Market Overview

The Israel Loitering Munition Market is valued based on a combination of historical data and government-backed defense reports. In 2024, Israel’s defense sector continued to lead in the development and deployment of advanced loitering munition systems, with an estimated defense budget of USD~ billion, a significant portion of which is allocated to unmanned and precision-guided munitions. The growing emphasis on precision warfare and the increasing military spending by Israel, particularly in the defense technology sector, fuels the growth of this market. Additionally, Israel’s continuous defense modernization and its position as a global leader in unmanned aerial systems (UAS) contribute to the expansion of loitering munitions as a crucial component of modern military strategies. This trend is expected to continue as Israel seeks to maintain its technological edge in defense systems.

Israel is the dominant force in the loitering munition market, with cities like Tel Aviv and Haifa serving as hubs for defense innovation and manufacturing. The country’s defense industry, including companies such as Rafael Advanced Defense Systems and Israel Aerospace Industries (IAI), plays a pivotal role in the global market. Israel’s dominance is driven by its high-tech defense capabilities, consistent investments in unmanned and precision-guided munitions, and a strategic emphasis on creating advanced weapons for modern warfare. The global demand for Israel’s military technology, coupled with the country’s political focus on national security, solidifies its leading position in the loitering munition market.

Market Segmentation

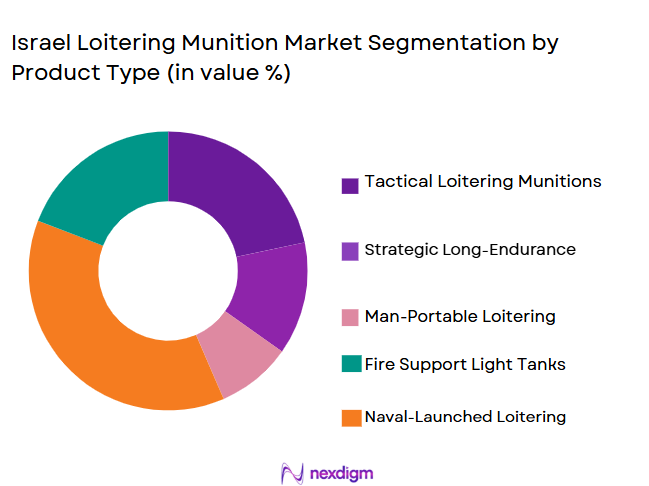

By Product Type

The Israeli Loitering Munition Market is segmented into several types of products, including fixed-wing, rotary-wing, and hybrid loitering munitions. Among these, the fixed-wing loitering munition holds the largest share due to its longer range, higher payload capacity, and better stability during flight. Fixed-wing loitering munitions, such as Israel’s “Harop” system, are deployed in a variety of military operations, ranging from intelligence gathering to precision strikes, making them an essential part of Israel’s defense strategies. Their ability to stay in the air for longer periods and strike at highly precise targets in complex environments provides a significant advantage in modern warfare scenarios.

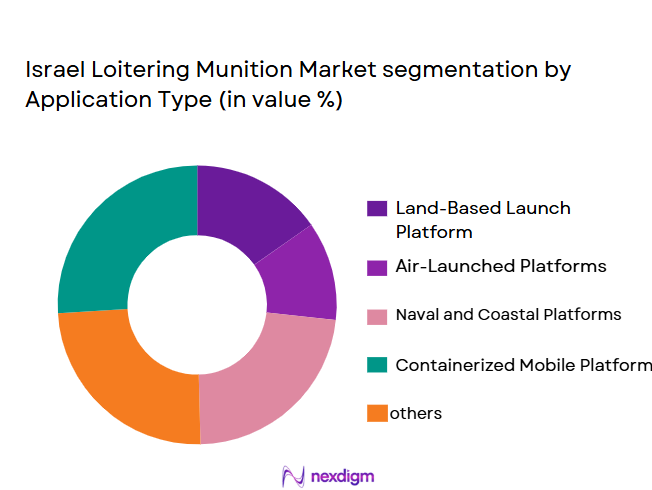

By Application

The market is divided into military applications, defense research and development, and security and surveillance. Military applications dominate the market, as loitering munitions are increasingly being used for intelligence, surveillance, reconnaissance, and precision strikes on high-value targets. Israel’s military, with its strategic defense initiatives and involvement in regional conflicts, relies heavily on these systems for asymmetric warfare. Additionally, the growing use of loitering munitions in counter-terrorism operations and border security operations increases their importance in the Israeli defense sector. These factors drive the dominance of the military application segment in the loitering munition market.

