Market Overview

The Israel Military Amphibious Vehicle market is valued at USD ~, driven by ongoing investment in military modernization and the strategic importance of amphibious capabilities for the Israel Defense Forces (IDF). Key drivers include geopolitical tensions in the Middle East, the demand for rapid-response vehicles for coastal and riverine warfare, and the focus on enhancing operational versatility. The need for robust amphibious platforms, including armored vehicles and landing crafts, continues to surge with Israel’s defense policies prioritizing both domestic and export capabilities.

Israel stands as a dominant player in the market, given its established defense infrastructure and ongoing defense technology innovations. The IDF, through its partnership with local defense contractors, drives the domestic demand for amphibious vehicles. Cities like Tel Aviv and Haifa host major defense manufacturing hubs, benefiting from proximity to research centers and the Mediterranean coastline. Additionally, Israel’s key relationships with global defense stakeholders bolster its market presence. Countries in the Middle East, such as Egypt and Lebanon, also indirectly contribute to market dynamics due to their naval and amphibious vehicle procurement needs, which further affect the regional demand for Israeli systems.

Market Segmentation

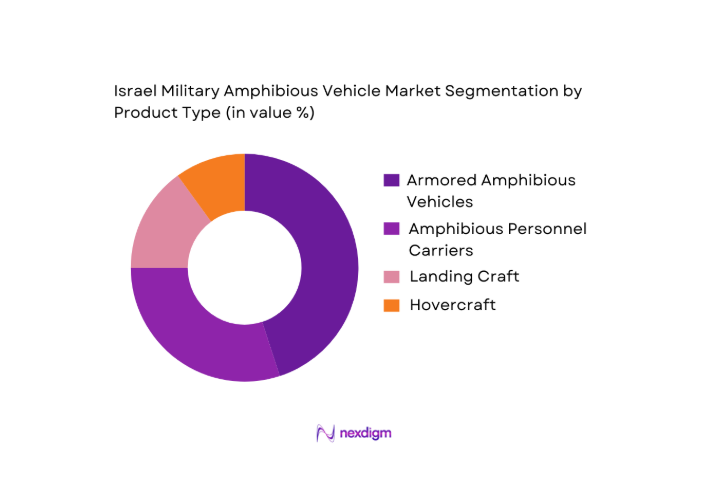

By Product Type

The Israel Military Amphibious Vehicle market is segmented by product type into armored amphibious vehicles, amphibious personnel carriers, landing craft, and hovercraft. Armored amphibious vehicles dominate the market due to their versatile role in providing troop transport, reconnaissance, and battlefield mobility across challenging terrains, including riverine and coastal areas. The emphasis on survivability and all-terrain mobility, alongside high demand for these vehicles from both IDF and export markets, drives this segment. In particular, the adoption of upgraded tracked amphibious vehicles with enhanced armor protection has significantly contributed to its market leadership.

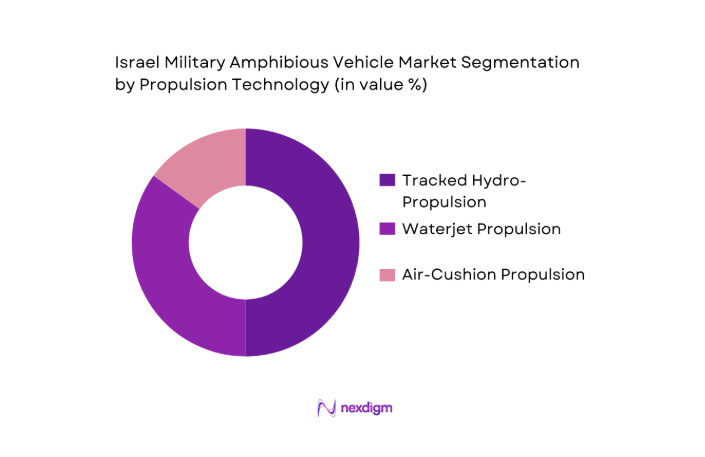

By Propulsion Technology

Another key segmentation is by propulsion technology, which includes tracked hydro-propulsion, waterjet, and air-cushion propulsion. The tracked hydro-propulsion segment is the market leader due to its efficiency in amphibious operations, providing superior off-road mobility combined with effective water navigation. The IDF’s usage of these systems in its armored vehicles for coastal operations and river crossing missions underscores their dominance. Waterjet propulsion, used in landing craft and lighter platforms, also sees growing adoption for its high-speed capabilities in naval operations.

