Market Overview

The Israel Inspection Drones market is aligned with the global inspection drone industry, valued at USD ~ billion based on a recent historical assessment published by recognized industry research bodies. Market activity is driven by demand for unmanned aerial systems across critical infrastructure inspection, energy asset monitoring, industrial facility surveillance, and public safety operations. Organizations increasingly rely on drones to reduce human risk, improve data accuracy, and shorten inspection cycles. Advances in autonomous navigation, high resolution imaging, and analytics software further strengthen procurement momentum across industrial and governmental users.

Market activity is concentrated in regions with advanced aerospace ecosystems and dense infrastructure networks, with Israel benefiting from strong innovation clusters in Tel Aviv and surrounding technology corridors. The United States and Western European countries remain influential due to large scale infrastructure assets, mature regulatory frameworks, and established drone adoption in utilities and transportation. Israel’s dominance is supported by defense oriented innovation, rapid commercialization of unmanned technologies, and close collaboration between startups, government agencies, and industrial operators that accelerate deployment and operational acceptance across multiple inspection use cases.

Market Segmentation

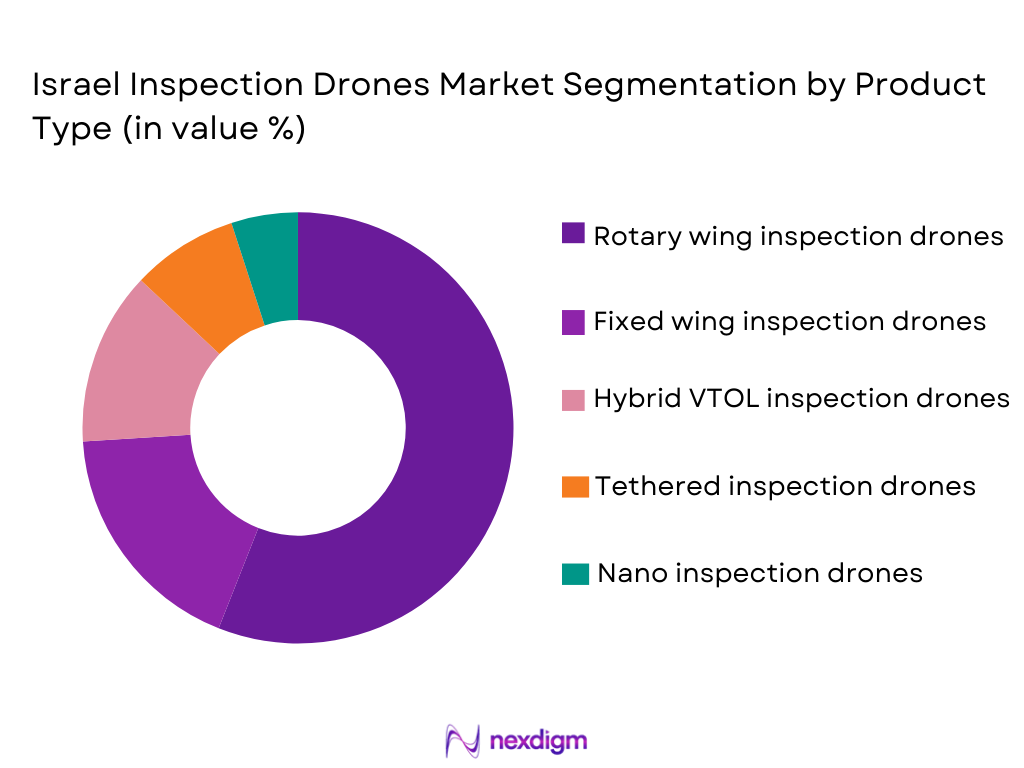

By Product Type:

Israel Inspection Drones market is segmented by product type into rotary wing inspection drones, fixed wing inspection drones, hybrid VTOL inspection drones, tethered inspection drones, and nano inspection drones. Recently, rotary wing inspection drones have a dominant market share due to their ability to hover, maneuver precisely in confined industrial environments, and support multiple sensor payloads required for infrastructure inspection. These platforms are preferred for energy facilities, construction sites, and urban inspections where vertical takeoff and landing is essential. Strong availability from domestic and international manufacturers, compatibility with thermal and optical sensors, and ease of pilot training reinforce adoption. Rotary wing systems also align well with regulatory operating envelopes, enabling faster deployment approvals. Their operational flexibility reduces inspection downtime and improves asset visibility, making them the preferred choice for enterprises seeking reliable and repeatable inspection workflows across diverse operating conditions and asset classes.

