Market Overview

The Israel Micro Drones market is valued at approximately USD ~billion, driven by its widespread adoption in both defense and commercial sectors. The market is propelled by technological advancements, particularly in autonomy and sensor integration. Israel’s long-standing dominance in drone technology, supported by its military and defense sectors, ensures a steady growth trajectory. The country’s expertise in aerospace technology, coupled with a significant push from its military infrastructure, has led to the rapid development and deployment of micro drones for various applications such as surveillance, reconnaissance, and even loitering munition systems.

Key cities such as Tel Aviv and Herzliya, where most of Israel’s defense and aerospace companies are located, dominate the market due to the region’s concentration of tech startups and military contractors. The country’s central role in global UAV exports, particularly in military-grade micro drones, cements its position as a leader in the market. Defense-focused innovations and ongoing strategic collaborations with other nations have solidified Israel’s dominant position within the global micro drone market.

Market Segmentation

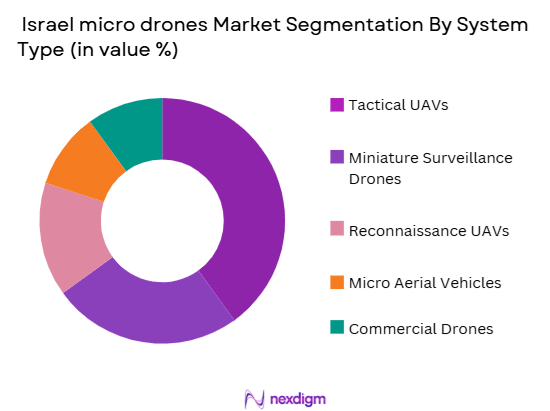

By System Type

The Israel Micro Drones market is segmented into various system types, including Tactical UAVs, Miniature Surveillance Drones, Reconnaissance UAVs, Micro Aerial Vehicles (MAVs), and Commercial Drones. Among these, Tactical UAVs have a dominant market share. This segment leads due to the strong demand from Israel’s defense forces, where these drones are widely used for surveillance and real-time intelligence gathering. Their small size, coupled with advanced payload capacity, makes them ideal for operations in difficult terrains and urban environments. Israel’s innovative development of tactical UAVs such as the Skylark series, widely adopted by defense agencies worldwide, has helped maintain their market leadership.

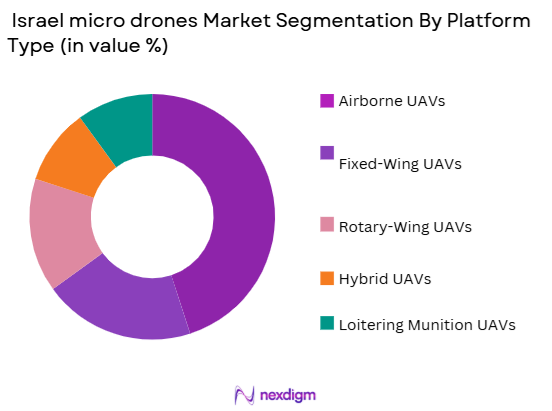

By Platform Type

The market for micro drones in Israel is also segmented by platform type, including Airborne UAVs, Fixed-Wing UAVs, Rotary-Wing UAVs, Hybrid UAVs, and Loitering Munition UAVs. Among these, Airborne UAVs lead the market. Their versatility and ability to operate in multiple environments, ranging from open fields to urban settings, have contributed to their dominance. Israel’s development of lightweight airborne UAV platforms for intelligence, surveillance, and reconnaissance (ISR) purposes has further cemented their importance in both military and commercial sectors. The ease of operation and longer endurance of these UAVs make them particularly valuable for military applications, providing real-time video and data transmission capabilities.

