Market Overview

Based on a recent historical assessment, the Israel land based remote weapon stations market recorded a market size of USD ~ billion, driven by sustained procurement programs, platform modernization initiatives, and active deployment across armored and fixed land platforms. Spending was supported by disclosed procurement allocations from the Ministry of Defense and confirmed contract values reported by domestic defense manufacturers, reflecting operational demand for remotely operated firepower, enhanced situational awareness, and force protection systems across land warfare environments and border security deployments.

Based on a recent historical assessment, dominance within the market is centered around Israel’s primary defense manufacturing and deployment hubs including Tel Aviv, Haifa, and Be’er Sheva, supported by proximity to defense R&D clusters and military command infrastructure. Israel remains the sole geographic contributor due to domestic manufacturing depth, integrated supply chains, and sustained defense investment. These cities benefit from co-location of system integrators, sensor developers, and electronics firms, enabling faster deployment cycles and close coordination with end-user military units.

Market Segmentation

By Product Type

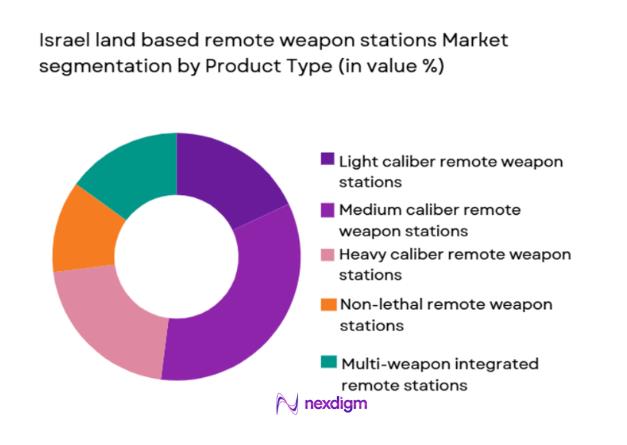

Israel land based remote weapon stations market is segmented by product type into light caliber remote weapon stations, medium caliber remote weapon stations, heavy caliber remote weapon stations, non-lethal remote weapon stations, and multi-weapon integrated remote stations. Recently, medium caliber remote weapon stations have a dominant market share due to their optimal balance between lethality, platform compatibility, and operational flexibility across armored vehicles and fixed installations. These systems are widely adopted by ground forces for patrol, border security, and urban operations because they support stabilized firing, advanced electro-optical sensors, and modular weapon integration. Their compatibility with existing armored personnel carriers and upgraded legacy platforms has accelerated adoption. Additionally, medium caliber systems align with current doctrine emphasizing precision engagement and reduced collateral exposure. Domestic manufacturers have prioritized this category due to export readiness and scalable configurations, reinforcing dominance through consistent procurement volumes and operational validation.

By Platform Type

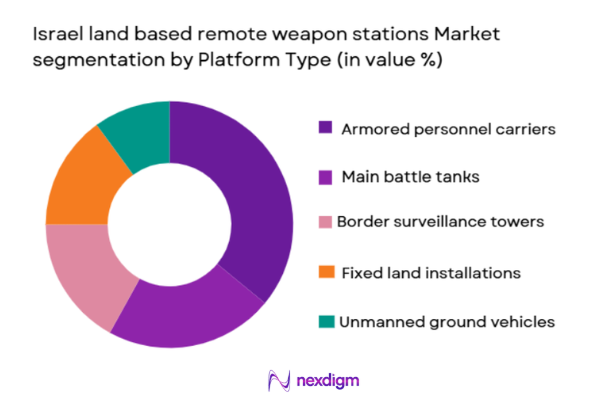

Israel land based remote weapon stations market is segmented by platform type into armored personnel carriers, main battle tanks, border surveillance towers, fixed land installations, and unmanned ground vehicles. Recently, armored personnel carriers dominate market share due to their extensive deployment across routine security operations, patrol missions, and rapid response units. These platforms require reliable remote weapon stations to enhance crew protection while maintaining continuous fire capability. Ongoing fleet upgrades and life extension programs have driven consistent retrofitting demand. Armored personnel carriers also serve as the primary platform for integrating new sensor and fire control technologies, supporting doctrine focused on mobility and survivability. Their operational versatility across multiple terrains and mission profiles has reinforced procurement prioritization by defense authorities.

