Market Overview

The Israel Military Battery Market is valued at USD ~ billion, driven by the increasing demand for high-performance, rugged battery systems to power a range of military platforms, including unmanned systems, ground vehicles, and portable soldier devices. The market is primarily driven by the advancement in battery technologies, such as lithium-ion and hybrid systems, that provide enhanced energy efficiency and performance under extreme conditions. Israel’s strategic focus on innovation, national defense, and self-sufficiency has made its defense industry one of the most technologically advanced globally, propelling the demand for military-grade batteries.

Israel, the United States, and other NATO allies dominate the market due to their significant defense budgets and advanced technological capabilities in battery system development. Israel’s military, the IDF, is known for adopting cutting-edge technologies, ensuring the demand for advanced batteries remains high. The country’s strong defense export market, particularly to the Middle East, Asia, and Europe, reinforces its dominance. The strong ties between Israel and the U.S. contribute to the continued collaboration on defense technology, boosting demand for military batteries.

Market Segmentation

By Battery Technology

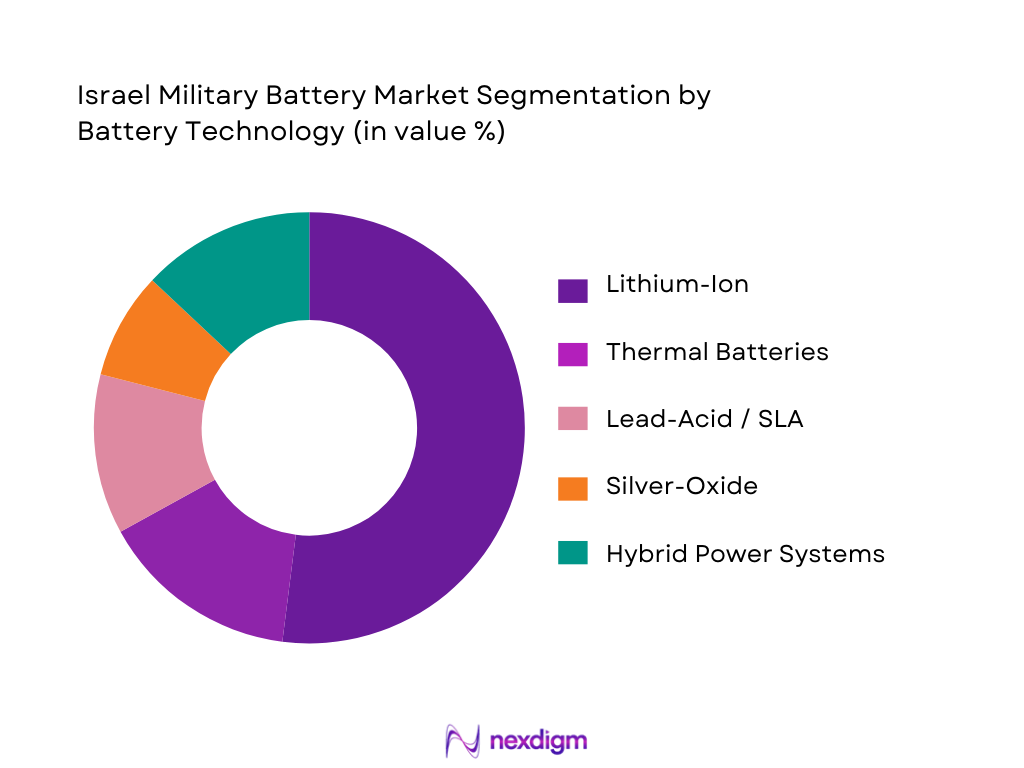

The Israel Military Battery Market is segmented by battery technology, including lithium-ion, thermal batteries, lead-acid/SLA, silver-oxide, and hybrid power systems. Lithium-ion batteries dominate the market due to their superior energy density, rechargeability, and lightweight properties, which are essential for both stationary and mobile military applications. The growth of electric military vehicles, drones, and portable soldier systems has driven the demand for high-performance lithium-ion batteries. The lithium-ion segment continues to lead, benefiting from technological advancements in energy storage, longevity, and power density, making it the preferred choice for Israel’s military applications.

