Market Overview

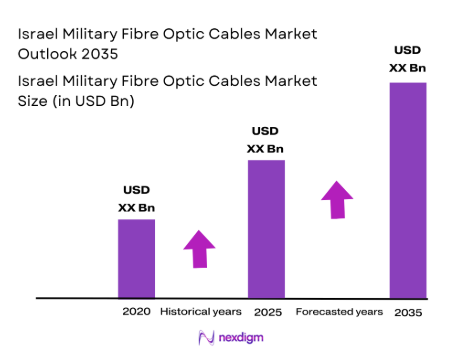

The Israel Military Fibre Optic Cables market is witnessing robust growth, with a market value estimated at USD ~ million in 2023. This growth is primarily driven by the increasing demand for secure, high-performance communication networks within the Israeli defense sector. Military fibre optic cables are essential for real-time, high-speed data transmission, vital for defense operations. Israel’s continued investment in defense technology, including its modernized communication systems, fuels this growth. Furthermore, Israel’s strategic defense policies and substantial military budget allocations ensure sustained growth in the military fibre optic cable market.

Israel is the dominant player in the military fibre optic cables market due to its high-tech defense sector, robust R&D capabilities, and strategic focus on cybersecurity and communications. Cities such as Tel Aviv and Haifa, home to leading defense technology companies like Elbit Systems and Rafael Advanced Defense Systems, are central to the market’s dominance. The government’s commitment to technological advancement in military infrastructure further strengthens Israel’s leadership in military communications, making it a hub for the adoption of advanced fibre optic technologies within defense networks.

Market Segmentation

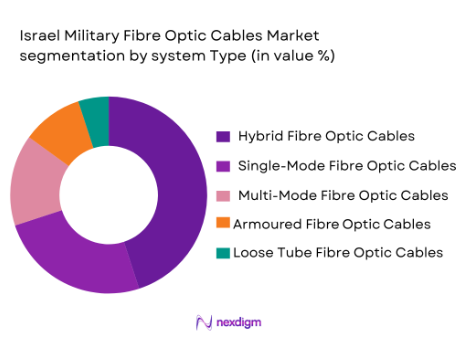

By System Type

The Israel Military Fibre Optic Cables market is segmented by system type, and hybrid fibre optic cables currently dominate the market. These cables combine the benefits of both single-mode and multi-mode fibres, offering enhanced flexibility and performance, making them ideal for military communications that require both high speed and long-range transmission. The versatility of hybrid cables allows them to be used across a variety of platforms, from land-based operations to naval and airborne systems, making them the preferred choice in defense networks.

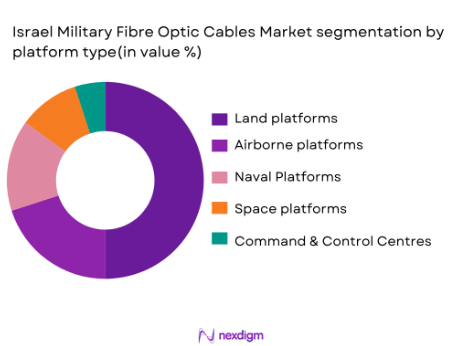

By Platform Type

In the platform type segment, land platforms lead the Israel Military Fibre Optic Cables market. This dominance is due to the increasing demand for secure and efficient communication systems for military ground operations. The need for robust communication infrastructure in combat zones, where fibre optic cables provide faster and more reliable data transmission, has contributed to the growth of this segment. The Israeli Defense Forces (IDF) use fibre optics extensively for command centers, tactical communication systems, and surveillance, driving the demand for land-based fibre optic cables.

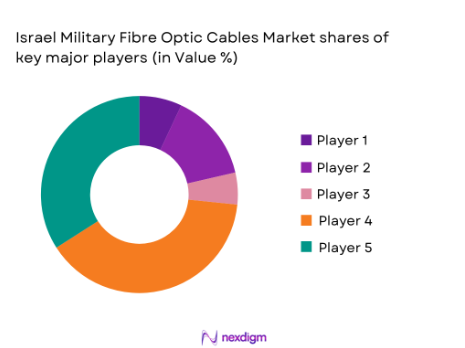

Competitive Landscape

The Israel Military Fibre Optic Cables market is characterized by a high degree of consolidation, with a few dominant players shaping the industry. Leading companies in this space include both global defense technology firms and local Israeli companies. These key players are focused on continuously innovating and enhancing their fibre optic cable systems to meet the increasing demands of military communication. The ongoing collaboration between Israel’s defense agencies and international firms further boosts the competitive dynamics within the market.

