Market Overview

The Israel Military 3D and 4D Printing market is valued at approximately USD ~ million in 2025, driven by rapid advancements in military manufacturing technologies. Israel’s military is increasingly adopting additive manufacturing for its ability to produce custom parts on demand, reducing reliance on external suppliers and ensuring operational flexibility. With growing defense budgets and Israel’s focus on innovation, 3D and 4D printing are becoming key technologies in producing complex parts quickly and cost-effectively. These systems are widely used in aerospace, land defense, and naval platforms.

Israel is a dominant player in the military 3D and 4D printing market due to its leading defense technology innovations and a strong focus on cutting-edge manufacturing solutions. The country’s robust defense infrastructure, coupled with government support for technological advancement, particularly in areas like drones and unmanned systems, positions Israel at the forefront. Tel Aviv, being the heart of Israel’s defense and aerospace industries, plays a pivotal role in the development and adoption of these advanced printing technologies.

Market Segmentation

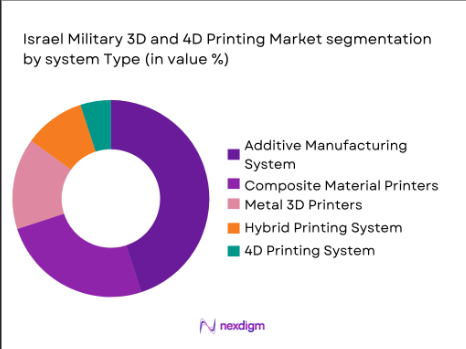

By System Type

The Israel Military 3D and 4D Printing market is segmented by system type into additive manufacturing systems, composite material printers, metal 3D printers, hybrid printing systems, and 4D printing systems. Additive manufacturing systems dominate the market as they offer greater flexibility in producing complex geometries and lightweight parts. The adoption of these systems is propelled by the need for rapid prototyping and custom parts, particularly for military applications such as drones and unmanned vehicles, where on-demand production is critical to meet evolving needs.

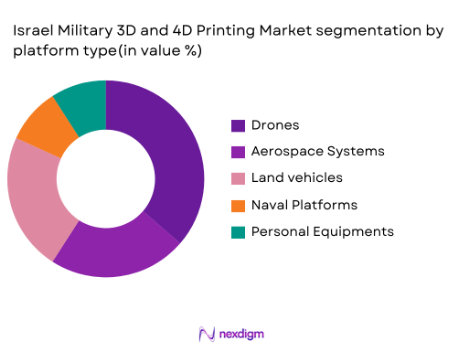

By Platform Type

The market is also segmented by platform type into land vehicles, aerospace systems, naval platforms, drones, and personal equipment. Drones represent the largest segment due to Israel’s strong focus on unmanned systems, which are extensively used in defense and intelligence operations. Drones require lightweight, durable, and high-performance parts that can be quickly manufactured using 3D and 4D printing technologies. The increased use of drones for surveillance, reconnaissance, and combat missions fuels the demand for these advanced manufacturing systems.

Competitive Landscape

The Israel Military 3D and 4D Printing market is characterized by a mix of domestic and international players, with Israel’s own defense and aerospace giants like Israel Aerospace Industries (IAI) and Elbit Systems leading the market. These companies have a strong presence in military 3D printing due to their long-standing relationships with the Israeli Defense Forces (IDF) and other defense agencies. Their focus on innovation and custom manufacturing solutions has solidified their leadership in the market. The market also sees participation from global companies such as Lockheed Martin and Boeing, who collaborate on defense projects involving advanced printing technologies.

| Company | Establishment Year | Headquarters | Technology Expertise | Product Range | Key Partnerships | Market Focus |

| Israel Aerospace Industries | 1953 | Israel | – | – | – | – |

| Elbit Systems | 1966 | Israel | – | – | – | – |

| Lockheed Martin | 1912 | USA | – | – | – | – |

| Boeing | 1916 | USA | – | – | – | – |

| Stratasys | 1989 | Israel | – | – | – | – |

Israel Military 3D and 4D Printing Market Dynamics

Growth Drivers

Technological Advancements in Additive Manufacturing for High-Performance Military Components

Additive manufacturing technology has seen significant advancements, enabling the production of complex military components with greater precision and functionality. For example, in 2023, Israel Aerospace Industries (IAI) developed 3D-printed drone components that enhanced performance while reducing the weight of the systems. The ability to print high-performance parts made from metals and composites is transforming military manufacturing processes, enabling faster design iterations, more customized solutions, and improved operational efficiency in mission-critical applications. This technological progress is driving the adoption of 3D and 4D printing technologies within Israel’s military sector

Increasing Need for Rapid Prototyping and On-Demand Manufacturing in Military Applications

The need for rapid prototyping and on-demand manufacturing in the military sector has become increasingly important as Israel’s defense forces seek to maintain operational flexibility. According to the Israel Defense Forces (IDF), the ability to quickly produce and deploy custom parts for military drones, armored vehicles, and other systems is critical. In 2024, the IDF is expected to leverage 3D and 4D printing technologies to meet this demand, reducing time delays and enhancing the ability to field new technologies more quickly. This has led to a surge in the adoption of additive manufacturing in military applications.

Market Challenges

Technological Barriers in Integrating Advanced Printing Solutions with Legacy Military Systems

A key challenge in the Israel military’s adoption of 3D and 4D printing technologies is the integration of these systems with legacy military platforms. Many existing military systems were not designed with additive manufacturing in mind, requiring complex adaptations or redesigns of parts to ensure compatibility with newer printed components. In some cases, legacy systems cannot accommodate the advanced materials or designs enabled by 3D and 4D printing without significant retrofitting, leading to delays and additional costs in production. The Israeli Ministry of Defense has acknowledged these challenges in several reports on defense technology upgrades.

