Market Overview

The Israel Military Antenna market is valued at approximately USD ~ in 2025. This market is primarily driven by the increasing demand for advanced communication systems within Israel’s defense forces, alongside growing export opportunities. Israel’s strategic defense initiatives, which include anti-jamming, secure satellite communication, and cutting-edge radar systems, fuel the market’s growth. Additionally, Israel’s robust defense budget and emphasis on high-tech military solutions, combined with regional geopolitical stability, have resulted in strong demand for high-performance military antennas.

Israel’s dominance in the military antenna market is largely attributed to its defense industry, spearheaded by cities such as Tel Aviv and Haifa, which host the country’s top defense technology companies. The nation’s global presence is reinforced by significant export agreements and collaborations with NATO members, the U.S., and other international defense forces. Israel’s advanced capabilities in electronic warfare, along with its strategic positioning in the Middle East, make it a leading hub for military antenna production and innovation, particularly in the airborne and satellite communication sectors.

Market Segmentation

By Technology

The Israel Military Antenna market is segmented by technology into phased-array antennas, controlled reception pattern antennas (CRPA), software-defined antennas (SDR), and legacy systems. Among these, phased-array antennas dominate the market in Israel, owing to their versatility and efficiency in radar, communication, and satellite systems. This technology provides significant advantages in electronic warfare (EW) and secure communications, which are vital to Israel’s defense priorities. Phased-array antennas’ ability to be electronically steered without moving parts ensures faster targeting and more reliable communications, making them essential for advanced defense applications.

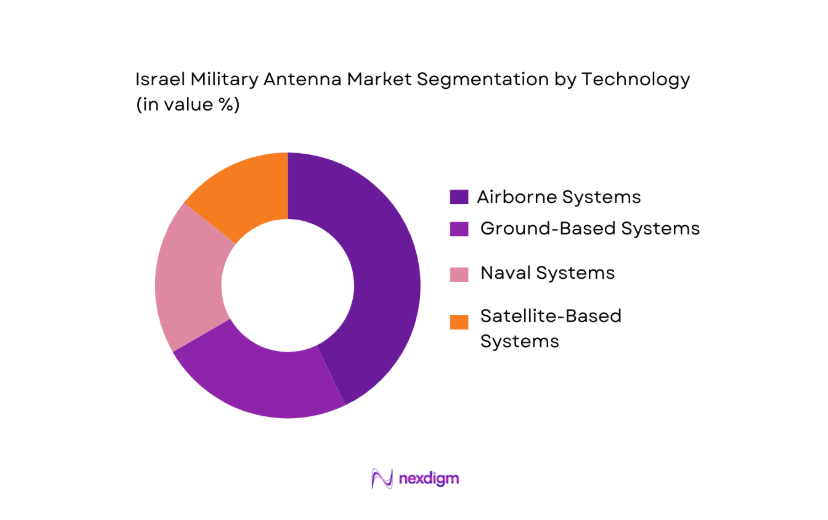

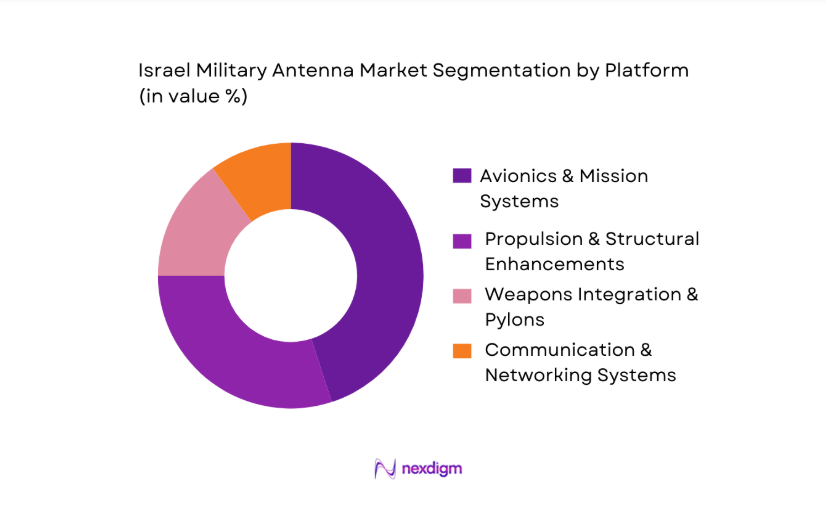

By Platform

The military antenna market in Israel is segmented by platform into ground-based systems, airborne systems, naval systems, and satellite-based systems. Airborne systems dominate the market, driven by Israel’s extensive investments in UAVs, fighter jets, and reconnaissance aircraft. The need for high-frequency communication systems that provide secure and real-time data exchange on these platforms contributes to the dominance of airborne systems in the military antenna market. Additionally, the IDF’s focus on enhancing its air superiority and intelligence, surveillance, and reconnaissance (ISR) capabilities amplifies the demand for advanced airborne antennas.

