Market Overview

The Israel Military Biometrics market is driven by the increasing need for secure and efficient identity management in the defense sector. In 2025, the market witnessed substantial growth, valued at approximately USD ~ million, and is poised for further expansion. This growth is fueled by advancements in biometric technologies such as facial recognition, fingerprint scanning, and iris recognition, which are becoming integral to military operations. These technologies help enhance security at critical facilities, improve personnel identification, and support counter-terrorism efforts. The increasing reliance on these solutions in border control, access management, and surveillance systems, driven by national security priorities, is expected to continue propelling the market’s growth in the coming years.

Key countries dominating the Israel Military Biometrics market include Israel, the United States, and several European nations. Israel, with its advanced defense technology infrastructure and significant government investments in cybersecurity and defense tech, is a leader in the adoption of military-grade biometrics. The country’s military and intelligence agencies, such as the Israel Defense Forces (IDF), utilize biometrics extensively to ensure the safety of its personnel and borders. The United States and European countries also contribute significantly to the global market, with their robust defense sectors and demand for high-tech solutions for border security, personnel tracking, and counter-terrorism operations.

Market Segmentation

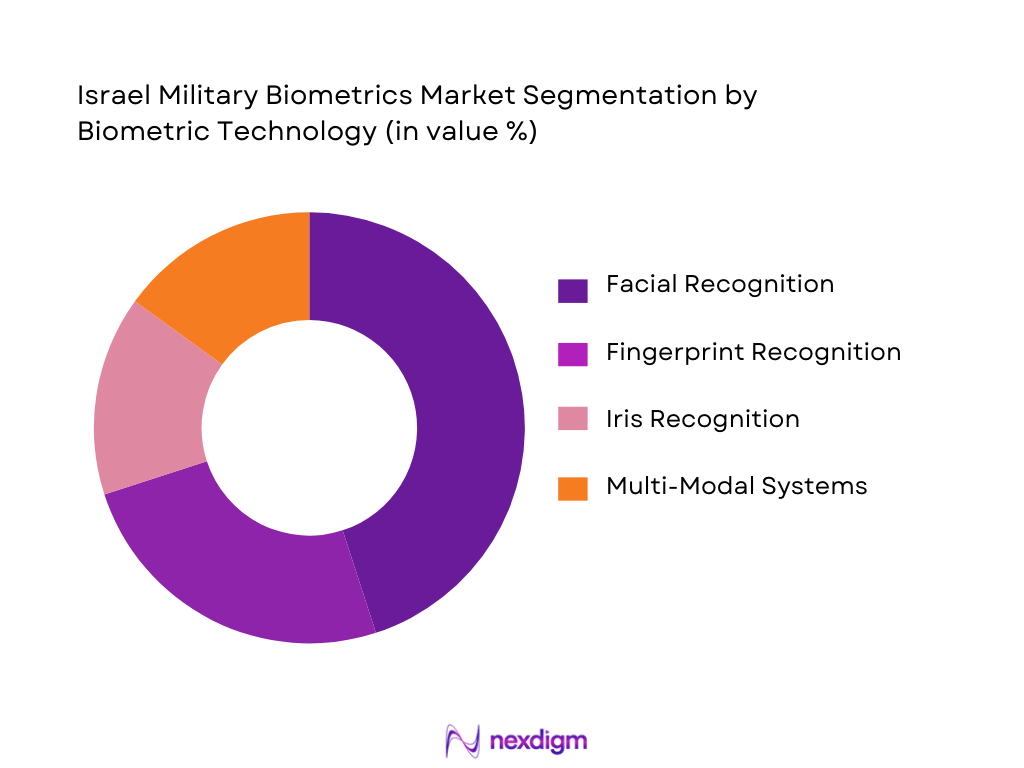

By Biometric Technology

The Israel Military Biometrics market is segmented by biometric technology, which includes fingerprint recognition, facial recognition, iris recognition, and multi-modal systems. Among these, facial recognition technology currently dominates the market. It has proven to be the most effective in providing quick and accurate identification of individuals, particularly in large-scale surveillance scenarios. Its integration with existing security infrastructure, coupled with advancements in AI-driven recognition algorithms, has made it the preferred solution for military applications such as border control, perimeter security, and personnel tracking. Furthermore, Israel’s emphasis on cutting-edge facial recognition solutions has driven the adoption of this technology across its defense forces and intelligence agencies.

