Market Overview

The Israel military aircraft modernization and retrofit market is valued at approximately USD ~, driven by increasing investments in upgrading existing aircraft fleets, which ensures operational effectiveness amidst evolving security threats. Israel’s focus on maintaining a highly capable defense force with advanced technologies and systems has pushed military contractors to modernize older aircraft, integrating cutting-edge avionics, radar, and weapons systems. Additionally, the Israeli government’s long-term defense budgets and strategic alliances with global defense powers like the United States have been key drivers of market growth.

Israel dominates the military aircraft modernization market due to its advanced defense sector and strategic importance in the Middle East. Key regions include Tel Aviv and Herzliya, where Israel Aerospace Industries (IAI) and Elbit Systems operate. Israel’s defense modernization programs are mainly driven by the Israel Air Force (IAF), which continually updates its fleet, including F-16s and F-35s. The proximity to conflict zones and the need for superior defense systems also enhance the country’s position as a global leader in military aircraft retrofit solutions.

Market Segmentation

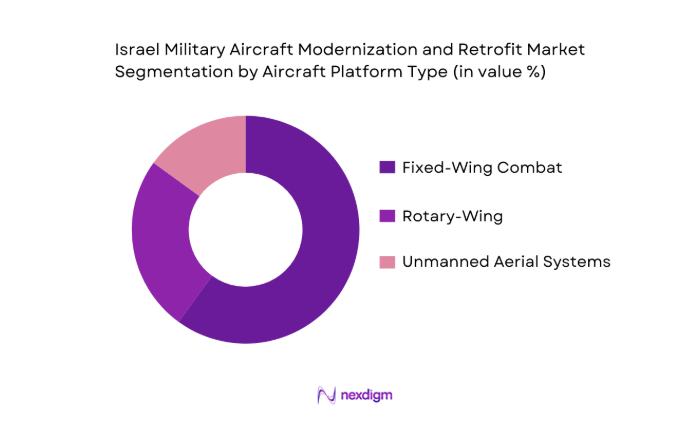

By Aircraft Platform Type

The market is segmented by aircraft platform type into fixed-wing combat, rotary-wing (helicopters), and unmanned aerial systems. Among these, fixed-wing combat aircraft retrofits dominate the market due to Israel’s heavy investment in aircraft like the F-16 and F-35 fleets, which require continuous upgrades to stay ahead of technological advancements. These retrofits often involve integration of new avionics, radar, and mission-specific systems, making this sub-segment particularly lucrative. Israel’s focus on strategic deterrence through its air force, along with its expertise in retrofitting, contributes to the strong demand for fixed-wing aircraft modernization.

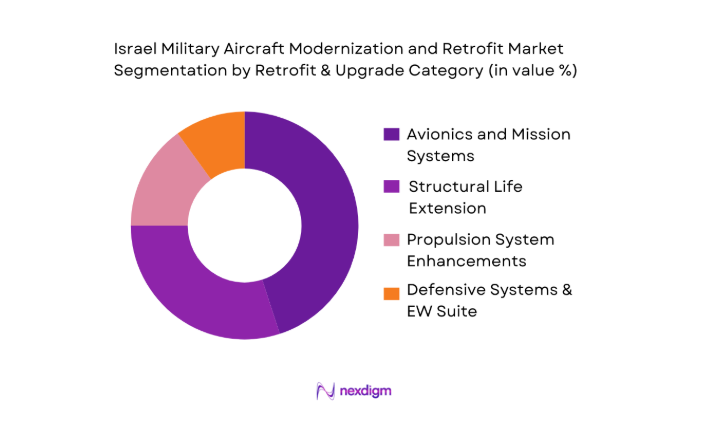

By Retrofit & Upgrade Category

Under retrofit and upgrade categories, avionics and mission systems integration dominate due to the emphasis on enhancing aircraft’s communication, navigation, and surveillance capabilities. Israel has been a pioneer in integrating cutting-edge technologies into its military aircraft. With the continuous evolution of digital avionics and an increased focus on cyber warfare, Israel’s retrofit programs prioritize avionics upgrades to enhance operational flexibility and stealth capabilities. Furthermore, the constant demand for advanced radar systems and electronic warfare capabilities solidifies this segment’s market leadership.