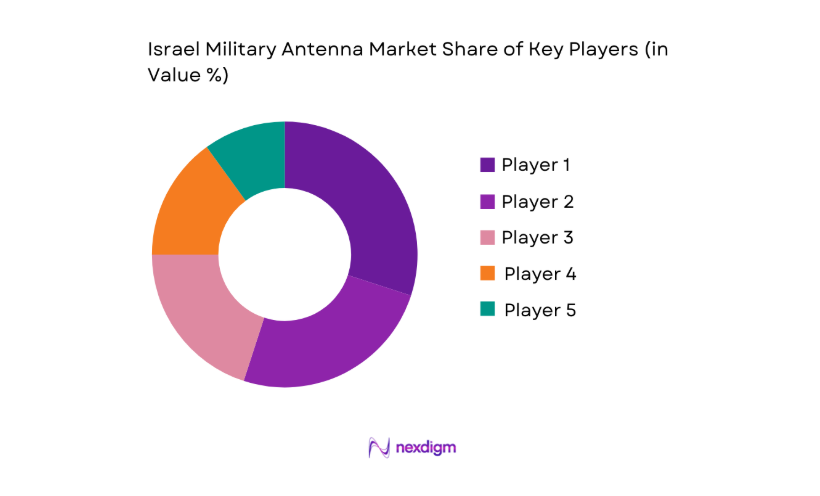

Competitive Landscape

The Israel Military Antenna market is dominated by a few major players, including local giants like Elbit Systems and Israel Aerospace Industries (IAI), alongside international players such as Thales Group and L3Harris Technologies. These companies lead the market by continually innovating and aligning their product offerings with the specific requirements of the Israel Defense Forces (IDF) and allied nations. Their strong technological expertise, robust export capabilities, and deep integration with military communication systems ensure their dominance in the competitive landscape.

| Company | Establishment Year | Headquarters | R&D Investment | Military Collaborations | Export Markets | Technology Focus | Product Range |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | Melbourne, Florida, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, Massachusetts, USA | ~ | ~ | ~ | ~ | ~ |

Israel Military Antenna Market Analysis

Growth Drivers

Defense Modernization Budgets & R&D Spend

The global defense sector continues to allocate significant funds toward modernization, which directly impacts the military antenna market. For instance, Israel’s defense budget for 2024 has been set at approximately USD ~, which is focused heavily on advanced technological developments, including communications and radar systems. In 2023, Israel’s Ministry of Defense allocated more than USD ~ for R&D in defense technology. This strong financial backing enables continuous upgrades in military antenna systems, as Israel looks to maintain technological superiority, particularly in satellite communications (SATCOM) and radar systems. Additionally, the global defense expenditure is forecasted to surpass USD 2.4 trillion by 2026, driving innovations in military antenna technologies.

Integration with Network-Centric Warfare

Israel has been at the forefront of integrating network-centric warfare (NCW) capabilities into its defense strategy. NCW relies on secure communication systems that require high-performance antennas to facilitate real-time data sharing and situational awareness. By 2024, Israel has invested over USD 5 billion in various NCW projects, incorporating satellite, radar, and communication technologies into a cohesive battlefield network. The global trend toward NCW systems is supported by an increasing focus on interoperability between allied forces, with Israel’s advanced military antenna systems being a key part of these strategic networks. As military forces worldwide adopt NCW strategies, demand for cutting-edge antenna technologies continues to grow.

Market Challenges

Procurement Cycles

Long procurement cycles are a significant challenge for the Israel Military Antenna market. In Israel, defense procurement is often influenced by strategic national security requirements, which can lead to delays in procurement decisions and budget allocations. The procurement cycle for major defense systems, including antennas, can take several years to complete, with some systems being in the evaluation phase for up to 3-5 years. For example, in 2024, Israel’s procurement program for advanced radar and SATCOM systems has faced delays due to budget approval procedures and contract negotiations. The extended procurement timelines slow down the deployment of new antenna technologies, leading to slower market adoption.

Export Controls

Export controls remain a significant hurdle for Israeli military antenna manufacturers, limiting their ability to access certain international markets. Israel enforces strict defense export regulations under the Defense Export Control Law, which governs the export of military and dual-use technologies. In 2024, these controls have restricted the export of certain advanced radar and communication systems, hindering the market potential for military antenna manufacturers. These regulations also prevent companies from fully capitalizing on the demand for military antennas in regions like Asia and Europe, where defense budgets are increasing. However, Israel’s defense export policies ensure that technology transfers align with national security interests.

Market Opportunities

UAV Swarms

The growing use of Unmanned Aerial Vehicles (UAVs) in modern warfare presents a significant opportunity for the Israel Military Antenna market. Israel has been a pioneer in developing UAV swarm technologies for surveillance, reconnaissance, and combat missions. As of 2024, Israel has invested heavily in UAV swarm systems, which require highly advanced antenna systems for communication and control. The increasing demand for military drones, particularly for intelligence, surveillance, and reconnaissance (ISR) purposes, will drive further growth in antenna technologies, especially in high-frequency communication systems capable of supporting these autonomous fleets.