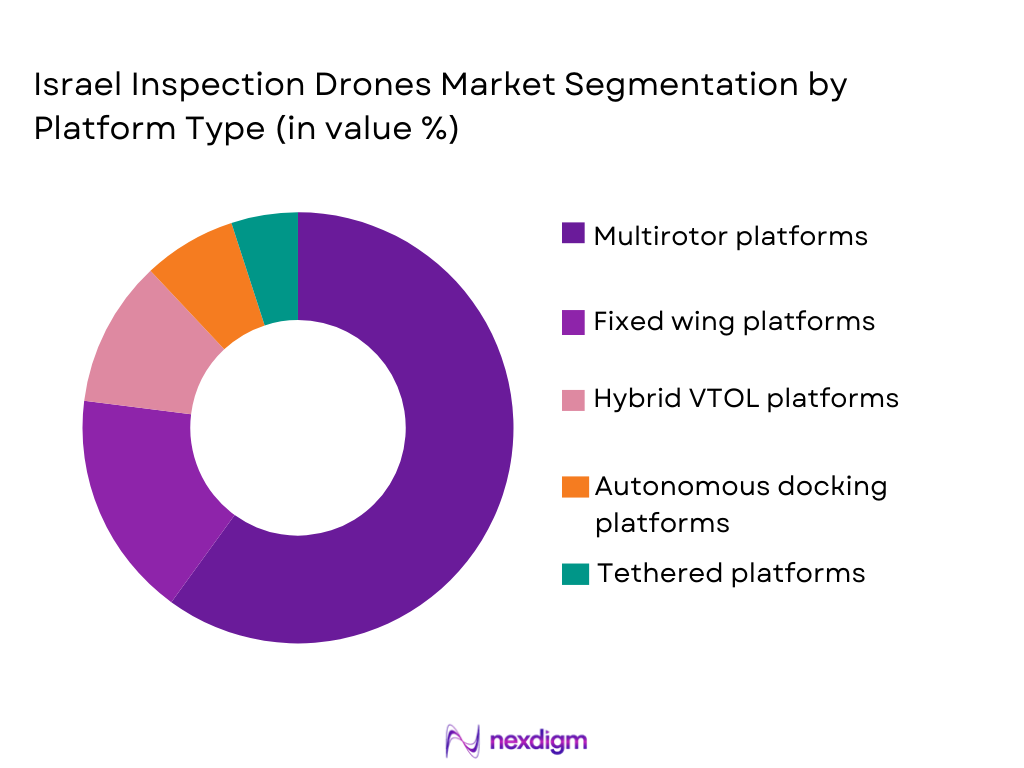

By Platform Type:

Israel Inspection Drones market is segmented by platform type into multirotor platforms, fixed wing platforms, hybrid VTOL platforms, autonomous docking platforms, and tethered platforms. Recently, multirotor platforms have a dominant market share due to their superior stability, precision control, and adaptability across industrial inspection scenarios. These platforms enable close range inspections of power lines, buildings, pipelines, and security infrastructure without requiring specialized launch infrastructure. Broad ecosystem support, standardized components, and strong software integration capabilities make multirotor systems cost effective and scalable. Their compatibility with autonomous flight planning and real time data transmission supports enterprise inspection programs. Familiarity among operators and maintenance teams further accelerates procurement decisions, positioning multirotor platforms as the preferred operational standard for inspection focused drone deployments across public and private sector users.

Competitive Landscape

The Israel Inspection Drones market demonstrates moderate consolidation, led by a combination of defense focused aerospace firms and specialized autonomous drone startups. Established players influence technology standards, certification pathways, and large contract procurement, while emerging companies compete through automation, analytics integration, and turnkey inspection solutions. Strategic partnerships with infrastructure operators and government agencies reinforce competitive positioning and long-term contracts.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~

|

~

|

~

|

~

|

~

|

| Rafael Advanced Defense Systems | 1948 | Israel | ~

|

~

|

~

|

~

|

~

|

| Airobotics | 2014 | Israel | ~

|

~

|

~

|

~

|

~

|

| Percepto | 2014 | Israel | ~

|

~

|

~

|

~

|

~

|

Israel Inspection Drones Market Analysis

Growth Drivers

Autonomous Infrastructure Inspection Adoption:

