Market Overview

The Israel homeland security and emergency management market has experienced steady growth in recent years, driven by increasing national security concerns and technological advancements in defense systems. In 2023, the market was valued at approximately USD ~ billion, and this trend is expected to continue with further investments from both government and private entities. Key drivers include heightened terrorist threats, growing cybersecurity risks, and the demand for advanced surveillance systems. In addition, Israel’s position as a global leader in military technology, innovation, and defense infrastructure plays a critical role in the expansion of the market.

Israel is the primary player in the homeland security and emergency management sector, largely due to its extensive investments in security infrastructure and its expertise in defense technologies. Tel Aviv, as the country’s innovation hub, houses numerous defense companies that lead in military and emergency management solutions. Jerusalem also plays a significant role as the political center, where strategic defense and security decisions are made. Israel’s dominance is further supported by its advanced research and development capabilities in defense technology, including cybersecurity, surveillance systems, and emergency response solutions.

Market Segmentation

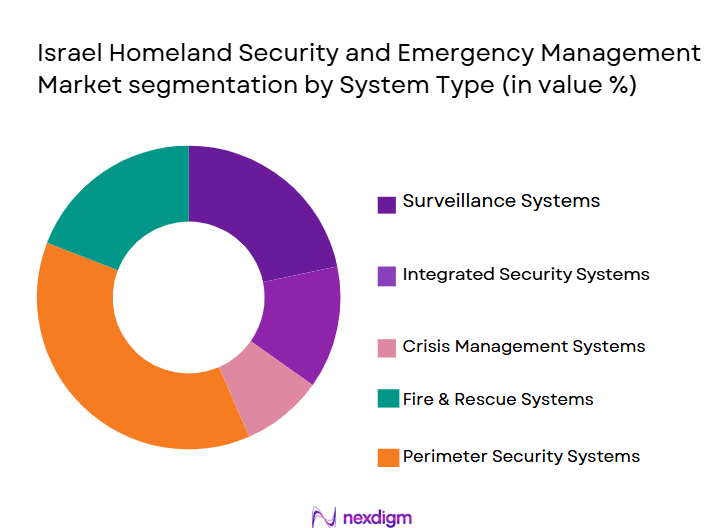

By System Type

The Israel homeland security and emergency management market is segmented by system type into surveillance systems, access control systems, cybersecurity systems, biometric identification systems, and emergency response systems. Among these, surveillance systems hold a dominant share of the market. The primary reason for this dominance is Israel’s focus on border security and counter-terrorism. With a continuous need to monitor and protect key infrastructure, surveillance systems such as video surveillance and drone surveillance are widely implemented across various sectors, including government, military, and critical infrastructure. Furthermore, Israel’s expertise in surveillance technology and high-quality systems makes it a global leader, driving the growth of this segment.

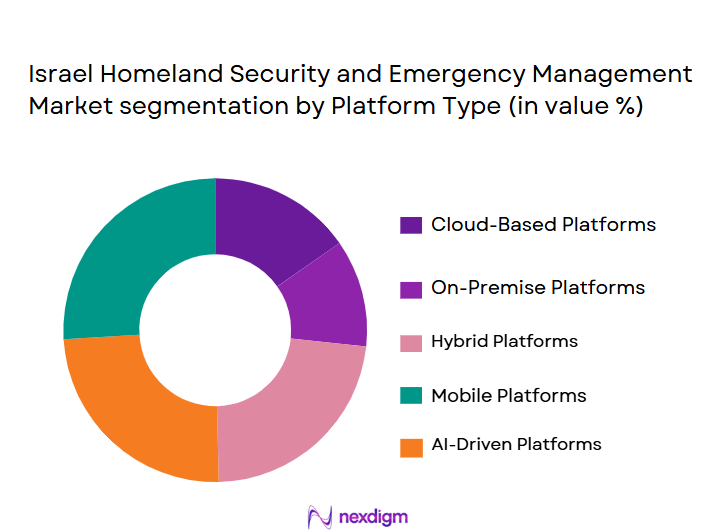

By Platform Type

The market is also segmented by platform type into cloud-based platforms, on-premise platforms, hybrid platforms, integrated systems platforms, and mobile platforms. Cloud-based platforms are dominating this segment, with a significant market share. The reason for the dominance of cloud-based platforms is the increasing shift towards digital transformation in security management. The flexibility, scalability, and cost-effectiveness of cloud solutions, coupled with Israel’s push towards advanced technological integration, make cloud-based platforms a preferred choice for government agencies and military organizations. These platforms enable real-time data processing, remote monitoring, and enhanced collaboration among various emergency response teams.

