Market Overview

The Israel land based military electro optical and infrared systems market based on a recent historical assessment was valued at USD ~ billion, supported by defense budget allocations and procurement disclosures from the Israeli Ministry of Defense and SIPRI-aligned defense spending datasets. Market activity is driven by sustained investments in land force modernization, accelerated deployment of surveillance and targeting systems, and integration of electro optical and infrared solutions across armored vehicles and border security infrastructure. Demand is further reinforced by indigenous manufacturing capabilities, export-oriented production programs, and continuous upgrades to sensor performance, image processing, and real time battlefield awareness systems.

The market is dominated by Israel, supported by strong domestic defense manufacturing clusters concentrated in Haifa, Tel Aviv, and Beersheba, where major system integrators, optics specialists, and semiconductor suppliers operate. The country’s leadership is driven by long-standing operational requirements, continuous field testing under active deployment conditions, and close coordination between defense forces and local industry. Additional demand influence comes from export partnerships with North America and select European defense programs, where Israeli-developed electro optical and infrared systems are integrated into land platforms due to proven reliability, rapid deployment capability, and advanced sensor fusion expertise.

Market Segmentation

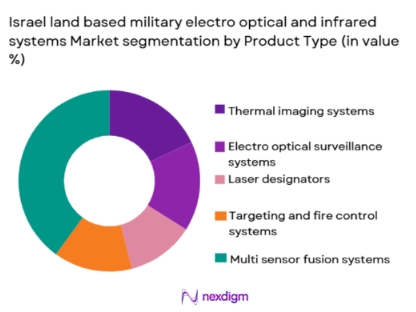

By Product Type

Israel land based military electro optical and infrared systems market is segmented by product type into c Recently, multi sensor fusion systems have a dominant market share due to their ability to integrate visible, infrared, and laser-based sensing into a single operational architecture, reducing platform payload constraints and improving real time decision making. These systems are increasingly favored for armored vehicles and border surveillance because they support simultaneous detection, identification, and tracking under varied terrain and visibility conditions. Strong domestic R&D capabilities, operational feedback from field deployment, and export demand for integrated solutions have reinforced their dominance. Additionally, defense forces prioritize systems that enhance survivability and network centric warfare compatibility, further accelerating adoption of multi sensor fusion platforms across land based military assets.

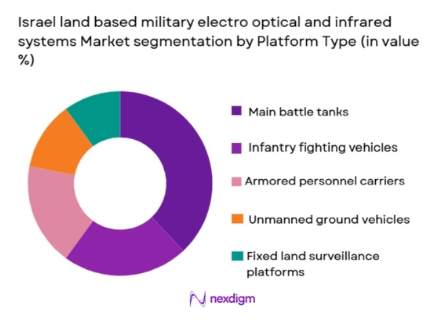

By Platform Type

Israel land based military electro optical and infrared systems market is segmented by platform type into main battle tanks, infantry fighting vehicles, armored personnel carriers, unmanned ground vehicles, and fixed land surveillance platforms. Recently, main battle tanks have held a dominant market share due to sustained modernization programs focused on enhancing lethality, survivability, and situational awareness of armored formations. Advanced electro optical and infrared suites are integral to tank upgrades, supporting long-range target acquisition and night fighting capability. Continuous upgrades to existing fleets, rather than full platform replacement, have sustained procurement volumes. Additionally, tanks deployed in complex operational environments require highly reliable imaging systems capable of operating under extreme thermal and vibration conditions, favoring premium EO/IR solutions and reinforcing this segment’s leading position within the market.

