Market Overview

The Israel Military Electro-Optical and Infrared Systems market is valued at USD ~billion. This growth is driven by advancements in optical sensor technology, a robust defense industry, and significant government investment in modernizing military capabilities. The market is bolstered by Israel’s expertise in high-tech military solutions and its strong global presence in defense exports. These systems are critical for surveillance, reconnaissance, and targeting applications, enhancing military effectiveness and safety in combat situations. The demand for more sophisticated electro-optical systems continues to grow as Israel focuses on improving defense capabilities and technological leadership.

The Israel Military Electro-Optical and Infrared Systems market is largely dominated by the country’s position as a global leader in defense technology, particularly in the areas of optical and infrared sensors. Key cities such as Tel Aviv and Haifa are central to defense innovation, housing leading defense companies and technology developers. These cities have well-established military ecosystems, with government initiatives supporting the development and export of advanced military technologies. Israel’s position at the forefront of defense innovation ensures its dominance in this sector.

Market Segmentation

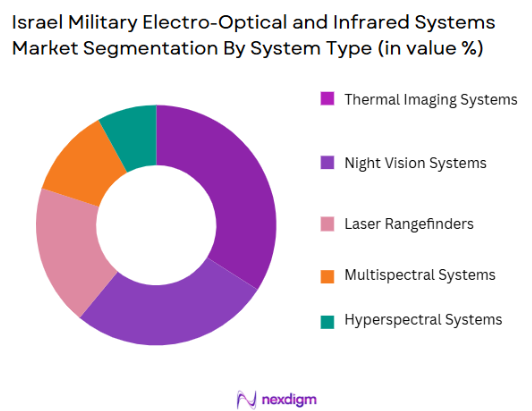

By System Type

The Israel Military Electro-Optical and Infrared Systems market is segmented by system type into thermal imaging systems, night vision systems, laser rangefinders, multispectral systems, and hyperspectral systems. Among these, thermal imaging systems have the dominant market share. This is due to their critical application in surveillance and target acquisition in various environments, particularly at night or in low-visibility conditions. They provide an essential capability for armed forces to operate effectively under challenging conditions. Leading companies have invested heavily in improving the performance and reducing the size of thermal imaging systems, contributing to their widespread adoption in both military and law enforcement applications.

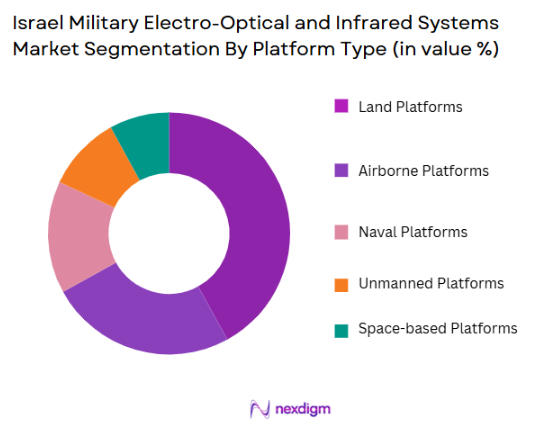

By Platform Type

The market is also segmented by platform type into land platforms, airborne platforms, naval platforms, unmanned platforms, and space-based platforms. Land platforms currently dominate the market, largely due to the extensive use of electro-optical and infrared systems in ground operations. These systems are integral to improving situational awareness, navigation, and target acquisition in military vehicles and stationary positions. Ground forces often require a high degree of mobility and precision, both of which are significantly enhanced by electro-optical and infrared systems. The integration of these systems into armored vehicles, tanks, and other ground assets has made land platforms a central focus for both manufacturers and end-users.

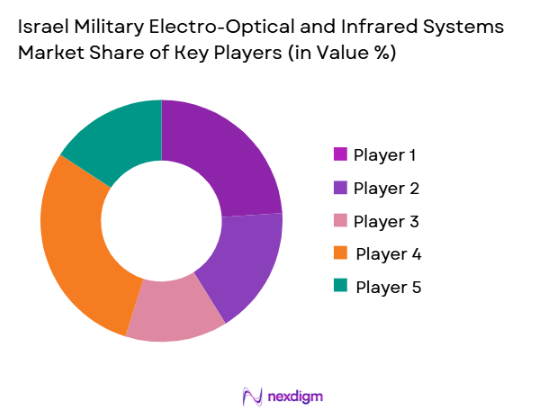

Competitive Landscape

The Israel Military Electro-Optical and Infrared Systems market is dominated by key players such as Elbit Systems, Rafael Advanced Defense Systems, Israel Aerospace Industries, and other local and international defense contractors. These companies leverage Israel’s strong defense ecosystem, along with their own research and development capabilities, to create highly sophisticated systems tailored to the unique needs of the Israeli military and its allies. The consolidation of the defense industry into a few large players highlights their significant influence over market trends, technological innovation, and export opportunities.

