Market Overview

The Israel Low Earth Orbit (LEO) Satellite market has witnessed significant growth, with a market size of USD ~ billion based on a recent historical assessment. This growth is fueled by technological advancements, the increasing demand for satellite communication, Earth observation, and defense applications. The reduction in satellite production and launch costs, advancements in satellite miniaturization, and growing reliance on satellite technologies across sectors such as telecommunications and remote sensing are driving the expansion of the market. Government investments and the strengthening of the regulatory framework are further supporting this growth, making Israel a key player in the global satellite industry.

The market is primarily dominated by Israel, the United States, and select European countries. Israel’s position as a global leader in satellite technology is driven by its cutting-edge aerospace innovations, strong government support, and a robust defense industry. Tel Aviv is a hub for satellite development, with key players such as Israel Aerospace Industries leading the way. The country’s commitment to space exploration, both for scientific purposes and commercial ventures, further strengthens Israel’s position as a critical player in the global satellite industry, driving technological advancements and fostering international collaborations.

Market Segmentation

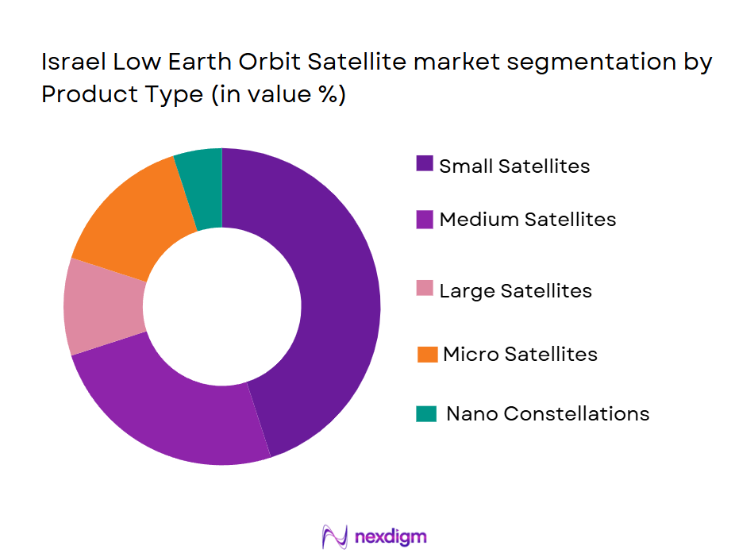

By Product Type

The Israel Low Earth Orbit Satellite market is segmented by product type into small satellites, medium satellites, large satellites, micro satellites, and nano satellites. Recently, the small satellites sub-segment has a dominant market share due to factors such as reduced launch costs, advancements in satellite miniaturization, and the increasing demand for satellite-based services across communication, Earth observation, and defense sectors. This growing demand has made small satellites the most cost-effective and versatile option for both commercial and government missions.

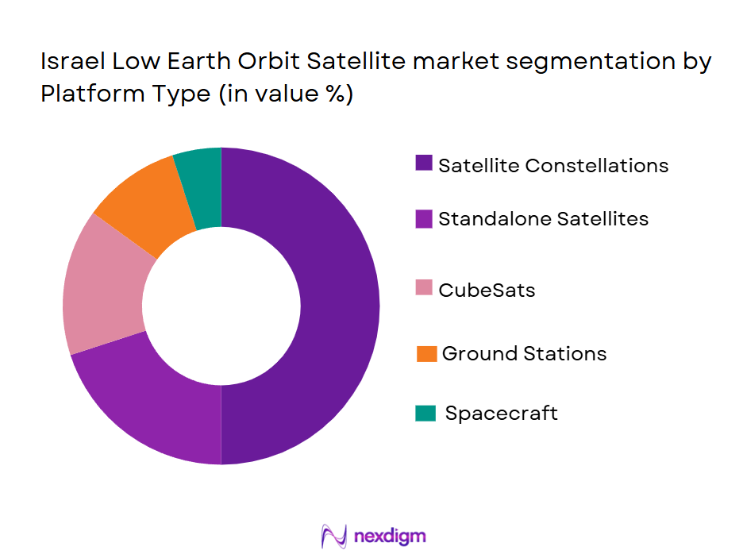

By Platform Type

The Israel Low Earth Orbit Satellite market is segmented by platform type into satellite constellations, standalone satellites, CubeSats, ground stations, and spacecraft. Satellite constellations have a dominant market share due to the increasing demand for interconnected networks providing global communication and operational efficiency. The high demand for data transmission, scientific research, and global connectivity drives the adoption of satellite constellations, making them the preferred choice for both government and commercial enterprises.

