Market Overview

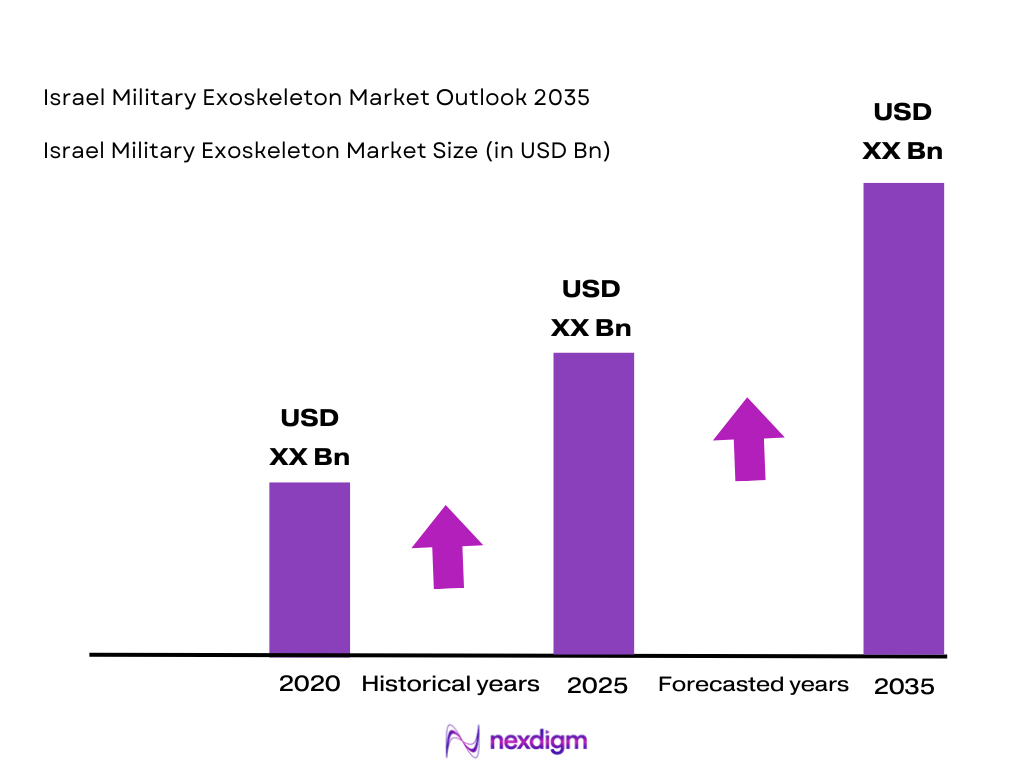

The Israel military exoskeleton market is estimated to experience substantial growth, driven by advancements in wearable technology and increased defense budgets. The market size is expected to reach approximately USD ~ million by a recent historical assessment, primarily driven by the demand for improved soldier mobility and protection. The Israeli defense sector has significantly invested in developing technologies that can enhance soldier performance, reducing physical strain and improving operational effectiveness. Military exoskeletons are seen as a vital part of modern warfare solutions, with Israel being at the forefront of innovation in this field. The market is fueled by collaborations between defense contractors and technology firms, along with increasing defense expenditure.

Countries such as Israel are leaders in the military exoskeleton market due to their strong defense infrastructure and focus on cutting-edge technology integration. Israel’s dominance is driven by its advanced defense systems and consistent government support for military R&D. Israel’s strategic geographic position and ongoing defense needs create a fertile environment for the development and deployment of exoskeleton technology. The country’s focus on enhancing the physical capabilities of its soldiers in challenging combat scenarios further consolidates its leadership in the market. The strong presence of defense giants and military contractors in Israel reinforces its position as the global leader in military exoskeletons.

