Market Overview

The Israel Main Battle Tank market is experiencing steady growth due to a combination of rising defense budgets, increased modernization programs, and evolving military strategies. The market size, valued at USD ~ billion based on a recent historical assessment, is largely driven by the country’s commitment to maintaining a technologically advanced and competitive defense system. Israel’s ongoing investment in military technology upgrades, including autonomous systems and advanced weaponry, plays a crucial role in driving market expansion. Additionally, the demand for exportable battle tanks has increased, contributing to the overall growth.

Key regions leading the market include Israel, North America, and Europe, with Israel being the dominant player. The country’s significant military spending and continuous development of next-generation battle tanks position it at the forefront of the global market. North America follows closely due to the presence of defense contractors and growing military needs. Europe also contributes significantly, driven by NATO’s defense initiatives and the ongoing need for modern armored vehicles in conflict zones. These regions collectively shape the trajectory of the Israel Main Battle Tank market.

Market Segmentation

By Product Type

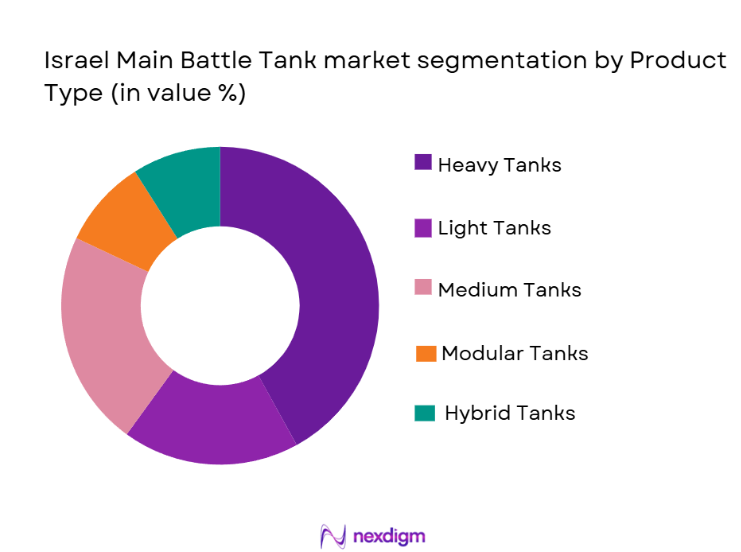

Israel Main Battle Tank market is segmented by product type into Heavy Tanks, Light Tanks, Medium Tanks, Modular Tanks, and Hybrid Tanks. The dominant sub-segment in this market is heavy tanks, primarily driven by their effectiveness in battlefield operations and superior protection. The robust performance and adaptability of these tanks in various combat environments make them the preferred choice for military forces in Israel and key international markets. The presence of leading manufacturers and continuous advancements in tank designs further support the dominance of this sub-segment.

By Platform Type

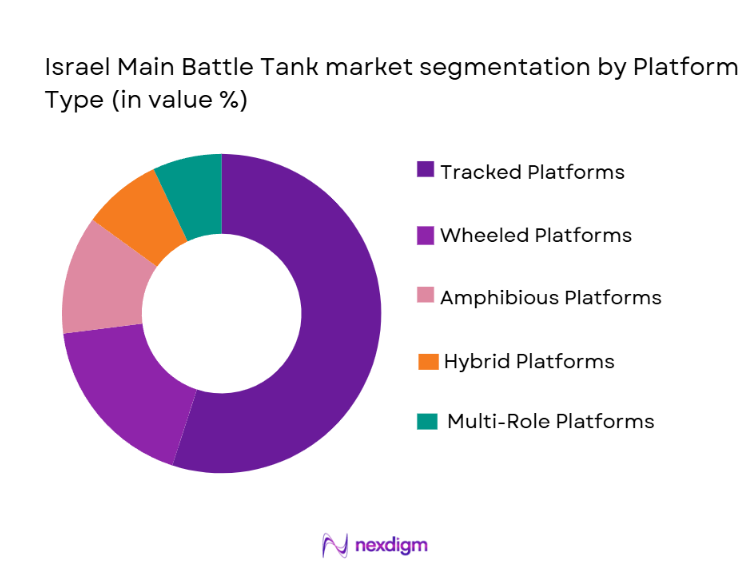

The Israel Main Battle Tank market is also segmented by platform type, which includes tracked platforms, wheeled platforms, amphibious platforms, hybrid platforms, and multi-role platforms. The most significant sub-segment is tracked platforms, as they offer superior mobility, stability, and armor protection, making them the preferred option for military applications. The need for reliable and rugged tank platforms in harsh environments drives the adoption of tracked platforms, positioning them as the leading sub-segment in the market.