| Company Name | Establishment Year | Headquarters | R&D Focus | Key Products | Market Reach | Partnerships |

| Elbit Systems | 1966 | Israel | – | – | – | – |

| Rafael Advanced Defense Systems | 1948 | Israel | – | – | – | – |

| Israel Aerospace Industries | 1953 | Israel | – | – | – | – |

| Optical Cable Corporation | 1983 | USA | – | – | – | – |

| Ciena Corporation | 1992 | USA | – | – | – | – |

Israel Military Fibre Optic Cables Market Dynamics

Growth Drivers

Growing demand for secure communication systems in military operations

The demand for secure communication systems within the Israeli military is escalating, driven by the increasing sophistication of cyber threats and the need for reliable, fast communication. The Israeli government has consistently allocated a significant portion of its defense budget towards enhancing the security and speed of its military communications infrastructure. In 2024, Israel’s defense expenditure is expected to exceed USD 22 billion, with a notable emphasis on advanced technologies such as fibre optic cables for secure communications. The integration of fibre optics into military systems enhances data transmission speed and ensures secure communications, crucial in combat and surveillance operations.

Technological advancements in fibre optic cable systems for military applications

Technological innovation in fibre optic cables has significantly advanced the capabilities of military communication systems in Israel. The shift towards using high-capacity fibre optic cables, such as those with improved shielding and resilience, is pivotal for the demands of modern military operations. The recent Israeli Ministry of Defense projects increased spending on research and development of fibre optics, which is poised to improve not only the speed but also the security of military communications. These advances have enabled higher capacity for real-time data transfer, a necessity for operations in combat zones and strategic military facilities. In addition, newer fibre optic systems support integration with emerging military technologies like drones and AI-driven defense systems.

Market Challenges

High cost of fibre optic cable systems and their installation

The cost of military-grade fibre optic cable systems and their installation remains a key challenge in Israel. Although fibre optics offer superior speed and security, the high initial cost of installation, particularly in remote and hazardous military environments, can be prohibitive. As of 2023, Israel’s defense budget allocated a significant amount towards upgrading communication networks, but costs related to infrastructure installation and maintenance are still substantial. These expenses include specialized labor for cable installation in tough environments, along with the necessary equipment for testing and securing the infrastructure. The high cost of fibre optic technology poses a financial hurdle to rapid adoption across the military’s various platforms.

Challenges in integrating new fibre optic systems with legacy military infrastructure

A significant challenge in Israel’s adoption of new fibre optic technologies is the integration of these advanced systems with existing military infrastructure. Israel’s military relies on a variety of legacy communication systems that were not designed to accommodate the speed and capacity of modern fibre optics. Integrating fibre optic cables with these older systems requires extensive modifications and can lead to compatibility issues. This integration process demands substantial technical expertise and increased costs for retrofitting and ensuring interoperability across platforms. Moreover, the complexity of this integration can delay the full deployment of fibre optic solutions within various defense branches.

Market Opportunities

Potential for growth in fibre optic cable applications in unmanned platforms

The potential for growth in fibre optic cable applications in unmanned platforms is significant, especially for military drones and robotic vehicles used in surveillance and combat scenarios. As Israel continues to invest in unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) for military use, the need for secure and high-speed data transmission grows. Fibre optic cables are increasingly being used in these platforms due to their ability to handle high data throughput while providing enhanced security and reduced interference. The Israeli military, known for its advanced UAVs and robotic systems, is likely to expand its use of fibre optics to support real-time communication and data streaming from unmanned platforms to command centers.

Expanding demand for fibre optic cables in military research and development

Israel’s focus on military research and development (R&D) continues to drive the demand for fibre optic cables. The need for secure, high-capacity communications is critical in research settings where rapid data transfer and real-time monitoring are essential. Israeli defense companies, in collaboration with the Ministry of Defense, are actively working on next-generation technologies that require fibre optic infrastructure to handle vast amounts of data. From cybersecurity research to the development of advanced weaponry and defense systems, fibre optic cables play a pivotal role in ensuring that the technological advancements in R&D are supported by robust communication networks. The government’s emphasis on technological innovation within its defense sector ensures a growing market for these cables.