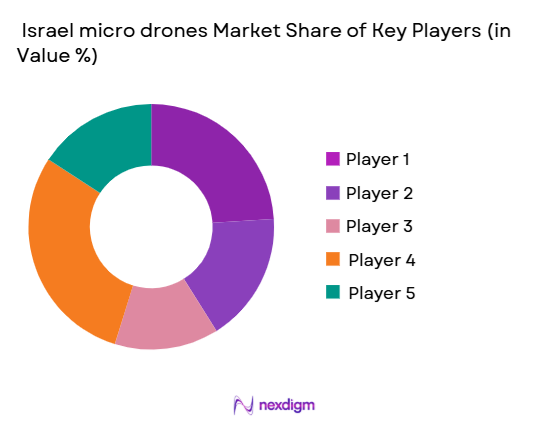

Competitive Landscape

The Israel Micro Drones market is dominated by a few key players, which include both local companies and multinational firms operating in the defense and commercial UAV space. Major players include Elbit Systems, Israel Aerospace Industries (IAI), UVision Air, Aeronautics Ltd., and INNODRON. These companies have established themselves as leaders in the development and manufacturing of high-performance micro drones, particularly in military applications. The consolidation within the market points to the significant influence of these key players, who continue to innovate and expand their market reach through both domestic growth and international sales.

| Company | Established | Headquarters | Key Parameter 1 | Key Parameter 2 | Key Parameter 3 | Key Parameter 4 | Key Parameter 5 | Key Parameter 6 |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| UVision Air | 2009 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Ltd. | 1997 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| INNODRON | 2012 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Micro Drones Market Analysis

Growth Drivers

Urbanization

Urbanization plays a crucial role in driving the demand for micro drones, particularly for urban surveillance, infrastructure monitoring, and smart city development. According to the World Bank, in 2024, around ~% of the global population resides in urban areas, with projections indicating continued growth, especially in emerging markets. In Israel, this urbanization trend is evident, with cities like Tel Aviv and Jerusalem experiencing rapid development. The need for efficient monitoring of urban spaces, traffic management, and infrastructure repair is spurring the adoption of drones. Urban areas have become hubs for micro drone applications, from surveillance to logistical tasks, aligning with Israel’s technological growth.

Industrialization

The continued industrialization in both developed and emerging economies has fostered a greater demand for micro drones in sectors such as agriculture, construction, and energy. As industries evolve, there’s a growing need for real-time data collection, mapping, and monitoring capabilities. The manufacturing sector, particularly in Israel, has been increasingly integrating drones for precision tasks such as monitoring construction sites, inspecting pipelines, and crop management. In 2024, global industrial production is expected to rise by approximately ~% according to the IMF, with industrial sectors in Israel also expanding, contributing to increased demand for micro drone technologies for automation and surveillance.

Restraints

High Initial Costs

High initial costs remain one of the key barriers to the widespread adoption of micro drones. In Israel, while the technology has evolved significantly, the costs associated with acquiring and maintaining micro drones, particularly those designed for commercial or military applications, can be prohibitive for many businesses. For instance, in 2024, the average cost of a military-grade micro drone system is upwards of USD ~, excluding additional operational and maintenance costs. The high cost of advanced sensors and the complexity of drone systems pose challenges for smaller enterprises. Despite this, ongoing technological advancements are gradually making drones more affordable, but the high upfront costs still present a significant restraint for widespread adoption.

Technical Challenges

Micro drones face significant technical challenges that hinder their potential, particularly in terms of flight time, payload capacity, and navigation systems. In Israel, the micro drones used in defense and surveillance applications require high precision and long endurance, which necessitate advanced technical capabilities. For instance, while battery life has improved, most micro drones still face limitations in terms of operational duration. As of 2024, even the most advanced drones available in Israel typically have a flight time of 1.5 to 2 hours, with limitations in battery capacity and payload flexibility. Additionally, the complex regulatory environment for drone operations adds to the technical challenges, slowing down innovation in certain areas.

Opportunities

Technological Advancements

Technological advancements offer significant opportunities for the Israel micro drone market. In 2024, Israel is witnessing cutting-edge innovations in drone autonomy, AI-based navigation, and miniaturized sensors. These advancements are expected to increase the functionality and efficiency of micro drones, expanding their applications across industries like agriculture, infrastructure, and urban planning. As these technologies continue to evolve, drones are expected to operate more autonomously, reducing operational costs and enabling wider adoption in previously inaccessible sectors. The integration of AI and IoT in micro drones provides an opportunity to automate monitoring processes, reducing human labor and improving operational efficiency.

International Collaborations

International collaborations present a significant opportunity for the growth of the Israel micro drone market. Israel has established strategic partnerships with countries like the United States, India, and several EU nations to provide drone technology for surveillance, agriculture, and environmental monitoring. In 2024, these collaborations are expected to intensify, with Israel playing a key role in providing advanced micro drone systems. The demand for Israel’s drones in international markets is driven by the country’s robust defense sector, which has pioneered the development of micro drones with advanced payloads and surveillance capabilities. These international partnerships are poised to open up new markets for Israeli drone technologies, especially in the defense and security sectors.

