Market Overview

Based on a recent historical assessment, the Israel Land-Based C4ISR Market was valued at USD ~ billion, derived from aggregated Israeli Ministry of Defense land-domain command, control, communications, computers, intelligence, surveillance, and reconnaissance program allocations reported in official defense budget disclosures and parliamentary defense expenditure statements. Market activity is driven by sustained modernization of ground force command networks, digitization of battlefield management systems, integration of intelligence fusion platforms, and continuous investment in secure tactical communications supporting maneuver units, border forces, and land-centric operational headquarters.

Based on a recent historical assessment, Tel Aviv, Haifa, and Beersheba dominate development and deployment activity due to their concentration of defense headquarters, system integrators, and land-force command centers supporting operational and testing environments. Israel remains the primary country of dominance because of sustained defense readiness requirements, mature indigenous defense manufacturing, and continuous land-border security operations. Urban concentration of defense R&D facilities, proximity to ground-force training commands, and centralized procurement oversight further reinforce regional leadership without reliance on external production hubs.

Market Segmentation

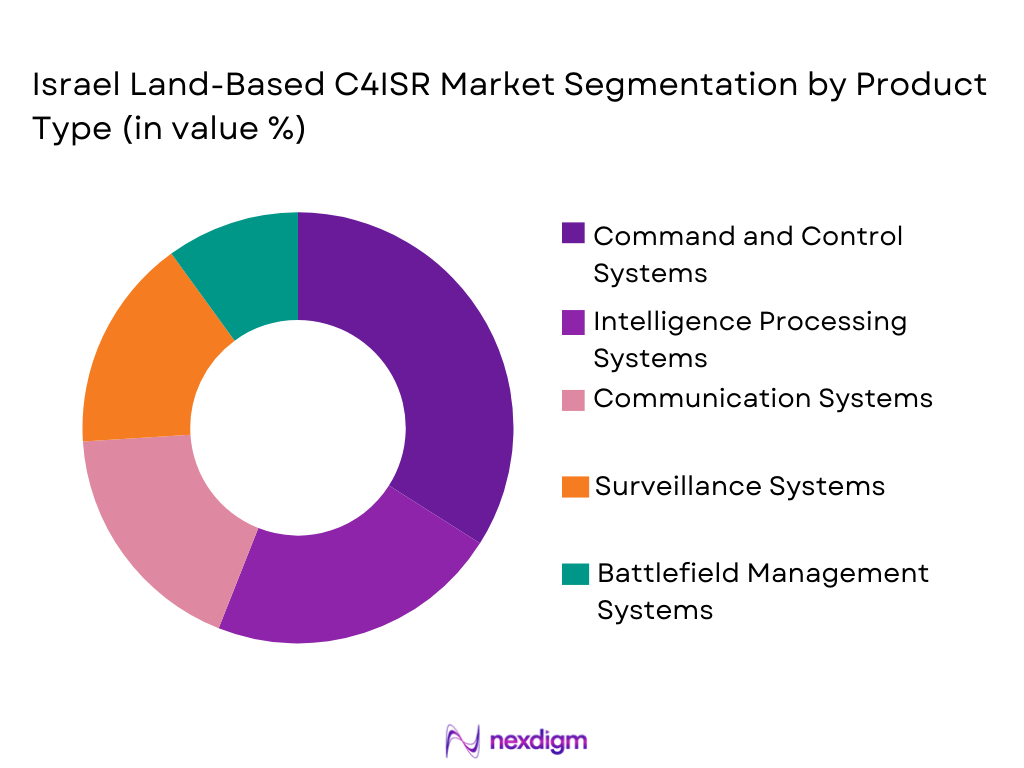

By Product Type

Israel Land-Based C4ISR Market market is segmented by product type into command and control systems, intelligence processing systems, communication systems, surveillance systems, and battlefield management systems. Recently, command and control systems have a dominant market share due to their central role in synchronizing land-force operations across brigades, divisions, and joint commands. Continuous upgrades to digital command networks, integration with intelligence and surveillance feeds, and mandatory interoperability requirements have elevated procurement volumes. High replacement frequency of legacy command nodes, coupled with doctrinal emphasis on rapid decision-making, sustains demand. Additionally, command and control systems receive priority funding due to their direct impact on operational readiness and force survivability.

