Market Overview

The Israel Medium Caliber Ammunition market is valued at approximately USD ~billion in 2024, driven by ongoing military modernization efforts, the demand for advanced ammunition systems, and the growing focus on enhancing defense capabilities in the region. Factors such as geopolitical tensions, especially in the Middle East, and the increasing need for high-performance ammunition to meet the evolving threats have further fueled this market’s growth. The market’s size is also supported by both government and commercial defense procurement. The demand for specialized medium-caliber ammunition, which includes armor-piercing and tracer rounds, has risen due to the growing complexity of military operations.

Key cities and countries such as Tel Aviv and Haifa dominate the market for medium-caliber ammunition in Israel, with the country’s advanced defense infrastructure and technological capabilities being major drivers. Israel’s strong defense industry, backed by robust research and development (R&D) initiatives, contributes significantly to its dominance in the market. The country’s strategic location in the Middle East and its ongoing defense collaborations with international partners, including the United States and Europe, also enhance its leadership in medium-caliber ammunition production and export.

Market Segmentation

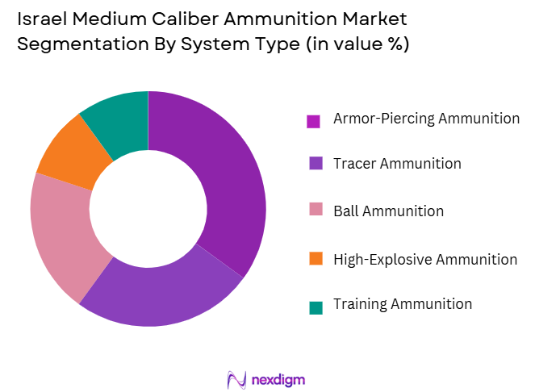

By System Type:

The Israel Medium Caliber Ammunition market is segmented by system type into ball ammunition, armor-piercing ammunition, tracer ammunition, high-explosive ammunition, and training ammunition. Among these, the armor-piercing ammunition segment dominates due to the increasing demand for ammunition capable of penetrating modern armored vehicles. This segment is particularly critical for military forces engaged in operations where superior firepower is required to neutralize advanced threats. Additionally, Israel’s technological advancements in developing highly effective armor-piercing rounds have positioned it as a global leader in this sub-segment. The military’s reliance on these rounds to enhance battlefield effectiveness further contributes to their dominance.

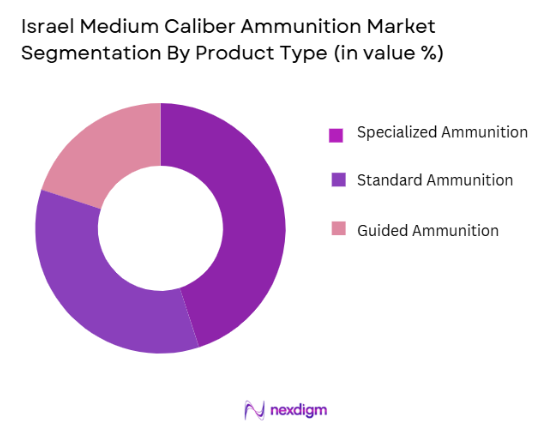

By Product Type:

The Israel Medium Caliber Ammunition market is also segmented by product type into standard ammunition, guided ammunition, and specialized ammunition. The specialized ammunition sub-segment holds a significant share due to its increasing use in specialized military operations. This includes ammunition such as smoke rounds, incendiary rounds, and non-lethal rounds, which are designed for specific operational requirements. Israel’s capability to design and produce these advanced types of ammunition, in line with its evolving defense strategies, has made it a preferred supplier for global defense markets. Furthermore, ongoing investments in R&D to improve ammunition precision and multifunctionality ensure the sustained growth of this sub-segment.

