Market Overview

The Israel high altitude pseudo satellites market is experiencing robust growth, primarily fueled by advancements in unmanned aerial vehicles (UAVs) and aerospace technology. As of 2023, the market size is valued at USD ~ billion and is expected to reach USD ~ billion by 2024. The market is driven by increasing demand for persistent surveillance, communications, and environmental monitoring capabilities in both military and commercial applications. Technological advancements, including enhanced battery life, autonomous flight capabilities, and integration with satellite systems, have bolstered market expansion. Governments and defense organizations continue to invest heavily in high-altitude pseudo satellites (HAPS) to improve border security, disaster management, and communication infrastructure.

Israel is the leading market for high altitude pseudo satellites due to its strategic emphasis on defense and aerospace technology. The country’s high-tech industry is supported by a robust defense sector, with companies such as Israel Aerospace Industries (IAI) and Elbit Systems being at the forefront of developing innovative high-altitude systems. Furthermore, Israel’s geographical location in the Middle East makes it a key player in surveillance and reconnaissance applications, driving the demand for pseudo satellites. The nation has also fostered a conducive regulatory environment and provided funding for the development of advanced aerospace technologies, maintaining its dominance in this emerging market.

Market Segmentation

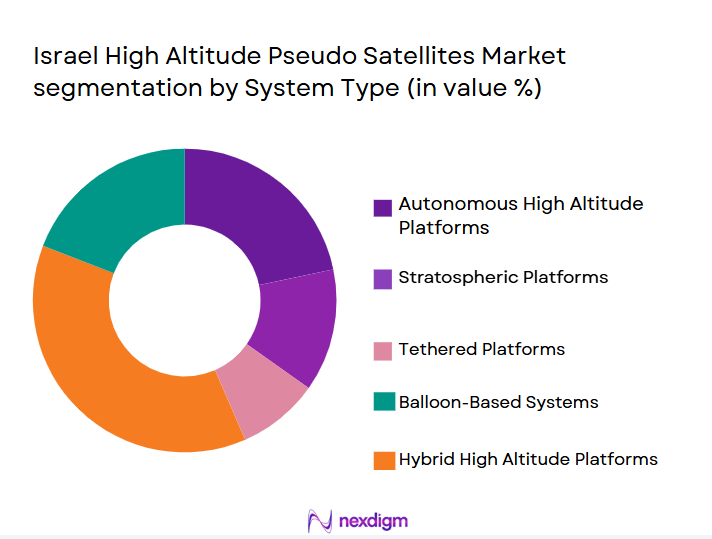

By System Type

The Israel high altitude pseudo satellites market is segmented by system type into solar-powered systems, hybrid propulsion systems, conventional aircraft-based systems, autonomous flight systems, and integrated satellite systems. Among these, solar-powered systems hold the dominant market share in 2024 due to their cost-efficiency and extended operational capabilities. Solar-powered systems have an inherent advantage in high-altitude operations as they are not reliant on fuel-based engines, making them more sustainable for long-duration flights. Leading manufacturers, such as Israel Aerospace Industries and Elbit Systems, have developed sophisticated solar-powered platforms that ensure long endurance while reducing operational costs, which further drives the demand for these systems in both defense and commercial sectors.

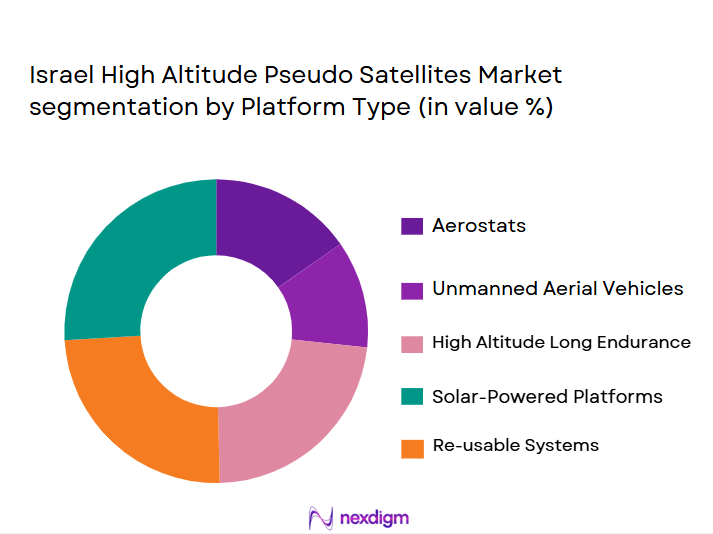

By Platform Type

The market is also segmented by platform type into aerial platforms, stratospheric platforms, orbital platforms, geostationary platforms, and low Earth orbit platforms. Stratospheric platforms dominate the market in 2024, as they offer the optimal altitude for pseudo satellites to remain operational for extended periods while avoiding interference from lower-altitude air traffic. Stratospheric platforms are ideal for high-altitude, long-endurance surveillance and communication tasks, which has made them particularly attractive to both defense and commercial users. Companies like IAI have developed innovative stratospheric platforms, which allow for stable and reliable performance in critical mission areas, solidifying their dominance in this segment.