Competitive Landscape

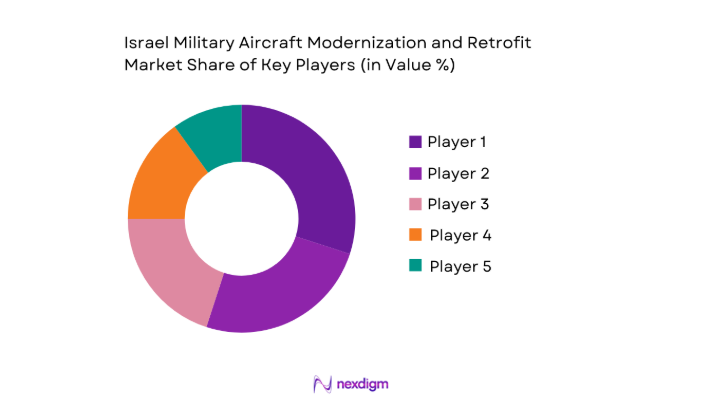

The Israel military aircraft modernization market is primarily driven by a few large players with a consolidated market presence. Key players include Israel Aerospace Industries, Elbit Systems, and Rafael Advanced Defense Systems. These companies dominate through their strong relationships with the Israel Air Force (IAF) and their expertise in military avionics, radar, and defense systems integration. The market consolidation allows these players to leverage economies of scale, develop innovative solutions, and fulfill large-scale government contracts. The market is highly competitive, with the integration of new technologies being a major factor in maintaining dominance.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Innovation Leadership | Government Contracts | Export Partnerships | R&D Investment | Workforce Size | Market Presence |

| Israel Aerospace Industries | 1953 | Tel Aviv | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Aircraft Modernization and Retrofit Market Analysis

Growth Drivers

IAF Fleet Modernization Imperatives

The Israel Air Force modernization is critical to maintaining Israel’s defense superiority in a volatile region. The Israeli government allocates approximately ~ of its GDP annually to defense, reflecting its strategic priorities and the need for fleet upgrades. The defense budget for 2024 is forecasted to exceed USD ~, with a significant portion directed toward aircraft modernization programs such as the F-35, F-16, and UAVs. These modernization efforts are crucial for ensuring the IAF’s operational readiness and integrating cutting-edge technologies. These expenditures support Israel’s commitment to maintaining a technologically advanced air force amid regional security challenges.

Geopolitical Risk Premiums

Geopolitical instability in the Middle East has led to substantial defense spending by Israel, with a heavy emphasis on aircraft modernization to address emerging threats. Israel’s defense spending is influenced by the volatility of its neighboring countries and the increasing threats from Iran and Syria. The defense budget for Israel remains robust, with the government’s 2024 budget allocation to defense set at USD ~, representing a stable share of its GDP, which is expected to grow at ~ in 2024. These geopolitical risks continue to elevate Israel’s focus on upgrading its air force and bolstering national defense through aircraft retrofits.

Market Challenges

Budgetary Constraints

While Israel maintains a strong defense budget, global economic challenges and inflationary pressures have impacted its ability to fully fund all defense initiatives. The Israeli government has been allocating approximately ~ of its GDP to defense, a relatively high proportion compared to other nations. However, in 2024, Israel’s GDP growth is expected to slow to ~, with inflation running at ~. These factors complicate defense budget decisions, leading to potential delays in aircraft modernization programs. With increased focus on maintaining national security, the government must balance modernization efforts with broader economic constraints.

Technology Obsolescence Cycles

The rapid pace of technological advancements in defense systems has led to obsolescence concerns for Israel’s older aircraft, such as the F-16s and F-15s. The 2024 forecast for global defense technology spending is expected to rise by ~ due to the increasing need for newer and more capable systems to counter evolving threats. Israel’s aircraft fleet modernization programs are being driven by the need to integrate advanced avionics, radar, and electronic warfare systems to combat increasingly sophisticated adversaries. Without consistent upgrades, older aircraft are at risk of falling behind in terms of operational effectiveness and defensive capabilities.

Market Opportunities

ISR Capability Backfits

Intelligence, Surveillance, and Reconnaissance (ISR) capabilities have become a critical component of military operations, and Israel is at the forefront of integrating ISR systems into its fleet. In 2024, the Israeli Air Force continues to prioritize ISR upgrades in its fleet modernization efforts. Israel’s defense procurement strategy focuses on retrofitting older aircraft with advanced ISR sensors and technologies to maintain tactical advantage. With Israel’s strategic location and geopolitical risks, ISR integration into retrofitted aircraft is becoming increasingly important for surveillance and reconnaissance missions. These systems enable the IAF to monitor potential threats in real-time, enhancing national security and intelligence-gathering capabilities.

