Market Overview

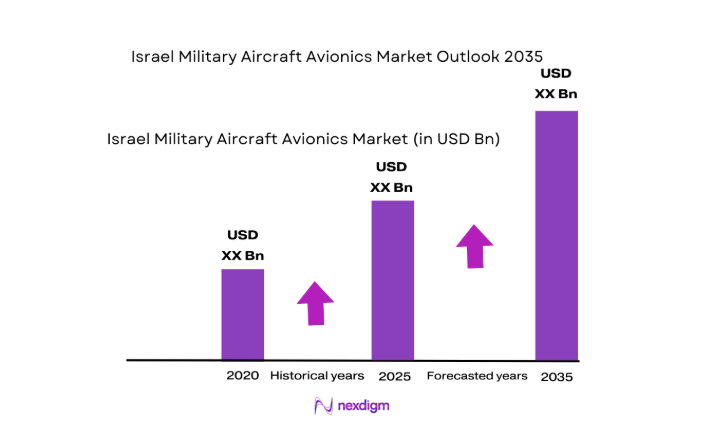

The Israel military aircraft avionics market is valued at USD ~ in 2025. This market is driven by the modernization of the Israeli Defense Forces (IDF), specifically the Israeli Air Force (IAF), which is continuously upgrading its existing fleet and expanding into new platforms like UAVs and advanced combat aircraft. High defense expenditure and a strong focus on integrating cutting-edge avionics systems like radar, communication, and EW systems have also contributed to market growth. Furthermore, the Israeli government’s robust defense export strategies continue to propel the market by providing avionics systems for global defense contracts and strategic partnerships.

Israel remains the dominant country in the military aircraft avionics market due to its long-standing military aviation prowess and high defense budget. Tel Aviv and Herzliya are key cities in this market, housing leading aerospace companies like Elbit Systems and Israel Aerospace Industries . These cities provide a robust ecosystem for defense technology, R&D, and avionics manufacturing. Moreover, Israel’s close defense ties with major global players and its defense exports to countries across North America, Europe, and the Middle East further consolidate its leadership in the avionics market.

Market Segmentation

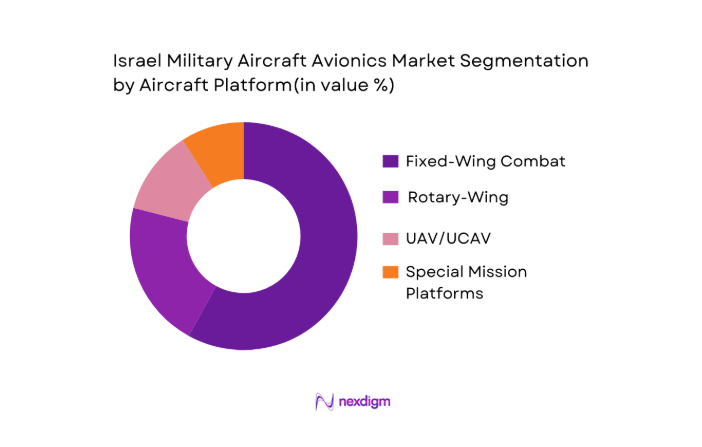

By Aircraft Platform

The Israeli military aircraft avionics market is primarily segmented by aircraft platform into fixed-wing, rotary-wing, unmanned aerial vehicles (UAV), and special mission platforms. Among these, fixed-wing platforms dominate the market share in 2024. This is primarily due to Israel’s heavy reliance on fighter jets and bombers like the F-35 and F-16, which require sophisticated avionics for communication, navigation, and mission systems. The presence of state-of-the-art avionics solutions in these platforms, such as radar systems, electronic warfare (EW) capabilities, and synthetic aperture radar (SAR), further enhances their operational efficiency, making them a key focus for Israel’s defense industry.