By Platform

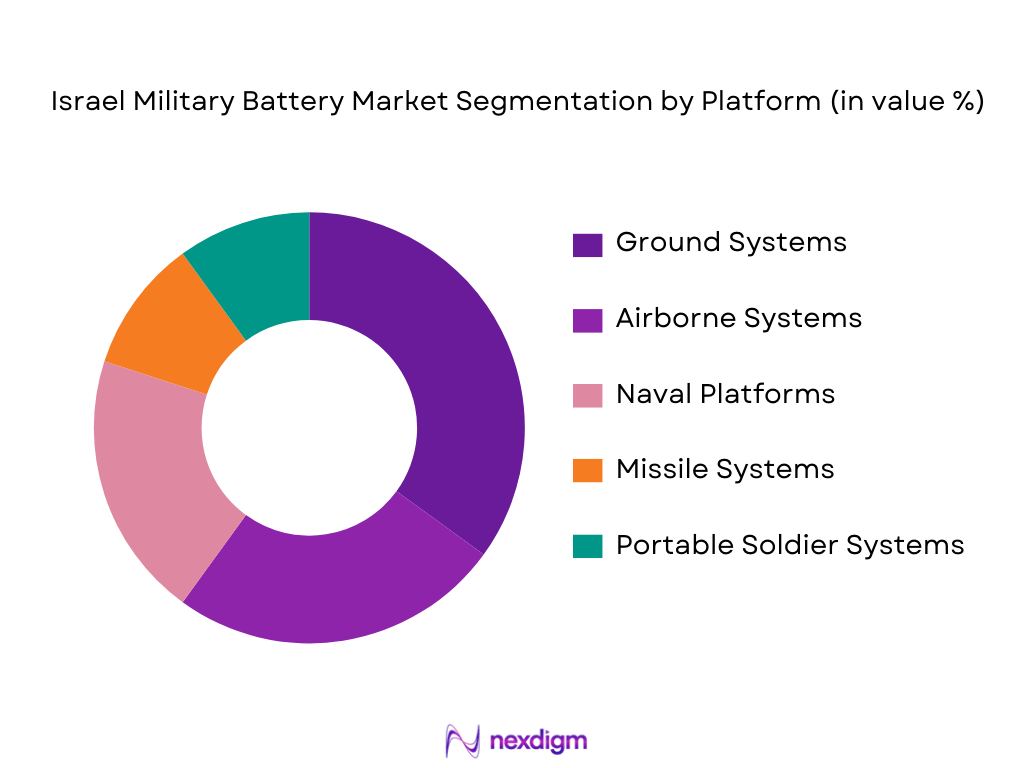

The market is also segmented by platform, including ground systems, airborne systems, naval platforms, missile systems, and portable soldier systems. Ground systems, including tanks and armored vehicles, are the largest segment, primarily driven by the demand for ruggedized, long-lasting batteries for military vehicles. These platforms require batteries that can withstand extreme environmental conditions while providing reliable performance over long missions. Ground systems remain the dominant segment due to Israel’s ongoing efforts to modernize its military vehicles and armored units, which rely on robust energy solutions.

Competitive Landscape

The Israel Military Battery Market is dominated by a few key players, including both local manufacturers and global defense contractors. These companies are pivotal in driving innovation and ensuring that Israel’s military remains at the forefront of technological advancements. Major players in the market include Tadiran Batteries, Rafael Advanced Defense Systems, and Epsilor Electric Fuel Ltd., all of which play significant roles in developing, manufacturing, and supplying military-grade battery systems for various military platforms. The presence of international firms like Saft Groupe and EnerSys also adds competitive pressure, promoting continuous innovation and technological advancement.

| Company | Establishment Year | Headquarters | Market Share | Product Portfolio | Technological Innovation | Defense Contracts |

| Tadiran Batteries | 1965 | Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Israel | ~ | ~ | ~ | ~ |

| Epsilor Electric Fuel Ltd. | 1989 | Israel | ~ | ~ | ~ | ~ |

| Saft Groupe | 1918 | France | ~ | ~ | ~ | ~ |

| EnerSys | 1882 | USA | ~ | ~ | ~ | ~ |

| Ultralife Corporation | 1986 | USA | ~ | ~ | ~ | ~ |

Israel Military Battery Market Analysis

Growth Drivers

Increasing reliance on autonomous and unmanned systems

The growing reliance on autonomous and unmanned systems is a key driver of the Israel Military Battery Market. Drones, unmanned ground vehicles (UGVs), and other robotic systems require reliable and long-lasting power sources to perform effectively in the field. These systems are increasingly being deployed for intelligence, surveillance, reconnaissance (ISR), and combat operations. Military batteries must meet stringent performance and durability requirements to support these systems, leading to a higher demand for specialized batteries with enhanced energy density, rapid recharging capabilities, and resilience to extreme environmental conditions.