Cyber-Resilience Avionics Packages

As cyber warfare becomes a significant threat to military assets, Israel has been investing heavily in cyber-resilience solutions for its aircraft. In 2024, Israel is integrating advanced cybersecurity measures into its fleet upgrades, focusing on ensuring the resilience of avionics and mission systems against cyber-attacks. The need for these systems is critical, given the global rise in cyber threats targeting military and defense technologies. The Israeli government’s focus on cyber defense is underscored by its 2024 defense budget, which includes significant allocations to enhancing cyber capabilities in military systems, ensuring that aircraft remain secure against emerging cyber threats.

Future Outlook

Over the next decade, the Israel military aircraft modernization market is poised for sustained growth, fueled by continuous technological advancements, regional security concerns, and a strong military-industrial base. The modernization of platforms like the F-16 and F-35, integration of advanced radar, avionics, and electronic warfare systems, as well as Israel’s strategic alliances with the U.S. and other defense partners, are expected to accelerate market expansion. The government’s ongoing investment in defense modernization programs ensures that the market will remain a critical component of Israel’s defense strategy, with new technologies being continuously integrated into aging aircraft fleets.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- Boeing Defense

- Northrop Grumman

- BAE Systems

- L3Harris Technologies

- Thales Group

- Raytheon Technologies

- Leonardo

- Safran Electronics & Defense

- General Dynamics

- Honeywell Aerospace

- General Electric Aviation

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aircraft Manufacturers

- Defense Contractors

- Aerospace OEMs

- Military Equipment Suppliers

- Airlines and Air Transport Operators

- Aerospace and Defense Engineers

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the ecosystem of key stakeholders within the Israel military aircraft modernization market. This step incorporates secondary research to understand the roles of manufacturers, service providers, and government agencies that influence market dynamics. The primary objective is to identify core factors like defense budgets, procurement cycles, and technology adoption that shape the market.

Step 2: Market Analysis and Construction

In this stage, we will analyze historical data of defense contracts, retrofit programs, and aircraft procurement. This includes assessing the demand for specific aircraft types and systems (avionics, radar, propulsion) and the rate of technological adoption. We will also assess the existing integration of systems in the Israeli air force and other allied countries to estimate future demand.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and projections will be validated through interviews with industry experts, including executives from Israel Aerospace Industries, Elbit Systems, and Rafael Advanced Defense Systems. These consultations will provide on-ground insights about future trends, defense priorities, and technological innovations within the defense sector.

Step 4: Research Synthesis and Final Output

The final phase will involve a synthesis of findings from primary interviews, secondary research, and expert opinions to form a comprehensive understanding of the Israel military aircraft modernization market. Insights gathered will be used to validate assumptions, refine forecasts, and provide actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

IAF fleet modernization imperatives

geopolitical risk premiums - Market Challenges

budgetary constraints

technology obsolescence cycles - Opportunities

ISR capability backfits

cyber‑resilience avionics packages - Market Trends

AI‑enabled mission systems

modular upgrade kits - Government Regulations

- SWOT Analysis

- Porter’s 5 Forces

- By Value, 2020–2025

- By Volume, 2020–2025

- By Average Program Spend, 2020–2025

- By Aircraft Platform Type (In Value %)

Fixed Wing Combat

Rotary Wing / Helicopter Modernization

Unmanned Aerial Systems retrofit modules - By Retrofit & Upgrade Category (In Value %)

Avionics and Mission Systems Integration

Structural Life Extension / Corrosion Control

Propulsion System Enhancements - By System Type (In Value %)

Navigation & Communications

Radar & Sensor Integration

Electronic Warfare & Countermeasure Systems - By Funding Source (In Value %)

Domestic Defense Budget

U.S. Foreign Military Sales programs

Export/Foreign retrofit service income - By End‑Use Tier (In Value %)

Israeli Air Force primary fleet

Export retrofit services to allied nations

Defense OEMs & Subsystem Integrators

- Market Share of Major Players

- Cross Comparison Parameters (Retrofit Program Delivery Lead Times, Integration Capability, Lifecycle Extension Efficiency Metrics, Defensive System Integration Scale, Export Authorization Footprint)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

Lockheed Martin Corporation

Boeing Defense, Space & Security

Northrop Grumman Corporation

BAE Systems plc

L3Harris Technologies, Inc.

Honeywell International Inc.

Leonardo S.p.A

Thales Group

Safran Group

General Dynamics Corporation

RTX Corporation

Textron Aviation Defense

- Operational readiness requirements

- Total cost of upgrade vs new acquisition calculus

- Technology adoption risk/performance metrics

- End‑user procurement decision factors

- By Value, 2026–2035

- By Volume, 2026–2035

- By Average Program Spend, 2026–2035