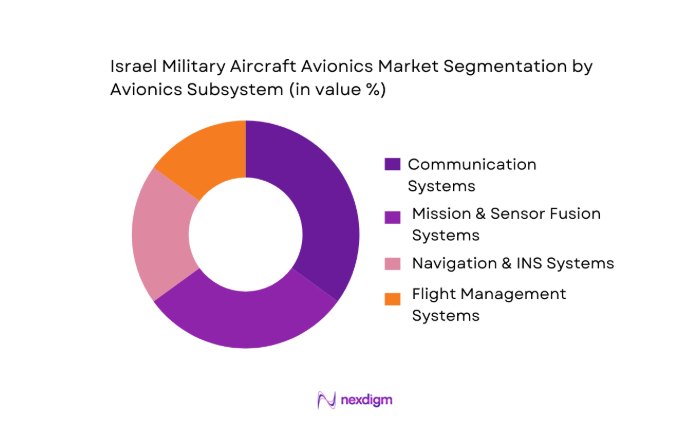

By Avionics Subsystem

The avionics subsystem segmentation is divided into various categories such as navigation systems, communication systems, mission & sensor fusion systems, and flight management systems. Communication systems, particularly secure SATCOM and VHF/UHF radios, dominate the market share in 2024. The continuous need for secure communication systems in military operations, combined with Israel’s strategic focus on network-centric warfare, has made communication systems the leading avionics segment. Israel’s expertise in encrypted communication and secure data transmission systems plays a significant role in this dominance.

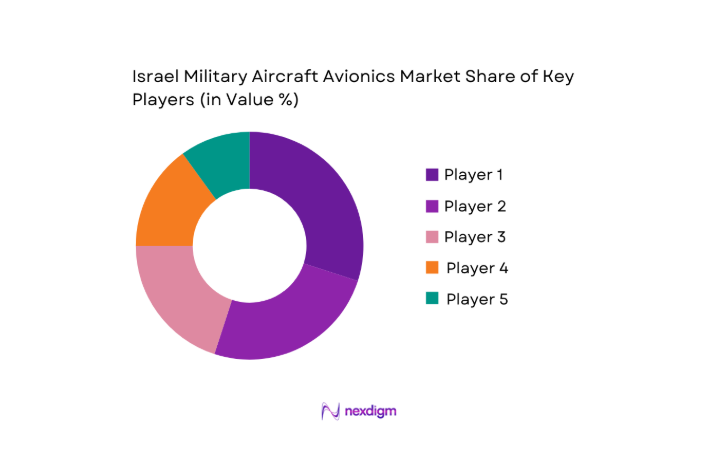

Competitive Landscape

The Israel military aircraft avionics market is dominated by a few key players, including Elbit Systems, Israel Aerospace Industries (IAI), and Rafael Advanced Defense Systems. These companies play a major role in supplying advanced avionics for both domestic military aircraft and export contracts. The competitive landscape is marked by significant investments in R&D, a focus on indigenous manufacturing, and continuous technological innovation. Israel’s defense firms benefit from strong government backing and close ties with military procurement programs, allowing them to maintain their position as global leaders in the avionics sector.

| Company Name | Establishment Year | Headquarters | Avionics Integration Capability | Defense Export Contracts | Technology Innovation Index | Key Partnerships | Market Focus |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Morris Plains, US | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, US | ~ | ~ | ~ | ~ | ~ |

Israel Military Aircraft Avionics Market Analysis

Growth Drivers

Modernization Programs

Modernization programs are a key growth driver in the Israel military aircraft avionics market. Israel has consistently invested in modernizing its defense technologies, with a focus on enhancing avionics capabilities for both existing platforms and new aircraft. The Israeli government allocates a significant portion of its defense budget to modernization initiatives, including the upgrade of avionics systems on fighter jets and UAVs. For example, Israel’s defense budget for 2024 is approximately USD ~, with a large proportion directed towards the development and enhancement of avionics technology across its air force, which is critical for maintaining technological superiority. The ongoing upgrades of fighter jets like the F-16 and F-35, as well as new-generation UAVs, further fuel demand for advanced avionics systems. Additionally, Israel’s commitment to innovation in defense technology, supported by state-backed programs, ensures continued investment in avionics modernization to maintain operational efficiency.

