Market Overview

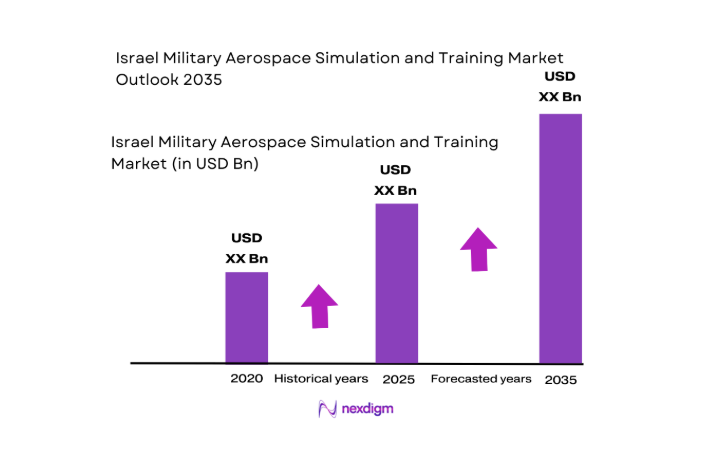

The Israel military aerospace simulation and training market is valued at approximately USD ~ in 2024, with steady growth expected to continue in 2024 due to increased defense expenditure, evolving threats, and the country’s focus on technological advancements. The market’s growth is primarily driven by the Israeli Defense Forces’ need for high-fidelity training systems, with advanced simulation tools used to train aircrews and ground forces on complex mission scenarios. Additionally, the demand for more realistic, integrated training systems and the country’s strong defense industry infrastructure, including domestic manufacturers like Elbit Systems and IAI, fuel market expansion.

Israel remains a dominant force in the aerospace simulation and training market due to its advanced military technology, robust defense budget, and strategic partnerships. The country’s dominance is attributed to a combination of factors such as significant investments in defense R&D, close ties with global military allies like the United States, and its leadership in UAV/UAS and avionics systems. Cities such as Tel Aviv and Herzliya are key hubs for innovation, where companies like Elbit Systems, IAI, and Rafael Advanced Defense Systems are based, solidifying Israel’s leading position in military simulation technology.

Market Segmentation

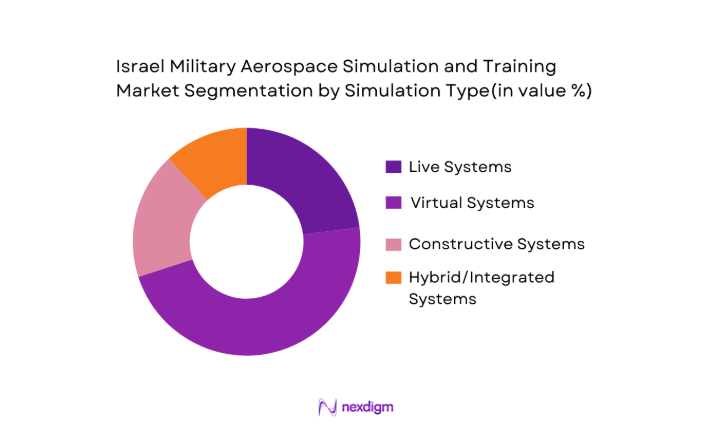

By Simulation Type

The Israeli military aerospace simulation market is segmented by simulation type into live, virtual, constructive, and hybrid systems. Among these, virtual simulations dominate the market share in 2024. The growing use of virtual reality (VR) and augmented reality technologies for immersive training environments has made virtual simulations particularly popular. These systems enable aircrews and defense personnel to engage in realistic, mission-critical training without the high operational costs associated with live training exercises. Additionally, virtual simulators are essential for the training of UAV operators and combat pilots, providing them with high-fidelity experiences for complex mission scenarios.

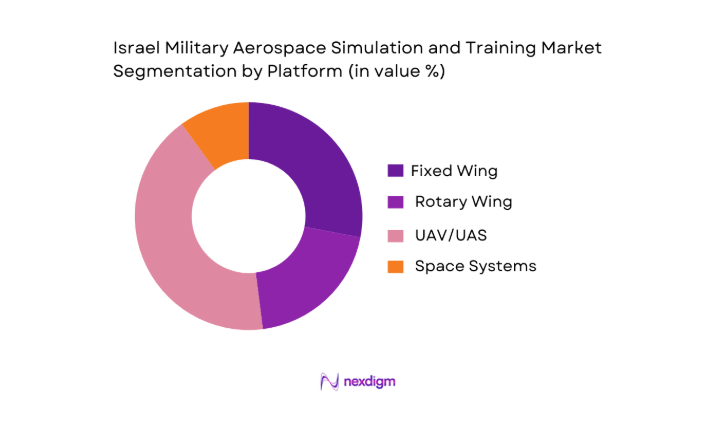

By Platform

The platform segment in the Israeli military aerospace simulation market includes fixed-wing, rotary-wing, UAV/UAS, and space systems. UAV/UAS simulation systems have the largest market share in 2024, reflecting the growing reliance on unmanned aerial systems for both reconnaissance and combat missions. Israel’s leadership in UAV technology, driven by companies like Elbit Systems and IAI, has led to an increasing demand for UAV simulation systems, which help operators improve their skills in handling UAVs in a range of operational environments, from surveillance to combat. This segment’s dominance is further strengthened by Israel’s emphasis on unmanned systems as part of its defense strategy.