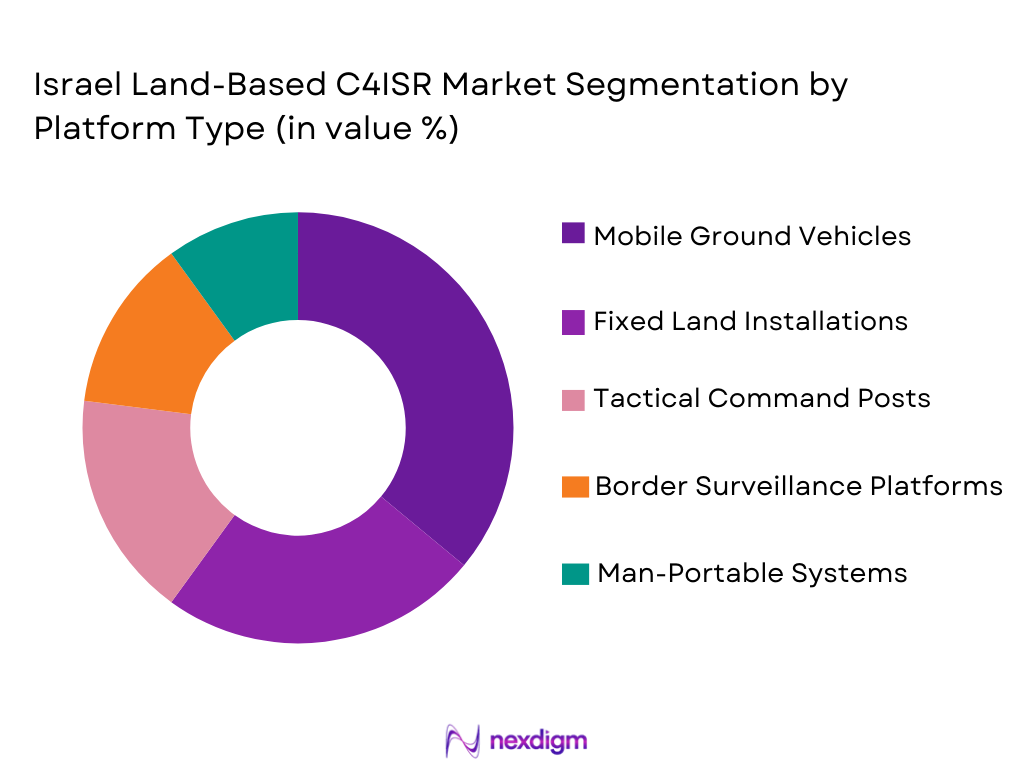

By Platform Type

Israel Land-Based C4ISR Market is segmented by platform type into fixed land installations, mobile ground vehicles, man-portable systems, tactical command posts, and border surveillance platforms. Recently, mobile ground vehicle platforms have a dominant market share due to their extensive deployment across armored, mechanized, and infantry formations. Integration of C4ISR systems into armored vehicles enhances situational awareness, network connectivity, and command continuity during maneuver operations. High operational tempo, frequent system upgrades, and integration with active protection and sensor suites further strengthen this segment. Vehicle-based platforms also benefit from standardized procurement cycles aligned with fleet modernization programs.

Competitive Landscape

The Israel Land-Based C4ISR Market is characterized by moderate consolidation, with a small number of domestic defense primes controlling core system integration while specialized firms supply subsystems and software layers. Strong government oversight, long-term framework contracts, and high entry barriers reinforce incumbent dominance. Major players influence standards, interoperability protocols, and lifecycle support models, while competition primarily occurs at the subsystem, software, and upgrade level rather than full-system displacement.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Land-System Integration Capability |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~

|

~

|

~

|

~

|

~

|

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~

|

~

|

~

|

~

|

~

|

| Tadiran Telecommunications | 1969 | Holon, Israel | ~

|

~

|

~

|

~

|

~

|

| Elta Systems | 1967 | Ashdod, Israel | ~

|

~

|

~

|

~

|

~

|

Israel Land-Based C4ISR Market Analysis

Growth Drivers

Ground Force Digital Transformation and Network-Centric Warfare Adoption:

Ground Force Digital Transformation and Network-Centric Warfare Adoption: is a primary growth driver because Israeli land forces increasingly depend on integrated digital command environments to execute high-tempo, multi-domain operations across complex terrains and contested borders. Continuous upgrades of legacy analog systems into fully networked command architectures enable faster decision cycles, real-time intelligence dissemination, and synchronized maneuver execution across brigades and divisions. Defense doctrine prioritizes information superiority, compelling sustained investment in secure data links, battlefield management software, and interoperable command nodes. These systems support persistent situational awareness by fusing intelligence, surveillance, and reconnaissance feeds into unified operational pictures accessible at multiple command levels. High operational readiness requirements necessitate constant system refresh cycles, driving recurring procurement and upgrade demand. Integration with joint and allied systems further increases complexity and spending. Budget-backed modernization programs ensure stable funding flows. Institutional emphasis on digital dominance reinforces long-term adoption.