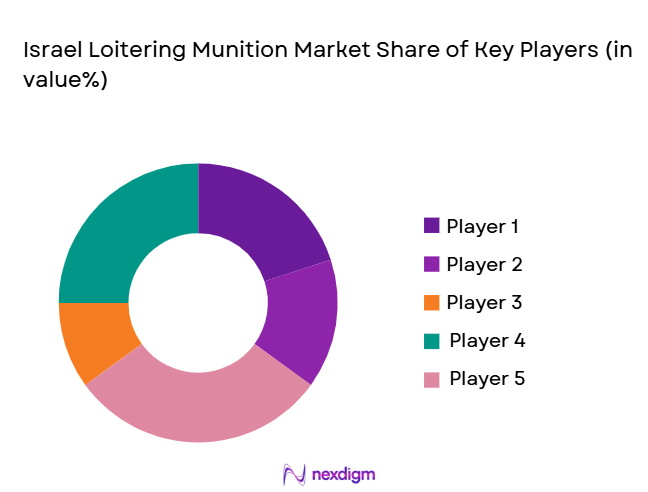

Competitive Landscape

The Israel Loitering Munition Market is led by several key players, primarily Israeli defense companies such as Rafael Advanced Defense Systems, Israel Aerospace Industries (IAI), and UVision Air Ltd. These companies are at the forefront of developing cutting-edge loitering munition technology, including the well-known “Harop” and “Hero” systems. The consolidation of the market among these major players highlights their dominance in both the domestic and international defense sectors. Israel’s continuous advancements in loitering munition technology ensure its ongoing leadership and innovation in this space.

| Company Name | Year Established | Headquarters | Technology Focus | Product Offering | Distribution Network |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ |

| UVision Air Ltd. | 2009 | Yehud, Israel | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ |

| Aeronautics Defense Systems | 1997 | Yavne, Israel | ~ | ~ | ~ |

Israel Loitering Munition Market Analysis

Growth Drivers

Increasing Military Spending by Israel’s Government

Israel’s defense budget has consistently been one of the highest in the Middle East, with an estimated defense expenditure of USD ~ billion in 2024. This increase in military spending is primarily driven by the need to enhance national security amidst regional instability. The Israeli government continues to prioritize defense technology, with substantial allocations aimed at modernizing its military capabilities. In 2024, Israel’s Ministry of Defense received a significant portion of the national budget, reflecting a strong commitment to advancing military technology. These investments directly support the development of loitering munition systems, boosting their demand in Israel’s defense sector.

Technological Advancements in Loitering Munition Systems

Technological progress in loitering munition systems is a key driver of the market. Israel has been at the forefront of developing these advanced systems, with an increasing focus on enhancing autonomy, precision, and payload capabilities. The Israeli defense sector has heavily invested in research and development (R&D), with a significant portion of the national defense budget dedicated to innovative military technologies. For instance, Israel Aerospace Industries (IAI) and Rafael Advanced Defense Systems have introduced numerous cutting-edge loitering munitions with enhanced guidance systems. Israel’s commitment to technology-driven defense solutions fuels the adoption of loitering munitions in modern warfare.

Market Challenges

High Production and Maintenance Costs

The production and maintenance of advanced loitering munition systems are associated with significant costs, limiting their widespread adoption. The price of materials, such as specialized components for precision guidance, as well as the complexity of developing autonomous systems, raises production expenses. The International Monetary Fund (IMF) estimates that Israel’s defense procurement processes often face delays and budgetary constraints due to these high costs. Additionally, the maintenance of loitering munitions, including the need for regular updates to software and hardware systems, adds an ongoing financial burden, complicating long-term military planning and procurement.

Technological Barriers in Autonomous Systems

Despite significant advancements, Israel’s loitering munition systems face ongoing challenges related to autonomous operation. The integration of artificial intelligence (AI) and machine learning (ML) technologies is essential for the next generation of loitering munitions, but the complexities of developing reliable, fully autonomous systems pose significant technological barriers. The Israeli government has allocated considerable resources to overcoming these challenges, but obstacles remain in perfecting these systems for battlefield use. Furthermore, the complexity of these systems means that extensive testing and fine-tuning are necessary, which can delay deployment and increase costs.

Opportunities

Rising Demand for Tactical Surveillance and Intelligence Systems

The growing need for tactical surveillance and intelligence systems presents significant opportunities for the loitering munition market. With regional tensions and evolving military needs, there is an increasing reliance on unmanned systems that provide real-time intelligence and surveillance. Loitering munitions, equipped with advanced sensors and guidance systems, are ideal for reconnaissance missions and battlefield intelligence. In 2024, Israel’s Ministry of Defense emphasized the importance of integrating these technologies into its defense strategy, leading to rising demand for loitering munitions in both Israel and global markets. The shift toward intelligence-driven military strategies is expected to accelerate the adoption of loitering munition systems.

