Market Overview

The Israel Military Aviation Maintenance, Repair and Overhaul (MRO) market is valued at approximately USD ~ billion in 2024, driven by the substantial defense spending in Israel and the importance of maintaining high levels of operational readiness within the Israeli Air Force (IAF). The market is supported by Israel’s robust defense infrastructure, strategic alliances with global defense contractors, and its unique position as a leader in defense technology and aviation. Maintenance contracts for fighter jets, UAVs, and transport aircraft play a pivotal role in driving the MRO sector. This steady demand for MRO services is bolstered by fleet upgrades, life extension programs, and constant innovations in aviation technology.

Israel is the dominant player in the MRO sector, with cities like Tel Aviv and Haifa housing major defense hubs and maintenance facilities. Israel Aerospace Industries (IAI) in Lod and Bedek Aviation, in particular, are key contributors to the local and international MRO supply chain. Israel’s dominance is further reinforced by its military strategy, where ensuring a high operational readiness of its air force and defense equipment is vital due to the geopolitical dynamics of the Middle East. Additionally, the Israeli government’s focus on defense modernization, backed by strategic alliances with the U.S. and other NATO countries, further enhances the market presence of Israeli MRO services globally.

Market Segmentation

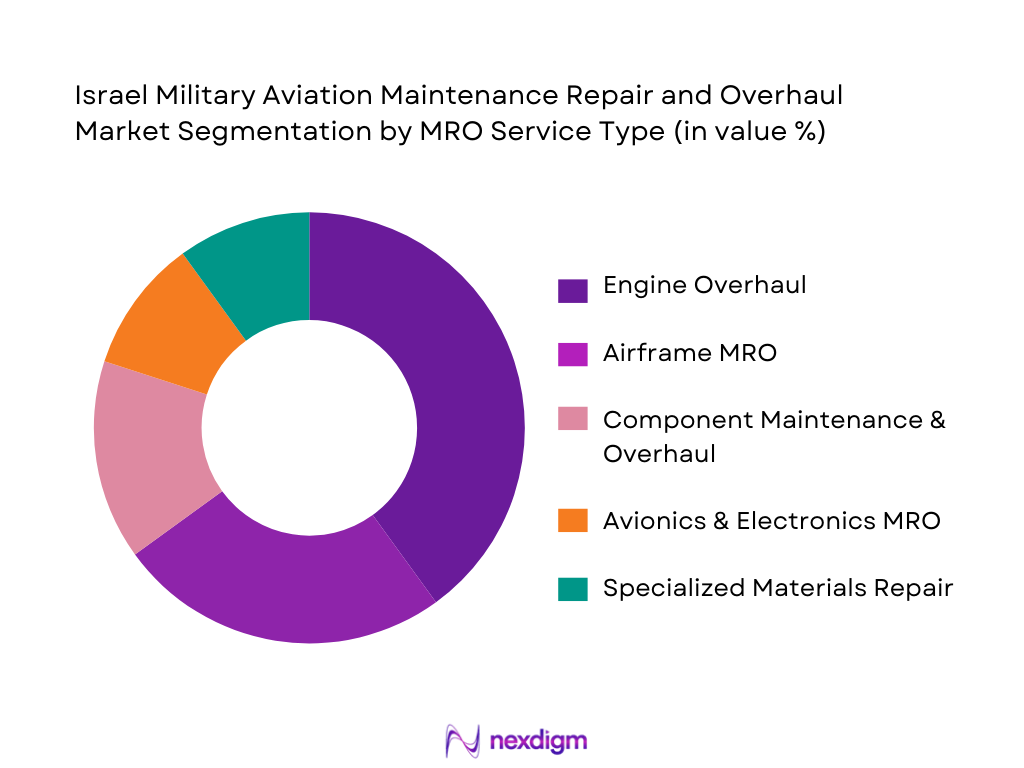

By MRO Service Type

The Israel Military Aviation MRO market is segmented by service type into Engine Overhaul, Airframe MRO, Component Maintenance & Overhaul, Avionics & Electronics MRO, and Specialized Materials Repair. The Engine Overhaul segment dominates the market, primarily due to the high operational tempo of Israel’s fleet, especially its fighter jets. These require frequent engine maintenance to maintain combat readiness, making engine overhauls a critical part of the Israeli MRO services. Additionally, the integration of advanced technologies like predictive maintenance plays a significant role in streamlining this segment’s dominance. The increasing complexity of military engines and rising defense budgets further support the strong demand for engine-related MRO services.