Market Segmentation

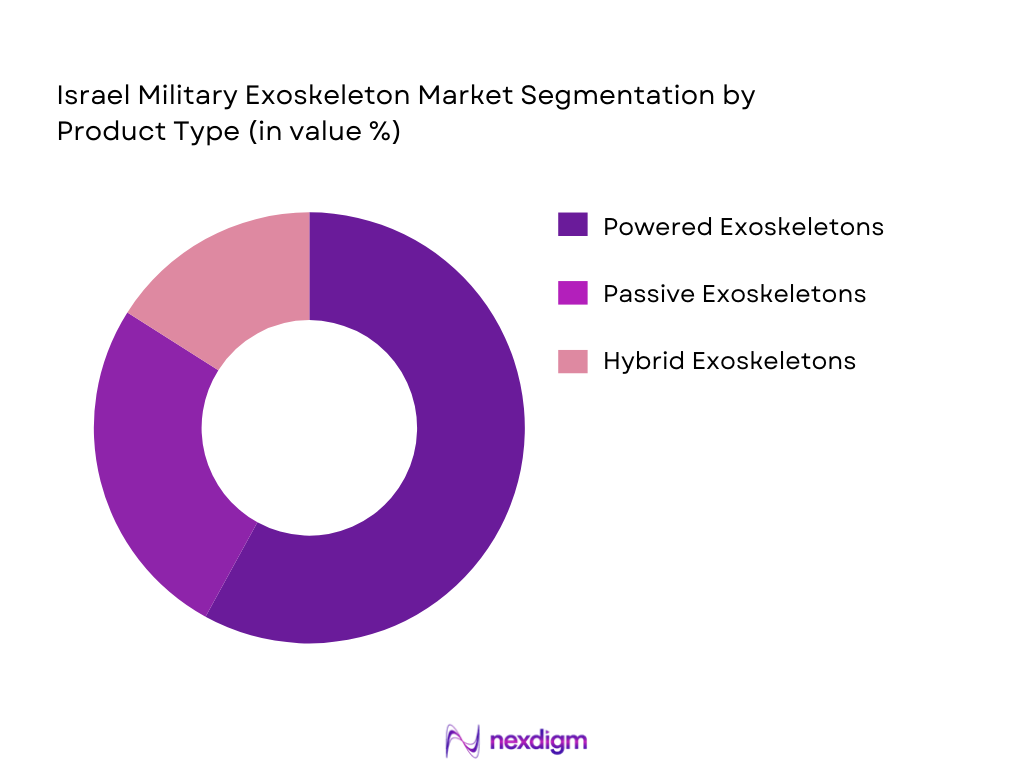

By Product Type

Israel Military Exoskeleton market is segmented by product type into powered exoskeletons, passive exoskeletons, and hybrid exoskeletons. Recently, powered exoskeletons have a dominant market share due to their enhanced mobility and functionality, which provides increased support for soldiers during prolonged operations. These exoskeletons are equipped with advanced actuators and sensors, allowing for efficient and ergonomic movement. Additionally, the increasing demand for exoskeletons capable of reducing soldier fatigue, coupled with technological advancements, has made powered exoskeletons the preferred choice in military applications.