Competitive Landscape

The Israel land based remote weapon stations market is moderately consolidated, led by a small group of vertically integrated defense manufacturers with strong government relationships and proprietary technologies. Major players benefit from long-term procurement contracts, export capabilities, and continuous innovation in sensors, stabilization, and fire control systems. Smaller firms operate as subsystem suppliers or niche technology providers, while competition centers on system performance, integration flexibility, and lifecycle support rather than pricing alone.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Core Platform Integration |

| Elbit Systems | 1966 | Haifa, Israel | ~

|

~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Smart Shooter | 2014 | Yagur, Israel | ~ | ~ | ~ | ~ | ~ |

| Controp Precision Technologies | 1977 | Hod Hasharon, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Land Based Remote Weapon Stations Market Analysis

Growth Drivers

Enhanced Force Protection and Soldier Survivability:

Enhanced force protection and soldier survivability remains a primary growth driver as Israel’s defense doctrine prioritizes minimizing personnel exposure during combat and security operations. Remote weapon stations allow operators to engage threats from within armored protection, significantly reducing injury risk during hostile engagements. The operational environment, characterized by asymmetric threats and urban combat scenarios, reinforces demand for remotely operated systems. Continuous border security operations further necessitate systems that enable persistent surveillance and rapid response. Integration of advanced optics and stabilization ensures engagement accuracy under movement. Military modernization programs emphasize survivability as a procurement criterion. This focus aligns with lessons learned from recent operational deployments. Consequently, budget allocations increasingly favor remote weapon station integration. The result is sustained demand growth across both new platforms and retrofitting programs.

Platform Modernization and Digital Battlefield Integration:

Platform modernization and digital battlefield integration is driving adoption as land forces transition toward network-centric operations. Remote weapon stations serve as critical nodes within integrated command and control architectures. Modern systems interface seamlessly with battlefield management systems, enabling real-time data sharing and coordinated engagements. This integration enhances situational awareness and decision-making speed. Legacy platforms undergoing upgrades increasingly incorporate digital fire control and sensor fusion. Defense planners prioritize systems that can be upgraded through software rather than hardware replacement. This approach reduces lifecycle costs and accelerates capability deployment. As modernization continues, remote weapon stations become standard components of upgraded fleets. The emphasis on interoperability further amplifies demand across platforms.

Market Challenges

High Integration and Lifecycle Costs:

High integration and lifecycle costs present a significant challenge as advanced remote weapon stations require complex installation, calibration, and maintenance. Integration with diverse vehicle platforms often demands customized engineering, increasing upfront expenditures. Lifecycle costs extend beyond procurement to include training, software updates, and spare parts. Budget constraints can delay procurement cycles or limit fleet-wide adoption. Smaller defense units may prioritize essential upgrades over advanced weapon systems. Additionally, sustaining system readiness requires skilled technicians and ongoing support contracts. Cost pressures are further amplified by rapid technological evolution. As systems age, compatibility with newer digital architectures becomes challenging. These factors collectively restrain faster market expansion.

Electronic Warfare and Cyber Vulnerability Risks:

Electronic warfare and cyber vulnerability risks challenge widespread deployment due to increasing reliance on digital connectivity. Remote weapon stations depend on sensors, data links, and software-driven controls that may be susceptible to jamming or cyber intrusion. Adversaries investing in electronic countermeasures raise concerns over system resilience. Ensuring secure communication channels adds complexity and cost to system design. Continuous software patching and cybersecurity validation are required. Operational commanders must balance connectivity benefits against potential vulnerabilities. Certification and testing requirements lengthen deployment timelines. These risks necessitate ongoing investment in system hardening. As threats evolve, maintaining secure operations remains a persistent challenge.

Opportunities

Expansion of Autonomous and Semi-Autonomous Ground Systems:

Expansion of autonomous and semi-autonomous ground systems presents a significant opportunity for the market as remote weapon stations are foundational to unmanned combat platforms. Defense planners increasingly explore unmanned ground vehicles for reconnaissance and force protection missions. Remote weapon stations enable these platforms to deliver controlled firepower without direct human exposure. Advances in AI-driven targeting and sensor fusion support this transition. Domestic innovation ecosystems actively develop autonomy-related technologies. Integration of remote weapon stations enhances mission versatility of unmanned platforms. Regulatory acceptance of autonomous systems is gradually increasing. Pilot deployments validate operational effectiveness. This convergence opens new procurement pathways and long-term growth potential.

