Market Overview

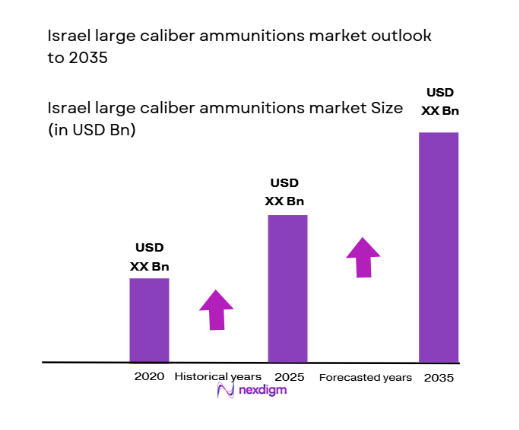

Based on a recent historical assessment, the Israel large caliber ammunitions market recorded an absolute market size of USD ~ billion, supported by confirmed procurement allocations, replenishment contracts, and export deliveries disclosed through the Israeli Ministry of Defense and SIPRI-aligned defense trade data. Demand is driven by sustained artillery and armored force readiness requirements, high operational consumption rates, and continuous stockpile renewal programs. Additional momentum comes from the integration of extended-range and precision-guided large caliber rounds, which increase effectiveness while aligning with evolving fire control and targeting doctrines.

Based on a recent historical assessment, Israel dominates the large caliber ammunitions ecosystem due to its concentrated defense manufacturing base and operational artillery density. Production and integration activities are centered around Haifa, Ramat Hasharon, and southern industrial zones supporting energetics and metal processing. Internationally, export demand from allied European and Asia–Pacific countries reinforces dominance, driven by combat-proven performance and reliable supply continuity. Close alignment between domestic armed forces and industry accelerates qualification, deployment, and iterative upgrades across multiple large caliber ammunition families.

Market Segmentation

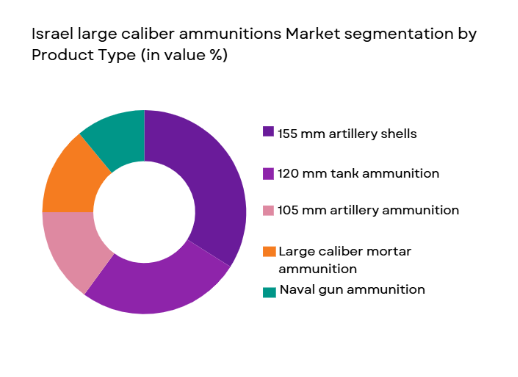

By Product Type

Israel large caliber ammunitions market is segmented by product type into 155 mm artillery shells, 120 mm tank ammunition, 105 mm artillery ammunition, large caliber mortar ammunition, and naval gun ammunition. Recently, 155 mm artillery shells have held a dominant market share due to sustained artillery modernization programs and high operational usage across ground formations. These shells are prioritized because they offer compatibility with self-propelled and towed artillery systems while supporting extended-range and precision guidance enhancements. Domestic production scale, mature supply chains, and ongoing replenishment cycles further reinforce demand. Export demand from allied nations seeking NATO-standard calibers also strengthens volume stability. Continuous upgrades, including base-bleed and guidance kits, enhance lifecycle relevance and maintain procurement momentum.

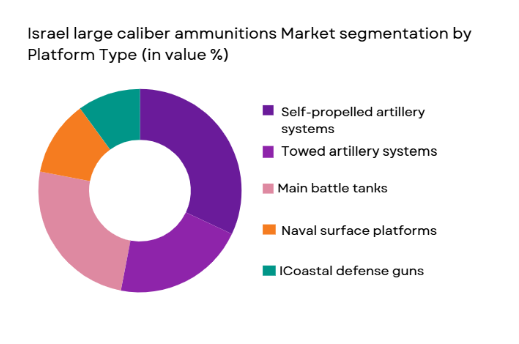

By Platform Type

Israel large caliber ammunitions market is segmented by platform type into self-propelled artillery systems, towed artillery systems, main battle tanks, naval surface platforms, and coastal defense guns. Recently, self-propelled artillery systems account for the dominant market share due to their central role in rapid maneuver warfare and sustained fire missions. These platforms require high and continuous ammunition availability, driving consistent procurement volumes. Their integration with digital fire control systems favors advanced large caliber rounds, including extended-range and precision variants. High operational tempo and readiness mandates further reinforce consumption rates. Long service life of these platforms ensures recurring replenishment and upgrade demand, sustaining dominance within the platform segmentation.