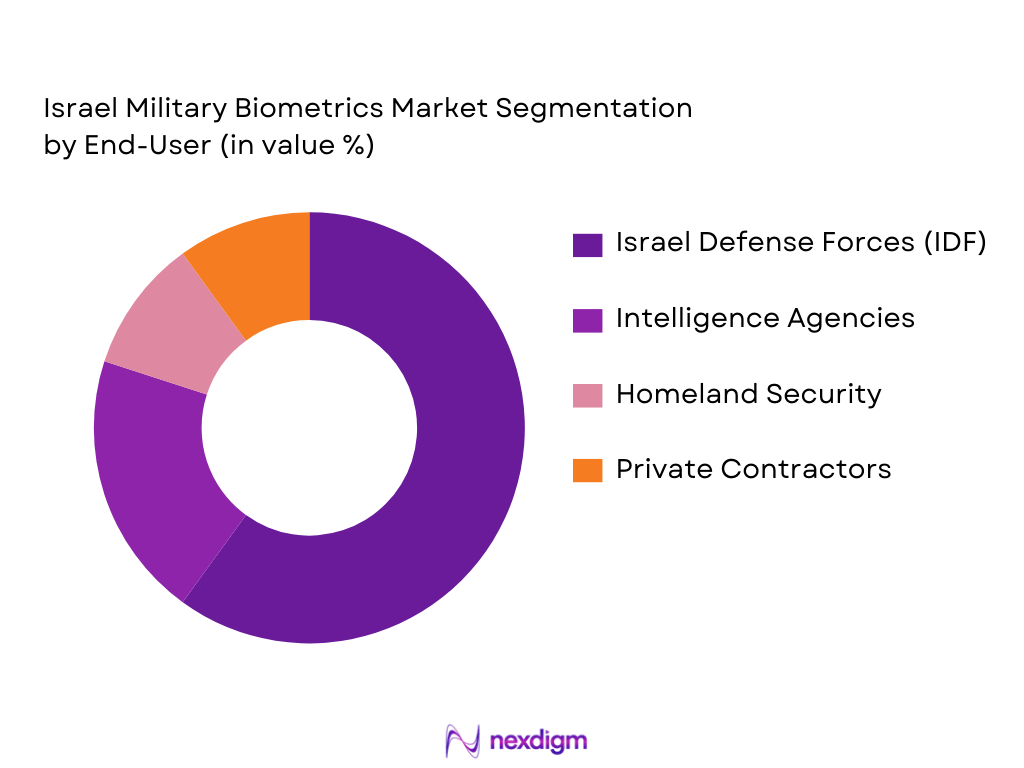

By End-User

The market is also segmented by end-user, which includes the Israel Defense Forces (IDF), national intelligence agencies, homeland security departments, and private defense contractors. The Israel Defense Forces, being the primary military body in Israel, holds the largest share of the market. The IDF has a longstanding history of implementing cutting-edge technology in its operations, and biometrics plays a critical role in personnel access control, surveillance, and intelligence gathering. The defense sector in Israel is highly advanced, and the IDF’s demand for biometric solutions continues to fuel the market’s growth, making it the dominant end-user of these technologies.

Competitive Landscape

The Israel Military Biometrics market is dominated by a few major players, including both local and global companies. Israel-based companies such as Elbit Systems and NICE Systems play a pivotal role in the market, providing tailored biometric solutions for military applications. International players like NEC Corporation, IDEMIA, and Thales Group also have a strong presence, offering a wide range of biometric products designed for military and defense use. These companies compete based on technological innovation, product reliability, and the ability to provide customized solutions that meet the specific needs of military and intelligence agencies.

| Company | Establishment Year | Headquarters | Technology Focus | Product Portfolio | Government Contracts |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ |

| NEC Corporation | 1899 | Japan | ~ | ~ | ~ |

| IDEMIA | 2007 | France | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ |

| NICE Systems | 1986 | Israel | ~ | ~ | ~ |

Israel Military Biometrics Market Analysis

Growth Drivers

Strategic Defense Priorities

Israel faces significant asymmetric threats, including terrorism, cyber warfare, and border security challenges. This drives the demand for rapid and accurate identification of individuals in sensitive situations. Biometrics plays a critical role in differentiating between authorized personnel and potential threats. The ability to verify identities instantly allows Israeli military and intelligence agencies to respond quickly to emerging threats, ensuring the safety of both personnel and citizens. As such, the need for robust biometric systems that enable rapid identification during high-stakes operations, such as counter-terrorism missions and border patrols, continues to grow in Israel’s defense strategy.

