Market Overview

Israel land based situational awareness systems market generated approximately USD ~ billion in revenue based on a recent historical assessment, supported by sustained national defense allocations and continuous investments in border security infrastructure. The market is driven by persistent requirements for real-time ground intelligence, force protection, and threat detection across land borders and sensitive zones. Demand is reinforced by rapid adoption of integrated sensor fusion, electro-optical surveillance, and command-and-control platforms aligned with national security priorities and operational readiness mandates.

Israel remains the dominant geography for land based situational awareness systems due to concentrated defense manufacturing, strong military-industry collaboration, and continuous operational deployment needs. Cities such as Tel Aviv, Haifa, and Beersheba lead system development and integration, supported by proximity to defense headquarters, R&D centers, and military bases. Dominance is further reinforced by indigenous technology development, fast procurement cycles, and operational feedback loops that accelerate deployment, upgrades, and sustained system utilization across national defense and border security agencies.

Market Segmentation

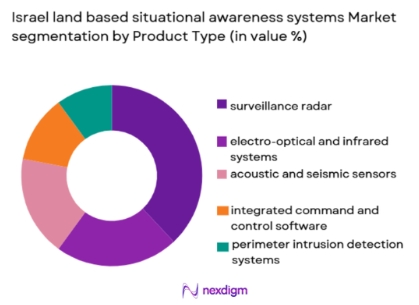

By Product Type

Israel land based situational awareness systems market is segmented by product type into ground surveillance radar, electro-optical and infrared systems, acoustic and seismic sensors, integrated command and control software, and perimeter intrusion detection systems. Recently, electro-optical and infrared systems have a dominant market share due to their ability to provide continuous day-night surveillance, high-resolution imaging, and rapid threat identification across complex terrain. These systems are widely deployed along borders and critical installations because they integrate easily with existing command networks and unmanned platforms. Strong domestic manufacturing capability, proven operational reliability, and rapid upgrade cycles further reinforce dominance. Continuous improvements in sensor accuracy, range, and AI-enabled analytics sustain higher procurement preference compared to other system types.

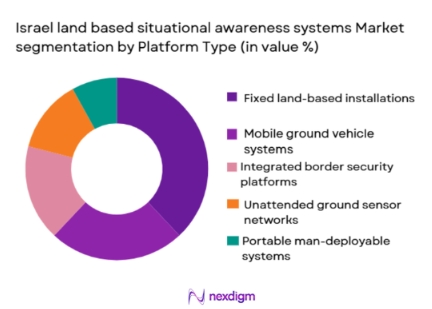

By Platform Type

Israel land based situational awareness systems market is segmented by platform type into fixed installations, mobile ground vehicle systems, portable man-deployable systems, unattended ground sensor networks, and integrated border security platforms. Recently, fixed land-based installations have a dominant market share due to their continuous operational availability, high sensor payload capacity, and integration with national command infrastructure. These platforms are preferred for long-term border monitoring and infrastructure protection because they support multi-sensor fusion and stable power supply. Their dominance is also driven by lower lifecycle disruption, centralized maintenance, and suitability for layered defense architectures supporting persistent situational awareness requirements.

Competitive Landscape

The competitive landscape of the Israel land based situational awareness systems market is moderately consolidated, characterized by a small group of dominant domestic defense firms with strong export capabilities. These players benefit from long-term government contracts, in-house R&D, and vertically integrated manufacturing, while smaller technology firms contribute niche sensing and analytics solutions through partnerships and subcontracting.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Deployment Environment |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Ashdod, Israel | ~ | ~ | ~ | ~ | ~ |

| Controp Precision Technologies | 1974 | Hod Hasharon, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Land Based Situational Awareness Systems Market Analysis

Growth Drivers

Border Security Modernization and Persistent Threat Monitoring Requirements:

This growth driver reflects the sustained need for continuous ground surveillance driven by geopolitical conditions and operational realities surrounding Israel’s land borders. Defense authorities require uninterrupted situational awareness to detect infiltration, smuggling, and asymmetric threats, which significantly elevates demand for advanced ground-based surveillance systems. Continuous modernization programs prioritize integrated sensor networks combining radar, electro-optical, and command platforms to improve reaction time and decision accuracy. These systems support layered defense doctrines by enabling early warning, target classification, and coordinated response. Domestic defense strategies emphasize technological superiority, resulting in consistent procurement cycles and upgrades. Operational feedback from active deployments directly informs system enhancement, accelerating replacement of legacy assets. Strong budgetary commitment to homeland security further sustains long-term investments. As threats evolve in complexity, situational awareness systems become foundational rather than auxiliary, reinforcing stable and recurring demand across military and security agencies.

Artificial Intelligence Enabled Sensor Fusion and Decision Support Adoption:

This driver is anchored in the rapid integration of AI and machine learning into land based surveillance architectures to manage large volumes of sensor data. AI enables automated target detection, anomaly recognition, and threat prioritization, reducing operator workload and response latency. Israeli defense doctrine strongly favors data-driven decision superiority, accelerating adoption of intelligent analytics across ground systems. AI-enabled fusion platforms combine radar, visual, thermal, and acoustic inputs into a unified operational picture. This capability enhances mission effectiveness in complex environments such as urban borders and rugged terrain. Continuous investment in defense AI startups strengthens domestic supply chains. As operational tempo increases, reliance on automated analytics becomes essential. This transformation drives higher system value, software upgrades, and long-term service contracts.

Market Challenges

High System Integration Complexity and Lifecycle Management Burden:

Land based situational awareness systems involve multiple sensors, communication links, and command software that must operate seamlessly in real time. Integrating new platforms with legacy military systems presents technical challenges that increase deployment timelines and costs. Interoperability requirements across army, border police, and intelligence units further complicate system architecture. Lifecycle management demands continuous calibration, software updates, and hardware maintenance under harsh environmental conditions. Skilled personnel are required to sustain operational readiness, increasing long-term costs. System downtime risks directly affect mission effectiveness, making reliability critical. These challenges can delay procurement decisions and limit rapid scalability. As system sophistication grows, integration complexity remains a structural constraint for the market.

Cybersecurity Vulnerabilities and Data Protection Constraints:

Situational awareness systems process sensitive operational data, making them prime targets for cyber intrusion and electronic warfare. Ensuring secure data transmission and storage requires advanced encryption and continuous monitoring, increasing system cost and complexity. Cyber resilience must be maintained across distributed sensors and command nodes, including remote border installations. Regulatory and military cybersecurity standards impose strict compliance requirements on vendors. Any breach risks operational compromise and national security exposure. Continuous threat evolution demands frequent system hardening and updates. These factors create procurement hesitancy and extend validation cycles. Cybersecurity therefore remains a persistent challenge influencing system design and deployment pace.

Opportunities

Expansion of Smart Border Infrastructure and Integrated National Surveillance Networks:

Israel continues to invest in smart border initiatives that integrate physical barriers with advanced sensing and analytics. These programs create significant opportunities for land based situational awareness system providers to supply end-to-end solutions. Integration of fixed sensors, mobile platforms, and centralized command centers increases system scope and value. Smart borders prioritize automation, early threat detection, and rapid response coordination. Vendors offering modular and scalable architectures are well positioned to benefit. Long-term maintenance and upgrade contracts further enhance revenue potential. Expansion of national surveillance networks also enables technology standardization. This opportunity supports sustained market growth and deeper system penetration.

Export of Proven Ground Surveillance Technologies to Allied Nations:

Israeli land based situational awareness solutions are combat-proven and highly regarded internationally. Export demand from allied countries seeking effective border security and internal surveillance systems continues to rise. Vendors can leverage operational credibility to expand into emerging defense markets. Adaptation of systems to diverse terrains and threat profiles enhances export attractiveness. Government-backed defense export frameworks support international sales. This opportunity diversifies revenue beyond domestic demand. Increased exports also drive economies of scale and further R&D investment. Global adoption reinforces Israel’s position as a leading provider of ground surveillance technologies.