Competitive Landscape

The Israel large caliber ammunitions market is moderately consolidated, characterized by a small group of domestic manufacturers with vertically integrated energetics, metal processing, and assembly capabilities. These players benefit from long-term defense contracts, close collaboration with the Israel Defense Forces, and strong export channels, while competition focuses on precision, safety compliance, and production scalability.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Caliber Specialization |

| IMI Systems | 1933 | Ramat Hasharon | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Denel Munitions | 1999 | Zurich | ~ | ~ | ~ | ~ | ~ |

| Nammo | 1998 | Raufoss | ~ | ~ | ~ | ~ | ~ |

Israel Large Caliber Ammunitions Market Analysis

Growth Drivers

Sustained Artillery and Armored Force Readiness Requirements:

Sustained Artillery and Armored Force Readiness Requirements act as a primary growth driver for the Israel large caliber ammunitions market because operational doctrines emphasize continuous availability of high-volume firepower. Artillery and armored units rely on large caliber rounds for deterrence, suppression, and decisive engagement across multiple operational scenarios. High training intensity further increases consumption beyond active operations. Stockpile management policies mandate regular replenishment to maintain readiness. Precision-guided and extended-range variants increase unit value while retaining large caliber relevance. Integration with digital fire control systems enhances effectiveness and justifies modernization budgets. Domestic production ensures rapid response to surge demand. Export orders complement domestic requirements. Collectively, these factors sustain consistent procurement volumes and market expansion.

Expansion of Precision and Extended-Range Large Caliber Ammunition Adoption:

Expansion of Precision and Extended-Range Large Caliber Ammunition Adoption drives market growth by increasing the strategic value of each round. Precision kits transform conventional shells into guided munitions, aligning with modern engagement requirements. Extended-range technologies improve standoff capability and survivability. These advancements encourage replacement of older stockpiles. Higher unit costs elevate overall market value. Operational success reinforces confidence in advanced rounds. Export customers increasingly demand such capabilities. Continuous R&D investment sustains innovation cycles. Compatibility with existing platforms reduces integration barriers. This combination strengthens long-term demand.

Market Challenges

Raw Material Cost Volatility and Energetics Supply Constraints:

Raw Material Cost Volatility and Energetics Supply Constraints challenge the Israel large caliber ammunitions market by increasing production cost uncertainty. Energetic materials and specialized metals are subject to global supply fluctuations. Price instability complicates long-term contracting. Manufacturers face margin pressure. Stockpiling of inputs raises working capital requirements. Regulatory controls on energetics sourcing add complexity. Supply disruptions risk delivery delays. Capacity scaling becomes difficult during surge demand. These factors collectively strain production planning and cost control.

Stringent Safety, Storage, and Export Compliance Requirements:

Stringent Safety, Storage, and Export Compliance Requirements constrain market operations due to strict handling and certification standards. Compliance increases production timelines. Storage infrastructure investments are substantial. Export licensing processes are lengthy. International regulations limit accessible markets. Documentation and audit requirements raise administrative costs. Disposal and demilitarization obligations add lifecycle expense. Non-compliance risks severe penalties. These challenges elevate operational complexity and limit rapid scaling.

Opportunities

Development of Next-Generation Precision Large Caliber Rounds:

Development of Next-Generation Precision Large Caliber Rounds presents a major opportunity by aligning lethality with accuracy and safety. Advanced guidance reduces collateral damage. Modular kits enable cost-effective upgrades. Demand from allied forces is increasing. Digital integration enhances interoperability. Continuous innovation differentiates suppliers. Export potential expands. Higher margins improve profitability. This opportunity supports sustained market advancement.