Competitive Landscape

The Israel Low Earth Orbit Satellite market is highly competitive, with both established players and new entrants contributing to its growth. Israel Aerospace Industries (IAI) is a major player, along with other companies such as Spacecom and private players like SpaceX. These companies focus on satellite manufacturing, launch services, and satellite communication solutions. While the market is primarily driven by innovation, strategic partnerships, and cost-effective solutions, governmental and regulatory support further strengthens the competitive landscape. Players continue to push for advancements in satellite technology, focusing on miniaturization, cost-efficiency, and sustainability.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Spacecom | 1993 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| OneWeb | 2012 | London, UK | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | Hawthorne, USA | ~ | ~ | ~ | ~ | ~ |

| Telesat | 1969 | Ottawa, Canada | ~ | ~ | ~ | ~ | ~ |

Israel Low Earth Orbit Satellite Market Analysis

Growth Drivers

Technological Advancements

The Israel Low Earth Orbit Satellite market is experiencing robust growth, largely due to rapid technological advancements. These advancements in satellite miniaturization, propulsion systems, and communication capabilities have made it increasingly feasible to deploy small, cost-effective satellites. Satellite constellations, which offer global communication coverage and operational efficiency, are rapidly gaining traction in both government and commercial sectors. Innovations in propulsion technologies are also helping to reduce the costs associated with satellite launches and prolong satellite lifespans. Israel, with its advanced aerospace and defense sectors, is well-positioned to capitalize on these developments, enabling the country to maintain a competitive edge in the global satellite industry. The push for global connectivity, particularly in remote and underserved areas, is expected to drive continued demand for low Earth orbit satellites.

Government Investment and Support

Government support and investment are crucial drivers of the Israel Low Earth Orbit Satellite market. The Israeli government has historically allocated significant resources to the space sector, particularly in defense and satellite communication applications. This government-backed support has led to the development of advanced satellite technologies, fostering an environment of innovation and growth. Israel’s strong regulatory framework provides the necessary infrastructure for satellite development and operations, while also creating opportunities for public-private partnerships. Additionally, Israel’s strategic location and political stability contribute to its attractiveness as a global hub for satellite manufacturing and launching services. As the government continues to invest in space exploration and satellite infrastructure, the country is expected to maintain its position as a key player in the global satellite industry.

Market Challenges

High Initial Capital Investment

One of the significant challenges faced by the Israel Low Earth Orbit Satellite market is the high initial capital investment required for satellite development, launch, and operation. Despite technological advancements that have lowered production costs, the overall financial burden remains considerable, particularly for smaller companies or startups. The high cost of entry makes it difficult for new players to compete effectively, limiting the number of participants in the market. Moreover, while Israel has numerous financial incentives for innovation, securing sufficient funding for large-scale satellite programs is still a challenge. In addition to this, the cost of maintaining and operating satellite constellations, along with managing ground infrastructure, adds to the financial strain. Reducing the costs of satellite deployment through innovations such as reusable launch vehicles and partnerships with global space agencies could help mitigate this challenge.

Regulatory and Licensing Issues

The regulatory landscape for satellite operations can be complex and burdensome, presenting a significant challenge to companies operating in the Israel Low Earth Orbit Satellite market. Obtaining the necessary licenses for satellite launches, frequency allocations, and orbital slots involves navigating a web of local and international regulations. These regulatory hurdles often result in delays and can increase costs, especially for new entrants to the market. The global nature of satellite communications and Earth observation services means that companies must also comply with international treaties and agreements, further complicating the process. Additionally, as satellite constellations become more widespread, the need for space debris management and compliance with international guidelines for debris mitigation has become a growing concern. These regulatory challenges may hinder market growth and increase operational complexities.

Opportunities

Commercial Expansion in Remote Areas

The growing demand for global connectivity, particularly in remote and underserved regions, presents a significant opportunity for the Israel Low Earth Orbit Satellite market. Israel’s satellite technology is well-suited to support initiatives aimed at providing internet access to areas lacking traditional communication infrastructure. With the increasing reliance on digital connectivity for business, education, and healthcare, satellite services offer a viable solution for reaching remote regions where terrestrial networks are not feasible. Several government-backed initiatives, as well as private sector collaborations, are focused on deploying satellites to provide internet connectivity and other essential services to rural populations. Israel’s expertise in satellite technology, combined with its advanced communications infrastructure, makes it well-positioned to capitalize on this growing demand and expand its commercial satellite offerings.