Competitive Landscape

The competitive landscape of the Israel land based military electro optical and infrared systems market is moderately consolidated, dominated by a small number of vertically integrated defense companies with strong domestic and export positions. These players benefit from close collaboration with defense forces, long-term procurement programs, and continuous product validation in operational environments. Market leadership is reinforced through proprietary sensor technologies, software-driven image processing, and system integration capabilities. Smaller specialized firms operate as subsystem suppliers, while major players retain control over full-system design, integration, and lifecycle support, limiting entry by new competitors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Land Platform Integration |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Controp Precision Technologies | 1993 | Israel | ~ | ~ | ~ | ~ | ~ |

| Opgal Optronic Industries | 1987 | Israel | ~ | ~ | ~ | ~ | ~ |

Israel and based military electro optical and infrared systems Market Analysis

Growth Drivers

Land Force Modernization and Sensor Integration:

sustained modernization of armored and ground combat units has created strong demand for advanced electro optical and infrared systems that enhance detection, targeting, and survivability across diverse operational environments. Defense planners increasingly prioritize sensor upgrades as cost-effective force multipliers compared to full platform replacement. Integration of EO/IR systems into command networks improves situational awareness and reduces engagement timelines. Continuous upgrades to legacy platforms sustain recurring procurement demand. Operational requirements for night and all-weather capability further reinforce adoption. Indigenous development accelerates deployment cycles and customization. Export programs extend production scale beyond domestic demand. Combined, these factors structurally reinforce long-term market expansion across land-based defense assets.

Border Security and Persistent Surveillance Requirements:

heightened focus on land border monitoring and infrastructure protection has significantly increased reliance on electro optical and infrared systems capable of persistent, wide-area surveillance. Fixed and mobile EO/IR installations enable early threat detection across complex terrain. Demand is reinforced by the need to reduce manpower exposure through remote monitoring. Integration with automated alert and tracking systems improves response efficiency. Long operational endurance and reliability are critical procurement criteria. Continuous system upgrades are required to counter evolving threats. Export demand for proven border surveillance solutions supports production stability. These drivers collectively sustain consistent market growth momentum.

Market Challenges

High System Cost and Budget Allocation Constraints:

advanced electro optical and infrared systems involve high development, integration, and lifecycle costs, placing pressure on defense procurement budgets. Sophisticated sensors, cooled infrared detectors, and processing hardware significantly increase unit costs. Budget competition with other defense priorities can delay procurement cycles. Smaller upgrade programs may be postponed during fiscal realignment. Export customers also face affordability constraints. Cost-sensitive platforms may opt for lower capability alternatives. Sustaining profitability while controlling costs remains challenging. These constraints can moderate short-term market expansion.

Integration Complexity with Legacy Platforms:

integrating modern EO/IR systems into older land platforms presents technical and operational challenges. Legacy vehicles often lack compatible power, space, and data interfaces. Custom engineering increases integration time and cost. Platform-specific modifications reduce standardization benefits. Operational downtime during upgrades impacts readiness. Training requirements increase with system complexity. Multiplatform fleets compound integration difficulties. These challenges can slow adoption rates and extend deployment timelines.

Opportunities

Intelligence Enabled Image Processing:

AI-driven analytics present strong opportunities to enhance target recognition, tracking, and threat classification capabilities of electro optical and infrared systems. Automated processing reduces operator workload and response time. Machine learning models improve performance in cluttered environments. Continuous data feedback enables adaptive system improvement. AI integration supports autonomous and semi-autonomous operations. Export customers increasingly demand AI-enabled solutions. Software-driven upgrades extend system lifecycle value. These factors create meaningful growth avenues.

Modular and Upgrade-Oriented System Architectures:

Modular and Upgrade-Oriented System Architectures: modular EO/IR designs allow scalable capability enhancement without full system replacement. Defense forces favor upgrade paths that reduce lifecycle costs. Modular architectures support rapid technology insertion. Interoperability across platforms improves procurement efficiency. Export customization becomes easier. Supply chain flexibility increases. Long-term support contracts expand revenue potential. This opportunity aligns well with evolving defense procurement strategies.

Future Outlook

Over the next five years, the market is expected to benefit from sustained land force modernization and increasing reliance on sensor-driven warfare concepts. Technological advances in AI, sensor fusion, and miniaturization will enhance system performance. Regulatory support for defense exports will remain important. Demand-side emphasis on survivability and situational awareness will continue to shape procurement priorities.