Future Outlook

Over the next decade, the Israel Micro Drones market is expected to experience significant growth, driven by advancements in autonomous flight systems, integration of AI for smarter operations, and increasing demand from both military and commercial sectors. Continued government and military investments in drone technology, as well as growing global demand for defense and surveillance systems, will play a crucial role in the expansion of the market. The development of more compact, high-performance systems capable of operating in challenging environments will further boost the market’s future potential.

Major Players in the Israel Micro Drones Market

- Elbit Systems

- Israel Aerospace Industries

- UVision Air

- Aeronautics Ltd.

- INNODRON

- Rafael Advanced Defense Systems

- Bluebird Aero Systems

- Skyfront

- Motorized Drones

- Quantum Systems

- UAV Factory

- Aerovironment

- Sierra Nevada Corporation

- Ben Gurion University Research Center

- DART Aerospace

Key Target Audience

- Defense and Military Organizations

- Aerospace & Defense Contractors

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- UAV Technology Developers

- System Integrators

- Drone Manufacturers and OEMs

- International Defense Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that highlights all significant stakeholders in the Israel Micro Drones market. Secondary research through industry databases, trade publications, and government reports forms the basis of identifying key drivers, trends, and challenges influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data regarding market trends, adoption rates, and technology advancements is compiled and analyzed. We assess penetration rates across various verticals like defense, infrastructure, and agriculture to estimate the market size for the given timeframe.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth, adoption, and technological developments are validated via interviews with key industry experts. These insights are crucial for refining market predictions and ensuring the accuracy of the derived data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from various sources and engaging with market leaders to finalize the report. This process ensures the inclusion of up-to-date information and a comprehensive understanding of emerging trends in the Israel Micro Drones market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for defense applications and ISR capabilities

Technological advancements in miniaturization and autonomy

Expanding use of drones in commercial sectors like agriculture and infrastructure - Market Challenges

Stringent government regulations and airspace control

High initial costs and investment requirements

Concerns regarding privacy and data security - Trends

Increased use of drones in urban environments for delivery and monitoring

Integration of AI for smarter, autonomous flight operations

Development of micro drones for swarm technology in defense and commercial applications

- Market Opportunities

Technological innovations in AI and autonomous flight systems

Growing demand for commercial drone solutions across industries

Potential for international market expansion and export opportunities - Government regulations

Restrictions on drone flight in urban airspace

Export controls for defense-related drone technologies

Safety and compliance regulations for micro drone usage - SWOT analysis

Strengths: Advanced drone technology and military expertise

Weaknesses: Regulatory hurdles and limited airspace access

Opportunities: Growing commercial adoption in agriculture and infrastructure

Threats: Geopolitical risks and counter-drone technologies - Porters 5 forces

High bargaining power of suppliers due to specialized components

Moderate threat of new entrants in the commercial drone space

High competitive rivalry among established defense contractors

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Tactical UAVs

Miniature Surveillance Drones

Reconnaissance UAVs

Micro Aerial Vehicles (MAVs)

Commercial Drones - By Platform Type (In Value%)

Airborne UAVs

Fixed-Wing UAVs

Rotary-Wing UAVs

Hybrid UAVs

Loitering Munition UAVs - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Autonomous Fitment Systems

Portable Fitment Systems

Specialized Fitment Systems - By End-User Segment (In Value%)

Defense and Military

Commercial and Civilian

Agriculture and Forestry

Infrastructure Inspection

Research & Development - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

Online Platforms

Government Agencies

OEMs (Original Equipment Manufacturers)

- Market Share Analysis

- CrossComparison Parameters(Price, Technology, Performance, Market Share, Distribution Channels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

UVision Air

Aeronautics Ltd.

INNODRON

Rafael Advanced Defense Systems

Bluebird Aero Systems

Skyfront

Motorized Drones

Quantum Systems

UAV Factory

Aerovironment

Sierra Nevada Corporation

Ben Gurion University Research Center

DART Aerospace

Percepto

- Increasing demand for military surveillance and reconnaissance drones

- Rising interest from agricultural sectors for crop monitoring and analysis

- Infrastructure inspection companies adopting drones for cost-efficient operations

- Commercial sectors leveraging drones for aerial mapping and logistics

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035