Shift towards energy-efficient, high-density battery systems

With technological advancements, the shift towards energy-efficient and high-density battery systems has become a central growth driver for the Israel Military Battery Market. Modern military platforms demand higher power output in more compact and lighter battery solutions to maintain operational effectiveness while reducing weight and enhancing mobility. High-density batteries such as lithium-ion have emerged as the preferred choice due to their ability to store more energy in a smaller volume, improving the endurance and performance of military systems. As Israel continues to modernize its defense capabilities and prioritize energy efficiency, the need for high-density, energy-efficient battery systems in all sectors, including ground, air, and naval platforms, will continue to rise.

Challenges

Integration of new battery systems with existing military platforms

Integrating new battery technologies into existing military platforms presents a significant challenge in the Israel Military Battery Market. Military platforms, ranging from armored vehicles to drones and missile systems, have long-established power requirements. The transition from older battery technologies to advanced solutions like lithium-ion and solid-state batteries can be complex and costly. In many cases, these new systems require re-engineering or modifications to accommodate the new battery technologies, which could affect operational efficiency, lead to delays, and increase the overall cost of integration.

Maintaining performance standards under extreme environmental conditions

Another significant challenge is ensuring that military batteries maintain optimal performance under extreme environmental conditions. Israel’s military operations often occur in harsh climates, including desert heat, high humidity, and cold weather conditions. Batteries used in military platforms must perform reliably in these extreme environments without degrading in capacity or performance. Military batteries must also be resistant to shocks, vibrations, and electromagnetic interference (EMI), making it difficult to meet the strict durability and performance standards required by the Israeli Defense Forces (IDF).

Opportunities

Emerging Demand for Sustainable Battery Solutions

The demand for more sustainable and environmentally friendly battery technologies is a growing opportunity in the Israel Military Battery Market. As global environmental concerns intensify, there is an increasing push for military systems to adopt eco-friendly solutions, including rechargeable and recyclable batteries. Sustainable battery technologies, such as lithium-sulfur and solid-state batteries, offer higher energy densities and longer life cycles, while generating less environmental impact. Israel, with its focus on innovation and environmental sustainability, is well-positioned to lead the charge in the development of these next-gen military-grade power solutions.

Advancements in Solid-State and Lithium-Sulfur Batteries

Advancements in solid-state and lithium-sulfur battery technologies present exciting opportunities for the Israel Military Battery Market. Solid-state batteries offer significant advantages over traditional lithium-ion batteries, such as higher energy density, faster charging times, and greater safety due to their non-flammable nature. This makes them highly suitable for military applications that demand high performance and reliability under harsh conditions. Lithium-sulfur batteries, with their lightweight nature and higher theoretical energy density, also offer the potential for enhancing the range and endurance of military platforms, particularly in unmanned aerial vehicles (UAVs) and other mobile systems. These new battery technologies represent a significant leap forward, providing the defense sector with the potential to reduce logistics burdens, enhance performance, and extend mission durations.

Future Outlook

Over the next several years, the Israel Military Battery Market is expected to see significant growth. Driven by continuous technological advancements, increased defense spending, and a growing demand for high-performance batteries in unmanned systems and autonomous vehicles, the market is poised for expansion. The ongoing modernization of Israel’s military equipment, coupled with increasing international demand for defense technologies, particularly from Israel’s strategic allies, will continue to fuel the need for innovative and efficient military batteries.

Major Players in the Market

- Tadiran Batteries

- Rafael Advanced Defense Systems

- Epsilor Electric Fuel Ltd.

- Saft Groupe

- EnerSys

- Ultralife Corporation

- GS Yuasa Corporation

- Panasonic Energy

- Arotech Corporation

- EaglePicher Technologies, LLC

- Bren-Tronics Inc.

- HBL Power Systems Ltd

- Lincad Ltd.

- Lithium Ion Technologies LLC

- Cell-Con Inc.

Key Target Audience

- Israel Ministry of Defense (MOD)

- National Security and Defense Agencies (Israel Security Agency [Shin Bet], Mossad)

- Military Equipment Manufacturers

- Defense Contractors (Rafael Advanced Defense Systems, Elbit Systems)

- Battery Technology Developers

- Unmanned Vehicle and Robotics Companies

- Military Vehicle Manufacturers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Israel Military Battery Market. This step uses secondary research through databases and industry reports to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration, platform adoption rates, and the resulting revenue generation is gathered. A focus on the types of military applications that require specific battery systems provides a comprehensive understanding of the market’s demand drivers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with experts and key stakeholders, including military equipment manufacturers and technology developers. These interviews provide operational insights and market trends, ensuring accurate data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data gathered from market analysis and expert consultations, ensuring that the conclusions drawn reflect real-time developments. This phase includes cross-referencing findings with major market players to confirm product trends and innovations.