Security and Intellectual Property Concerns with 3D and 4D Printed Military Components

As the adoption of 3D and 4D printing grows, security concerns have emerged regarding the protection of intellectual property (IP) and the potential for unauthorized duplication of sensitive military components. In 2023, Israel’s Ministry of Defense expressed concerns about the possibility of third parties obtaining blueprints for key military systems through unsecured 3D printing technologies. Ensuring that printed components remain secure and that IP is protected from cyber threats remains a significant challenge, as the open-source nature of 3D printing could lead to vulnerabilities in the production process.

Market Opportunities

Growing Demand for Customized Military Parts and On-Demand Manufacturing Solutions

The demand for customized, mission-specific military parts that can be produced quickly and efficiently is growing significantly. Israel’s defense forces are increasingly adopting 3D and 4D printing to create tailored components for military drones, aircraft, and other critical systems. With Israel’s strategic need for high-performance military equipment, 3D and 4D printing are becoming essential tools for on-demand manufacturing. In 2024, Israel’s defense budget includes a focus on this area, aiming to reduce lead times and enhance operational flexibility by printing parts directly on-site or in forward military bases.

Israel’s Position as a Global Leader in Defense Innovation Promoting Further 3D and 4D Printing Adoption

Israel’s reputation as a global leader in defense innovation is contributing to the rapid adoption of 3D and 4D printing in military applications. As a pioneer in military technology, Israel is continuously exploring new ways to enhance the efficiency and effectiveness of its military. The Israeli government has been heavily investing in defense technology, with a portion of this focus directed towards additive manufacturing as a key enabler of innovation in defense systems. This positions Israel to remain at the forefront of military 3D and 4D printing, creating significant opportunities for growth in the sector.

Future Outlook

Over the next decade, the Israel Military 3D and 4D Printing market is poised for significant growth, driven by the ongoing need for rapid prototyping and on-demand manufacturing capabilities in defense applications. With Israel’s military continuously seeking innovative ways to enhance operational efficiency, the adoption of advanced manufacturing technologies like 3D and 4D printing will accelerate. Furthermore, technological advancements in 4D printing, which allows for materials to change properties in response to environmental conditions, will further enhance the capabilities of military platforms, providing significant operational advantages.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Lockheed Martin

- Boeing

- Stratasys

- Northrop Grumman

- Raytheon Technologies

- General Electric

- Airbus

- General Dynamics

- Kratos Defense & Security Solutions

- Thales Group

- BAE Systems

- Leonardo

- Honeywell International

Key Target Audience

- Defense Contractors

- Aerospace Manufacturers

- Israeli Defense Forces

- Ministry of Defense

- Military Technology Providers

- Aerospace and Defense R&D Institutions

- Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping out the key stakeholders and variables in the Israel Military 3D and 4D Printing market. Through desk research and secondary data sources, we identify the driving forces, such as defense spending and technological advancements, as well as the challenges impacting the adoption of these technologies.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the market’s growth, trends, and adoption rates are compiled. We analyze industry trends, the adoption of additive manufacturing in defense, and the specific demands of the Israeli military for rapid prototyping and custom parts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are refined and validated through consultations with industry experts, defense contractors, and military representatives. These consultations help refine data insights and ensure that the analysis reflects the real-world needs and challenges of the market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all findings, including expert feedback and secondary data, to provide a comprehensive outlook. The research is validated through discussions with military experts and defense contractors, ensuring accuracy and reliability of the market forecasts.

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense spending in Israel fueling the adoption of advanced manufacturing technologies

Technological advancements in additive manufacturing for high-performance military

components

Increasing need for rapid prototyping and on-demand manufacturing in military applications - Market Challenges

High initial cost of 3D and 4D printing systems

Technological barriers in integrating advanced printing solutions with legacy military systems

Security and intellectual property concerns with 3D and 4D printed military components - Market Opportunities

Growing demand for customized military parts and on-demand manufacturing solutions

Israel’s position as a global leader in defense innovation promoting further 3D and 4D printing adoption

Partnerships between defense companies and 3D printing firms to drive further technological advancements - Trends

Integration of AI and machine learning with 3D and 4D printing for smarter manufacturing solutions

Shift toward lightweight and durable 3D printed materials for military applications

Increased focus on sustainability and eco-friendly 3D and 4D printing materials in military production

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Additive Manufacturing Systems

Composite Material Printers

Metal 3D Printers

Hybrid Printing Systems

4D Printing Systems - By Platform Type (In Value%)

Land Vehicles

Aerospace Systems

Naval Platforms

Drones

Personal Equipment - By Fitment Type (In Value%)

Linefit

Retrofit

OEM Fitment

Maintenance Fitment

Aftermarket Fitment - By End User Segment (In Value%)

Defense Contractors

Military Forces

Aerospace and Defense Manufacturers

Technology Providers

MRO (Maintenance, Repair, and Overhaul) Providers - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

OEM Procurement

Government Procurement

Defense Technology Contracts

- Israel Military 3D and 4D Printing Market Competitive Landscape

Market Share Analysis - Cross Comparison Parameters (Technological Innovation, Cost Efficiency, Intellectual Property Security, Government Regulations, Supplier Network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Lockheed Martin

Boeing

Elbit Systems

Israel Aerospace Industries

Stratasys

Materialize

RAPID Technologies

EOS GmbH

3D Systems

Desktop Metal

Arcam AB

GE Additive

SABIC

Renishaw

Hewlett Packard Enterprise

- Growing demand for advanced manufacturing in military aircraft and aerospace systems

- Increase in the use of 3D printing for military drones and unmanned systems

- Rapid adoption of 3D printing in vehicle maintenance and repair services for military platforms

- Technological advancements in personal military equipment, including body armor and weaponry

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035