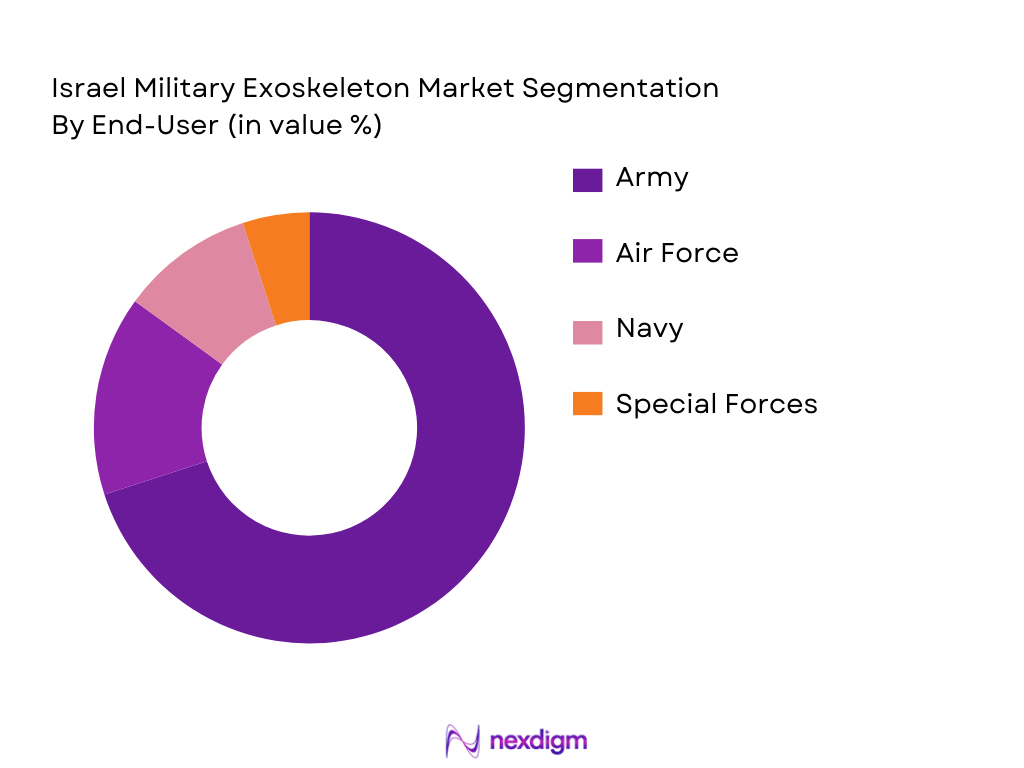

By End-User

The Israel Military Exoskeleton market is segmented by end-user into the army, air force, navy, and special forces. The army has a dominant market share, as the primary consumer of military exoskeletons for enhancing soldiers’ physical capabilities in combat. The demand for exoskeletons in ground operations, where prolonged movement and carrying heavy equipment are common, has contributed to this dominance. As the army continues to modernize and enhance its technological capabilities, the adoption of military exoskeletons is expected to remain the highest among defense sectors.

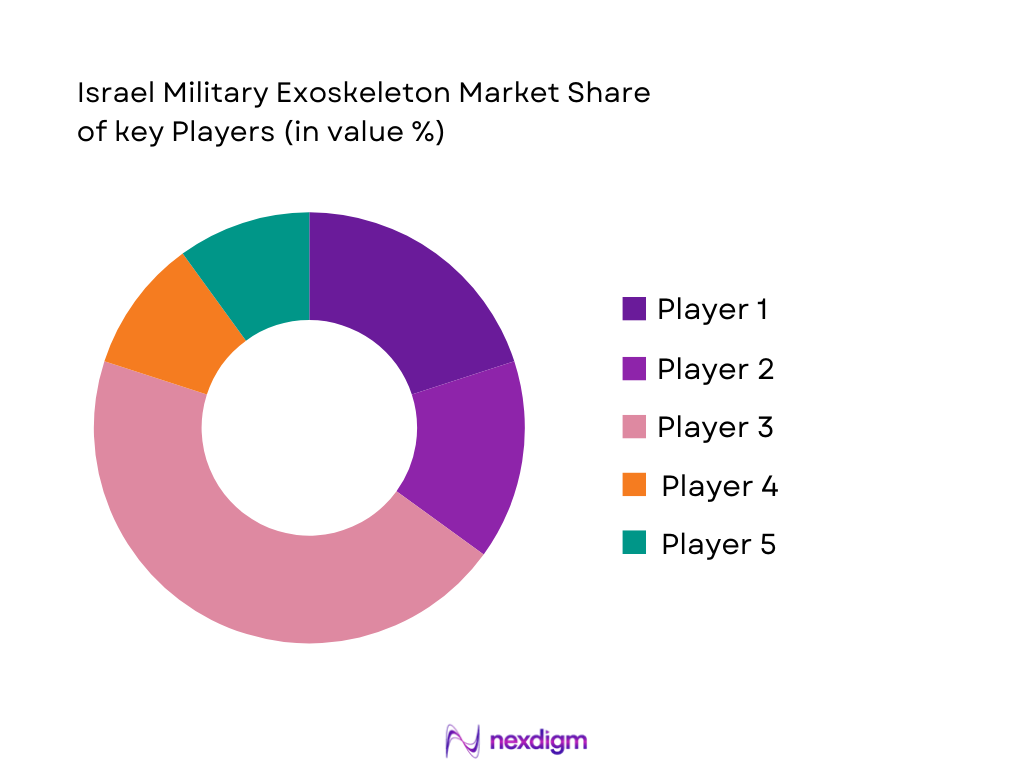

Competitive Landscape

The competitive landscape of the Israel military exoskeleton market is characterized by significant consolidation, with a few key players dominating the sector. These players focus on innovation, particularly in enhancing the mobility and comfort of exoskeletons, making them essential for military operations. Major companies are also collaborating with government defense departments to ensure that their products meet rigorous safety standards and operational requirements. The presence of strong technological capabilities, coupled with substantial investments in R&D, makes these companies central to the market’s expansion.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Technology Integration |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1950 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Bionik Laboratories | 2006 | Toronto, Canada | ~ | ~ | ~ | ~ | ~ |

| Cyberdyne | 2004 | Japan | ~ | ~ | ~ | ~ | ~ |

| Ekso Bionics | 2005 | Richmond, USA | ~ | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Technological Advancements in Robotics