Growth in Military Exports from Israel

Israel’s strong defense industry and technological expertise have led to an increase in the export of loitering munition systems to global markets. The Israeli defense sector, including companies like Rafael Advanced Defense Systems and IAI, has established itself as a leader in unmanned systems. Israel’s defense exports reached over USD ~ billion in 2024, with loitering munitions being a significant part of this figure. The global interest in advanced military technologies, particularly in regions like Europe, Asia, and North America, presents a growing opportunity for Israel to expand its market share and further strengthen its position as a global leader in loitering munition systems.

Future Outlook

Over the next several years, the Israel Loitering Munition Market is expected to experience continued growth, driven by Israel’s ongoing commitment to technological innovation in defense systems and the increasing demand for precision-guided, autonomous weapons globally. The Israeli defense industry is expected to remain a leading exporter of loitering munition systems, capitalizing on strategic partnerships and military alliances, particularly in regions such as Europe, North America, and Asia-Pacific. Additionally, the continuous advancements in AI, miniaturization, and loitering munition capabilities are expected to open up new use cases, propelling the market forward. Israel’s focus on enhancing the operational efficiency and effectiveness of its defense systems ensures a bright future for the loitering munition market.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- UVision Air Ltd.

- Elbit Systems

- Aeronautics Defense Systems

- MBDA

- Northrop Grumman

- General Dynamics

- Boeing

- Lockheed Martin

- Thales Group

- Kongsberg Gruppen

- Leonardo S.p.A

- Telespazio

- BAE Systems

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Contractors

- Aerospace and Defense Manufacturers

- Defense Procurement Agencies

- Research and Development Agencies

- International Defense Organizations

- Border Security and Homeland Defense Agencies

Research Methodology

Step 1: Identification of Key Variables

This step involves creating a comprehensive ecosystem map of the Israel Loitering Munition Market. Using a combination of secondary data sources from government reports and industry publications, the goal is to identify the key drivers, challenges, and opportunities shaping the market.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Israeli loitering munition market. This includes assessing defense expenditure trends, technological advancements, and application areas such as military, R&D, and surveillance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and refined through consultations with defense experts and industry practitioners. These interviews provide valuable insights into the current trends, technological challenges, and potential future developments in loitering munition systems.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and insights, followed by extensive engagement with manufacturers to verify product details, market performance, and customer preferences. This ensures a comprehensive and accurate market analysis.

- Executive Summary

- Israel Loitering Munition Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Operational demand for precision strike and ISR capabilities

Proven battlefield effectiveness in asymmetric warfare

Continuous innovation in autonomous and sensor technologies - Market Challenges

High R&D and unit costs for advanced systems

Export controls and regulatory restrictions

Electronic warfare and countermeasure vulnerabilities - Market Opportunities

Development of AI-enabled and swarm-capable munitions

Rising export demand from allied and partner nations

Integration with multi-domain command and control networks - Trends

Miniaturization of sensors and propulsion systems

Increased endurance and range capabilities

Shift toward networked and autonomous strike solutions

- By Market Value 2024–2029

- By Installed Units 2024–2029

- By Average System Price 2024–2029

- By System Complexity Tier 2024–2029

- By System Type (In Value%)

Tactical Loitering Munitions

Strategic Long-Endurance Loitering Munitions

Man-Portable Loitering Munitions

Vehicle-Launched Loitering Munitions

Naval-Launched Loitering Munitions - By Platform Type (In Value%)

Land-Based Launch Platforms

Air-Launched Platforms

Naval and Coastal Platforms

Containerized Mobile Platforms

Multi-Domain Integrated Platforms - By Fitment Type (In Value%)

New System Procurement

Payload and Warhead Upgrade Fitment

Guidance and Seeker Retrofit

Communication and Data-Link Integration Fitment

Software and Autonomy Upgrade Fitment - By EndUser Segment (In Value%)

Israeli Defense Forces

Special Operations Units

Intelligence and Surveillance Agencies

Border and Homeland Security Forces

Export-Oriented Foreign Militaries - By Procurement Channel (In Value%)

Direct Government Contracts

Domestic Defense OEM Procurement

Joint Development and Co-Production Programs

Foreign Military Sales

Upgrade and Sustainment Contracts

- Market Share Analysis

- Cross Comparison Parameters

(Endurance Time, Strike Range, Payload Type, Guidance Accuracy, Autonomy Level) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

UVision Air

Aeronautics Group

BlueBird Aero Systems

XTEND Defense

General Atomics

AeroVironment

MBDA

Thales Group

Saab

Rheinmetall

Edge Group

L3Harris Technologies

- Defense forces prioritize precision, survivability, and rapid deployment

- Special units require portable and low-signature systems

- Intelligence users focus on persistent ISR and real-time data links

- Export customers value combat-proven reliability and modular upgrades

- Forecast Market Value 2030–2035

- Forecast Installed Units 2030–2035

- Price Forecast by System Tier 2030–2035

- Future Demand by Platform 2030–2035