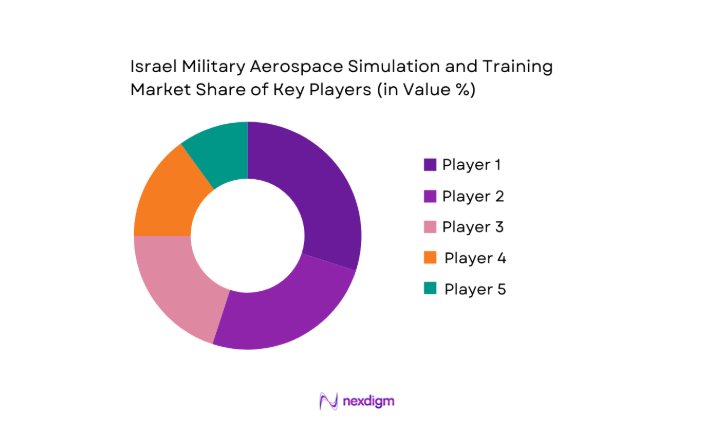

Competitive Landscape

The Israeli military aerospace simulation and training market is characterized by the presence of both domestic and global players. Key companies such as Elbit Systems, Israel Aerospace Industries, and Rafael Advanced Defense Systems dominate the market due to their strong expertise in defense technologies, comprehensive product offerings, and deep government ties. Additionally, global players like CAE Inc., Thales Group, and Lockheed Martin also hold a significant share of the market, particularly in advanced training technologies. This consolidation among major players helps drive the adoption of cutting-edge simulation systems and collaborative development of new solutions tailored to the needs of the Israeli Defense Forces.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Type | Key Customers | R&D Focus |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ |

| CAE Inc. | 1947 | Montreal, Canada | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

Israel Military Aerospace Simulation & Training Market Analysis

Growth Drivers

Defense Budget Allocation for Simulation Modernization

The allocation of defense budgets for simulation and training modernization continues to rise globally. As of 2024, Israel’s defense budget is approximately USD ~, with a significant portion allocated for advanced training systems and military modernization. The country’s emphasis on technological advancements in defense systems, including aerospace simulation, is reflected in its ongoing investment into high-fidelity training platforms. These systems help enhance the operational readiness of the Israeli Defense Forces, particularly for complex mission scenarios involving aircraft and UAVs. Furthermore, global defense spending is expected to increase as nations prioritize technological advancements in military preparedness, driving further investments in simulation technologies.

Strategic Demand for High-Fidelity Immersive Training

The demand for high-fidelity immersive training has been propelled by the increasing complexity of modern warfare. As of 2024, Israel’s military forces, particularly the Israeli Air Force, are investing in advanced training technologies, such as virtual reality and augmented reality , to provide more realistic simulations. The use of these immersive technologies allows military personnel to train in controlled environments that replicate real-world conditions. The global demand for immersive training is also growing, with the U.S. military alone allocating approximately USD ~ for simulation and virtual training projects in the coming years. This growing shift to immersive, AI-driven technologies is fueling Israel’s investment in simulation platforms for both national and export purposes.

Market Challenges

Integration Complexity

The integration of advanced simulation technologies with existing military systems presents a significant challenge in the defense sector. As of 2025, Israel’s defense industry faces hurdles related to interoperability between live training platforms and virtual/constructive systems. The challenge is exacerbated by the rapidly evolving nature of aerospace technologies, particularly UAVs, requiring constant updates to simulation systems. The integration complexity is evident in the U.S. military’s multi-billion-dollar investment in the Integrated Training Systems program, designed to address issues surrounding live-virtual-constructive environments. Similarly, Israel must continually invest in ensuring its simulation systems are compatible with international standards while meeting the evolving needs of the IDF.

Regulation & Certification Standards

Regulatory and certification standards for defense technologies, including simulation systems, remain a challenge for manufacturers. In 2024, the Israeli government, along with international defense organizations like NATO, enforces stringent certification processes for all defense-related technology. These standards are aimed at ensuring the operational effectiveness and safety of simulation systems. However, compliance with these standards can delay product rollouts and increase development costs for companies like Elbit Systems and Israel Aerospace Industries. These regulatory hurdles are particularly difficult for export-oriented companies that must meet varying certification requirements across different markets.