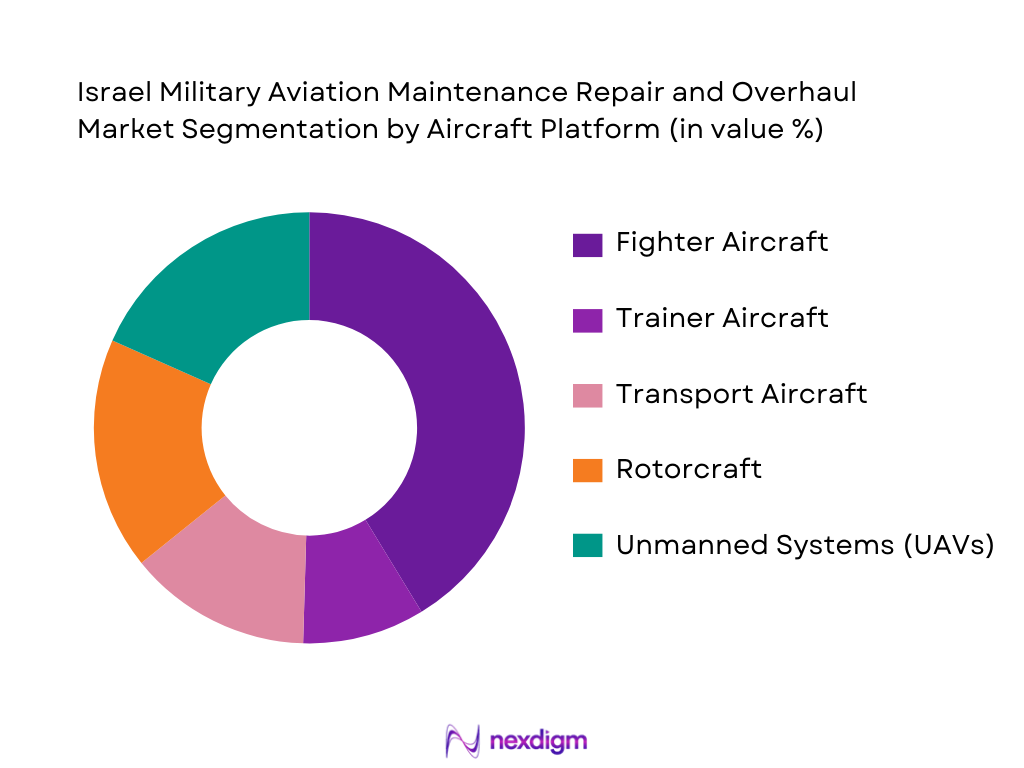

By Aircraft Platform

The market is segmented by aircraft platform into Fighter Aircraft, Trainer Aircraft, Transport Aircraft, Rotorcraft, and Unmanned Systems (UAVs). Among these, Fighter Aircraft dominate the segment due to the heavy investment by Israel in maintaining a fleet of technologically advanced fighter jets like the F-35 and F-16, both of which require high levels of maintenance, upgrades, and overhauls. Israel’s defense strategy emphasizes air superiority, which contributes to the ongoing demand for MRO services in this segment. Furthermore, the growing importance of UAVs in military operations has fueled the need for dedicated UAV MRO services, although fighter aircraft continue to lead the market.

