forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through interviews with industry experts and military practitioners. These consultations will provide operational insights, validating and refining the hypotheses related to market growth, technology adoption, and geopolitical impacts.

Step 4: Research Synthesis and Final Output

This phase involves consolidating the insights from primary and secondary research and synthesizing them into a comprehensive market report. The findings will be verified through engagement with key industry stakeholders, ensuring the accuracy and relevance of the final output.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions and security threats in the region

Advancements in missile defense technology and system integration

Increased defense budgets and government support for advanced systems - Challenges

High cost of development and system integration

Complex regulatory environment and certification processes

Limitations in system interoperability with existing platforms - Opportunities

Growing demand for multi-layered defense solutions

Strategic partnerships with global defense organizations

Expansion into emerging markets with defense collaboration - Trends

Integration of AI and machine learning in missile defense systems

Adoption of modular and scalable defense solutions

Increasing interest in joint defense programs with allied countries

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Surface-to-air Missile Systems

Mobile Air Defense Systems

Fixed Ground-Based Defense Systems

Active Defense Systems

Passive Defense Systems - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Airborne Platforms

Hybrid Platforms

Mobile Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit

Upgrades

Modular Fitment

Custom Fitment - By End User Segment (In Value%)

Military

Government Agencies

Aerospace & Defense Contractors

Private Security Contractors

International Alliances & Partners - By Procurement Channel (In Value%)

Direct Procurement

Tenders & Bidding

Private Sector Deals

Government & Military Auctions

Third-party Contractors

- Market Share Analysis

- Cross Comparison Parameters (Technology innovation, system integration capabilities, cost-effectiveness, government contracts, international partnerships)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

IMI Systems

Thales Group

Lockheed Martin

Raytheon Technologies

Northrop Grumman

BAE Systems

Leonardo

Saab

MBDA

Kongsberg Gruppen

L3Harris Technologies

General Dynamics

- Enhanced demand from military and defense agencies

- Rising investment by international defense contractors

- Shift towards advanced defense solutions by private security contractors

- Strong focus on R&D and innovation for end-user customization

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035