Market Overview

The Israel Military Communications market is valued at USD ~ billion. This market is primarily driven by the country’s strategic focus on defense modernization, technological advancements in secure communication systems, and a robust defense budget. Israel’s military is at the forefront of adopting cutting-edge communication technologies, which support tactical and strategic operations, thereby fueling demand for military communication solutions. Investments in satellite communication systems, software-defined radios, and integrated command-and-control platforms have led to continued market growth.Israel dominates the military communications market due to its advanced defense infrastructure, the presence of leading defense contractors like Elbit Systems, and a strong focus on innovation in military technology. Key cities such as Tel Aviv, Herzliya, and Haifa are central hubs for military technology development, with many defense companies headquartered in these locations. The government’s long-standing investment in defense research and development plays a significant role in maintaining Israel’s leadership in the global military communications market.

Market Segmentation

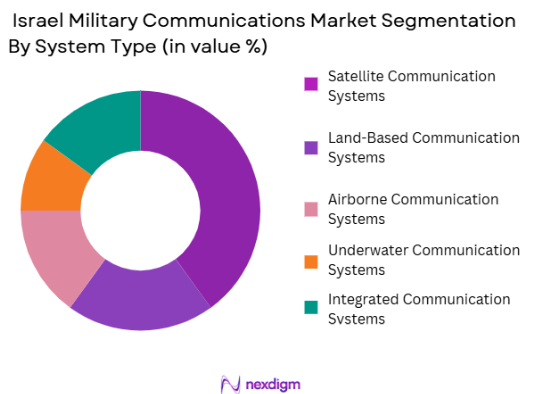

By System Type

The Israel Military Communications market is segmented into various system types, including satellite communication systems, land-based communication systems, airborne communication systems, underwater communication systems, and integrated communication systems. Among these, satellite communication systems currently hold the dominant share due to their ability to provide secure, wide-reaching communication capabilities for military forces operating across different terrains. The demand for satellite communications is driven by the need for real-time data transmission, secure voice communication, and global connectivity in defense operations. Israel’s leadership in satellite technology, supported by companies like Israel Aerospace Industries (IAI), has further cemented this segment’s dominance.

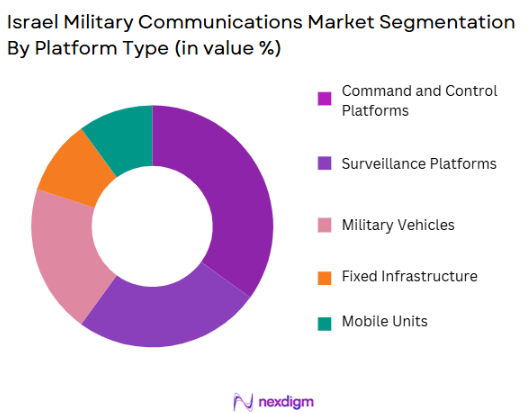

By Platform Type

The market is also segmented by platform type into command and control platforms, surveillance platforms, military vehicles, fixed infrastructure, and mobile units. Command and control platforms dominate the market share as they are integral to military decision-making, coordination, and operational execution. The ability to transmit critical information securely and in real-time between command centers and field units is a key factor in the continued growth of this segment. Israel’s emphasis on building advanced command and control systems, particularly for tactical and strategic use in defense operations, ensures the dominance of this platform.

Competitive Landscape

The Israel Military Communications market is dominated by a few major players, including Elbit Systems, Israel Aerospace Industries (IAI), Rafael Advanced Defense Systems, and foreign companies such as Motorola Solutions and Thales Group. These companies hold significant market influence due to their technological innovations, strong ties with the Israeli government, and a global customer base. The market sees ongoing consolidation as large defense contractors acquire smaller companies to expand their product offerings and technological capabilities.

| Company | Established Year | Headquarters | R&D Investment | Technological Focus | Key Markets | Product Portfolio |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Motorola Solutions | 1928 | Schaumburg, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Urbanization

Urbanization has become a key growth driver for Israel’s military communications market. As Israel’s cities expand and urban areas become more densely populated, the need for enhanced security and communication systems becomes even more critical. Military operations, including surveillance, border security, and intelligence gathering, increasingly rely on robust communication networks that can function effectively in urban environments. As urbanization increases, the demand for more advanced communication systems that can handle high data traffic, deliver secure communications, and integrate with surveillance systems grows. Urban military operations are more complex and require communications technology that can adapt to dynamic environments, providing real-time data and high-level security. This trend is driving both government investment and technological innovation in military communications systems to meet the growing urban security demands, which is expected to significantly boost market growth.