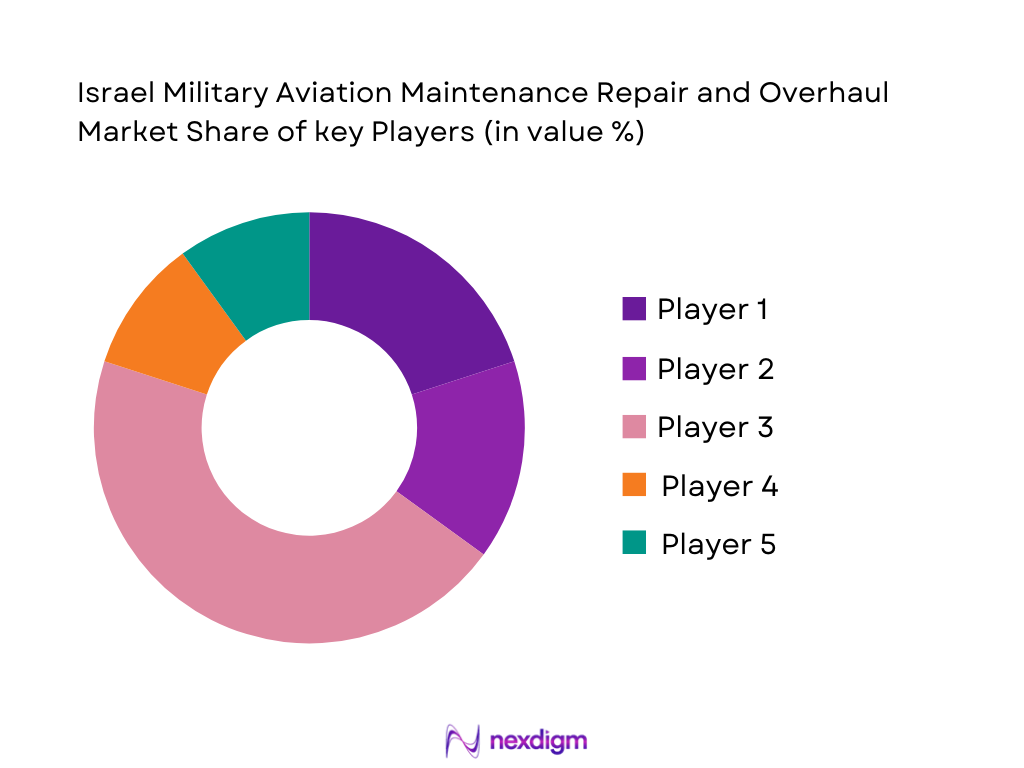

Competitive Landscape

The Israel Military Aviation MRO market is dominated by key players, with Israel Aerospace Industries (IAI) being the largest contributor to the market. Other important players include Elbit Systems and global defense contractors such as Lockheed Martin, Boeing, and Rolls-Royce. These companies play a major role in ensuring that the operational requirements of the Israeli military are met, particularly in terms of the advanced technology and capabilities required for high-level aviation maintenance. The market sees significant collaboration between Israeli and international defense firms to maintain military readiness.

| Company Name | Establishment Year | Headquarters | MRO Services Provided | Aircraft Platforms Supported | Technologies Used | Key Clients |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | Derby, UK | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

Israel Military Aviation Maintenance Repair and Overhaul Market Dynamics

Growth Drivers

Fleet Modernization Programs & Defense Modernization Budgets

Israel’s commitment to maintaining a technologically advanced and combat-ready military fleet is a major driver for the MRO market. The continuous need to modernize aircraft, including fighter jets, transport planes, and UAVs, has led to the allocation of substantial defense budgets for fleet upgrades and replacement programs. This includes acquiring the latest models of aircraft and upgrading older ones with state-of-the-art avionics, engines, and systems. The Israeli Air Force (IAF) has a strong focus on maintaining air superiority, which translates into long-term investments in MRO services. These modernization programs necessitate regular and specialized maintenance, driving the demand for MRO services to ensure that aircraft remain mission-ready and compliant with the latest defense standards.

Life Extension Programs (LEPs) and Mission Readiness Mandates

Life Extension Programs (LEPs) are vital to ensuring that Israel’s fleet can operate effectively beyond their original design life. The Israeli Ministry of Defense often conducts LEPs to extend the life of critical aircraft and systems. These programs are essential in ensuring continued operational capability and mission readiness, especially given the high cost of acquiring new platforms. LEPs, which involve major overhauls, engine replacements, and avionics upgrades, provide a steady demand for MRO services to maintain the operational efficiency and safety of Israel’s military aircraft.

Market Challenges

Skilled Labor & Technician Shortages

A significant challenge facing Israel’s Military Aviation MRO market is the shortage of skilled labor and technicians, especially those trained in advanced aircraft technologies. The complexity of modern military aircraft, including stealth technology, precision weapons systems, and cutting-edge avionics, requires specialized knowledge and expertise. However, the rapid pace of technological advancements in the aerospace sector has outpaced the training and availability of skilled technicians. This shortage can lead to delays in maintenance schedules, a backlog in repair services, and higher labor costs, ultimately affecting the operational readiness of the Israeli military.

