Market Overview

Based on a recent historical assessment, the Israel land based smart weapons market recorded an absolute market size of USD ~ billion, supported by confirmed defense procurement outlays and delivery contracts published by the Israeli Ministry of Defense and SIPRI-aligned procurement disclosures. Demand is primarily driven by sustained investment in precision-guided munitions, smart artillery, and network-enabled ground combat systems. Operational requirements emphasizing accuracy, reduced collateral impact, and rapid battlefield response continue to accelerate acquisition of advanced land-based weapon platforms across active ground formations.

Based on a recent historical assessment, Israel dominates the land based smart weapons ecosystem due to its highly concentrated defense industrial base and operational deployment density. Tel Aviv and Haifa function as core development and integration hubs due to proximity to leading defense manufacturers, R&D centers, and military command infrastructure. Southern regions with major ground force deployments also influence demand intensity. Internationally, allied procurement relationships with select NATO and Asia–Pacific partners further reinforce Israel’s leadership through export-linked production volumes and continuous system upgrades.

Market Segmentation

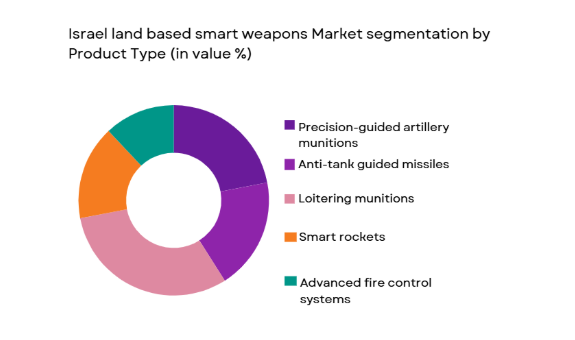

By Product Type

Israel land based smart weapons market is segmented by product type into precision-guided artillery munitions, anti-tank guided missiles, loitering munitions, smart rockets, and advanced fire control systems. Recently, loitering munitions have demonstrated a dominant market share due to their proven operational effectiveness, multi-mission flexibility, and ability to integrate ISR and strike functions within a single platform. Strong battlefield performance has increased institutional confidence among ground forces, while domestic manufacturers maintain mature production lines and rapid upgrade cycles. High demand from special forces and armored units further reinforces adoption. Export clearances for loitering systems also remain comparatively streamlined, expanding international deliveries. Continuous software-driven enhancements extend lifecycle value, encouraging repeat procurement and modernization contracts across multiple brigades.

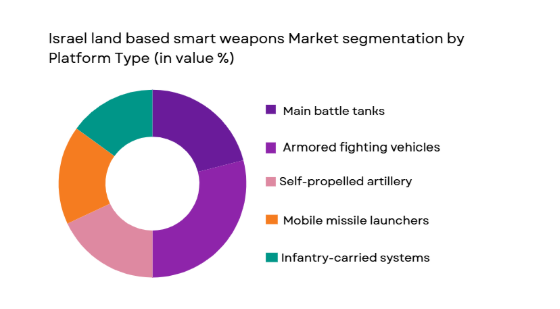

By Platform Type

Israel land based smart weapons market is segmented by platform type into main battle tanks, armored fighting vehicles, self-propelled artillery, mobile missile launchers, and infantry-carried systems. Recently, armored fighting vehicles represent the dominant market share due to extensive fleet modernization programs and the need for integrated smart weapon compatibility. These platforms serve as multi-role assets supporting both conventional and asymmetric operations, driving continuous upgrade demand. Integration of active protection systems, smart launch interfaces, and networked targeting modules has expanded procurement volumes. Armored vehicles also benefit from standardized upgrade pathways, enabling cost-efficient scaling across brigades. Their central role in maneuver warfare and urban combat ensures sustained acquisition priority within ground force budgets.