The rapid advancement in robotics technology, especially in exoskeletons, is a significant growth driver in the Israel military exoskeleton market. Military exoskeletons are designed to reduce physical stress on soldiers, enhancing their endurance and agility during combat. The use of robotics to augment human capabilities ensures that soldiers can carry heavier loads, perform tasks more efficiently, and reduce fatigue during prolonged missions. With major defense contractors and tech companies in Israel continuously pushing the envelope of innovation, technological advancements in robotics are enabling more sophisticated, durable, and efficient exoskeleton systems. These innovations are particularly focused on reducing weight, improving mobility, and increasing battery life, which are crucial for military applications. As Israel continues to invest heavily in R&D in robotics and defense technology, the demand for exoskeletons in military operations is expected to rise, further driving the market. Additionally, Israel’s strong government backing for defense technologies and integration of robotics within its military operations ensures steady growth in this area.

Government Defense Expenditure Growth

Another key driver for the market’s expansion is Israel’s increasing defense budget, which focuses on technological advancements and modernization of the armed forces. With the need to enhance military capabilities and maintain strategic superiority, the government has allocated substantial funds for the development and deployment of advanced technologies such as military exoskeletons. This consistent increase in defense spending supports the adoption of new technologies in the Israeli military, making exoskeletons a key focus. As the country invests in developing systems to improve the performance, mobility, and safety of soldiers, the demand for exoskeletons is expected to rise. Additionally, with rising global security threats, there is an urgency to modernize defense systems, contributing to the high demand for exoskeletons within Israel’s military branches. The government’s strategic initiatives in defense technology further bolster market growth, creating a conducive environment for innovation and adoption in military operations.

Market Challenges

High Development and Manufacturing Costs

One of the main challenges hindering the growth of the Israel military exoskeleton market is the high development and manufacturing costs. Exoskeleton systems require sophisticated engineering, advanced robotics, and high-grade materials that result in considerable production expenses. The integration of AI, sensors, and advanced motors to improve exoskeleton functionality increases the complexity and cost of manufacturing. Moreover, military exoskeletons must meet stringent safety and operational standards, which adds to the overall cost of production. These high costs present a significant barrier to widespread adoption, particularly in a time of global financial constraints and budgetary pressures within military organizations. Despite these challenges, Israel’s commitment to defense innovation, supported by government funding, helps offset these costs. However, for broader adoption across various defense sectors, the cost of production needs to decrease, which remains a major hurdle for manufacturers and the military alike.

Regulatory and Certification Delays

Another challenge faced by the Israel military exoskeleton market is the lengthy process of regulatory approval and certification. Exoskeletons intended for military use must comply with stringent safety, operational, and ethical standards. The time-consuming process of obtaining certifications for these technologies can delay the market entry of new products. Furthermore, exoskeletons often require multiple iterations and extensive testing to ensure their durability and efficiency in combat environments. This certification process can result in significant delays in product development, limiting the ability of manufacturers to bring advanced exoskeletons to market quickly. Additionally, differing international regulations and standards can complicate the deployment of military exoskeletons in international defense contracts, further exacerbating the challenges faced by manufacturers.

Opportunities

Expansion of Hybrid Exoskeletons for Multi-Role Use

One of the most significant opportunities in the Israel military exoskeleton market is the expansion of hybrid exoskeletons that can serve multiple roles across various branches of the military. Hybrid exoskeletons, which combine powered and passive elements, offer soldiers enhanced mobility while conserving energy for longer missions. This innovation allows for more flexible applications, from tactical operations to rehabilitation purposes. The hybrid nature of these exoskeletons makes them adaptable to a wide range of military environments, increasing their appeal to different sectors, including ground forces, special operations, and air force units. As the demand for versatile, multi-functional exoskeletons grows, manufacturers will be encouraged to focus on developing and refining these systems. The growing focus on improving soldier mobility and reducing fatigue in the military will drive further investment in hybrid exoskeleton solutions.