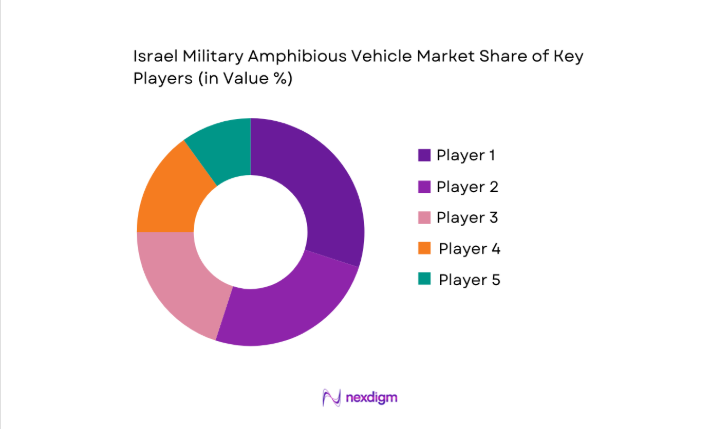

Competitive Landscape

The Israel Military Amphibious Vehicle market is characterized by a highly competitive landscape, with both local manufacturers and global players competing for government contracts and international sales. Key Israeli defense contractors, such as Plasan and Rafael Advanced Defense Systems, dominate due to their strong ties to the IDF and expertise in armored vehicles. Meanwhile, global players like BAE Systems and General Dynamics also hold significant market influence, offering advanced amphibious platforms. The competition centers around technological advancements, integration with advanced defense systems, and cost-effectiveness for both local and export markets.

| Company | Establishment Year | Headquarters | Key Products | Market Focus | R&D Investment | Clientele | Manufacturing Capacity |

| Plasan | 1985 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Israel | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1899 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

Israel Military Amphibious Vehicle Market Analysis

Growth Drivers

Defense Modernization

Israel’s defense modernization efforts continue to drive advancements in military technologies, including amphibious vehicles. The Israeli Ministry of Defense (MoD) has allocated a substantial portion of its defense budget to upgrading existing military assets and acquiring cutting-edge technologies. In 2024, the Israeli defense budget is projected to reach USD ~. The government’s commitment to modernization includes enhancing amphibious vehicle capabilities to ensure superior mobility in both land and water environments. These investments are designed to bolster the IDF’s operational efficiency across all theaters of conflict, with amphibious vehicles playing a crucial role in rapid deployment and coastal defense. The defense spending of Israel is critical in shaping its military vehicle capabilities.

Littoral Threat Environment

The Middle East remains a volatile region, where littoral threats such as coastal warfare and maritime security challenges are prominent. Israel faces constant threats along its coastlines, which require specialized amphibious vehicles capable of both land and sea operations. Israel’s coastal security is of paramount importance, especially considering the threats posed by regional naval forces. In 2024, Israel’s defense forces are expected to enhance their naval and amphibious capabilities due to rising threats in the Mediterranean and the Red Sea. The Israel Navy, which plays a significant role in securing maritime borders, is expanding its fleet of amphibious vehicles, underpinned by regional security dynamics and global maritime trade concerns.

Market Challenges

R&D Cost Burden

The high cost of research and development for military technologies remains a significant challenge for the Israeli defense sector, particularly in the amphibious vehicle segment. As of 2024, Israel allocates approximately ~ of its defense budget to R&D, which is essential for developing advanced amphibious systems. However, rising global inflation rates and the increasing cost of raw materials for vehicle construction pose substantial barriers to R&D in this field. The Israeli defense sector is heavily reliant on innovation and cost-effective production, which challenges the industry’s ability to continually develop and deploy advanced amphibious vehicles while staying within budget constraints.

Export Control Regimes

Israel’s strict export control regulations limit the ability of defense companies to sell amphibious vehicle systems abroad. In 2024, Israeli defense companies are required to comply with international arms control treaties, such as the Wassenaar Arrangement, which restrict the sale of advanced amphibious technologies to certain countries. Export restrictions are designed to prevent sensitive technology from reaching hostile actors, but these controls can hinder the growth of Israel’s amphibious vehicle market. In 2024, the Israeli government also faces pressure from global buyers seeking amphibious systems, creating a delicate balance between national security interests and global market demand.

Opportunities

Autonomous Amphibious Systems

There is growing demand for autonomous amphibious systems, driven by the potential to enhance military capabilities while reducing risk to personnel. Israel is at the forefront of developing unmanned military vehicles, including autonomous amphibious platforms. As of 2024, Israel’s defense industry is investing heavily in autonomous systems, with an expected increase in defense-related robotics projects. The IDF has expressed interest in unmanned amphibious vehicles for reconnaissance, logistics, and assault operations. These technologies will allow Israel to maintain operational superiority in coastal and riverine environments, especially where human safety and rapid decision-making are critical. The integration of AI and machine learning into amphibious platforms presents significant market opportunities.