Competitive Landscape

The Israel homeland security and emergency management market is dominated by a few major players, including local defense companies and global technology providers. These companies play a significant role in the development, manufacturing, and deployment of advanced security systems and emergency management solutions. Key players such as Elbit Systems, Rafael Advanced Defense Systems, and IAI (Israel Aerospace Industries) lead the market with their innovative defense technologies and strong government ties. This consolidation of market power underscores the critical role of defense technology and the growing importance of homeland security in Israel.

| Company | Establishment Year | Headquarters | Technology Focus | Product Portfolio | Global Reach | Security Features | Strategic Partnerships | R&D Investment | Government Contracts |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1984 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| IAI (Israel Aerospace Industries) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| NICE Systems | 1986 | Ra’anana, Israel | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Verint Systems | 1994 | Melville, New York, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Israel homeland security and emergency Market Analysis

Growth Drivers

Increasing Terrorist Threats and Border Security Requirements

Israel’s security situation is heavily influenced by ongoing threats from terrorist organizations and neighboring regions. The country continues to face significant security challenges due to its geopolitical position, making border security a critical priority. As of 2024, Israel’s Ministry of Public Security has allocated approximately USD ~ billion annually for border security and counter-terrorism initiatives. The rise in cyber-attacks, particularly from hostile entities, also exacerbates security concerns. The threat environment has led to investments in advanced border surveillance technologies, including drones and AI-based monitoring systems. Data from the Israeli National Security Council highlights an increase in cross-border security threats, motivating the continuous upgrade of security infrastructure.

Technological Advancements in Cybersecurity and AI-Based Surveillance

Cybersecurity is a cornerstone of Israel’s defense strategies, driven by increasing reliance on digital systems across military, government, and commercial sectors. The Israeli government has made substantial investments in enhancing its cybersecurity frameworks, reflected in the 2024 National Cyber Directorate budget, which is expected to exceed USD 1 billion. With the integration of AI and machine learning into surveillance and cybersecurity systems, Israel is at the forefront of developing cutting-edge solutions to protect critical infrastructure. This technological leap is driven by the constant need to address sophisticated cyber threats from adversarial states. In addition, Israel’s advanced R&D sector contributes significantly to these advancements, bolstered by defense contractors like Rafael and Elbit Systems.

Market Challenges

High Capital Expenditure and Installation Costs

The high capital expenditure required for implementing advanced homeland security technologies is a major challenge for the Israeli market. With ongoing conflicts and the necessity for constant system upgrades, security technology costs are substantial. As of 2024, the average expenditure for high-end surveillance systems, including AI-based cameras and drones, has risen to USD 150 million for a medium-sized installation. Additionally, infrastructure integration with existing security systems adds further costs. The Israel Security Agency (ISA) has reported that despite these investments, the need to upgrade and maintain sophisticated systems regularly strains public and private budgets, limiting the accessibility of some security technologies.

Complexity in System Integration and Management

Integrating advanced security systems across various sectors remains a challenge due to the complexity of blending new technologies with existing infrastructure. As of 2024, around 60% of large-scale security operations in Israel require continuous management of multi-layered systems, leading to integration difficulties. According to reports by Israel’s Ministry of Defense, security systems from different vendors often have compatibility issues, leading to inefficiencies and delays in response times. This complexity increases operational costs and complicates the procurement process, especially for smaller defense contractors. Moreover, the evolving nature of threats means security systems need to be updated frequently, further adding to the complexity.