Future Outlook

Over the next 5-10 years, the Israel Military Fibre Optic Cables market is expected to show significant growth driven by continuous government support, advancements in fibre optic technology, and the growing demand for secure, high-speed communication systems. The Israeli government’s commitment to enhancing its defense capabilities, particularly in cybersecurity and secure communications, is expected to fuel the demand for high-performance fibre optic cables. Additionally, the integration of fibre optic systems with next-generation military technologies such as autonomous systems, UAVs, and AI-driven defense platforms will further accelerate market expansion.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Optical Cable Corporation

- Ciena Corporation

- General Electric

- Huawei Technologies

- Cisco Systems

- General Dynamics

- Northrop Grumman

- Mitsubishi Electric

- Bezeq International

- TAT Technologies

- Alcatel-Lucent

- Corning Inc.

Key Target Audience

- Ministry of Defense, Israel

- Israeli Armed Forces

- Defense Technology Manufacturers

- Military Contractors

- Government and Regulatory Bodies

- Telecom and Network Solutions Providers

- Technology Innovators in Fiber Optics

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping out key variables that influence the Israel Military Fibre Optic Cables market. The primary objective is to identify all stakeholders in the defense communication sector, including manufacturers, suppliers, and government agencies. A combination of secondary data, including industry reports and government publications, is used to gather initial information.

Step 2: Market Analysis and Construction

During this phase, historical data on market trends, fibre optic cable installations, and defense communication systems are compiled. This information helps in understanding the growth trajectory of military fibre optic cables, along with evaluating market penetration and demand forecasts. Data from military procurement and defense technology contracts also contribute to shaping the market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are a crucial step to validate the market hypotheses. Interviews with industry leaders, such as defense contractors and military procurement officers, are conducted to obtain real-world insights on fibre optic cable adoption in defense systems. These expert inputs are used to refine the data and ensure accuracy in the analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the findings from the previous stages and validating the data through primary and secondary sources. This includes engaging with military equipment manufacturers to confirm the applicability and performance of fibre optic cables in defense systems. The outcome is a comprehensive and accurate report on the Israel Military Fibre Optic Cables market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

Market Definition and Scope

Value Chain & Stakeholder Ecosystem

Regulatory / Certification Landscape

Sector Dynamics Affecting Demand

Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for secure communication systems in military operations

Technological advancements in fibre optic cable systems for military applications

Increased defense budget allocations by the Israeli government - Market Challenges

High cost of fibre optic cable systems and their installation

Challenges in integrating new fibre optic systems with legacy military infrastructure

Vulnerabilities in cable security during deployment in conflict zones - Market Opportunities

Potential for growth in fibre optic cable applications in unmanned platforms

Expanding demand for fibre optic cables in military research and development

Opportunities for collaboration between defense tech companies and telecom providers - Trends

Growing adoption of fibre optic cables for secure military communication

Shift towards modular and flexible cable systems in defense networks

Increasing use of fibre optic cables for cyber defense and surveillance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Single-Mode Fibre Optic Cables

Multi-Mode Fibre Optic Cables

Armoured Fibre Optic Cables

Hybrid Fibre Optic Cables

Loose Tube Fibre Optic Cables - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Command & Control Centres - By Fitment Type (In Value%)

Internal Systems

External Systems

Modular Systems

Portable Systems

Integrated Systems - By End User Segment (In Value%)

Military Communication Networks

Defense Contractors

Government Research Institutions

Military Logistics & Supply Chains

Combat & Tactical Units - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Defense Programs

Third-Party Distributors

Military Contractors

B2B Partnerships

- Market Share Analysis

- Cross Comparison Parameters (System Complexity, Integration with Existing Infrastructure, Fitment Options, Procurement Channels, End-User Segments)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Optical Cable Corporation

TAT Technologies

Bezeq International

Mellanox Technologies

Mitsubishi Electric

Marmon Utility

Ciena Corporation

General Electric

Siemens AG

Huawei Technologies

Cisco Systems

Northrop Grumman

- Growing integration of fibre optic cables in military UAV systems

- Adoption of advanced fibre optic networks for secure battlefield communication

- Increased focus on resilient and durable fibre optic systems for combat units

- Demand for real-time data transfer in military logistics and command centers

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035