| Company Name | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Strategic Partnerships | Global Reach |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Opgal Optronic Industries | 1985 | Kiryat Gat, Israel | ~ | ~ | ~ | ~ |

| Controp Precision Technologies | 1987 | Kfar Saba, Israel | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant growth driver for the Israel Military Electro-Optical and Infrared Systems market. As cities and infrastructure grow, so does the need for advanced surveillance and security systems. Urban areas are increasingly becoming centers of political, economic, and strategic importance, and ensuring their protection becomes paramount. This has led to a higher demand for electro-optical and infrared systems, as these technologies provide critical capabilities for monitoring and securing large metropolitan areas. Additionally, urbanization often brings challenges like population density, increased threats, and complex environments that necessitate the use of high-tech solutions such as real-time surveillance, improved targeting systems, and integrated monitoring technologies. Israel, being a global leader in these defense technologies, is positioning itself at the forefront of meeting these demands both domestically and through exports.

Industrialization

Industrialization is another key growth driver for the Israel Military Electro-Optical and Infrared Systems market. As industries and defense sectors evolve, the need for more advanced, automated, and efficient security systems is growing. Military applications, including border protection, counter-terrorism, and surveillance of critical infrastructure, increasingly rely on electro-optical and infrared systems to provide precision and real-time data. The ongoing industrialization in Israel supports the rapid integration of these systems into military operations, where they can significantly improve efficiency, accuracy, and the ability to function in diverse and challenging environments. This trend is especially visible in areas like unmanned vehicles and drones, where integration of electro-optical and infrared sensors enhances overall operational capabilities.

Restraints

High Initial Costs

A significant restraint in the Israel Military Electro-Optical and Infrared Systems market is the high initial cost of these systems. Advanced electro-optical and infrared technologies, while providing immense value in terms of surveillance, reconnaissance, and military operations, come with a hefty price tag. This high upfront cost is a barrier for many military organizations, especially those with limited defense budgets or those in developing regions. The price includes not only the procurement of the systems but also the installation, maintenance, and necessary training for personnel to operate these complex systems. Despite the long-term benefits of these technologies, such as enhanced operational efficiency and better mission success rates, the initial expenditure remains a major obstacle for many nations and defense contractors.

Technical Challenges

Another constraint to the growth of the Israel Military Electro-Optical and Infrared Systems market is the technical complexity involved in developing and maintaining these systems. The systems often require sophisticated integration with other technologies, including satellites, unmanned vehicles, and command and control centers, which can be highly challenging. Additionally, the rapid pace of technological advancements means that systems can become outdated quickly, creating pressure on manufacturers to continually innovate and improve their offerings. The technical challenges of miniaturizing the equipment without sacrificing performance, ensuring reliability in extreme conditions, and managing power consumption effectively remain persistent issues. These challenges demand significant investment in R&D, which may not always be feasible for every market player.

Opportunities

Technological Advancements

One of the most promising opportunities for the Israel Military Electro-Optical and Infrared Systems market is the continued advancements in technology. Innovations such as artificial intelligence (AI), machine learning, and quantum technologies are poised to significantly enhance the capabilities of electro-optical and infrared systems. These advancements can improve real-time data analysis, increase the accuracy of targeting systems, and enhance the overall effectiveness of military operations. Furthermore, the integration of AI with infrared systems could help in the automatic identification of targets and the assessment of threats in complex environments. Israel, with its strong innovation-driven ecosystem, is well-positioned to capitalize on these advancements, ensuring that its defense capabilities remain at the cutting edge.

International Collaborations

International collaborations represent another key opportunity in the Israel Military Electro-Optical and Infrared Systems market. Israel’s strong defense sector and its international partnerships offer vast opportunities for expanding its market share globally. Countries across the world are increasingly seeking partnerships with Israel to gain access to its advanced defense technologies. Collaborative ventures, joint development agreements, and technology transfer agreements are becoming increasingly common, especially in the areas of defense systems, surveillance, and reconnaissance technologies. These collaborations allow Israel to not only expand its influence but also generate revenue from the global defense market. As nations recognize the strategic importance of advanced electro-optical systems, they are more inclined to collaborate with Israeli firms to integrate these technologies into their own military arsenals.