Complex Certification and Regulatory Compliance for Defense MRO

Military aviation MRO services are heavily regulated by both domestic and international standards. Israel’s strict defense certification processes, combined with compliance requirements from NATO and other international defense partners, make MRO operations particularly complex. Aircraft maintenance, modifications, and overhauls must meet rigorous standards to ensure safety, performance, and mission effectiveness. Any failure to comply with these standards can result in costly delays, penalties, and reduced operational capability. Furthermore, the increasing complexity of modern aircraft, which often incorporate highly classified or advanced technology, adds an additional layer of regulatory challenges that MRO providers must navigate carefully.

Opportunities

Expansion of UAV/UAS MRO Capabilities

Unmanned Aerial Vehicles (UAVs) and Unmanned Aerial Systems (UAS) have become an essential part of Israel’s military strategy, particularly in intelligence gathering, surveillance, and reconnaissance missions. The rapid growth in the use of UAVs presents significant opportunities for the MRO sector. As the Israeli military expands its UAV fleet, there is an increasing demand for specialized UAV maintenance, including engine servicing, avionics repair, and software updates. Additionally, as UAV technology becomes more advanced, the need for high-end repair and support services grows. This expansion of UAV/UAS MRO capabilities offers significant growth potential for MRO service providers in Israel.

Dual‑Use Technologies & Export‑Oriented MRO Services

The integration of dual-use technologies—systems and components designed for both military and civilian applications—presents new avenues for growth in the MRO sector. Israel’s established defense technology expertise is increasingly being leveraged for export-oriented MRO services, particularly for foreign military sales. Countries purchasing Israeli military equipment often require MRO services, creating an additional revenue stream for local providers. The strategic nature of Israel’s defense relationships, especially with the U.S. and European NATO members, allows MRO providers to capitalize on international contracts and expand their footprint in the global market. Furthermore, the increasing international demand for high-tech MRO services presents opportunities for Israeli firms to become leaders in this niche area.

Future Outlook

Over the next few years, the Israel Military Aviation MRO market is expected to continue its growth trajectory, driven by the need for fleet modernization, life-extension programs, and increasing technological upgrades. As Israel remains focused on maintaining air superiority and ensuring the readiness of its advanced fleet, the MRO services sector will see increased demand. Additionally, the integration of artificial intelligence and machine learning in predictive maintenance and the growing importance of UAVs in military operations will further fuel the market’s expansion. Investments in state-of-the-art MRO technologies will improve service efficiency and reduce maintenance costs, making it an attractive area for both domestic and foreign defense contractors.

Major Players

- Israel Aerospace Industries – Bedek MRO

- Elbit Systems

- AMMROC

- Lockheed Martin

- RTX Corporation

- Boeing Defense

- Northrop Grumman

- BAE Systems

- Airbus Defence & Space MRO Services

- Rolls‑Royce Military Engine Services

- GE Aviation Military MRO

- Safran Helicopter Engines MRO

- M7 Aerospace

- TAT Technologies

- Lufthansa Technik Military MRO Division

Key Target Audience

- Investments and venture capitalist firm

- Israeli Ministry of Defense (MOD)

- Israeli Air Force

- Defense contractors (OEMs and component suppliers)

- Government defense procurement agencies (Israeli Ministry of Defense)

- Aviation technology firms (focusing on avionics and electronics)

- Aviation MRO facilities & service providers

- Foreign military buyers (interested in Israeli MRO services)

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the key stakeholders in the Israel Military Aviation MRO market, including government bodies, military aviation units, contractors, and service providers. The research will include a mix of desk research, utilizing secondary data from reputable sources, and market intelligence reports from defense sector databases. The goal is to identify the most critical factors influencing the demand for MRO services in Israel.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to build a robust market size model for the Israel Military Aviation MRO market. The model will focus on historical trends, current demand for services, and future growth based on defense budgets and aircraft fleet upgrades. Insights into maintenance cycles, aircraft types, and MRO service providers will be analyzed.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we will validate the data collected by consulting with industry experts in the Israeli defense sector. Telephone interviews, surveys, and consultations with top-level executives and experts from major MRO providers and military branches will refine our market analysis.

Step 4: Research Synthesis and Final Output

The final phase will include comprehensive interviews with Israel-based MRO contractors, OEMs, and government defense procurement departments to verify findings. The results will be validated against industry benchmarks to ensure the accuracy of our market size, competitive landscape, and growth forecasts.