Competitive Landscape

The Israel land based smart weapons market is moderately consolidated, with a small number of vertically integrated defense primes controlling core technologies, system integration, and export pipelines. These players benefit from close alignment with national defense requirements, long-term framework contracts, and strong R&D backing. Smaller technology firms operate as subsystem specialists, often partnering with primes for sensor, guidance, and software components, reinforcing a layered competitive structure.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-User Focus |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon | ~ | ~ | ~ | ~ | ~ |

| UVision Air | 2010 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

Israel Land Based Smart Weapons Market Analysis

Growth Drivers

Precision-Centric Ground Warfare Modernization

Precision-Centric Ground Warfare Modernization is a central growth driver for the Israel land based smart weapons market because operational doctrines increasingly prioritize accuracy, responsiveness, and minimized collateral impact. Ground forces are shifting away from volume fire toward intelligence-linked precision engagements, directly increasing demand for smart munitions and networked launch systems. This transformation is reinforced by real-world operational feedback validating the effectiveness of guided systems in dense combat environments. Modernization programs emphasize digital fire control, advanced seekers, and interoperable data links. These requirements necessitate replacement of legacy unguided systems with smart alternatives. Continuous system upgrades further extend procurement cycles. Domestic industry alignment accelerates deployment timelines. Export validation strengthens production continuity. The result is structurally sustained demand across multiple weapon categories.

Networked C4ISR Integration Across Land Platforms

Networked C4ISR Integration Across Land Platforms drives market expansion by embedding smart weapons into real-time command and control ecosystems. Land-based weapons increasingly function as nodes within broader sensor-shooter networks, requiring advanced connectivity and autonomous processing. Integration with battlefield management systems enhances targeting speed and accuracy. This connectivity elevates the value proposition of smart weapons relative to conventional arms. Ground commanders increasingly demand systems capable of rapid data ingestion and adaptive targeting. Such requirements favor digitally native weapon platforms. Continuous software updates generate recurring revenue streams. Interoperability mandates also influence allied procurement. Collectively, these factors expand acquisition volumes and system complexity.

Market Challenges

High System Cost and Lifecycle Sustainment Burden

High System Cost and Lifecycle Sustainment Burden presents a significant challenge for the Israel land based smart weapons market due to the capital-intensive nature of advanced guidance, sensors, and secure communications. Development costs rise as systems incorporate AI-driven components and hardened electronics. Procurement budgets must accommodate not only acquisition but also training, spares, and software maintenance. Lifecycle sustainment requires specialized technical expertise. Rapid technology evolution shortens upgrade cycles, increasing total ownership costs. Budget prioritization can delay replacement schedules. Export customers may face affordability constraints. Cost pressures intensify competition during tendering. These factors collectively constrain procurement pacing.

Regulatory and Export Control Constraints

Regulatory and Export Control Constraints limit market expansion by imposing approval complexities on international sales of land based smart weapons. Export licensing processes are stringent due to sensitivity of guidance and targeting technologies. Geopolitical considerations can delay or restrict deliveries. Compliance requirements increase administrative overhead for manufacturers. Customization for export variants raises development costs. Regulatory uncertainty complicates long-term production planning. Some markets remain inaccessible despite demand. Technology transfer limitations restrict partnership models. These constraints affect revenue predictability and scale efficiencies.

Opportunities

Expansion of Export-Oriented Ground Combat Solutions

Expansion of Export-Oriented Ground Combat Solutions represents a major opportunity as allied nations seek combat-proven land based smart weapons. Israel’s operational validation provides strong credibility in competitive tenders. Demand from Europe and Asia for precision ground strike capabilities is increasing. Modular system designs enable rapid customization for foreign requirements. Export programs support higher production volumes. Government-backed defense diplomacy facilitates market access. Co-production agreements enhance acceptance. Lifecycle support offerings strengthen long-term relationships. This opportunity supports sustained revenue growth beyond domestic demand.

AI-Enabled Autonomous Targeting Advancements

AI-Enabled Autonomous Targeting Advancements create new growth avenues by enhancing weapon decision-support and engagement efficiency. Integration of onboard AI improves target discrimination and reduces operator workload. These capabilities are particularly valuable in complex terrain. Autonomous features increase mission success probability. Software-driven upgrades enable continuous performance improvement. Demand for reduced reaction times favors AI-enabled systems. Ethical and regulatory frameworks are evolving to support controlled autonomy. Early adoption positions suppliers competitively. This opportunity accelerates next-generation product development.