Hybrid Propulsion Adoption

The adoption of hybrid propulsion technology in military vehicles, including amphibious systems, offers numerous advantages in terms of fuel efficiency and sustainability. Israel’s defense sector is increasingly looking to integrate hybrid propulsion systems into its amphibious vehicle fleets to improve mobility in both land and water environments. Hybrid propulsion offers an eco-friendly solution to address the growing fuel cost pressures faced by defense forces. As of 2024, Israel’s military vehicles are utilizing hybrid propulsion systems in select amphibious platforms, marking a trend toward energy-efficient defense technologies. This adoption of hybrid technology could play a pivotal role in the future development of amphibious vehicles.

Future Outlook

The Israel Military Amphibious Vehicle market is poised for significant growth over the next decade, driven by increased regional instability and Israel’s strategic focus on amphibious operations in coastal and riverine environments. The IDF’s ongoing modernization plans, coupled with technological advancements in amphibious platforms and propulsion systems, will continue to spur market expansion. Additionally, Israel’s robust export network and partnerships with global defense forces will further bolster demand for amphibious vehicles. Over the next 5 years, the market is expected to see innovations in autonomous amphibious vehicles, offering enhanced operational efficiency for military operations.

Major Players

- Plasan

- Rafael Advanced Defense Systems

- BAE Systems

- General Dynamics

- Lockheed Martin

- Navistar Defense

- Thales Group

- SAIC

- Rheinmetall AG

- Naval Group

- Harris Corporation

- Oshkosh Defense

- Iveco Defense Vehicles

- KMW

- China North Industries Group Corporation

Key Target Audience

- Israel Defense Forces

- Ministry of Defense

- Government and Regulatory Bodies

- Defense Procurement Agencies

- Investments and Venture Capitalist Firms

- OEM Manufacturers

- International Military Exporters

- Private Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping all stakeholders within the Israel Military Amphibious Vehicle market, including defense contractors, governmental bodies, and end-users. We leverage secondary research through government publications, industry reports, and proprietary databases to map the ecosystem and identify critical drivers.

Step 2: Market Analysis and Construction

We analyze historical data to evaluate market trends, penetration rates, and key product offerings. This phase includes assessment of amphibious vehicle adoption in defense forces and the comparison of regional vs. global demand.

Step 3: Hypothesis Validation and Expert Consultation

The next phase involves validating our hypotheses through interviews with industry experts, including military officers, procurement specialists, and OEM representatives. This step ensures the accuracy of assumptions regarding technological trends, defense budgets, and purchasing patterns.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research into a detailed market analysis report, integrating quantitative data with qualitative insights from primary sources. This phase will involve final discussions with defense contractors and governmental agencies to ensure the report’s accuracy and relevance.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

defense modernization

littoral threat environment

interoperability requirements - Market Challenges

R&D cost burden

export control regimes - Opportunities

autonomous amphibious systems

hybrid propulsion adoption - Trends

AI navigation

survivability enhancements - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Platform Type (In Value %)

Amphibious Armored Combat Vehicles

Amphibious Personnel Carriers

Amphibious Utility Landing Craft - By Propulsion Technology (In Value %)

waterjet power

tracked hydro‑propulsion

air‑cushion - By End‑Use Mission Profile (In Value %)

assault

rapid insertion

coastal defense - By Procurement Category (In Value %)

IDF direct

FMS/Foreign Military Sales - By OEM Tier (In Value %)

Prime OEMs

Tier‑1 subsystems

SME innovators

- Market Share of Key Players

- Cross‑Comparison Parameters (platform mobility speed, payload capacity, amphibious transition time, C4ISR integration level, exportability index, lifecycle support infrastructure, propulsion efficiency, survivability rating)

- SWOT Analysis of Key Players

- Pricing Architecture & Bid Outcome Trends

- Detailed Profiles of Major Players

Plasan

Automotive Industries Ltd.

Carmor Integrated Vehicle Solutions

Israel Aerospace Industries

Rafael Advanced Defense Systems

BAE Systems

General Dynamics

Lockheed Martin

Rheinmetall AG

SAIC

Griffon Hoverwork Ltd.

Marsh Buggies Incorporated

EIK Engineering Sdn Bhd

Hitachi Construction Machinery

Wilco Manufacturing

- IDF Procurement Drivers

- Total Cost of Ownership

- Technology Adoption Factors

- Geopolitical & Budgetary Influences

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035