Autonomous infrastructure inspection adoption is driving the Israel Inspection Drones market as asset owners increasingly seek unmanned solutions that reduce operational risk while improving inspection frequency and data consistency. Industrial operators managing energy grids, transportation networks, and industrial plants benefit from drones capable of executing repeatable missions without continuous human control. Automation reduces labor dependency and enables inspections in hazardous or inaccessible environments, improving workforce safety. Integrated navigation and obstacle avoidance systems allow drones to operate in complex environments such as substations, ports, and dense urban infrastructure. Data captured through autonomous missions supports predictive maintenance strategies that lower long term operational costs. Enterprises value consistent data outputs that integrate with digital asset management platforms and maintenance planning tools. Government agencies also favor autonomous systems for border and infrastructure monitoring due to reliability and reduced manpower requirements. As autonomy matures, inspection drones become embedded into routine asset management workflows rather than being deployed only for exceptional inspections.

Advanced Sensor and Analytics Integration:

Advanced sensor and analytics integration accelerates market growth by transforming inspection drones into data intelligence platforms rather than simple imaging tools. High resolution optical, thermal, multispectral, and LiDAR sensors enable detection of structural defects, heat anomalies, and material degradation. Analytics software processes captured data into actionable insights, reducing analysis time for engineers and inspectors. Integration with cloud platforms allows real time access to inspection results across distributed teams. AI powered anomaly detection improves inspection accuracy and reduces false positives. Enterprises increasingly prioritize solutions that combine hardware and software into unified inspection ecosystems. Domestic technology expertise supports rapid innovation in sensor fusion and analytics development. This capability differentiation strengthens procurement demand from industrial and government users seeking comprehensive inspection intelligence.

Market Challenges

Regulatory Complexity and Airspace Restrictions:

Regulatory complexity and airspace restrictions challenge market expansion by increasing compliance costs and limiting operational flexibility for inspection drone deployments. Operators must navigate layered approval processes involving aviation authorities, local municipalities, and security agencies. Restrictions on beyond visual line of sight operations constrain inspection efficiency for large infrastructure networks. Compliance requirements mandate investments in pilot certification, safety systems, and documentation. Variability in regulatory interpretation across jurisdictions creates uncertainty for service providers. Delays in approval timelines impact project scheduling and return on investment. Security related airspace limitations further restrict deployment in sensitive zones. These factors collectively slow scaling of inspection drone operations despite strong underlying demand.

Payload Endurance and Operational Constraints:

Payload endurance and operational constraints limit inspection coverage and increase mission complexity for advanced inspection drones. High performance sensors consume power and reduce flight time, requiring careful mission planning. Limited endurance necessitates multiple sorties for large assets, increasing operational overhead. Weather sensitivity impacts mission reliability, particularly for long duration inspections. Balancing payload weight with stability and safety remains a design challenge. Battery technology improvements progress incrementally, constraining rapid gains in endurance. Operators must invest in redundancy and backup systems to maintain service continuity. These constraints affect total cost of ownership and adoption decisions among cost sensitive users.

Opportunities

Expansion of Fully Autonomous Inspection Services:

Expansion of fully autonomous inspection services presents significant opportunity as industries move toward continuous monitoring models. Persistent drone operations supported by docking stations enable scheduled inspections without onsite crews. Utilities and industrial operators benefit from real time condition awareness and rapid anomaly response. Service based inspection models create recurring revenue streams for providers. Integration with enterprise systems enhances operational transparency. Regulatory evolution supporting automated operations further strengthens opportunity viability. Domestic innovation capacity supports rapid scaling of autonomous service offerings. This shift positions inspection drones as core infrastructure management tools.

Integration with Smart Infrastructure Programs:

Integration with smart infrastructure programs offers opportunity as governments and municipalities invest in digital infrastructure monitoring. Inspection drones complement sensor networks and digital twins by providing visual and spatial data. Urban infrastructure modernization initiatives create demand for aerial inspection capabilities. Alignment with sustainability and safety objectives supports public sector adoption. Technology interoperability enhances value proposition for smart city planners. Domestic suppliers can leverage proximity to pilot projects for rapid validation. This opportunity supports long term institutional demand for inspection drone solutions.