Collaboration with Private Sector for Advanced R&D

Another major opportunity for the Israel military exoskeleton market lies in increasing collaboration with the private sector for advanced R&D. Many defense contractors in Israel are partnering with technology firms specializing in robotics, AI, and wearable technologies to enhance the capabilities of military exoskeletons. By leveraging the expertise of private tech companies, defense contractors can speed up the development process, reduce costs, and create innovative exoskeleton systems that meet the specific needs of the military. The private sector brings valuable technological expertise, while the government’s investment in defense infrastructure ensures that these innovations can be quickly integrated into military operations. These collaborations offer an opportunity to accelerate the growth of the market and meet the increasing demand for advanced exoskeletons in the military sector.

Future Outlook

Over the next five years, the Israel military exoskeleton market is poised for significant growth, driven by advancements in technology, increasing defense expenditure, and the ongoing demand for better soldier protection and mobility. The integration of AI and machine learning in exoskeleton systems will further enhance their capabilities, making them more efficient and adaptable to a variety of military environments. Technological developments are expected to reduce costs and improve performance, increasing the adoption of military exoskeletons. Strong government support for defense innovation, coupled with global security concerns, will continue to drive the demand for exoskeletons in military operations, ensuring steady growth for the market.

Major Players

- Rafael Advanced Defense Systems

- Bionik Laboratories

- Cyberdyne

- Ekso Bionics

- Lockheed Martin

- Honda Motor Co.

- Parker Hannifin

- General Electric

- Hyundai Motor Co.

- ABB Robotics

- ReWalk Robotics

- Exoskeletons Australia

- Saab Group

- Robotic Systems Lab

- Elbit Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense equipment suppliers

- Technology developers for military applications

- Defense technology startups

- International defense agencies

- Military research and development teams

Research Methodology

Step 1: Identification of Key Variables

Identifying key variables involves analyzing technological trends, market dynamics, and the regulatory environment to set a foundation for market analysis.

Step 2: Market Analysis and Construction

This step involves collecting market data, examining market size, growth trends, and competitive strategies in the military exoskeleton market.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions from defense technology experts and industry leaders are consulted to validate the hypothesis formed from the preliminary research and market analysis.

Step 4: Research Synthesis and Final Output

Data is synthesized to generate final market insights, forming the basis for a comprehensive market report detailing the Israel military exoskeleton market outlook to 2035.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancement in wearable technologies

Government defense expenditure growth

Increased focus on soldier safety and performance

- Market Challenges

High development and manufacturing costs

Complexity in user adaptation and training

Regulatory hurdles and certification delays

- Market Opportunities

Increasing demand for lightweight exoskeleton solutions

Collaboration with private sector for R&D

Growth in demand for rehabilitation exoskeletons

- Trends

Rise in hybrid exoskeleton designs

Increased investment in AI integration for exoskeletons

Growing importance of exoskeletons in battlefield simulations

- Government Regulations

Stringent military safety standards

Import/export restrictions on military technology

Compliance with international arms treaties

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Exoskeletons for Soldiers

Exoskeletons for Heavy Lifting

Exoskeletons for Mobility Assistance

Exoskeletons for Tactical Operations

Exoskeletons for Training

- By Platform Type (In Value%)

Ground Forces

Air Forces

Naval Forces

Special Operations

Intelligence Units

- By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Modular Fitment

- By EndUser Segment (In Value%)

Defense Forces

Private Contractors

Research Institutions

Military Equipment Manufacturers

Government Agencies

- By Procurement Channel (In Value%)

Direct Purchase

Government Procurement Programs

Third-party Distributors

Online Procurement Platforms

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters (Technology Integration, Exoskeleton Mobility, Durability, Weight Efficiency, Cost-effectiveness, User Comfort, Power Consumption, Flexibility of Use, Maintenance Requirements, Integration with Existing Military Equipment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Military Industries (IMI)

Elbit Systems

Rafael Advanced Defense Systems

Bionik Laboratories

ReWalk Robotics

Cyberdyne

Exoskeletons Australia

Lockheed Martin

Abbott Laboratories

Parker Hannifin

Honda Motor Co.

Robotics Research

Ekso Bionics

BMW Group

Saab Group

- Government Military Contracts

- Private Defense Contractors

- Military Technology Developers

- Specialized Defense Units

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035