Space Debris Mitigation Technologies

As the number of satellites in orbit increases, space debris has become a significant concern for satellite operators. Israel has the opportunity to lead the way in developing technologies that address this growing issue. With its strong aerospace and defense sectors, Israel is well-equipped to develop satellite de-orbiting systems, collision avoidance technologies, and solutions for space debris removal. The need for sustainable space operations has never been more critical, and governments worldwide are introducing stricter regulations to mitigate the risks posed by space debris. Israel’s leadership in space sustainability could not only enhance the longevity of its satellite systems but also foster international partnerships in space debris management. As the market for space sustainability solutions grows, Israel is well-positioned to capitalize on this emerging opportunity.

Future Outlook

The Israel Low Earth Orbit Satellite market is poised for significant growth over the next five years. Advancements in satellite technology, including miniaturization, propulsion systems, and inter-satellite communications, will drive growth in both commercial and government applications. With continued investment from the Israeli government and private enterprises, Israel is expected to strengthen its position as a leader in the satellite industry. The demand for global connectivity, remote sensing, and satellite-based communication will continue to increase, spurring further developments in satellite constellations and LEO-based infrastructure. Regulatory support for satellite deployment and space sustainability will also contribute to market growth. As the market matures, Israel is likely to see greater international collaborations and partnerships, further expanding its influence in the global satellite industry.

Major Players

- Israel Aerospace Industries

- Spacecom

- OneWeb

- SpaceX

- Telesat

- Rocket Lab

- Boeing

- SES

- Maxar Technologies

- Inmarsat

- Thales Alenia Space

- Lockheed Martin

- Airbus Defence and Space

- Northrop Grumman

- Blue Origin

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite manufacturers

- Telecommunications companies

- Aerospace and defense contractors

- Commercial satellite service providers

- Satellite launch service providers

- Space policy and regulation agencies

Research Methodology

Step 1: Identification of Key Variables

The key variables impacting the Israel Low Earth Orbit Satellite market were identified through market research, industry reports, and expert consultations to ensure a comprehensive understanding of the market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

A detailed market analysis was conducted to define the market structure, segmentations, and key trends. Quantitative and qualitative analysis tools were employed to forecast market size and identify growth patterns over the forecasted period.

Step 3: Hypothesis Validation and Expert Consultation

Market forecasts and findings were validated through discussions with industry experts, key players, and stakeholders in the satellite and aerospace sectors to ensure the accuracy and relevance of the data.

Step 4: Research Synthesis and Final Output

The research data was synthesized into actionable insights, producing a comprehensive report detailing market trends, forecasts, competitive landscapes, and strategic recommendations for industry stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Communication Satellites

Government Investment in Space Programs

Technological Advancements in Satellite Miniaturization - Market Challenges

High Initial Investment

Complex Regulatory Compliance

Satellite Congestion and Space Debris - Market Opportunities

Expanding Commercial Satellite Applications

Growth in Space Tourism and Private Sector Investment

Emerging Markets for Internet Connectivity - Trends

Increase in Satellite Constellations

Adoption of AI and Machine Learning for Satellite Operations

Collaboration Between Space Agencies and Private Players - Government Regulations

Licensing Requirements for Satellite Operators

Spectrum Allocation for Satellite Communications

International Treaties and Agreements on Space Debris Mitigation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Small Satellites

Medium Satellites

Large Satellites

Mini Satellites

Micro Satellites - By Platform Type (In Value%)

Satellite Constellations

Standalone Satellites

CubeSats

Ground Stations

Spacecraft - By Fitment Type (In Value%)

End-to-End Solutions

Launch Services

Satellite Integration

Ground Operations

Data Services - By EndUser Segment (In Value%)

Government and Defense

Telecommunications

Remote Sensing & Earth Observation

Scientific Research

Commercial Enterprises - By Procurement Channel (In Value%)

Direct Procurement

System Integrators

Distributors

Online Platforms

Public Auctions

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Fitment Type, EndUser Segment, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Aerospace Industries

Spacecom

Rafael Advanced Defense Systems

Rocket Lab

IntelSat

OneWeb

SpaceX

Blue Origin

ArianeGroup

Telesat

SES S.A.

Inmarsat

Thales Alenia Space

Virgin Galactic

Maxar Technologies

- Government and Military Satellite Applications

- Commercial Satellite Services

- Environmental and Agricultural Remote Sensing

- Private Sector Communications Networks

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035