Modernization of Force Identity Infrastructure

The modernization of Israel’s military identity infrastructure is another key growth driver for the biometrics market. With increasing emphasis on technological integration, Israel’s defense forces are adopting cutting-edge biometric technologies to streamline security processes, reduce human errors, and enhance operational efficiency. Technologies like facial recognition, fingerprint scanning, and iris recognition are being integrated into military operations, ensuring personnel identity is confirmed rapidly and securely in real-time environments. This modernization aims to enhance the overall safety of military bases, secure installations, and government facilities.

Market Challenges

Data Sovereignty & Legal Defensibility Parameters

Biometric data, by nature, is sensitive, raising concerns about data sovereignty and its legal defensibility, especially when used in military or national security applications. For Israel, which operates in a complex geopolitical environment, ensuring compliance with international data protection laws is critical. Data sovereignty laws, which dictate where and how biometric data can be stored and processed, may conflict with the operational requirements of military and intelligence agencies. This regulatory complexity can slow down adoption and pose legal challenges for companies and government agencies relying on biometrics for national security.

Civil Liberties & Compliance Constraints (Operational Risk Metrics)

The use of biometric technologies for national security purposes often leads to concerns about civil liberties, especially in democratic societies like Israel. The mass collection and storage of biometric data raise privacy and human rights issues. Striking a balance between robust security and protecting individual rights becomes a critical challenge. Moreover, compliance with local and international regulations on data protection, such as the General Data Protection Regulation (GDPR), can pose operational hurdles. Legal constraints on how biometrics can be used may limit their effectiveness in some defense applications.

Market Opportunities

AI-Augmented Recognition Algorithms

One of the most promising opportunities for Israel’s military biometrics market is the integration of AI-driven recognition algorithms. These AI models enhance the accuracy, speed, and reliability of biometric systems by learning and adapting to new patterns, environments, and threats. In high-stakes military operations, the need for real-time, flawless identification is paramount, and AI-powered systems can ensure that even in complex environments—such as crowded border areas or in low-visibility combat zones—biometric systems can deliver accurate results. The ongoing development of AI algorithms that improve recognition accuracy will significantly elevate the market for military biometrics.

Edge & Mobile Biometric Deployment in Theater

Another opportunity lies in the deployment of biometric systems at the “edge” of operations, such as on mobile devices or within field operations. In military settings, especially during deployment or on-the-ground operations, soldiers need immediate access to secure biometric verification systems. The rise of mobile biometric devices—rugged, portable biometric scanners integrated with real-time data processing at the point of operation—presents a unique opportunity for the market. This capability ensures that military personnel can authenticate identities and access secure systems in any theater, enhancing operational efficiency and security while minimizing the time spent waiting for central server access.

Future Outlook

Over the next six years, the Israel Military Biometrics market is expected to experience significant growth, primarily driven by ongoing advancements in biometric technology and the increasing demand for robust security solutions across military and defense applications. With the global geopolitical landscape becoming more complex, Israel’s security needs will continue to be at the forefront of the market’s expansion. The continuous innovations in AI, facial recognition, and multi-modal systems will further enhance the market’s growth trajectory. Additionally, the increasing reliance on biometrics for border security, personnel identification, and surveillance will play a pivotal role in shaping the future of military operations in Israel.

Major Players

- Elbit Systems

- IDEMIA

- NEC Corporation

- Thales Group

- NICE Systems

- Aware Inc.

- Crossmatch Technologies

- Safran Identity & Security

- BIO-Key International

- M2SYS Technology

- Cognitec Systems

- Dermalog Identification Systems

- 13 HID Global

- ZKTECO Co. Ltd.

- Fulcrum Biometrics LLC

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Israel Ministry of Defense (MoD)

- Israeli Security Agency (Shin Bet)

- Israel National Cyber Directorate (INCD)

- U.S. Department of Defense (DoD)

- European Union Agency for Cybersecurity (ENISA)

- Military and Defense Contractors

- Security Solution Integrators

- Border Control and Homeland Security Authorities

- Intelligence Agencies

- Israel Intelligence Corps (AMAN)

Research Methodology

Step 1: Identification of Key Variables

In this step, we identify and define the critical factors that influence the Israel Military Biometrics market. These include technological innovations, defense budgets, security demands, and geopolitical factors. The data gathered through desk research and primary industry interviews helps establish a clear market landscape.

Step 2: Market Analysis and Construction

The historical performance of the Israel Military Biometrics market is analyzed, including key performance indicators such as adoption rates, technology trends, and market volume. This analysis forms the foundation for predicting market trends and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Experts from the military and defense industry are consulted to validate initial hypotheses regarding technology adoption, market drivers, and trends. These consultations provide valuable operational insights that refine the analysis.