Competitive Landscape

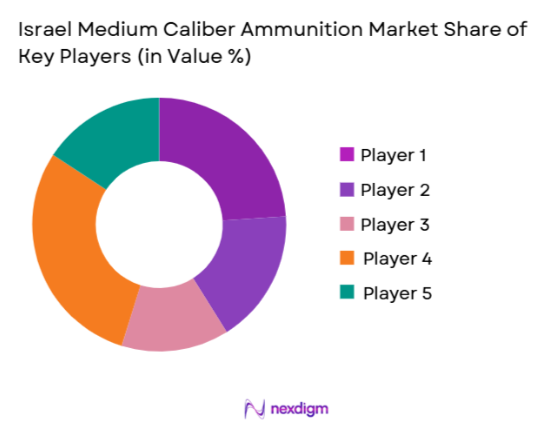

The Israel Medium Caliber Ammunition market is characterized by strong competition from both local and international players. The market is dominated by a few major players who offer advanced and specialized ammunition products. Companies like Israel Military Industries (IMI), Elbit Systems, and Rafael Advanced Defense Systems lead the market due to their technological expertise and extensive defense contracts. The growing global demand for high-performance ammunition and the increasing focus on modernization programs for military forces across the world have further intensified the competition.

| Company Name | Establishment Year | Headquarters | Product Range | Market Presence | R&D Capabilities | Technological Advancements |

| Israel Military Industries | 1933 | Ramat HaSharon | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 1958 | Haifa | ~ | ~ | ~ | ~ |

| Soltam Systems | 1980 | Ashdod | ~ | ~ | ~ | ~ |

| Aeronautics Ltd | 1997 | Yavne | ~ | ~ | ~ | ~ |

Israel Medium Caliber Ammunition Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver for the growth of the Israel Medium Caliber Ammunition market as the nation continues to enhance its urban defense infrastructure. Israel’s urban population has steadily increased, with over ~% of its population residing in urban areas, according to the World Bank. This rise in urbanization has led to increased demand for sophisticated ammunition systems to protect urban territories and critical infrastructures. With rapid urban expansion, there is a growing need for advanced defense systems, including medium-caliber ammunition, capable of countering emerging threats in urban combat situations.

Industrialization

The industrialization of defense and manufacturing sectors in Israel is another key driver for the market. With a well-established defense industry, Israel has seen its manufacturing sector grow at a rate of ~% annually from 2020 to 2023, as per the International Monetary Fund (IMF). This industrial growth contributes significantly to the production of ammunition, including medium-caliber rounds used by military forces. The development of state-of-the-art manufacturing facilities supports the demand for high-performance ammunition systems, catering to both domestic needs and export markets.

Restraints

High Initial Costs

The high initial cost of medium-caliber ammunition systems remains a key restraint in the market. Developing and manufacturing specialized ammunition involves significant investment in research, development, and production facilities. For example, the production of advanced armor-piercing and high-explosive rounds requires state-of-the-art technology and compliance with stringent regulatory standards. In Israel, the cost to develop these advanced systems can exceed USD ~ million per contract, which restricts accessibility for smaller defense contractors. These high costs limit the pace of adoption, particularly among developing nations.

Technical Challenges

Technical challenges in developing medium-caliber ammunition capable of meeting modern warfare demands pose significant barriers. In Israel, technological hurdles such as ensuring consistent ammunition performance across diverse combat environments and preventing misfires have led to longer development timelines. While Israel’s defense industry is advanced, maintaining a technological edge requires continuous investment in R&D, which can be costly and time-consuming. For instance, the ongoing development of guided munitions has faced delays due to these challenges, affecting production schedules.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the Israel Medium Caliber Ammunition market. With the ongoing development of precision-guided ammunition, there is a rising demand for advanced systems that can deliver greater accuracy and effectiveness. In 2024, Israel has continued its commitment to defense innovation, with the Israeli Defense Forces (IDF) investing heavily in smart ammunition technology that can adapt to diverse combat situations. As the global defense sector increasingly prioritizes technological innovation, Israel’s advancements in this field provide a substantial opportunity for market growth.

International Collaborations

Israel’s international defense collaborations, particularly with the United States, European Union, and Asia-Pacific countries, open new opportunities for the medium-caliber ammunition market. These collaborations, in the form of joint ventures and defense agreements, have expanded Israel’s reach into global markets. In 2024, Israel’s defense exports were valued at over USD ~ billion, with significant growth in ammunition exports. This trend is expected to continue as countries seek advanced defense technologies to enhance their own military capabilities.