Competitive Landscape

The competitive landscape of the Israel Main Battle Tank market is characterized by a few key players with significant market influence, both locally and internationally. Major defense contractors and military manufacturers continue to consolidate their presence through strategic collaborations and technological innovations. These companies drive the market by delivering advanced armored vehicles equipped with cutting-edge features, and their dominance is reinforced by large-scale defense contracts and strong ties to governmental defense procurement processes.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Israel Military Industries | 1933 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

Israel Main Battle Tank Market Analysis

Growth Drivers

Technological Advancements

Technological advancements are one of the primary growth drivers in the Israel Main Battle Tank market. Israel has always been at the forefront of military technology, and its innovations in autonomous systems, advanced armament, and next-generation armor are integral to the evolution of its battle tanks. The introduction of AI, machine learning, and active protection systems (APS) in battle tanks has elevated their operational efficiency, survivability, and firepower, making them highly sought after by global defense forces. These cutting-edge systems provide tanks with greater autonomy, faster decision-making capabilities, and enhanced performance in complex battlefield scenarios, directly contributing to their growing adoption worldwide. As global defense forces continue to modernize, the demand for such advanced systems increases, positioning Israel as a leader in tank production.

Increasing Military Expenditures

Rising defense budgets globally have also contributed significantly to the growth of the Israel Main Battle Tank market. With geopolitical instability in regions like the Middle East and Eastern Europe, countries are increasing their defense budgets to bolster their military capabilities. As defense modernization becomes a top priority, nations are focusing on upgrading their fleets with advanced military technologies, including battle tanks. Israel, known for its high-tech defense solutions, is benefiting from this trend, with international customers increasingly seeking Israeli-made tanks. Governments with growing security concerns and outdated armored vehicles are looking for modern, reliable, and technologically superior battle tanks, thereby expanding Israel’s market reach. The continued rise in defense spending ensures a steady demand for Israel’s cutting-edge tanks in the coming years.

Market Challenges

High Production Costs

One of the primary challenges facing the Israel Main Battle Tank market is the high production cost of its advanced systems. Israel’s battle tanks incorporate some of the most sophisticated technologies in the defense industry, such as advanced armoring, automation, and integrated weapon systems, which significantly raise production expenses. These high costs can limit the number of units manufactured, especially for countries with tight defense budgets. Additionally, the lengthy development timelines required for research and testing add to the financial burden. This challenge is particularly pressing in the face of global competition, where countries with lower production costs may attract budget-conscious buyers, making it difficult for Israel to compete in some cost-sensitive markets.

Geopolitical Instability

Geopolitical instability and regional conflicts pose a significant challenge for the Israel Main Battle Tank market. The Middle East, where Israel is located, has long been a region of military tension, which not only affects local demand but also influences export opportunities. Countries in unstable regions may hesitate to procure military assets due to uncertain future security conditions or the fear of involvement in regional conflicts. Moreover, political tensions and export restrictions can complicate international sales, especially in regions where arms trade is highly regulated. These geopolitical factors can cause fluctuations in demand and hinder market growth, requiring manufacturers to adapt quickly to changing global dynamics.

Opportunities

Expansion of Export Markets

A key opportunity for the Israel Main Battle Tank market lies in expanding its presence in emerging and developing markets. As military modernization efforts intensify worldwide, countries across Asia, Africa, and Latin America are increasingly looking to update their defense fleets, including acquiring modern battle tanks. Israel’s reputation for providing high-tech, reliable military equipment positions it well to capture this growing demand. Furthermore, Israel’s established relationships with key international defense players allow it to enter new markets with relative ease. As countries in the Middle East, Asia-Pacific, and Africa continue to prioritize military spending, there is significant potential for Israel to increase its export sales of battle tanks, particularly those designed for modern warfare scenarios.