Future Outlook

The Israel Inspection Drones market is expected to experience sustained expansion over the next five years, supported by increasing automation across infrastructure, energy, and industrial asset management. Technological progress in autonomous navigation, artificial intelligence, and sensor miniaturization will enhance operational reliability and data quality. Regulatory alignment with commercial unmanned operations is anticipated to improve deployment efficiency. Demand-side momentum will be reinforced by infrastructure modernization programs and heightened emphasis on safety, efficiency, and predictive maintenance across public and private sectors.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Airobotics

- Percepto

- Aeronautics Group

- BlueBirdAero Systems

- Steadicopter

- XTEND

- UVisionAir

- Cando Drones

- FlyTechUAV

- SmartShooter

- Heven Drones

- CopterPix

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Energy and utilities operators

- Infrastructure asset owners

- Industrial manufacturing companies

- Defense and homeland security agencies

- Construction and engineering firms

- Port and transportation authorities

Research Methodology

Step 1: Identification of Key Variables

The research process began with defining the market boundaries, product scope, and application coverage for the Israel Inspection Drones market. Key variables such as platform types, end-use sectors, and regulatory influences were identified. Secondary data sources were reviewed to establish baseline assumptions. These variables formed the foundation for structured market analysis.

Step 2: Market Analysis and Construction

Market construction involved consolidating data from industry publications, company disclosures, and regulatory sources. Qualitative insights were aligned with quantitative benchmarks to ensure coherence. Segmentation logic was applied to reflect realistic market structures. Cross-validation ensured consistency across all analytical dimensions.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultation with industry professionals and domain specialists. Expert feedback was used to test assumptions related to technology adoption and demand drivers. Divergent viewpoints were reconciled through comparative analysis. This step strengthened analytical credibility and relevance.

Step 4: Research Synthesis and Final Output

All validated inputs were synthesized into a unified analytical framework. Narrative insights were aligned with structured data outputs for clarity. Consistency checks ensured alignment with defined objectives. The final output was prepared to support strategic decision-making.

- Executive Summary

- Israel Inspection Drones Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for autonomous inspection across critical infrastructure

High operational efficiency compared to manned inspection methods

Strong domestic innovation ecosystem supporting drone technologies

Increasing defense and homeland security surveillance requirements

Rapid adoption of AI and sensor fusion in inspection missions - Market Challenges

Stringent airspace and operational regulations

High system costs for advanced sensor-equipped platforms

Cybersecurity and data protection concerns

Limited endurance in complex inspection environments

Integration challenges with legacy monitoring systems - Market Opportunities

Expansion of smart infrastructure and digital monitoring projects

Export potential for defense-grade inspection drone platforms

Integration of drones into predictive maintenance ecosystems - Trends

Shift toward fully autonomous inspection operations

Increased use of AI-driven anomaly detection

Growing adoption of BVLOS inspection missions

Miniaturization of high-performance sensors

Convergence of inspection and surveillance capabilities - Government Regulations & Defense Policy

Strengthening of unmanned aerial system certification frameworks

Increased defense funding for unmanned inspection platforms

Policy support for domestic drone manufacturing and R&D - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Visual inspection drones

Thermal inspection drones

Multispectral inspection drones

LiDAR-enabled inspection drones

Hybrid sensor inspection drones - By Platform Type (In Value%)

Fixed-wing drones

Rotary-wing drones

Hybrid VTOL drones

Nano and micro drones

Tethered inspection drones - By Fitment Type (In Value%)

Factory-integrated inspection systems

Modular payload-based systems

Retrofit inspection kits

Custom mission-configured systems

Turnkey inspection drone solutions - By EndUser Segment (In Value%)

Energy and utilities operators

Defense and border security agencies

Construction and infrastructure firms

Industrial manufacturing facilities

Environmental and agricultural authorities - By Procurement Channel (In Value%)

Direct government procurement

Defense and aerospace OEM contracts

System integrator partnerships

Technology licensing agreements

Commercial distributor networks - By Material / Technology (in Value %)

Composite airframe structures

Carbon fiber reinforced polymers

AI-enabled computer vision systems

Autonomous navigation software

Secure communication and data links

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Platform endurance, Payload capacity, Sensor integration capability, Autonomy level, Communication security, Regulatory compliance, Mission flexibility, Lifecycle cost, After-sales support, Export readiness) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Aeronautics Group

BlueBird Aero Systems

UVision Air

Airobotics

Steadicopter

XTEND

Percepto

Sky Sapience

Cando Drones

SmartShooter

Heven Drones

FlyTech UAV

- Energy operators prioritize reliability and thermal imaging accuracy

- Defense agencies focus on secure communication and endurance

- Infrastructure firms demand rapid deployment and cost efficiency

- Industrial users emphasize integration with asset management systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035