Expansion of Export Partnerships with Allied Militaries:

Expansion of Export Partnerships with Allied Militaries offers growth by leveraging Israel’s combat-proven ammunition performance. Allies seek reliable suppliers. Framework agreements stabilize demand. Co-production models improve access. Export volumes smooth domestic demand cycles. Government support facilitates approvals. Long-term support contracts enhance revenue stability. This opportunity strengthens global market presence.

Future Outlook

Over the next five years, the Israel large caliber ammunitions market is expected to advance through steady replenishment demand and increased adoption of precision-guided variants. Technological development will focus on range extension, safety, and guidance integration. Regulatory support for domestic production and exports will remain strong. Demand will be reinforced by artillery modernization programs and allied procurement partnerships.

Major Players

- IMI Systems

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Soltam Systems

- Tomer Ltd

- Ashot Ashkelon Industries

- Rheinmetall Denel Munitions

- Nammo

- BAE Systems Munitions

- General Dynamics Ordnance and Tactical Systems

- Northrop Grumman

- Hanwha Defense

- Nexter Munitions

- Saab Bofors Dynamics

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Artillery and armored corps commands

- Ammunition manufacturers

- Defense system integrators

- Weapons platform OEMs

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including caliber categories, production volumes, procurement contracts, and pricing structures were identified using official defense disclosures and trade databases.

Step 2: Market Analysis and Construction

Data were analyzed through bottom-up assessment across product and platform segments, aligning domestic procurement with validated export deliveries.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with defense analysts, retired artillery officers, and industry specialists.

Step 4: Research Synthesis and Final Output

Validated insights were consolidated into a structured market model ensuring accuracy, relevance, and strategic usability.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Sustained artillery and armored force modernization

High operational consumption and stockpile replenishment

Expansion of precision guided large caliber ammunition

Strong domestic production capabilities

Export demand for combat proven ammunition - Market Challenges

High raw material and energetics cost volatility

Stringent safety and storage regulations

Complex export licensing requirements

Manufacturing capacity constraints during surges

Environmental and disposal compliance pressures - Market Opportunities

Development of extended range precision ammunition

Increased export partnerships with allied nations

Upgrades to existing artillery ammunition stocks - Trends

Shift toward precision guided large caliber rounds

Increased focus on insensitive munition technologies

Automation in ammunition manufacturing

Demand for extended range and higher lethality

Integration with digital fire control systems - Government Regulations & Defense Policy

Priority support for domestic ammunition production

Strict compliance with international arms regulations

Policies encouraging defense exports - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

155 mm artillery shells

120 mm tank ammunition

105 mm artillery ammunition

Mortar ammunition above 81 mm

Naval gun large caliber ammunition - By Platform Type (In Value%)

Self propelled artillery systems

Towed artillery systems

Main battle tanks

Naval surface combatants

Coastal defense artillery platforms - By Fitment Type (In Value%)

New production ammunition

Replenishment and stockpile replacement

Upgraded and extended range ammunition

Export configured ammunition

Training and practice ammunition - By EndUser Segment (In Value%)

Israel Defense Forces ground forces

Israel Defense Forces armored corps

Israel Defense Forces artillery corps

Naval forces

Foreign military customers - By Procurement Channel (In Value%)

Direct Ministry of Defense procurement

Long term framework contracts

Emergency operational procurement

Foreign military sales

Export contracts through defense agencies - By Material / Technology (in Value %)

High explosive and fragmentation warheads

Extended range base bleed technology

Precision guided artillery kits

Insensitive munition compositions

Advanced propellant and casing materials

- Market share snapshot of major players

- Cross Comparison Parameters (caliber range, lethality, effective range, guidance capability, production capacity, unit cost, safety compliance, export readiness, lifecycle support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

IMI Systems

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elta Systems

Soltam Systems

Tomer Ltd

Ashot Ashkelon Industries

EURENCO Bofors

Rheinmetall Denel Munitions

BAE Systems Munitions

Nammo

Northrop Grumman

General Dynamics Ordnance and Tactical Systems

Hanwha Defense

- Artillery units emphasize sustained fire and accuracy

- Armored corps prioritize advanced tank ammunition

- Naval forces require large caliber gun ammunition

- Export customers seek reliable and combat proven rounds

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035