Market Opportunities

AI-Powered Scenario Generation

The integration of artificial intelligence into simulation platforms presents a significant opportunity for market growth. AI allows for the dynamic creation of realistic training scenarios that adapt to the actions of trainees, providing a more immersive and challenging training environment. As of 2024, Israel’s defense sector is increasingly utilizing AI to enhance training fidelity, with a focus on autonomous UAV operations and complex air combat scenarios. The growth of AI-powered systems is supported by global advancements in machine learning and AI, which have proven their value in enhancing training outcomes. Countries worldwide are investing in these technologies to stay ahead in military readiness, creating new growth avenues for Israel’s simulation providers.

UAS/UAV Autonomous Mission Training

The demand for UAVs and their autonomous mission capabilities has grown substantially. In 2025, Israel is a world leader in UAV technology, and its defense forces are increasingly focused on training operators for autonomous UAV missions. These platforms, capable of performing complex tasks without direct human control, require specialized training simulations that replicate real-world mission environments. The continued development of UAVs and the demand for unmanned systems training represents a significant opportunity for Israel’s aerospace simulation market. With Israel’s advanced capabilities in UAV development and global demand for such systems, the market is well-positioned for growth.

Future Outlook

Over the next decade, Israel’s military aerospace simulation and training market is expected to experience steady growth. This growth will be fueled by advancements in simulation fidelity, the ongoing need for more efficient training methods, and the integration of AI and machine learning technologies into training environments. Additionally, as Israel continues to face evolving security threats, there will be an increasing demand for high-fidelity simulators that can replicate complex battlefield conditions, enhancing the readiness of aircrews, UAV operators, and other defense personnel.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- CAE Inc.

- Thales Group

- Lockheed Martin

- L-3 Communications

- Northrop Grumman

- Saab AB

- BAE Systems

- Rockwell Collins

- Indra Sistemas

- Leonardo S.p.A.

- Harris Corporation

- Kongsberg Gruppen ASA

Key Target Audience

- Government and Regulatory Bodies

- Military Procurement Agencies

- Defense Contractors & Manufacturers

- Investments and Venture Capitalist Firms

- Defense Simulation and Training Solution Providers

- Air Force and Defense Forces Training Institutions

- Private Aerospace and UAV Operators

- International Defense Alliances and Military Procurement Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves the construction of a comprehensive ecosystem map that includes key stakeholders in the Israeli military aerospace simulation and training market. We gather data from various sources, including government reports, defense industry databases, and military publications, to identify the primary factors influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves the collection and analysis of historical data to understand market growth patterns, including the adoption of different simulation types and platforms. We evaluate trends in procurement and training requirements, focusing on the relationship between technological innovation and military preparedness.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through in-depth interviews with industry professionals, including representatives from simulation providers, military officials, and defense experts. These consultations provide insights into evolving market trends, technological advancements, and customer needs, which help validate the accuracy of our assumptions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and expert feedback to produce a comprehensive analysis of the Israeli military aerospace simulation and training market. We engage with manufacturers, industry stakeholders, and defense agencies to ensure the report accurately reflects the current state and future outlook of the market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Defense budget allocation for simulation modernization

Strategic demand for high‑fidelity immersive training

Export demand - Market Challenges

Integration complexity

Regulation & certification standards - Opportunities

AI‑powered scenario generation

UAS/UAV autonomous mission training - Trends

Cloud‑based simulation services

Interoperability with international standards - Government Regulations

Defense Procurement frameworks

Data security & military information security compliance - SWOT Analysis

- Porter’s Five Forces

- By value, 2020-2025

- By volume , 2020-2025

- By average contract price, 2020-2025

- By Simulation Type (In Value %)

Live Systems

Virtual Simulators

Constructive Simulators - By Platform (In Value %)

Fixed Wing

Rotary Wing

UAV/UAS platforms - By Deployment Model (In Value %)

On‑Premises Defense Facilities

Cloud‑Enabled Simulation Services

Mobile/Edge Simulation Kits - By End‑Use Application (In Value %)

Pilot Combat Readiness & Tactics

Maintenance & Technical Certification

Mission Planning & C2 Integration - By Technology Adoption (In Value %)

AI‑Enabled Adaptive Training

Augmented/Virtual Reality Interfaces

Digital Twin Environments

- Market Share of Major Players

- Cross Comparison Parameters (Simulator fidelity score, Integration capability, AI/ML adaptability index, Training throughput, After‑sales & sustainment support rating, Cyber‑resilience compliance in simulation software)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Elbit Systems Ltd.

Israel Aerospace Industries

SimiGon Ltd.

CAE Inc.

Lockheed Martin Global Training & Logistics

Arotech Corporation

Rheinmetall AG

Thales Group

BAE Systems plc

RTX Corporation

Northrop Grumman Corporation

The Boeing Company

Kongsberg Gruppen ASA

Indra Sistemas, S.A.

Saab AB

- Operational readiness requirements

- Total cost of ownership of simulation systems

- Interoperability with global training standards

- Certification & compliance in defense acquisitions

- By value, 2026-2035

- By volume , 2026-2035

- By average contract price, 2026-2035