Market Opportunities

Growth in Cyber Defense Technologies and Smart City Initiatives

Cyber defense technologies are becoming increasingly vital for Israel’s national security, with rising global cyber threats influencing the adoption of these technologies. In 2024, Israel’s government is investing heavily in cybersecurity for critical infrastructure, particularly in smart city development. Cities like Tel Aviv are integrating IoT systems, which require robust cybersecurity frameworks. The demand for AI-based cybersecurity solutions is growing, with key companies like CyberArk and Check Point Software leading the charge in innovation. Israel’s ongoing investment in smart cities and cybersecurity is expected to fuel market growth in the coming years, providing opportunities for the development of state-of-the-art security systems that meet the needs of urban infrastructures.

Public-Private Collaboration for Urban Security Solutions

Public-private partnerships (PPPs) are becoming a key avenue for urban security solutions in Israel. In 2024, government contracts for urban security projects, such as the Tel Aviv Metropolitan Smart Security Initiative, have seen significant private sector involvement. This trend is expected to continue as local municipalities, such as those in Jerusalem and Haifa, partner with private companies to implement advanced security solutions like AI-powered surveillance and emergency response systems. This collaboration enhances the overall effectiveness and reach of homeland security technologies, leading to a more cohesive and comprehensive market ecosystem.

Future Outlook

Over the next decade, the Israel homeland security and emergency management market is expected to experience continued growth driven by increasing security concerns, advancements in defense technologies, and the expanding adoption of AI and cybersecurity solutions. The market is likely to benefit from Israel’s strong defense infrastructure, its partnerships with global defense firms, and continuous government investment in national security. Furthermore, the demand for real-time surveillance and emergency management platforms is projected to increase, especially in response to evolving threats such as cyber warfare and terrorism.

Major Players in the Market

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- NICE Systems

- Verint Systems

- Lockheed Martin

- General Electric

- Northrop Grumman

- Thales Group

- Raytheon Technologies

- BAE Systems

- Honeywell

- Motorola Solutions

- Leidos

- Harris Corporation

Key Target Audience

- Government agencies

- Defense contractors and manufacturers

- Private sector security firms

- Critical infrastructure operators (Telecom, Energy, Utilities)

- Emergency service providers

- Military agencies and armed forces

- Investments and venture capitalist firms

- Regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Israel Homeland Security and Emergency Management Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Israel Homeland Security and Emergency Management Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple homeland security solution providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Israel Homeland Security and Emergency Management market.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing terrorist threats and border security requirements

Technological advancements in cybersecurity and AI-based surveillance

Government investments in critical infrastructure protection - Market Challenges

High capital expenditure and installation costs

Complexity in system integration and management

Regulatory constraints and privacy concerns - Market Opportunities

Growth in cyber defense technologies and smart city initiatives

Public-private collaboration for urban security solutions

Rising demand for emergency response technologies in healthcare - Trends

Adoption of AI and machine learning in security systems

Increasing demand for integrated, multi-functional platforms

Emergence of real-time emergency response systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveillance Systems

Access Control Systems

Cybersecurity Systems

Biometric Identification Systems

Emergency Response Systems - By Platform Type (In Value%)

Cloud-Based Platforms

On-Premise Platforms

Hybrid Platforms

Integrated Systems Platforms

Mobile Platforms - By Fitment Type (In Value%)

Retrofit Systems

New Installation Systems

Modular Systems

Customizable Fitments

Turnkey Solutions - By End-user Segment (In Value%)

Government & Military

Private Sector Security

Critical Infrastructure Operators

Emergency Service Providers

Healthcare & First Responders - By Procurement Channel (In Value%)

Direct Purchase

Distributors & Resellers

Online Marketplaces

Government Contracts

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Growth Rate, Product Innovation, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Strategic Alliances, Regional Coverage) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israeli Aerospace Industries

Israel Security Agency (Shin Bet)

Nice Systems

Motorola Solutions

Verint Systems

Rafael Advanced Defense Systems

Carmi Engineering

Lockheed Martin

General Electric

Northrop Grumman

Thales Group

Raytheon Technologies

BAE Systems

Honeywell

- Government agencies focusing on border security and defense

- Private sector industries investing in surveillance and access control

- Critical infrastructure operators prioritizing resilience against cyberattacks

- Healthcare institutions implementing emergency management systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035