Major Players

- Elbit Systems

- Rafael AdvancedDefense Systems

- Israel Aerospace Industries

- Controp Precision Technologies

- Opgal Optronic Industries

- Meprolight

- CI Systems

- ESC BAZ

- Dani Optics

- SCD Semiconductor Devices

- NextVision

- UVision Air

- IMI Systems

- ELOP Electro Optics

- Cielo Technologies

Key Target Audience

- Defense procurement agencies

- Military modernization programs

- Armored vehicle manufacturers

- Border security authorities

- Defense system integrators

- Export control agencies

- Investment and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including market size, platform types, system categories, and procurement patterns were identified to define the analytical framework and scope.

Step 2: Market Analysis and Construction

Secondary data from defense budgets, company disclosures, and international defense databases were analyzed to construct market estimates and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through defense industry expert inputs and cross-comparison with operational deployment trends and procurement programs.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into structured analysis ensuring consistency, accuracy, and compliance with defined research objectives.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising investment in land based situational awareness systems

Continuous modernization of armored and ground combat platforms

Strong domestic defense innovation ecosystem

High operational demand driven by asymmetric warfare environments

Integration of electro optical systems with network centric warfare architectures - Market Challenges

High development and qualification costs for advanced sensors

Export control and technology transfer restrictions

Complex integration requirements with legacy platforms

Rapid obsolescence due to fast evolving sensor technologies

Dependence on specialized semiconductor and detector supply chains - Market Opportunities

Expansion of AI driven target recognition capabilities

Growing demand for lightweight and power efficient systems

Increased adoption of electro optical systems on unmanned ground platforms - Trends

Shift toward multisensor fusion architectures

Miniaturization of electro optical and infrared payloads

Rising use of artificial intelligence in image processing

Preference for modular and upgradeable system designs

Greater emphasis on all weather and day night operational capability - Government Regulations & Defense Policy

Defense export licensing under national security frameworks

Priority funding for indigenous defense technology development

Procurement policies favoring domestically developed systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Thermal imaging systems

Electro optical surveillance systems

Laser designation and rangefinding systems

Target acquisition and fire control systems

Multispectral and hyperspectral imaging systems - By Platform Type (In Value%)

Armored fighting vehicles

Main battle tanks

Unmanned ground vehicles

Static border surveillance installations

Man portable land systems - By Fitment Type (In Value%)

Original equipment manufacturer fitment

Retrofit and upgrade installations

Modular mission kits

Externally mounted sensor suites

Integrated sensor mast systems - By EndUser Segment (In Value%)

Army and ground forces

Border security and homeland defense agencies

Special operations forces

Intelligence and reconnaissance units

Defense research and test establishments - By Procurement Channel (In Value%)

Direct government procurement

Defense ministry tenders

Intergovernmental defense agreements

Domestic defense integrators

Export oriented defense contracts - By Material / Technology (in Value %)

Cooled infrared detector technology

Uncooled infrared detector technology

CCD and CMOS electro optical sensors

Advanced signal processing electronics

AI enabled image analytics software

- Cross Comparison Parameters (Sensor Resolution, Detection Range, System Weight, Power Consumption, Integration Flexibility, AI Capability, Environmental Robustness, Lifecycle Cost, Export Readiness, Upgradeability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

CONTROP Precision Technologies

Opgal Optronic Industries

NextVision Stabilized Systems

Tamarisk Technologies

Smartshooter

Top I Vision

Camero Tech

SCD Semiconductor Devices

Esc BAZ

IMCO Industries

Marom Dolphin

TAT Technologies

- Ground forces prioritize real time target acquisition and survivability enhancement

- Border security agencies focus on persistent surveillance and early warning

- Special operations units demand compact and covert sensor solutions

- Intelligence units emphasize high resolution imaging and data fusion capabilities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035