Export-Oriented Customization and Modular Upgrades:

Export-oriented customization and modular upgrades create opportunities as global demand for adaptable land weapon systems rises. Israel’s defense industry has strong export credentials supported by proven operational performance. Modular remote weapon stations can be tailored to diverse customer requirements. This flexibility enhances competitiveness in international tenders. Upgrade kits for legacy systems extend product relevance. Export programs also offset domestic procurement fluctuations. Partnerships with foreign platform manufacturers expand addressable markets. Compliance with international standards facilitates adoption. As geopolitical demand for land defense systems increases, export-focused strategies drive incremental growth.

Future Outlook

The Israel land based remote weapon stations market is expected to maintain steady growth over the next five years, supported by ongoing platform upgrades and sustained security requirements. Technological advancements in AI-assisted targeting and sensor fusion will enhance system effectiveness. Regulatory support for domestic manufacturing remains strong. Demand will be reinforced by border security operations and modernization of armored fleets. Export activity is anticipated to complement domestic procurement momentum.

Major Players

• Rafael AdvancedDefense Systems

• Israel Aerospace Industries

• Smart Shooter

• Controp Precision Technologies

• SCD Semiconductors

• NextVision Stabilized Systems

• Elta Systems

• Aeronautics Group

• UVision Air

• Robotican

• XTEND Defense

• ThirdEye Systems

• IMI Systems

• Aselsan Israel

Key Target Audience

• Army procurement divisions

• Border security agencies

• Armored vehicle manufacturers

• Homeland security organizations

• Defense system integrators

• Investments and venture capitalist firms

• Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Market variables including procurement volume, platform deployment, technology adoption, and regulatory factors were identified through secondary research and defense disclosures.

Step 2: Market Analysis and Construction

Data was analyzed to construct market structure, segmentation, and competitive dynamics using validated defense industry frameworks.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense analysts, industry experts, and system integrators familiar with land weapon systems.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured report ensuring consistency, accuracy, and relevance to stakeholders.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Heightened border security requirements

Modernization of armored ground fleets

Emphasis on soldier survivability

Integration of automation and remote warfare

Rising asymmetric threat environment - Market Challenges

High system integration costs

Complex maintenance requirements

Export control and compliance constraints

Electronic warfare vulnerabilities

Limited skilled operator availability - Market Opportunities

Expansion of autonomous ground combat systems

Upgrades of legacy armored platforms

Increased cross-border defense collaborations - Trends

Adoption of AI enabled targeting

Shift toward modular and scalable designs

Enhanced sensor fusion capabilities

Increased focus on urban warfare solutions

Integration with battlefield management systems - Government Regulations & Defense Policy

Stringent defense procurement standards

Export licensing and compliance regimes

Focus on domestic defense manufacturing

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light caliber remote weapon stations

Medium caliber remote weapon stations

Heavy caliber remote weapon stations

Non-lethal remote weapon stations

Multi-weapon integrated remote stations - By Platform Type (In Value%)

Armored personnel carriers

Main battle tanks

Border surveillance towers

Fixed land installations

Unmanned ground vehicles - By Fitment Type (In Value%)

New vehicle integration

Retrofit upgrades

Modular add-on systems

Field replaceable units

Permanent fixed mounts - By EndUser Segment (In Value%)

Army ground forces

Border security forces

Homeland security agencies

Special operations units

Defense research and testing units - By Procurement Channel (In Value%)

Direct government contracts

Defense offset programs

Foreign military sales

Emergency operational procurement

Public private defense partnerships - By Material / Technology (in Value %)

Electro-optical targeting systems

Stabilized firing mechanisms

AI assisted fire control

Remote command and control software

Lightweight composite structures

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (System lethality, Stabilization accuracy, Sensor range, Integration flexibility, Weight profile, Power consumption, AI capability, Maintenance complexity, Cost efficiency, Export readiness) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Aselsan Israel

Smart Shooter

UVision Air

IMI Systems

Controp Precision Technologies

SCD Semiconductors

Aeronautics Group

XTEND Defense

Robotican

ThirdEye Systems

Elta Systems

NextVision Stabilized Systems

- Operational demand for reduced troop exposure

- Preference for systems with rapid deployment capability

- Growing need for interoperability with existing platforms

- Increased emphasis on lifecycle support and training

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035