- Executive Summary

- Research Methodology (Market Boundaries and Operational Definitions, Abbreviations, MRO Lifecycle Classification, Defense Readiness Index, Israeli Strategic Assumptions, Data Sources & Validation Protocols, Limitations and Future Scope)

- Definition and Scope

- Strategic Importance of MRO for Military Aviation (Platform Readiness Rate,

- Operational Availability, Depot vs Line Maintenance Balance)

- Historical Evolution & Israeli MRO Ecosystem Genesis

- MRO Service Types in Military Aviation (Engine Overhaul, Airframe

- Maintenance, Component CMRO, Avionics Support, UAV-specific MRO)

- Israel Defense Forces (IDF) Maintenance Standards & Compliance Environment

- Value Chain and Military Aviation Logistics Integration

- Growth Drivers

Fleet Modernization Programs & Defense Modernization Budgets

Life Extension Programs (LEPs) and Mission Readiness Mandates

Integration of Predictive Maintenance & Digital Twin Technology

Export Demand for MRO Support and Aftermarket Services - Market Challenges

Skilled Labor & Technician Shortages

Complex Certification and Regulatory Compliance for Defense MRO

Long Cycle Times & Spare Parts Supply Chain Fragility

Geopolitical Pressures & Rapid Operational Tempo - Opportunities

Expansion of UAV/UAS MRO Capabilities

Dual‑Use Technologies & Export‑oriented MRO Services

Expansion into Next‑Generation Avionics & Software‑Defined MRO

Strategic Partnerships with OEMs & International MRO Providers - Trends

Predictive & Condition‑Based Maintenance Adoption

AI‑assisted Diagnostics & Robotics in MRO Operations

Sustainable and Green Maintenance Practices

Modular Platform Standardization - Regulatory & Compliance Framework

Israel Defense Standards (IDS) for Aviation MRO

Export Controls and ITAR/EAR Equivalents for Defense Maintenance

Quality Assurance Certifications & NATO/Western Standards Alignment - Strategic SWOT Analysis

Sector‑Specific Strengths, Weaknesses, Risks, and Defense Readiness Impacts - Stakeholder & Ecosystem Mapping

- IDF Maintenance Depots vs Private Contractors

- Key Government Bodies influencing the MRO procurement

- Porter’s Five Forces Analysis (Defense Procurement Bargaining Power, New Entrants, Provider Rivalry, Substitutes, Supplier Power)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By MRO Service Type (In Value %)

Engine Overhaul

Airframe MRO

Component Maintenance & Overhaul

Avionics & Electronics MRO

Specialized Materials Repair - By Aircraft Platform (In Value %)

Fighter Aircraft

Trainer Aircraft

Transport Aircraft

Rotorcraft

Unmanned Systems (UAVs) - By Contract Model (In Value %)

Performance‑Based Logistics (PBL)

Time & Materials

Fixed‑Price Depot Contracts

Turnkey Solutions - End‑User (In Value %)

IDF Air Force

Ministry of Defense

Foreign Military Sales

OEM Support Contracts - By Deployment Stage (In Value %)

Routine Scheduled Maintenance

Mid‑Life Upgrade Programs

Unscheduled Repair

Retrofit & Modification

- Market Share of Major Players (Domestic & International)

- Cross‑Comparison Parameters (Company Overview, Core Military MRO Capabilities, Business Strategy for Defense Accounts, Recent Developments, Technology Footprint, Strength & Weakness in MRO Services, Organizational Structure, Annual Revenues, Revenue Breakdown by Service Type, Number of Defense Contracts, Distribution/ Service Network, Maintenance Footprint (Hangars/Depots), Warranty & Spare Parts Policies, Turnaround Times, Defense Compliance Ratings)

- Competitor Profiles

Israel Aerospace Industries – Bedek MRO (Military & Defense Aviation Capabilities)

Elbit Systems (Defense Integration & MRO Support)

AMMROC (Advanced Military Maintenance, Repair & Overhaul Center)

Lockheed Martin (Global Defense MRO Footprint)

RTX Corporation (Collins Aerospace)

Boeing Defense (Military Platform MRO)

Northrop Grumman (Defense Systems MRO)

BAE Systems (Defense Aviation Support)

Airbus Defence & Space MRO Services

Rolls‑Royce Military Engine Services

GE Aviation Military MRO

Safran Helicopter Engines MRO

M7 Aerospace (Elbit Subsidiary with MRO)

TAT Technologies (Defense Thermal & Support Services)

Lufthansa Technik Military MRO Division

- Readiness Requirements by Platform Type

- Budget Allocations & Strategic Procurement Priorities

- Regulatory and Compliance Expectations

- End‑User Decision Drivers & Pain Points

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035