- Executive Summary

- Research Methodology (Market Definitions and Scope (Battery chemistries, ruggedized/thermal standards, platform integration), Abbreviations (DoD power codes, MIL‑spec terms), Israel Defense Procurement Framework, Data Sources (MOD procurement budgets, defence primes, OEM mandates), Primary Research Approach (Defense OEM interviews, military power system integrators), Limitations & Assumptions)

- Market Introduction

- Strategic Importance for Israel Defense Forces

- Battery Technology Evolution

- Platform Power Requirements

- Mission‑Critical Operational KPIs

- Growth Drivers

Increasing reliance on autonomous and unmanned systems

Shift towards energy-efficient, high-density battery systems

Growing need for tactical mobility in harsh environments

Expansion of Israel’s defense technology exports

Technological advancements in battery chemistries - Challenges

Integration of new battery systems with existing military platforms

Maintaining performance standards under extreme environmental conditions

Ensuring long-term sustainability and cost-effectiveness

Shortage of critical raw materials

Complex regulatory landscape - Opportunities

Emerging Demand for Sustainable Battery Solutions

Advancements in Solid-State and Lithium-Sulfur Batteries

Increase in Military Spending by Allied Nations

Integration with Next-Gen Military Systems

Government Incentives for Local Manufacturing

Collaboration with Global Defense Companies

Advancements in Charging Infrastructure

Battery Recycling and Second-Life Applications - Trends

Transition towards solid-state batteries

Growth in hybrid power systems

Increased adoption of modular battery designs

Rising use of digital battery management systems (BMS)

Growing demand for environmentally sustainable and recyclable technologies - Government Policy

Strict certification standards and MIL‑STD compliance

National standards for battery safety, efficiency, and interoperability

Impact of export controls under ITAR/EAR regulations

Government incentives for local battery manufacturing

National defense policy focused on innovation and self-sufficiency

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Battery Technology (In Value %)

Lithium‑Ion (Tactical grade)

Thermal Batteries (Missile & Torpedo class)

Lead‑Acid / SLA (Heavy equipment legacy)

Silver Oxide / Zn Air (Specialty guided weapons)

Hybrid (Battery + Supercapacitor systems) - By Platform (In Value %)

Ground Systems (Tanks, APCs)

Airborne (UAVs, AWACS power)

Naval (Combat vessels, Submarine modules)

Missile Systems (Thermal/Reserve Power)

Portable Soldier Systems (Wearables & HMMWV power packs) - By Voltage & Power Range (In Value %)

Sub‑12V (Communications & sensors)

12–24V (Tactical devices)

24V (High‑power mobile platforms)

High‑Energy (>1000Wh modules) - By Application (In Value %)

Combat Mobility

Surveillance & ISR systems

Command & Control power

Emergency backup & base power

Autonomous systems & Robotics - By Distribution / Procurement Channel (In Value %)

Direct MOD Contracts

Prime Defense Contractors

Subcontractors & Integrators

After‑Market Support & Logistics

Export/Foreign Military Sales (FMS)

- Market Share Analysis (by Value & Volume)

- Cross‑Comparison Parameters (Company Overview, Defense Segment Focus , Battery Technology & Chemistries, Certification Compliance, Manufacturing Footprint, Global Supply Chain Strength, R&D Investment, Tactical Field Support Infrastructure, After‑Sales & Spares Capability, Export/FMS Sales, MOD Contract History, Price Positioning, Warranty & Reliability Metrics, Energy Density Leadership, Integration Ease)

- SWOT Matrix

- Detailed Competitor Profiles

EnerSys, Inc. (global defense energy systems)

Saft Groupe S.A. (multi‑technology defense batteries)

GS Yuasa Corporation

Ultralife Corporation

EaglePicher Technologies, LLC

Tadiran Batteries (Israel)

Epsilor‑Electric Fuel Ltd. (Israel smart Li‑ion defense)

Cell‑Con, Inc.

Arotech Corporation

Bren‑Tronics Inc.

HBL Power Systems Ltd (supplies defense power)

Panasonic Holdings Corporation

LG Energy Solution, Ltd.

Lithium Ion Technologies LLC

Lincad Ltd.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035