Step 4: Research Synthesis and Final Output

In the final phase, the insights gathered from various sources are synthesized to produce an accurate and comprehensive view of the Israel Military Biometrics market. This includes a detailed report with validated data, trends, and actionable recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Defense & National Security Definitions, Abbreviations, Intelligence Sourcing Approach, Primary Defense & Military Stakeholder Interviews, Data Modeling & Forecasting Method, Limitations & Risk Factors)

- Definition and Scope

- Overview Genesis

- IDF & Defense Sector Biometrics Adoption Rationale (Operational Identity Verification Use Cases)

- Israel’s Defense Procurement Framework & RFP Dynamics

- Military Biometrics Lifecycle & Deployment Benchmarks

- Supply Chain & Defense Ecosystem Interfaces

- Growth Drivers

Strategic Defense Priorities (Asymmetric Threats, Rapid Identification Needs)

Modernization of Force Identity Infrastructure

Growth of AI‑Enabled Biometric Analytics in Defense Operations

Interoperability with Coalition Forces

Defense Budget Allocations

Operational Demand for Zero‑Trust Identity Frameworks - Market Challenges

Data Sovereignty & Legal Defensibility Parameters

Civil Liberties & Compliance Constraints (Operational Risk Metrics)

Environmental & Field Deployment Reliability (Harsh Environments)

Cybersecurity and Spoof Resistance Hardening

Integration Complexity with Legacy C4ISR Systems - Market Opportunities

AI‑Augmented Recognition Algorithms

Edge & Mobile Biometric Deployment in Theater

Real‑Time Threat Profiling & Predictive Analytic

Export Growth via Defense Technology Partnerships

Dual‑Use Technologies Across Border & Civil Security - Market Trends

Shift to Contactless & Infrared Biometric Modalities

Expansion of Multi‑Modal Biometric Platforms

Autonomous & Unattended Authentication Nodes

Cloud & Secure Data Fabric Integration

AI Signature Conduct & Behavioral Biometrics - Government Policy & Regulatory Framework

National Security Legislation Impact

Export Control Regimes & Defense Export Certification

Defense Standards & Compliance (Technical Performance Standards)

Privacy Governance for Military Biometric

Defense Procurement Guidelines

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-202

- By Biometric Technology (In Value %)

Fingerprint Recognition (Operational Precision Metric)

Facial Recognition (Target Track & Engagement Suitability)

Iris / Retinal Recognition (High‑Security Authentication)

Voice & Speech Biometrics (Command & Control Integration)

Multi‑Modal / Hybrid Recognition (Fusion Algorithms & Ensemble Systems) - By Solution Stack (In Value %)

Hardware (Sensors, Terminals, Rugged Devices)

Software (Algorithms, Matching Engines, Interoperability Middleware)

Services (Integration, Maintenance, Training, Cybersecurity Hardening) - By Use‑Case (In Value %)

Personnel Access Control (Secure Entry Points)

Perimeter & Border Surveillance

Combatant Identification & Biometrics Intel

Asset & Weapon System Authorization

Forensic & Investigative Identification - By End User (In Value %)

Israel Defense Forces (IDF)

Intelligence and National Security Institutions

Homeland Security & Border Police

Defense Integrators & Sub‑contractors

Security Contractors & Managed Services - By Acquisition Model (In Value %)

Direct Government Contracts

Public‑Private Strategic Partnerships

Defense System Integrators

Export / Foreign Military Sales

- Market Share by Value & Installed Base (Domestic & Export)

- Cross‑Comparison Parameters (Company Overview, Strategic Defense Focus, Technology Portfolio, Global Footprint in Defense, Field Deployments, Recognition Technology Benchmarks, Security Certification Levels, Integration Partnerships, Pricing Architecture, Contract Wins, R&D Intensity, Service Capabilities, Interoperability Support, After‑Sales Defense Support)

- Major Competitors

Elbit Systems Ltd.

IDEMIA

NEC Corporation

HID Global

Aware, Inc.

Leidos Holdings Inc.

Fulcrum Biometrics LLC

Safran Identity & Security

Crossmatch Technologies

BIO‑Key International

M2SYS Technology

Thales Group

Cognitec Systems

Dermalog Identification Systems

Microsoft (Defense AI Biometrics)

ZKTECO Co. Ltd.

Export Integrators (Defense Integrator Consortiums)

- Biometric Deployment Demand Evaluation

- Procurement Behavior & Budget Pipeline

- Use Case Prioritization Metrics

- Operational Pain Points & Requirements

- Command Decision Hierarchy & Technology Adoption

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035