UAV Proliferation

The proliferation of Unmanned Aerial Vehicles (UAVs) is significantly shaping the future of the military aircraft avionics market in Israel. As Israel’s defense strategy increasingly relies on UAVs for surveillance, reconnaissance, and combat missions, the demand for specialized avionics systems has surged. Israel is a global leader in UAV technology, with its UAVs used by defense forces around the world. In 2024, the global UAV market is projected to surpass USD ~, with Israel’s contribution growing as its UAV exports continue to expand. The integration of sophisticated avionics systems in UAVs, including GPS navigation, sensors, and communication systems, plays a vital role in the market. As Israel continues to refine UAV technologies, including the development of autonomous drones and swarm technology, demand for avionics solutions will remain robust. This growth is supported by Israel’s strategic focus on leveraging UAVs to enhance its intelligence, surveillance, and reconnaissance (ISR) capabilities.

Market Challenges

Cybersecurity in Avionics

Cybersecurity is a major challenge within the Israeli military aircraft avionics sector. As avionics systems become increasingly interconnected with other military platforms, the risk of cyber threats intensifies. In 2024, Israel’s National Cyber Directorate reported over 1,000 cyberattacks targeting critical national infrastructure, with military systems being one of the most targeted sectors. The Israeli military invests heavily in cyber defense, particularly for avionics systems that manage sensitive data related to mission execution. However, maintaining security amidst the evolving landscape of cyber threats remains a critical concern. Advanced encryption, secure communication systems, and robust cybersecurity measures are essential for mitigating these risks. The rising frequency of cyber-attacks on military assets, including attempts to hack into satellite communications, has prompted the need for continuous innovation in cybersecurity technologies to protect avionics systems from potential breaches and disruptions.

Standards Certification Bottlenecks

Standards certification for avionics systems poses a significant challenge for the Israel military aircraft avionics market. The stringent requirements set by international regulatory bodies such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) often lead to bottlenecks in the certification process. In Israel, the Civil Aviation Authority (CAA) works closely with the Ministry of Defense to ensure compliance with aviation standards, but delays in the certification of new technologies can affect the market’s growth trajectory. In 2024, Israel’s aviation authorities processed over 300 avionics certification requests, with an increasing number of requests related to new-generation technologies such as AI-powered mission systems and autonomous flight management systems. These certification delays can impede the adoption of advanced avionics systems in military aircraft, creating a roadblock for new program rollouts. This challenge is particularly pronounced as the defense industry seeks to rapidly deploy emerging technologies without compromising on regulatory compliance and safety standards.

Opportunities

Autonomous Mission Systems

The demand for autonomous mission systems in military aircraft presents a significant opportunity for growth in the Israel military aircraft avionics market. Israel is at the forefront of autonomous technologies, particularly in unmanned aerial vehicles (UAVs) and autonomous combat systems. Autonomous mission systems reduce the need for human intervention in critical missions, enabling faster and more efficient operations in complex battle environments. In 2024, Israel’s defense sector allocated substantial funds for the development of autonomous systems, with specific emphasis on AI-enabled avionics that integrate machine learning and decision-making algorithms. Israel’s defense strategy increasingly focuses on integrating autonomous technologies in various platforms, such as combat aircraft and UAVs, for enhanced operational capabilities. With Israel’s strong technological infrastructure and its commitment to military innovation, the market for autonomous mission systems is expected to continue growing, supported by both domestic demand and exports to global defense markets.

Data Fusion

Data fusion is transforming military avionics systems, creating a valuable growth opportunity in the Israel market. Data fusion involves the integration of multiple data streams—such as radar, sensors, and satellite data—into a cohesive and actionable format. This technology enhances situational awareness, decision-making, and mission execution capabilities. In 2024, Israel’s military is increasingly deploying data fusion techniques across its air force and defense systems, particularly in advanced avionics for aircraft like the F-35 and UAVs. The integration of data fusion technologies in avionics systems allows for real-time processing of vast amounts of information, improving decision-making during combat and surveillance operations. The Israeli military’s focus on network-centric warfare and real-time data exchange further accelerates the adoption of these systems. The demand for advanced data fusion capabilities will continue to grow as Israel develops more sophisticated avionics systems capable of handling complex operational environments.