Industrialization

The process of industrialization in Israel is another critical factor driving growth in the military communications sector. With a strong emphasis on defense and aerospace technology, Israel’s industrial base has expanded to support the development of advanced communication systems. The country’s growing industrial sectors, including defense manufacturing, aerospace, and high-tech industries, are increasingly adopting cutting-edge communication technologies. As industrialization accelerates, military communication systems are becoming integral not only for national defense but also for the operational efficiency of industrial sectors in need of secure, real-time communication solutions. Furthermore, industrial growth demands more advanced and secure data transfer, boosting the adoption of secure communication technologies in both civilian and military sectors. The need for reliable communication networks within industries, including remote operations and in-field communications, supports the expanding role of military-grade communication solutions in Israel’s industrial sector.

Restraints

High Initial Costs

One of the significant constraints affecting the growth of Israel’s military communications market is the high initial cost of advanced communication systems. The installation and maintenance of state-of-the-art technologies, such as satellite communication systems, software-defined radios (SDRs), and integrated communications platforms, require substantial upfront investment. These systems, while offering high security and functionality, come with significant costs related to procurement, installation, and training. For smaller defense agencies or less affluent nations looking to invest in Israel’s military communication solutions, these high costs may limit their ability to adopt such systems. While the long-term benefits, such as improved operational efficiency and security, can justify the investment, the high initial costs present a significant barrier to entry for some entities. This remains a critical challenge for market players looking to expand their global reach, particularly in emerging markets.

Technical Challenges

Technical challenges are another major restraint in the Israel military communications market. As military operations become more complex, the communication systems required to support them must also evolve, integrating various technologies such as satellite communications, SDR, and real-time data transmission. However, these systems often encounter compatibility issues with existing infrastructures, leading to delays in deployment and operational inefficiencies. Moreover, the fast pace of technological change in the defense sector means that systems can quickly become outdated, requiring constant upgrades. Addressing these issues involves significant research and development investment, as well as overcoming hurdles in system integration and ensuring that these systems can communicate seamlessly across multiple platforms. The complexity of these advanced systems also necessitates highly specialized training for personnel, which can further slow down adoption rates and add to the overall cost. As a result, these technical challenges can hinder the growth and scalability of military communication solutions.

Opportunities

Technological Advancements

Technological advancements in the field of military communications present significant opportunities for the Israeli market. Continuous innovations, such as the development of software-defined radios (SDRs), enhanced satellite communication systems, and secure networking protocols, are revolutionizing military communication systems. These technologies enable more efficient, secure, and flexible communication solutions for defense forces operating in diverse environments, whether on land, air, sea, or in space. Moreover, the increasing demand for integrated communication systems that combine voice, data, and video feeds into a unified platform presents a major opportunity for growth. Israel, with its established reputation for advanced defense technology, is well-positioned to lead in the development and commercialization of these cutting-edge solutions. As military forces around the world seek to enhance interoperability, security, and operational efficiency, Israeli companies can leverage technological advancements to create new products and expand their market share, both domestically and internationally.

International Collaborations

International collaborations present a promising opportunity for Israel’s military communications market. Israel has established itself as a leader in defense and security technology, and its military communications solutions are in high demand globally. Collaborating with international defense contractors, governments, and military agencies provides an opportunity to expand Israel’s reach into new markets, especially in regions with emerging defense needs. Joint ventures, partnerships, and technology-sharing agreements can help Israeli companies gain access to larger markets and boost their research and development capabilities. Furthermore, collaboration with international partners allows for the integration of diverse technologies and ideas, fostering innovation. As countries around the world seek to modernize their military communication systems, Israel’s expertise in secure and advanced communication technology positions the country as an attractive partner. These collaborations could also help in meeting international security requirements, providing Israeli companies with access to lucrative defense contracts and global recognition.