Competitive Landscape

The Israel high altitude pseudo satellites market is dominated by a few key players, such as Israel Aerospace Industries (IAI), Elbit Systems, and Aeronautics Ltd., along with a mix of global and regional companies. These companies have established strong market positions by leveraging their cutting-edge technological innovations and a robust understanding of the defense and aerospace sectors. The market landscape is characterized by high competition in both R&D and procurement contracts, especially for government and defense projects.

| Company | Establishment Year | Headquarters | R&D Investment | Technological Innovation | Global Reach | Military Applications | Partnerships with Governments | Product Portfolio |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Ltd. | 1997 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| UVision Air | 2009 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel High Altitude Pseudo Satellites Market Dynamics

Growth Drivers

Advancements in Autonomous Aerial Vehicle Technologies

The increasing adoption of autonomous aerial vehicle (AAV) technologies plays a pivotal role in the growth of the Israel high altitude pseudo satellites market. In 2024, the Israeli government continues to invest heavily in AI-driven technology for military and commercial applications, with a focus on autonomous flight systems for unmanned aerial vehicles (UAVs). In 2023, Israel Aerospace Industries (IAI) successfully tested an autonomous high-altitude UAV system that can operate for extended durations without human intervention. Furthermore, the expansion of AI research, with Israel ranking 7th globally in AI research, is expected to further enhance the capabilities of high-altitude systems, driving their adoption for both surveillance and communication purposes. This technology advancement is further supported by Israel’s advanced defense technology, which has received substantial government funding, with an allocation of $~ billion to Israel’s defense budget for technology R&D in 2024.

Increased Demand for Persistent Surveillance Capabilities

There has been a significant surge in demand for persistent surveillance capabilities in regions like the Middle East and parts of Africa. Israel’s strategic location and its geopolitical landscape have heightened the necessity for surveillance, especially for defense and border security applications. In 2024, Israel’s Ministry of Defense is expected to expand its budget by ~% to enhance surveillance technologies, with particular emphasis on unmanned systems. The global demand for real-time surveillance has been facilitated by advancements in satellite and UAV technologies. The Ministry of Defense’s increased spending on surveillance capabilities—reaching up to $~ billion in 2024—is indicative of the growing reliance on pseudo satellites for sustained surveillance.

Market Challenges

Technological Complexity and Cost of High-Altitude Systems

Despite their potential, high-altitude pseudo satellite systems face significant technological challenges, particularly regarding their complexity and cost. Developing and maintaining these systems is capital and resource-intensive. In 2024, Israel’s Aerospace sector is projected to invest $~ billion into R&D for advanced high-altitude systems to overcome these hurdles. This funding includes the development of systems capable of long-duration flights in extreme conditions, which significantly increases the technological complexity. Additionally, the cost of building reliable high-altitude platforms remains a concern. Current estimates indicate that the cost of developing a high-altitude UAV system can reach up to $~ million per unit, presenting a significant challenge for widespread adoption, particularly in emerging market.

Regulatory Restrictions on Autonomous Aircraft Operations

While autonomous flight technologies have advanced significantly, regulatory restrictions on autonomous aircraft operations continue to pose a significant challenge. In 2024, Israel’s Civil Aviation Authority has imposed stricter guidelines on the use of unmanned aerial systems, particularly those operating at high altitudes. The challenge lies in ensuring that these high-altitude platforms do not interfere with other air traffic or violate aviation laws. Regulatory bodies are working to streamline these processes, but there is a continued need for more comprehensive legal frameworks. This regulatory uncertainty complicates the market growth, as manufacturers must navigate complex approval processes before bringing products to market.

Market Opportunities

Expansion of Civilian Applications in Telecommunications

The expansion of civilian applications, especially in telecommunications, offers significant growth opportunities for the high altitude pseudo satellites market. Israel’s telecom industry has experienced rapid growth in recent years, driven by increased demand for high-speed internet and communication services. In 2024, the country’s telecom sector is projected to generate over $~ billion in revenue, with high-altitude platforms playing a critical role in providing coverage in remote and rural areas. Israel’s burgeoning 5G network and plans for future smart city integrations are expected to rely heavily on HAPS to deliver consistent connectivity in areas where traditional infrastructure cannot reach. As 5G networks are deployed more widely, the need for high-altitude platforms will continue to rise.