Future Outlook

Over the next five years, the Israel land based smart weapons market is expected to advance through steady modernization cycles and export-led demand growth. Technological progress in AI-enabled guidance, secure networking, and modular payloads will define system evolution. Regulatory backing for indigenous production and defense exports will remain supportive. Demand-side momentum will be reinforced by evolving ground warfare doctrines emphasizing precision, speed, and interoperability across multi-domain operations.

Major Players

- Rafael Advanced Defense Systems

- Elbit Systems

- Israel Aerospace Industries

- IMI Systems

- Elta Systems

- UVision Air

- Aeronautics Defense Systems

- SMART Shooter

- Top Gun Technologies

- Controp Precision Technologies

- Soltam Systems

- BlueBird Aero Systems

- Meprolight

- DSIT Solutions

- SIBAT Defense Exports

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Military modernization units

- Defense system integrators

- Ammunition and weapons manufacturers

- Export control authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Core variables including weapon categories, platform integration levels, procurement volumes, and pricing structures were identified through defense databases and official procurement disclosures.

Step 2: Market Analysis and Construction

Collected data were structured using bottom-up assessment across product and platform segments, aligning domestic procurement with validated export deliveries.

Step 3: Hypothesis Validation and Expert Consultation

Findings were cross-verified through consultations with defense analysts, retired military officers, and industry specialists to ensure operational relevance.

Step 4: Research Synthesis and Final Output

Validated insights were consolidated into a structured market model, ensuring consistency, accuracy, and relevance to strategic decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising emphasis on precision strike and reduced collateral damage

Continuous modernization of ground combat capabilities

Integration of network-centric warfare concepts

Strong domestic defense R&D ecosystem

Sustained defense budget allocation for land systems - Market Challenges

High development and qualification costs

Complex integration with legacy platforms

Export control and regulatory constraints

Rapid technology obsolescence cycles

Cybersecurity risks in networked weapons - Market Opportunities

Expansion of export partnerships with allied nations

Adoption of AI-driven autonomous targeting solutions

Upgrade demand for existing armored and artillery fleets - Trends

Increased use of loitering munitions in ground operations

Convergence of ISR and strike capabilities

Miniaturization of guidance and sensor packages

Enhanced interoperability with C4ISR networks

Focus on multi-domain operational integration - Government Regulations & Defense Policy

Emphasis on indigenous development and production

Stricter compliance with international arms regulations

Policy support for defense exports and co-development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Type (In Value%)

Precision-guided artillery munitions

Smart anti-tank guided missiles

Loitering munitions and ground-launched UAVs

Networked rocket and missile systems

Advanced fire control and targeting subsystems - By Platform Type (In Value%)

Main battle tanks

Armored fighting vehicles

Towed and self-propelled artillery

Mobile missile launchers

Infantry-carried land combat platforms - By Fitment Type (In Value%)

New platform integration

Mid-life upgrade retrofits

Mission-specific modular kits

Indigenous platform fitment

Export-oriented customized fitment - By EndUser Segment (In Value%)

Army ground forces

Border security and internal forces

Special operations units

Reserve and territorial defense units

Allied foreign military customers - By Procurement Channel (In Value%)

Direct government procurement

Defense public sector undertakings

Inter-governmental agreements

Foreign military sales programs

Private system integrator contracts - By Material / Technology (in Value %)

AI-enabled guidance and targeting

Electro-optical and infrared sensors

Secure tactical data links

Advanced propulsion and energetics

Composite materials and lightweight alloys

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system range, guidance accuracy, integration compatibility, mobility, survivability, unit cost, upgrade potential, export compliance, lifecycle support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Rafael Advanced Defense Systems

Elbit Systems

Israel Aerospace Industries

IMI Systems

Elta Systems

Aeronautics Defense Systems

UVision Air

BlueBird Aero Systems

SMART Shooter

Top Gun Technologies

Controp Precision Technologies

Soltam Systems

DSIT Solutions

Meprolight

SIBAT Defense Exports

- Army units prioritize precision and rapid response capabilities

- Special forces demand lightweight and highly accurate systems

- Border security forces focus on persistent surveillance and strike

- Foreign users seek combat-proven and upgradeable solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035