Border Security Operations and Persistent Land Surveillance Requirements:

Border Security Operations and Persistent Land Surveillance Requirements: drive market expansion due to Israel’s continuous need to monitor, detect, and respond to threats along multiple land borders. Land-based C4ISR systems form the backbone of border command centers, integrating sensor networks, surveillance platforms, and rapid response units. Persistent surveillance mandates high-reliability systems capable of continuous operation under harsh conditions. Increased deployment of sensor fusion technologies and automated threat detection tools boosts system complexity and value. Tactical commanders rely on integrated communications and intelligence feeds to coordinate responses in real time. Continuous border activity results in accelerated wear, driving replacement and upgrade cycles. Government prioritization of border security ensures consistent budget allocation. Operational lessons directly influence system evolution.

Market Challenges

System Integration Complexity Across Legacy and Modern Platforms:

System Integration Complexity Across Legacy and Modern Platforms represents a critical restraint for the Israel Land-Based C4ISR Market because land forces operate a heterogeneous mix of legacy analog systems, mid-life digital upgrades, and newly deployed network-centric architectures that must function seamlessly during live operations. Integrating multiple generations of hardware and software requires extensive customization, interface development, and middleware solutions to ensure compatibility across command nodes, sensors, and communication layers. Many legacy platforms were not originally designed for real-time data exchange, forcing system integrators to redesign interfaces while maintaining operational continuity. Testing and validation cycles become longer and more resource intensive due to the need to certify interoperability under combat-ready conditions. Operational units cannot afford extended downtime, which constrains upgrade windows and complicates phased deployment strategies. Procurement authorities often delay acquisition decisions to mitigate integration risk, slowing market velocity. Vendor coordination across subsystems further increases project complexity and cost exposure. These factors collectively elevate program risk profiles and constrain rapid scalability despite sustained demand.

Cybersecurity Vulnerabilities in Network-Centric Land Operations:

Cybersecurity Vulnerabilities in Network-Centric Land Operations pose a significant challenge as expanding connectivity across land-based C4ISR networks increases exposure to cyber intrusion, electronic warfare, and data manipulation threats. Command and control systems process sensitive operational data, making them high-value targets for adversarial cyber activities aimed at degrading situational awareness or disrupting decision-making. Ensuring system resilience requires continuous investment in encryption technologies, intrusion detection systems, secure authentication protocols, and cyber hardening measures. Compliance with national cybersecurity certification frameworks adds additional development layers and prolongs system deployment timelines. Rapid technology evolution demands frequent software updates, increasing maintenance burdens and lifecycle costs. Balancing interoperability with allies and internal security requirements complicates system architecture decisions. Shortages of specialized cybersecurity professionals further strain implementation capacity. These pressures increase total ownership costs and slow adoption of advanced capabilities despite clear operational need.

Opportunities

Artificial Intelligence Enabled Tactical Decision Support Systems:

Artificial Intelligence Enabled Tactical Decision Support Systems represent a significant opportunity for the Israel Land-Based C4ISR Market as operational environments generate increasingly large volumes of sensor, intelligence, and communication data that exceed human processing capacity during high-tempo land operations. AI-driven analytics platforms enable automated correlation of surveillance feeds, intelligence reports, and battlefield data into actionable insights presented in near real time to commanders at multiple echelons. This capability directly enhances decision speed, reduces cognitive burden, and improves operational accuracy during complex maneuver and border security missions. Indigenous development of military-grade artificial intelligence aligns with national technology priorities and benefits from Israel’s strong domestic software ecosystem. Integration of AI modules into existing C4ISR architectures allows capability enhancement without complete system replacement, improving cost efficiency. Continuous software-driven upgrades extend system relevance and lifecycle value. Operational validation of AI-supported decision tools accelerates acceptance across land forces. Budget-backed experimentation programs further support sustained deployment. Collectively, these factors create a durable pathway for value expansion across software-centric C4ISR components.

Modular Open Architecture and Export-Oriented Land C4ISR Platforms:

Modular Open Architecture and Export-Oriented Land C4ISR Platforms offer a substantial opportunity as defense customers increasingly demand flexible systems that can be rapidly adapted to evolving operational doctrines and diverse deployment environments. Open architectures reduce vendor lock-in, simplify integration of third-party subsystems, and accelerate upgrade cycles by allowing component-level replacement rather than full system overhauls. Modular designs support scalable configurations ranging from brigade-level command posts to vehicle-mounted and man-portable solutions, increasing addressable use cases. Export-aligned architectures enable compliance with varying international standards and security requirements, enhancing global market accessibility. Domestic land-force adoption provides a stable baseline for development and testing, reducing risk for export customers. Standardized interfaces lower training and maintenance complexity, improving lifecycle cost efficiency. Government support for defense exports strengthens commercialization prospects. Rising international demand for interoperable land C4ISR systems reinforces long-term opportunity realization.