Future Outlook

Over the next decade, the Israel Military Electro-Optical and Infrared Systems market is expected to continue its upward trajectory, driven by technological advancements and a continued focus on modernizing defense capabilities. The integration of advanced AI, machine learning, and autonomous systems into electro-optical and infrared technologies will open up new possibilities for military applications. Additionally, increasing global defense budgets and the rising need for high-precision, real-time surveillance systems will further fuel market growth.

Major Players in the Market

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Opgal Optronic Industries

- Controp Precision Technologies

- Aeronautics Ltd.

- Magal Security Systems

- SimiGon Ltd.

- Camero-Tech Ltd.

- BlueBird Aero Systems

- Metatron Ltd.

- Tadiran Group

- Israel Military Industries (IMI) Systems

- Raytheon Israel

- El-Op Ltd.

Key Target Audience

- Defense Ministries and Armed Forces

- Military Contractors and Suppliers

- Government and Regulatory Bodies

- Aerospace and Defense Equipment Manufacturers

- Military Technology Investors

- Defense Procurement Agencies

- Research & Development Divisions in Defense Companies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and defining the key variables that influence the Israel Military Electro-Optical and Infrared Systems market. This includes gathering industry-specific data on technology advancements, military demand, government regulations, and global export trends. The research team will rely on a combination of secondary sources such as industry reports, government publications, and market databases to collect relevant information.

Step 2: Market Analysis and Construction

In this phase, comprehensive historical data on the market is compiled, focusing on past growth trends, technology adoption rates, and market penetration. The team will also assess the ratio of market players, product offerings, and geographical demand variations to ensure accurate market construction and forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed during the initial analysis will be validated through consultations with industry experts. These include interviews with military personnel, defense technology specialists, and product developers to ensure that the data reflects current market dynamics and technological advancements.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all data points into a coherent market analysis. This will include further validation with industry leaders and stakeholders to ensure that the forecasted trends and market size estimations are both accurate and actionable for stakeholders in the Israel Military Electro-Optical and Infrared Systems market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased military modernization and defense spending

Advancements in electro-optical and infrared technologies

Rising demand for situational awareness in military operationMarket Challenges

High cost of advanced electro-optical and infrared systems

Complexity in system integration

Cybersecurity concerns and vulnerability in military applications - Trends

Shift towards autonomous and AI-powered systems

Integration of multispectral and hyperspectral sensors for enhanced performance

Growing collaboration between military and commercial sectors - Market Opportunities

Expansion of unmanned systems using electro-optical and infrared technologies

Increasing demand for surveillance and reconnaissance systems

Development of lightweight and compact systems for portable platforms - Government regulations

Export restrictions on defense technologies

National security regulations for military equipment

Certification and safety standards for infrared systems - SWOT analysis

Strength: Technological leadership in electro-optical and infrared systems

Weakness: High production cost of advanced systems

Opportunity: Expansion into emerging markets for defense solutions - Porters 5 forces

Threat of new entrants: Moderate, due to high R&D investment and regulatory requirements

Bargaining power of suppliers: Low, as few suppliers dominate high-end electro-optical technology

Competitive rivalry: High, with numerous players in the defense industry

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Thermal Imaging Systems

Night Vision Systems

Laser Rangefinders

Multispectral Systems

Hyperspectral Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Unmanned Platforms

Space-based Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit

Aftermarket

Integrated Solutions

Standalone Systems - By EndUser Segment (In Value%)

Military

Defense Contractors

Government & Public Safety

Security Forces

Research & Development - By Procurement Channel (In Value%)

Direct Purchase from OEM

Defense Auctions

System Integrators

Defense Contracting Agencies

Public Sector Procurement

- Market Share Analysis

- CrossComparison Parameters(Technological Innovation, Cost-effectiveness, Market Penetration, Brand Reputation, Customer Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Magal Security Systems

Aeronautics Ltd.

Controp Precision Technologies

Opgal Optronic Industries

SimiGon Ltd.

Camero-Tech Ltd.

BlueBird Aero Systems

Metatron Ltd.

Tadiran Group

Israel Military Industries (IMI) Systems

Raytheon Israel

El-Op Ltd.

- Military agencies driving demand for surveillance and reconnaissance

- Increasing use in intelligence agencies and border patrol units

- R&D in defense contractors shaping the market

- Government defense procurement channels focusing on long-term contracts

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035