Future Outlook

The Israel land based situational awareness systems market is expected to maintain steady growth over the next five years, supported by continuous defense modernization and evolving threat environments. Advancements in artificial intelligence, sensor fusion, and secure communications will enhance system effectiveness. Regulatory support for domestic defense manufacturing and exports will remain strong. Demand will be reinforced by border security priorities and infrastructure protection requirements.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Elta Systems

- Controp Precision Technologies

- Aeronautics Group

- Opgal Optronic Industries

- Tadirah Communications

- NextVision Stabilized Systems

- Camero-Tech

- Sentrycs

- Bird Aerosystems

- SMARTSHOOTER

- UVision Air

- XTEND

Key Target Audience

- Defense ministries and armed forces

- Border security agencies

- Homeland security organizations

- Critical infrastructure operators

- Defense system integrators

- Technology and system manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Market scope, system categories, end users, and technology variables were identified through secondary research and defense policy analysis to establish the analytical framework.

Step 2: Market Analysis and Construction

Data was synthesized from defense budgets, procurement programs, and company disclosures to construct market structure and segmentation models.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense technology experts, system integrators, and industry analysts to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a coherent market model, ensuring consistency across qualitative and quantitative assessments.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising border security and territorial monitoring requirements

Increased focus on real-time battlefield awareness

Advancements in sensor fusion and analytics technologies

Growing investment in ground-based defense modernization

Demand for integrated and network-centric situational awareness - Market Challenges

High system integration and lifecycle costs

Complex interoperability with legacy defense systems

Data security and cyber resilience concerns

Operational reliability in harsh terrain conditions

Lengthy defense procurement and approval cycles - Market Opportunities

Expansion of smart border and perimeter surveillance projects

Adoption of AI-driven threat detection and analytics

Upgrades and modernization of existing ground surveillance assets - Trends

Shift toward multi-sensor fusion architectures

Increased use of autonomous and unattended ground sensors

Integration of AI and machine learning for threat assessment

Emphasis on modular and scalable system designs

Enhanced focus on secure data sharing and command integration - Government Regulations & Defense Policy

Strengthening of national border security regulations

Defense procurement policies favoring domestic innovation

Emphasis on cybersecurity and data protection standards

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electro-optical and infrared surveillance systems

Ground surveillance radar systems

Acoustic and seismic sensing systems

Integrated command and control software suites

Border and perimeter monitoring systems - By Platform Type (In Value%)

Fixed land-based installations

Mobile ground vehicle mounted systems

Portable and man-portable systems

Unmanned ground sensor networks

Integrated border security infrastructure - By Fitment Type (In Value%)

New system installations

Retrofit and upgrade solutions

Modular add-on sensor packages

Platform-integrated turnkey systems

Hybrid deployment configurations - By EndUser Segment (In Value%)

Army and ground forces

Border security and homeland defense agencies

Intelligence and reconnaissance units

Special operations forces

Critical infrastructure protection authorities - By Procurement Channel (In Value%)

Direct government procurement contracts

Defense ministry tenders

System integrator led procurement

Public sector framework agreements

Emergency and rapid acquisition programs - By Material / Technology (in Value %)

Advanced electro-optical sensor materials

Phased array radar technologies

Artificial intelligence enabled analytics

Secure communication and data fusion technologies

Hardened electronics and ruggedized enclosures

- Cross Comparison Parameters (system range, sensor accuracy, integration capability, data fusion performance, cyber resilience, deployment flexibility, lifecycle support, scalability, cost efficiency)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elta Systems

Aeronautics Group

Camero-Tech

CONTROP Precision Technologies

Opgal Optronic Industries

Tadirah Communications

UVision Air

SMARTSHOOTER

NextVision Stabilized Systems

Sentrycs

Bird Aerosystems

XTEND

- Ground forces prioritizing real-time situational visibility

- Border agencies focusing on persistent surveillance coverage

- Intelligence units leveraging advanced data fusion capabilities

- Infrastructure authorities emphasizing early threat detection

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035