Future Outlook

The Israel Land-Based C4ISR Market is expected to maintain steady growth over the next five years, supported by continuous land-force modernization, digital transformation initiatives, and sustained border security requirements. Advancements in artificial intelligence, secure communications, and sensor fusion will shape system evolution. Regulatory emphasis on cybersecurity and interoperability will influence procurement frameworks. Demand-side factors include operational readiness imperatives and rapid adaptation to emerging threats, reinforcing long-term investment continuity.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- TadiranTelecommunications

- Elta Systems

- Orbit Communication Systems

- Aeronautics Group

- IMCO Industries

- ContropPrecision Technologies

- BIRD Aerosystems

- Camero-Tech

- ODS Security Solutions

- RT LTA Systems

- SysTechDefense

- Marom Dolphin

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries

- Military procurement agencies

- Homeland security organizations

- Border security forces

- Defense OEMs

- System integrators

Research Methodology

Step 1: Identification of Key Variables

Key market variables were identified through analysis of official defense budgets, procurement programs, and land-force modernization initiatives. Demand drivers, technology trends, and operational requirements were mapped. Data sources were validated for credibility and relevance. Variables were aligned with land-domain C4ISR scope.

Step 2: Market Analysis and Construction

Market structure was constructed using budget allocation analysis and program-level aggregation. Segmentation was defined based on system type and platform deployment. Competitive dynamics were assessed through company disclosures. Consistency checks ensured alignment with operational realities.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through defense domain expert inputs and secondary literature review. Assumptions were tested against historical procurement behavior. Discrepancies were reconciled using official documentation. Validation ensured analytical robustness.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a structured market narrative. Quantitative and qualitative findings were integrated coherently. Formatting and compliance checks were applied rigorously. Final output reflects validated, policy-aligned analysis.

- Executive Summary

- Israel Land-Based C4ISR Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for integrated battlefield awareness across ground forces

Acceleration of digital transformation within land-based defense operations

Increased emphasis on real-time intelligence fusion and decision support

Expansion of border security and territorial surveillance infrastructure

Ongoing modernization of legacy command and control systems - Market Challenges

High system integration complexity across legacy and modern platforms

Cybersecurity risks associated with network-centric warfare systems

Lengthy defense procurement and approval cycles

Dependence on advanced semiconductor and secure communication components

Operational interoperability challenges across multi-agency deployments - Market Opportunities

Adoption of artificial intelligence driven decision support tools

Expansion of modular and scalable C4ISR architectures

Growing demand for indigenous and export-compliant land-based systems - Trends

Shift toward software-defined and open architecture C4ISR systems

Increased deployment of AI-enabled analytics at the tactical edge

Integration of unmanned ground sensor networks with command platforms

Emphasis on resilient and cyber-hardened communication links

Growing use of cloud-enabled mission data management - Government Regulations & Defense Policy

Strengthening of national cybersecurity compliance frameworks

Policies promoting domestic defense technology development

Enhanced oversight on secure data handling and system certification - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Intelligence Processing Systems

Surveillance and Reconnaissance Systems

Communication Networks

Integrated Battlefield Management Systems - By Platform Type (In Value%)

Fixed Land Installations

Mobile Ground Vehicles

Man-Portable Systems

Tactical Command Posts

Border Surveillance Platforms - By Fitment Type (In Value%)

New Deployment Programs

System Upgrades

Retrofit Installations

Lifecycle Modernization

Emergency Operational Fitments - By EndUser Segment (In Value%)

Army and Ground Forces

Border Security Agencies

Homeland Security Organizations

Special Operations Units

Intelligence and Surveillance Agencies - By Procurement Channel (In Value%)

Direct Government Contracts

Defense OEM Integrators

System Integrator Partnerships

Government-to-Government Programs

Emergency and Fast-Track Procurement - By Material / Technology (in Value %)

Secure Software-Defined Architectures

AI-Based Data Analytics Engines

Encrypted Communication Hardware

Sensor Fusion Technologies

Cloud-Enabled Tactical Networks

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System Integration Capability, AI Analytics Maturity, Cybersecurity Resilience, Platform Interoperability, Deployment Flexibility, Lifecycle Support Strength, Indigenous Technology Content, Export Compliance Readiness, Cost Efficiency) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Tadiran Telecommunications

Elta Systems

Orbit Communication Systems

Aeronautics Group

IMCO Industries

Controp Precision Technologies

BIRD Aerosystems

Camero-Tech

ODS Security Solutions

RT LTA Systems

SysTech Defense

Marom Dolphin

- Ground forces prioritize real-time situational awareness and rapid decision cycles

- Border security agencies focus on persistent surveillance and threat detection

- Special operations units require portable and secure communication systems

- Homeland security organizations emphasize interoperability and data sharing

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035