Collaborations with Global Defense Contractors

Collaborating with global defense contractors presents a strong opportunity for Israeli tank manufacturers. By partnering with large defense firms in markets such as the U.S. and the U.K., Israel can gain access to larger procurement contracts and enhance its technological capabilities. These collaborations allow Israel to integrate its innovative systems, such as the Trophy Active Protection System, into a broader range of military vehicles, thereby increasing the global demand for its products. Moreover, these partnerships can lead to co-development projects that leverage the strengths of both parties, opening doors to new defense contracts and expanded market reach. With strategic collaborations, Israel can tap into new markets and maintain its competitive edge in the global defense industry.

Future Outlook

The future outlook for the Israel Main Battle Tank market looks promising as technological advancements continue to reshape the industry. Over the next few years, it is expected that Israel will continue to lead in military tank innovation, driven by ongoing research into autonomous vehicles and advanced materials. The demand for Israeli-made battle tanks in international markets will likely rise, fueled by geopolitical tensions and the need for military modernization. Additionally, government regulations and defense spending will support the growth of the market, ensuring that the industry remains competitive and innovative.

Major Players

- Israel Military Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- BAE Systems

- General Dynamics

- Northrop Grumman

- Thales Group

- Kongsberg Gruppen

- Patria Oyj

- Textron Systems

- Leonardo S.p.A.

- Saab AB

- Oshkosh Corporation

- Rheinmetall AG

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and manufacturers

- Military agencies and departments

- Security forces and defense ministries

- International defense procurement authorities

- Defense research and development organizations

- Military equipment distributors and suppliers

Research Methodology

Step 1: Identification of Key Variables

This step involves determining the key factors that influence the market dynamics, such as defense budgets, geopolitical stability, and technological advancements.

Step 2: Market Analysis and Construction

Market construction follows through in-depth analysis of historical data, segmentation patterns, and regional trends to establish a comprehensive understanding of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are tested through expert consultations with industry professionals, allowing for refined projections based on practical insights and updated information.

Step 4: Research Synthesis and Final Output

The final output synthesizes the data from previous steps, providing a well-rounded view of the Israel Main Battle Tank market with a focus on emerging trends, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Modernization Programs

Rising Demand for Defense Export

Technological Advancements in Armament Systems - Market Challenges

High Production Costs

Geopolitical Tensions Affecting Sales

Complexity in Integration of New Technologies - Market Opportunities

Emerging Markets Expansion

Collaborations with International Defense Contractors

Development of Autonomous Combat Tanks - Trends

Integration of AI and Automation in Tank Systems

Enhanced Armament and Armor Capabilities

Increased Focus on Cybersecurity in Tank Operations - Government Regulations

Export Regulations and Licensing

Environmental Compliance and Sustainability Standards

Safety and Security Regulations for Military Vehicles

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Heavy Tanks

Light Tanks

Medium Tanks

Modular Tanks

Hybrid Tanks - By Platform Type (In Value%)

Tracked Platforms

Wheeled Platforms

Amphibious Platforms

Hybrid Platforms

Multi-role Platforms - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Retrofit

Upgrade

Modular Fitment

Assembled Fitment - By EndUser Segment (In Value%)

Military Forces

Private Security Contractors

Defense Research Agencies

Governmental Agencies

Export Markets - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Tendering Process

Public-private Partnerships

Foreign Military Sales

- Market Share Analysis

- CrossComparison Parameters (Market Share, Growth Rate, Technological Advancements, Geopolitical Impact, EndUser Preferences)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Military Industries

Elbit Systems

Rafael Advanced Defense Systems

Merkava Industries

General Dynamics

Lockheed Martin

BAE Systems

Northrop Grumman

Thales Group

Kongsberg Gruppen

BAE Systems AB

Patria Oyj

Textron Systems

Leopard 2 Manufacturers

Saab AB

- Military Forces Adoption Trends

- Private Security Contractors’ Preferences

- Defense Research Agencies’ Involvement in Development

- Export Market Demand Patterns

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035