Future Outlook

Over the next decade, the Israel Medium Caliber Ammunition market is expected to experience substantial growth, driven by advancements in ammunition technology, increased defense spending, and Israel’s continued emphasis on military modernization. The market will likely see an increase in demand for high-performance, multi-purpose ammunition capable of addressing complex and evolving battlefield threats. Additionally, partnerships with international defense forces and the expansion of export opportunities will further bolster market growth. The Israel Defense Forces (IDF) will continue to drive the need for advanced medium-caliber ammunition systems, contributing to both domestic and global market demand.

Major Players

- Israel Military Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Soltam Systems

- Aeronautics Ltd

- Ashot Ashkelon

- Magal Security Systems

- Israel Aerospace Industries

- Tavor Systems

- CIMIC Group

- Rada Electronics Industries

- Mistral Group

- Meprolight

- Tadiran Electronic Systems

- IMI Systems

Key Target Audience

- Defense Contractors

- Military Forces

- Law Enforcement Agencies

- Private Security Firms

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Research and Development Units

- Homeland Security Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables driving the Israel Medium Caliber Ammunition market. Through desk research and leveraging both primary and secondary data sources, we compile an extensive list of market drivers, challenges, and opportunities. These variables include technological advancements, defense spending, geopolitical factors, and the demand for specialized ammunition.

Step 2: Market Analysis and Construction

In this phase, historical data from credible sources is collected to assess the market’s performance over the past few years. Key metrics, such as market size, growth trends, and segmentation data, are analyzed. We also study the market’s response to defense policy changes and technological shifts to better understand current and future market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Once the market hypothesis is formulated based on the data analysis, it is validated through consultations with industry experts, including manufacturers, government officials, and military procurement officers. These expert insights help refine the analysis and ensure its accuracy and relevance.

Step 4: Research Synthesis and Final Output

The final phase consolidates all the gathered data, market insights, and expert opinions. The research findings are synthesized into a comprehensive report, covering all key aspects of the Israel Medium Caliber Ammunition market. This report provides actionable insights, helping stakeholders make informed decisions based on reliable and validated data.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense budgets in Israel and neighboring regions

Advancements in ammunition technology

Rising demand for defense systems in volatile geopolitical landscapes - Market Challenges

Strict government regulations on military procurement

Fluctuating defense expenditure

Limited domestic production capacity for specialized ammunition

- Trends

Rising integration of digital technologies in ammunition systems

Shift towards environmentally friendly ammunition production

Growing focus on precision-guided munitions

- Market Opportunities

Expanding global demand for advanced ammunition systems

Strategic defense collaborations with international partners

Increase in defense exports to allied nations - Government regulations

Israel’s defense export controls

International arms treaties and compliance

Export restrictions on high-tech defense products - SWOT analysis

Strength: High level of technological innovation in ammunition

Weakness: Reliance on foreign suppliers for certain components

Opportunity: Expanding presence in global defense markets

Threat: Heightened geopolitical tensions affecting market stability - Porters 5 forces

High bargaining power of suppliers due to limited domestic manufacturing

Moderate threat of new entrants due to high capital requirements

Low threat of substitutes due to specialization in ammunition products

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ball Ammunition

Armor-Piercing Ammunition

Tracer Ammunition

High-Explosive Ammunition

Training Ammunition - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Air-Based Platforms

Unmanned Aerial Vehicles (UAVs)

Modular Systems - By Fitment Type (In Value%)

Infantry Weapons

Vehicle-Mounted Weapons

Aircraft Guns

Naval Guns

Remote Weapons Stations - By End-User Segment (In Value%)

Military Forces

Law Enforcement Agencies

Defense Contractors

Private Security Firms

Civilian Markets - By Procurement Channel (In Value%)

Government Procurement

Direct Commercial Sales

Through International Defense Partnerships

Defense Contractors

Public Sector Agencies

- Market Share Analysis

- CrossComparison Parameters(Price competitiveness, Technological innovation, Market share, Product differentiation, Regulatory compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Military Industries

Elbit Systems

IMI Systems

Rafael Advanced Defense Systems

Soltam Systems

Tavor Systems

Ashot Ashkelon

Aeronautics Ltd

Magal Security Systems

Israel Aerospace Industries

CIMIC Group

Rada Electronics Industries

Mistral Group

Meprolight

Tadiran Electronic Systems

- Increasing demand from law enforcement agencies for non-lethal ammunition

- Rising investments in military modernization programs

- Integration of new ammunition technology into naval defense systems

- Growing demand for specialized ammunition in homeland security

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035