Market Overview

The Israel Launch Vehicle Avionics market is estimated to be valued at approximately USD ~ billion in 2025, supported by substantial investments in defense and aerospace sectors. The growth of the market is driven by the increasing demand for advanced satellite launch capabilities, space exploration programs, and national security requirements. In 2024, Israel Aerospace Industries and Rafael Advanced Defense Systems saw a significant uptick in government spending, which has been allocated toward the development of cutting-edge avionics systems for military and commercial space applications. The robust defense budget, coupled with global space missions, acts as a catalyst for this growth.

Israel is a dominant player in the launch vehicle avionics market, with cities like Tel Aviv, Haifa, and Herzliya playing critical roles in the sector’s development. Tel Aviv is a hub for research and development activities in avionics systems, while Haifa is home to Israel Aerospace Industries, a key player in the development of space technologies and avionics systems. Herzliya is known for being a center for defense technology and aerospace innovations. Israel’s strong government backing, technological advancements, and strategic location in the Middle East give it a significant competitive advantage in the launch vehicle avionics market.

Market Segmentation

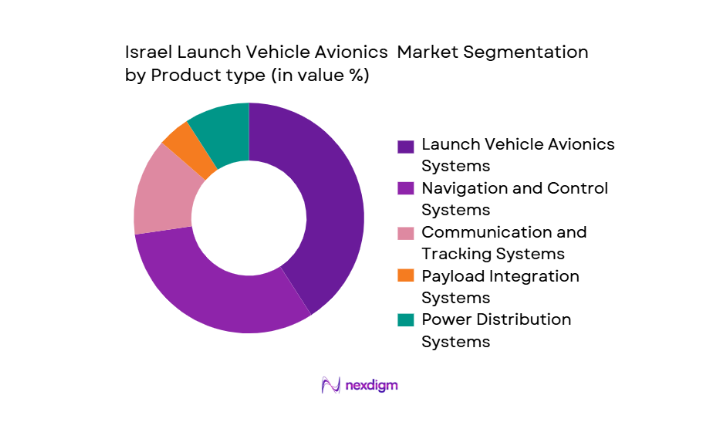

By Product Type

The Israel Launch Vehicle Avionics market is segmented into Launch Vehicle Avionics Systems, Navigation and Control Systems, Communication and Tracking Systems, Payload Integration Systems, and Power Distribution Systems.

Launch Vehicle Avionics Systems is the dominant sub-segment due to the increasing number of satellite and defense missions that require reliable and sophisticated avionics solutions. Israel, being at the forefront of missile defense and space exploration, particularly through organizations such as Israel Aerospace Industries and Rafael Advanced Defense Systems, contributes to the growing demand for these systems. The expertise of these organizations in developing avionics systems for defense and commercial purposes has cemented their position in the market.

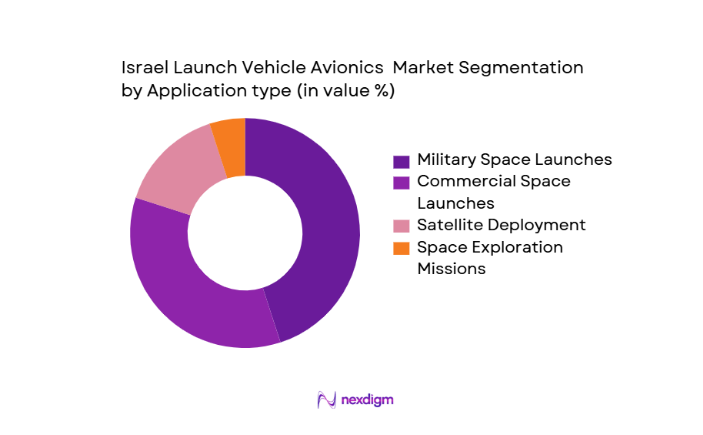

By Application

The market is segmented into Military Space Launches, Commercial Space Launches, Satellite Deployment, and Space Exploration Missions.

Military Space Launches holds the dominant share within this segmentation. The Israeli government’s defense budget for space-related technologies, along with its defense programs such as the Iron Dome and Arrow missile defense systems, heavily influences this segment. Israel’s strategic defense capabilities rely on sophisticated space systems, which require robust avionics systems for military space launch vehicles. The high level of investment in the defense sector ensures the growth of avionics systems dedicated to military space applications.