Future Outlook

Over the next decade, the Israel military aircraft avionics market is expected to witness robust growth, driven by advancements in avionics technology, the increasing integration of artificial intelligence (AI), and the growing demand for modernized military platforms. Key factors fueling the market’s growth include increased defense budgets, the expanding use of UAVs, and Israel’s ongoing focus on enhancing the capabilities of its military aircraft. Moreover, the shift towards autonomous systems and the adoption of open architecture standards will continue to shape the market dynamics.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Honeywell International

- Raytheon Technologies

- Collins Aerospace

- Thales Group

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- Leonardo S.p.A.

- General Dynamics

- Rockwell Collins

- L3 Technologies

- SAAB AB

Key Target Audience

- Defense Ministries

- Military Aviation Units

- Aerospace and Defense OEMs

- Defense Contractors

- Tier 1 Avionics Integrators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- International Military Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map of all significant stakeholders within the Israel military aircraft avionics market. This includes key avionics integrators, defense contractors, and government entities, ensuring that we understand the dynamics that influence market growth.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data to assess market penetration across various avionics segments. By studying the demand across fixed-wing, rotary-wing, and UAV platforms, we will refine our understanding of market trends and growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts and senior executives at defense firms, OEMs, and avionics suppliers. These discussions will help fine-tune our analysis and ensure the accuracy of assumptions about market drivers and technological advancements.

Step 4: Research Synthesis and Final Output

The final phase synthesizes findings into a comprehensive report, utilizing both qualitative and quantitative data gathered during the earlier stages. This includes final engagement with key market players to verify insights and solidify conclusions, ensuring that the report offers actionable, market-specific intelligence.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Modernization Programs

UAV Proliferation - Market Challenges

Cybersecurity in Avionics

Standards Certification Bottlenecks - Opportunities

Autonomous Mission Systems

Data Fusion - Trends

AI/ML in Avionics

Software‑Defined Avionics - Government Regulations

- SWOT Analysis

- Porters Five Forces

- By Value, 2020‑2025

- By Volume, 2020‑2025

- By Average Price per Unit , 2020‑2025

- By Aircraft Platform (In Value %)

Fixed Wing Combat

Rotary Wing

Unmanned Aerial Vehicles - By Avionics Subsystem (In Value %)

Navigation & INS

Flight Management

Communication Systems - By Technology Type (In Value %)

Open Architecture & MOSA‑Ready Systems

Legacy vs. Next‑Gen / AI‑Assisted Avionics - By Integration Level (In Value %)

OEM Native Integration

Retrofit & Upgrade Solutions

Turnkey System Integrators - By End User (In Value %)

Israel Defense Forces Aviation

Foreign Military Sales Recipients

Defense Contractors & Tier‑1 Integrators

- Market Share of Major Players

- Cross Comparison Parameters (Avionics Integration Capability, Open Architecture & MOSA Compliancy, EW & Sensor Fusion Maturity, Safety & Certification Standards, Export Control & ITAR Status, Supply Chain Risk & Local Manufacturing Footprint)

- SWOT of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Elbit Systems Ltd.

Israel Aerospace Industries

ELTA Systems Ltd.

Rafael Advanced Defense Systems

Astronautics

RADA Electronic Industries Ltd.

Honeywell International Inc.

Raytheon Technologies / Collins Aerospace

Thales Group

BAE Systems

Northrop Grumman

Lockheed Martin

SAAB AB

Leonardo S.p.A.

General Dynamics

- Procurement Decision Factors

- Budget Allocation & Funding Cycles

- Operational Requirements

- After‑Sales Support & Lifecycle Services

- By Value, 2026‑2035

- By Volume, 2026‑2035

- By Average Price per Unit, 2026‑2035