GNSS Anti-Jam Systems Integration

With the rise in global threats targeting GNSS signals, there is a growing demand for anti-jamming solutions. Israel’s military has been at the forefront of integrating anti-jam technologies in its navigation and communication systems, providing a robust market opportunity for military antenna manufacturers. By 2024, the IDF is increasing its investment in anti-jamming technologies, driven by the need to protect its critical systems from adversarial interference. The use of military antennas capable of ensuring secure GNSS communication will play a vital role in maintaining operational effectiveness across all platforms.

Future Outlook

Over the next decade, the Israel Military Antenna market is expected to exhibit a steady growth trajectory, driven by the increasing demand for advanced, secure communication systems across military platforms. This growth will be further accelerated by the ongoing expansion of Israel’s defense export markets, especially in Asia and Europe, where demand for sophisticated communication and radar systems is on the rise. Additionally, innovations in phased-array and software-defined antennas will continue to play a pivotal role in enhancing Israel’s strategic defense capabilities.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Thales Group

- L3Harris Technologies

- Raytheon Technologies

- Rafael Advanced Defense Systems

- Leonardo S.p.A.

- Cobham plc

- Northrop Grumman Corporation

- BAE Systems

- Rohde & Schwarz

- Lockheed Martin Corporation

- Honeywell International Inc.

- Kratos Defense & Security Solutions

- Viasat, Inc.

Key Target Audience

- Investments and Venture Capitalist Firms

- Israel Ministry of Defense

- Defense Procurement Agencies

- IDF

- Government and Regulatory Bodies

- Military and Aerospace Contractors

- System Integrators

- Telecommunications and Satellite Service Providers

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research focuses on identifying key variables that influence the Israel Military Antenna market. This involves creating an ecosystem map of all stakeholders, including manufacturers, defense agencies, and integrators. Extensive desk research is conducted to gather relevant data from primary and secondary sources, helping us understand the key drivers of market demand.

Step 2: Market Analysis and Construction

Historical data from defense budgets, military contracts, and export figures are analyzed to establish baseline data for the Israel Military Antenna market. The analysis covers major platforms, such as airborne and naval systems, to understand trends in technology adoption. This phase also evaluates the competitive environment and forecasts growth across various sub-segments.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to the market growth drivers and challenges are validated through expert consultations. These discussions involve industry veterans, military procurement specialists, and defense technology experts who provide operational insights to refine our market projections.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all data gathered in previous steps. This includes verifying market data with key stakeholders, analyzing customer preferences, and providing a clear outlook on future growth trends. Detailed insights into technological advancements, such as phased-array antennas and software-defined systems, are integrated to provide a comprehensive analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Defense Modernization Budgets & R&D Spend

Integration with Network‑Centric Warfare

Demand for SATCOM & Electronic Warfare Capabilities - Market Challenges

Procurement Cycles

Export Controls

Supply Chain Constraints - Market Opportunities

UAV swarms

GNSS anti‑jam systems integration - Market Trends

Phased Array penetration

AI‑assisted RF systems - Government Regulations & Defense Export Policy

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Antenna Volume, 2020-2025

- By Average Contract Price , 2020-2025

- By Technology (In Value %)

Phased Array Antennas

Controlled Reception Pattern Antennas

Electronically Steerable Antennas - By Platform (In Value %)

Ground Systems

Airborne Systems

Naval Systems - By Frequency Band (In Value %)

HF/VHF

UHF

SHF

EHF/Millimeter‑Wave - By End Application (In Value %)

Secure Communications

Electronic Warfare & Jamming

ISR & Radar Signal Systems

GNSS Anti‑Jamming / Navigation Resilience - By Customer Segment (In Value %)

IDF

Foreign Military Sales & Exports

Defense Integrators & Tier‑1 Contractors

- Market Share of Major Players

- Cross Comparison Parameters (Antenna Gain & Bandwidth Capability, Frequency Flexibility, Integration with EW & SATCOM Systems, Production Lead Time, Export Compliance & ITAR/EAR Footprint)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Company Profiles of Major Players

Elbit Systems Ltd.

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elta Systems

Cobham plc

L3Harris Technologies

Raytheon Technologies

Thales Group

Northrop Grumman

BAE Systems

Rohde & Schwarz

Lockheed Martin

Honeywell International

Kratos Defense & Security Solutions

Viasat, Inc.

- Procurement Criteria

- Total Cost of Ownership Considerations

- Influence of Export Standards

- Impact of Geopolitical Risk on End User Adoption

- By Market Value, 2026-2035

- By Antenna Volume, 2026-2035

- By Average Contract Price, 2026-2035