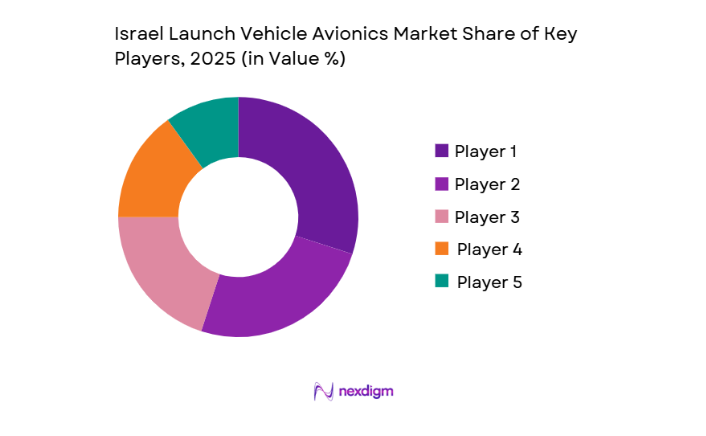

Competitive Landscape

The Israeli launch vehicle avionics market is highly competitive, dominated by a few key players. Israel Aerospace Industries (IAI) is one of the largest contributors to the market, closely followed by Rafael Advanced Defense Systems, Elbit Systems, and Space IL. These companies lead the market due to their significant role in the country’s defense and space programs. IAI’s advanced avionics systems for satellite launches and missile defense applications, and Rafael’s expertise in developing state-of-the-art defense technologies, help maintain their dominance.

| Company Name | Year of Establishment | Headquarters | Revenue in 2024 | Market Position | Key Products | Global Footprint |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| SpaceIL | 2011 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Godrej Aerospace | 1958 | Mumbai, India | ~ | ~ | ~ | ~ |

Israel Launch Vehicle Avionics Market Analysis

Growth Drivers

Rising Commercial Small Satellite Launch Demand

Small satellite deployments have surged globally due to initiatives in broadband, Earth observation, and IoT infrastructure, significantly expanding commercial launch service orders. This surge compels launch service providers to prioritize avionics that support frequent, cost-efficient missions with high reliability. The need for robust but lightweight avionics systems for small launchers drives investment in modular, scalable guidance, navigation, telemetry, and command systems. Commercial operators also seek avionics solutions that integrate easily with standardized payload interfaces, reducing integration time and enhancing mission throughput. Furthermore, the competitive pressure among launch providers to distinguish their services on reliability and cadence accelerates avionics innovation and adoption, with suppliers developing systems capable of rapid configuration and certification. The result is a feedback loop where high mission frequency elevates demand for next-generation avionics, which in turn supports broader commercial space ecosystems and attracts new customers, escalating market growth.

Government Space Modernization and Defense Programs

Government space programs and defense modernization initiatives increasingly allocate budgets toward advanced launch vehicle technologies, which include high-precision avionics subsystems. National space agencies and defense departments prioritize advanced guidance, navigation, and control systems capable of supporting strategic missions such as reconnaissance, national security payload delivery, and scientific exploration. These programs often involve multi-year procurements with high certification standards that favor established avionics suppliers with proven reliability histories. Moreover, governments incentivize local industry growth and technology sovereignty, prompting substantial investments in indigenous avionics research and development.

Market Challenges

High Development Cost and Certification Complexity

Launch vehicle avionics systems are among the most technically demanding components of space launch infrastructure, requiring extreme reliability, fault tolerance, and compliance with rigorous certification standards. Developing avionics capable of surviving vibration, thermal stress, radiation exposure, and vacuum environments substantially increases engineering time and capital expenditure. Certification processes imposed by government agencies and defense bodies require extensive testing, redundancy validation, and mission simulations, which prolong development cycles and elevate costs. Smaller suppliers often face barriers entering the market due to the financial burden of qualification testing and documentation requirements. Additionally, frequent design revisions driven by evolving mission requirements compound engineering complexity. Integration challenges across propulsion, guidance, and telemetry subsystems further raise development risk.

Supply Chain Constraints and Component Availability

The launch vehicle avionics market depends heavily on specialized electronic components such as radiation-hardened processors, high-precision inertial sensors, and space-grade power electronics, many of which have limited global suppliers. Supply chain disruptions, geopolitical restrictions, and export control regulations can delay procurement timelines and increase component costs. Dependence on long-lead items complicates production planning for launch providers operating on tight mission schedules. Additionally, qualification requirements restrict substitution flexibility, meaning suppliers cannot easily replace unavailable components without re-certification. As launch cadence increases globally, competition for these components intensifies, placing further strain on suppliers and integrators. These constraints increase operational risk and limit scalability, particularly for emerging launch vehicle programs seeking cost efficiency and rapid deployment.