Integration with Emerging 5G and IoT Networks

Israel’s commitment to advancing 5G and IoT technologies presents a lucrative opportunity for the high-altitude pseudo satellites market. In 2024, Israel is forecasted to be among the first countries to implement nationwide 5G connectivity, with expectations that over 90% of the population will have access to high-speed 5G services. High-altitude pseudo satellites are poised to complement 5G and IoT networks, enabling seamless connectivity even in the most isolated regions. The integration of HAPS with 5G is projected to enhance network coverage and data throughput, particularly in rural and underdeveloped areas. With the government and private sectors investing heavily in 5G infrastructure, the demand for satellite alternatives in supporting this network is expected to increase exponentially.

Future Outlook

Over the next decade, the Israel high altitude pseudo satellites market is expected to grow significantly, driven by continuous advancements in UAV technologies and increased military and commercial demand for surveillance and communication systems. Israel’s strategic location and its commitment to defense innovation will keep it at the forefront of the market. Additionally, the integration of new technologies such as artificial intelligence (AI) and machine learning in pseudo satellites is expected to further drive market growth, offering enhanced capabilities for real-time data processing, autonomous operations, and optimized flight endurance.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Aeronautics Ltd.

- IMI Systems

- UVision Air

- Skylark Drones

- Rada Electronic Industries

- Ashtrom Group

- Avnon Group

- Rafael Advanced Defense Systems

- Magal Security Systems

- Inverto Group

- Gilat Satellite Networks

- AeroVironment

- Leonardo S.p.A.

Key Target Audience

- Aerospace Manufacturers

- Military and Defense Contractors

- Government Agencies (Israel Ministry of Defense, U.S. Department of Defense)

- Satellite Communication Providers

- Environmental Monitoring Agencies

- Investments and Venture Capitalist Firms

- Regulatory Bodies (Federal Aviation Administration)

- Telecommunications Provider

Research Methodology

Step 1: Identification of Key Variables

The first step of the research methodology involves identifying the key variables that influence the high altitude pseudo satellites market. This involves conducting in-depth desk research to map out the ecosystem of stakeholders, including manufacturers, government bodies, and end-users. Proprietary and secondary data sources are used to define the relevant market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

This step involves the collection and analysis of historical data to evaluate market trends, revenue generation, and growth trajectories. Through analyzing existing market data, forecasts for the Israel high altitude pseudo satellites market are built, identifying emerging sub-segments and key technological advancements.

Step 3: Hypothesis Validation and Expert Consultation

To validate the hypotheses, primary data is gathered through consultations with industry experts and practitioners from the aerospace and defense sectors. Expert interviews will provide a first-hand look into market conditions, technological innovations, and government policies that affect the market. |

Step 4: Research Synthesis and Final Output

In the final phase, insights from primary and secondary sources are synthesized, and the market dynamics, forecasts, and competitor landscapes are finalized. Validation from industry leaders ensures the accuracy and reliability of the market analysis, resulting in a comprehensive final report.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in autonomous aerial vehicle technologies

Increased demand for persistent surveillance capabilities

Rising need for satellite alternatives in remote regions - Market Challenges

Technological complexity and cost of high-altitude systems

Regulatory restrictions on autonomous aircraft operations

Concerns over data security and interception - Market Opportunities

Expansion of civilian applications in telecommunications

Integration with emerging 5G and IoT networks

Strategic partnerships with defense contractors - Trends

Growing adoption of hybrid propulsion systems

Increased reliance on AI and machine learning for autonomous navigation

Development of multi-purpose pseudo satellite platforms

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Solar-powered Systems

Hybrid Propulsion Systems

Conventional Aircraft-based Systems

Autonomous Flight Systems

Integrated Satellite Systems - By Platform Type (In Value%)

Aerial Platforms

Stratospheric Platforms

Orbital Platforms

Geostationary Platforms

Low Earth Orbit Platforms - By Fitment Type (In Value%)

Fixed Wing Integration

Rotary Wing Integration

Modular Fitments

Quick Deployments

All-in-one Systems - By EndUser Segment (In Value%)

Military & Defense

Commercial Communications

Environmental Monitoring

Search and Rescue Operations

Telecommunications - By Procurement Channel (In Value%)

Direct Sales

Channel Partnerships

Online Retailers

Government Procurement

Third-party Integrators

- Market Share Analysis

- Cross Comparison Parameters

(Power Efficiency, Payload Capacity, Altitude Range, Data Transmission Speed, System Cost Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Aeronautics Ltd.

IMI Systems

IAI Malat

Skylark Drones

UVision Air

Rada Electronic Industries

Ashtrom Group

Avnon Group

Rafael Advanced Defense Systems

Magal Security Systems

Inverto Group

Gilat Satellite Networks

AeroVironment

- Growing interest from military sectors for surveillance and reconnaissance

- Commercial interest in providing persistent communication networks

- Rising demand for real-time environmental monitoring

- Shift towards telecommunication services in remote regions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035