Future Outlook

Over the next 5-10 years, the Israel Military Communications market is expected to show significant growth driven by the continued demand for secure, reliable communication systems within military operations. Technological advancements in software-defined radios (SDRs), satellite communications, and integrated communication platforms will be key drivers. Furthermore, Israel’s growing defense collaborations with other countries will foster international demand for advanced communication solutions, ensuring a steady market expansion.

Major Players in the Market

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Motorola Solutions

- Thales Group

- Harris Corporation

- L3 Technologies

- Lockheed Martin

- General Dynamics

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- Leonardo

- Rockwell Collins

- Boeing

Key Target Audience

- Government defense agencies

- Military contractors and defense suppliers

- Investments and venture capitalist firms

- Aerospace and defense manufacturers

- Security agencies and law enforcement organizations

- International defense ministries and agencies

- Military technology research institutions

- Large-scale defense integrators and system designers

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying all the critical variables that influence the Israel Military Communications market. This includes understanding the dynamics of military spending, technological advancements, and key players in the sector. Secondary research is used to gather data from government publications, industry reports, and historical data to construct a comprehensive market landscape.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing both qualitative and quantitative data. Historical market data, technological advancements, and market penetration rates are assessed. Furthermore, a deep dive into product sales, revenue growth, and competitive performance is conducted to ensure accuracy in market projections.

Step 3: Hypothesis Validation and Expert Consultation

The initial hypotheses on market trends are validated through consultations with industry experts, key players, and defense contractors. Expert insights are gathered through direct interviews and consultations, which help refine the market dynamics and support hypotheses with real-time data and practical feedback.

Step 4: Research Synthesis and Final Output

In the final stage, the market data is synthesized to create a comprehensive and detailed report. This involves direct engagement with military communication systems manufacturers and further validation of the results gathered in previous steps. Insights are cross-checked with industry reports and verified with practical on-the-ground feedback to ensure a thorough, well-rounded analysis.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending by regional governments

Advancements in secure communication technology

Rising demand for integrated communication systems - Market Challenges

Cybersecurity threats and vulnerabilities

High cost of advanced communication systems

Technological complexities in system integration - Trends

Shift towards Software-Defined Radio (SDR) technology

Focus on multi-domain communications

Increased adoption of encrypted communications

- Market Opportunities

Emerging markets in defense modernization

Growing need for military interoperability

Advancements in AI and machine learning integration - Government regulations

National security regulations on military communications

Import/export restrictions on defense technologies

Compliance with international military communication standards - SWOT analysis

Strength: Advanced R&D capabilities

Weakness: High dependency on government contracts

Opportunity: Expansion into international defense markets - Porters 5 forces

Threat of new entrants: Moderate

Bargaining power of suppliers: High

Bargaining power of buyers: Moderate

Threat of substitutes: Low

Industry rivalry: High

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Satellite Communication Systems

Land-Based Communication Systems

Airborne Communication Systems

Underwater Communication Systems

Integrated Communication Systems - By Platform Type (In Value%)

Command and Control Platforms

Surveillance Platforms

Military Vehicles

Fixed Infrastructure

Mobile Units - By Fitment Type (In Value%)

Ground Fitment

Vehicle Fitment

Aircraft Fitment

Naval Fitment

Portable Systems - By EndUser Segment (In Value%)

Military Defense

Government Agencies

Private Contractors

Aerospace Industry

Security & Surveillance Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Auctions and Bidding

Third-Party Distributors

Online Procurement Platforms

Regional Procurement Networks

- Market Share Analysis

- CrossComparison Parameters(Market Share, Product Innovation, Pricing Strategy, Customer Loyalty, Regional Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Motorola Solutions

Thales Group

General Dynamics Mission Systems

Harris Corporation

Lockheed Martin

Northrop Grumman

L3 Technologies

Leonardo

Raytheon Technologies

Boeing

Rockwell Collins

Honeywell Aerospace

- Increased demand from defense contractors for robust communication systems

- Higher integration of communications in command and control operations

- Shift in military focus towards secure mobile communication platforms

- Rising preference for customized, platform-specific communication solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035