Opportunities

Adoption of Autonomous and AI-Enabled Avionics Systems

Advances in artificial intelligence, machine learning, and autonomous control present significant opportunities for the launch vehicle avionics market. AI-enabled avionics can optimize trajectory planning, detect anomalies in real time, and autonomously respond to off-nominal conditions without ground intervention. This capability enhances mission reliability while reducing operational complexity and staffing requirements. Launch providers increasingly value autonomous health monitoring systems that improve vehicle reusability and post-flight diagnostics. As regulatory confidence in autonomous systems grows, suppliers that integrate AI-driven decision logic into certified avionics architectures gain a competitive edge. These technologies also enable adaptive mission profiles and rapid launch responsiveness, aligning with defense and commercial priorities. Consequently, autonomous avionics adoption represents a high-value growth avenue for suppliers investing in software-defined architectures.

Expansion of Small Launch and Responsive Launch Programs

The growing emphasis on responsive launch capabilities for defense, disaster monitoring, and commercial applications creates strong opportunities for avionics suppliers. Governments and private operators seek launch systems that can be deployed rapidly with minimal preparation, requiring highly integrated and modular avionics suites. Small launch vehicles designed for rapid turnaround rely on standardized avionics that reduce integration time and simplify logistics. This shift favors suppliers offering plug-and-play avionics platforms compatible across multiple vehicle designs. Additionally, responsive launch initiatives prioritize domestic supply chains and secure systems, encouraging local avionics development and long-term procurement agreements. As responsive launch becomes a strategic priority, avionics systems optimized for speed, reliability, and flexibility will experience sustained demand growth.

Future Outlook

Over the next five years, the Israel Launch Vehicle Avionics market is expected to experience significant growth. This will be driven by continuous advancements in avionics technology, especially in digital and autonomous systems. Furthermore, the increasing frequency of satellite launches, both military and commercial, and Israel’s continued involvement in international space missions will further expand the demand for avionics systems. Israel’s aerospace and defense industry, already a key player in global space activities, will see greater investments in space exploration missions, thus increasing the need for advanced avionics.

Major Players

- Israel Aerospace Industries (IAI)

- Rafael Advanced Defense Systems

- Elbit Systems

- SpaceIL

- Godrej Aerospace

- Thales Alenia Space

- Northrop Grumman

- Lockheed Martin

- Boeing

- Airbus Defence and Space

- Raytheon Technologies

- Orbital Sciences

- Arianespace

- SpaceX

- Blue Origin

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace & Defense Manufacturers

- Satellite Operators

- Space Exploration Agencies

- Defense Contractors

- Space Launch Providers

- Aerospace Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves identifying critical variables that influence the Israel Launch Vehicle Avionics market, including government defense spending, technological advancements, and the demand for space missions. This is done using a combination of secondary research and proprietary data from trusted sources.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to understand market trends, the role of key players, and the overall market structure. This phase assesses revenue generation, market penetration, and the technological landscape in the avionics and space industries.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics and future trends are validated through interviews with industry experts, including key players in the aerospace and defense sectors. This provides practical insights to refine market assumptions and ensure accurate data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all the research, providing comprehensive insights into the market, including the performance of leading companies, technology trends, market segmentation, and projections. The goal is to deliver actionable intelligence to business professionals and stakeholders in the Israel launch vehicle avionics market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Defense and Aerospace Investments

Advancements in Satellite Technology and Communication Systems - Market Challenges

High Cost of Avionics R&D and Manufacturing

Regulatory and Compliance Challenges - Opportunities

Expansion of Commercial Space Launch Demand

Strategic Collaborations with Global Space Agencies - Trends

Integration of AI and Machine Learning in Avionics

Automation of Space Launch Systems - Government Regulation

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type (In Value %)

Launch Vehicle Avionics Systems

Navigation and Control Systems

Communication and Tracking Systems

Payload Integration Systems - By Application (In Value %)

Military Space Launches

Commercial Space Launches

Satellite Deployment

Space Exploration Missions - By Technology (In Value %)

Traditional Avionics

Digital Avionics

Advanced Avionics - By Distribution Channel (In Value %)

Direct Sales (OEMs and System Integrators)

Third-party Suppliers

Online Sales Platforms - By Region (In Value %)

Central Israel

Northern Israel

Southern Israel

International Markets

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Number of Dealers and Distributors, Production Capacity)

- SWOT Analysis

- Pricing Analysis

- Detailed Profiles of Key Players

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Elbit Systems

SpaceIL

NSL

IAI Space Division

Orbital Sciences

Raytheon Technologies

Boeing

Thales Alenia Space

Northrop Grumman

Airbus Defence and Space

Lockheed Martin

Bharat Electronics Limited

Godrej Aerospace

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035