Market Overview

The Israel Military Frigates Market is valued based on significant investments from the Israeli government in its naval defense systems, especially the development of cutting-edge multi-role frigates. Israel’s defense budget has been consistently increasing, with the Israeli Ministry of Defense estimating it to exceed USD ~ billion in 2024, a key factor driving naval procurements. The modernization of Israel’s naval capabilities, particularly the procurement of advanced frigates such as the Sa’ar 6-class, is central to the country’s strategy of maintaining security and maritime dominance in the Mediterranean. These investments are supported by Israel’s reliance on high-tech defense systems and its strategic maritime interests, positioning the market for growth in the coming years.

Israel stands as a dominant player in the Middle East’s naval defense sector, with the country’s strategic location on the Mediterranean coast bolstering its defense significance. Tel Aviv, as the economic and defense hub, plays a central role in coordinating military procurements, while Haifa serves as the main naval port. The country’s defense partnerships with global powers, especially the United States, provide Israel with access to state-of-the-art technologies and frigates, further cementing its position in the market. Israel’s continued investments in modernizing its naval fleet, particularly its frigate capabilities, reflect its commitment to securing its maritime borders and maintaining regional dominance.

Market Segmentation

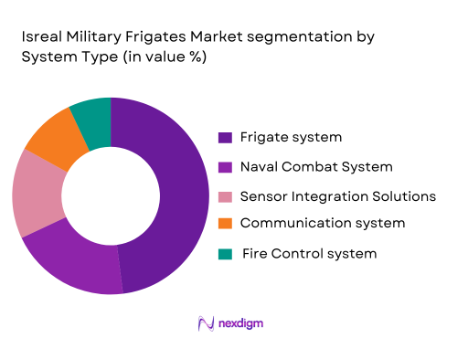

By System Type

The Israel Military Frigates Market is segmented by system type, including Frigate Systems, Naval Combat Systems, Sensor Integration Solutions, Communication Systems, and Fire Control Systems. Among these, the Frigate Systems segment leads the market. This dominance is due to Israel’s focus on multi-role frigates that combine multiple defense functions, such as anti-air, anti-submarine, and surface warfare. Israel has prioritized acquiring and upgrading frigate systems, exemplified by the Sa’ar 6-class frigates, which incorporate advanced radar, missile defense systems, and automation technology. The development of indigenous defense technologies has also contributed to the growth of this segment, with Israel producing highly capable, versatile frigates for both national defense and international sales.

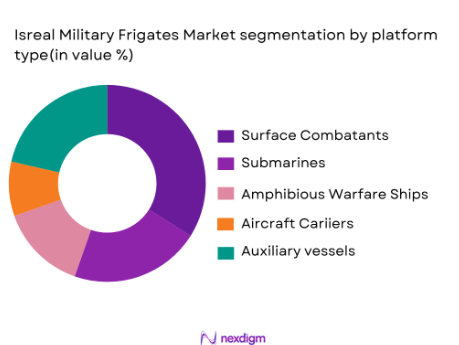

By Platform Type

The market is also segmented by platform type, including Surface Combatants, Submarines, Amphibious Warfare Ships, Aircraft Carriers, and Auxiliary Vessels. The Surface Combatants segment holds the dominant market share in Israel’s naval defense strategy. The country has focused on acquiring advanced surface combatants, particularly frigates, as they provide versatile platforms capable of performing a range of operations from defense to surveillance. Israel’s Sa’ar 6-class frigates, which serve as key components of its naval fleet, are specifically designed for this purpose, offering capabilities in both defense and offense while maintaining flexibility in operational scenarios.

Competitive Landscape

The Israel Military Frigates Market is dominated by key players including both domestic defense contractors and international defense firms. Israel’s strategic military defense capabilities are heavily supported by global defense partnerships, especially with countries like the United States and Germany. Israeli companies such as Israel Shipyards Ltd. and the Israel Aerospace Industries (IAI) play a crucial role in designing and building advanced frigates. These local players benefit from collaborations with international defense companies, bringing cutting-edge technologies to Israel’s naval fleet. The competitive landscape is further strengthened by global companies that provide key defense systems integrated into Israeli naval platforms.

| Company | Establishment Year | Headquarters | Technology Focus | Market Reach | Naval Contracts | Strategic Collaborations |

| Israel Shipyards Ltd. | 1959 | Haifa, Israel | – | – | – | – |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | – | – | – | – |

| Thyssenkrupp Marine Systems | 1990 | Germany | – | – | – | – |

| Lockheed Martin | 1995 | USA | – | – | – | – |

| BAE Systems | 1999 | United Kingdom | – | – | – | – |

Israel Military Frigates Market Dynamics

Growth Drivers

Increasing naval defense budgets in the Middle East

The Middle East region continues to bolster its naval defense expenditure, particularly driven by ongoing geopolitical tensions and the need for enhanced maritime security. In 2023, the Middle Eastern countries allocated a combined $85 billion for defense, with a substantial portion dedicated to naval capabilities. Israel, as part of this trend, has also seen a consistent rise in its defense budget, which stood at approximately $25 billion for 2023. This is expected to remain robust with a forecast of sustained defense expenditure growth into 2024. The focus on naval defense is especially prevalent due to rising threats in the Mediterranean and the Red Sea. The government’s commitment to reinforcing its naval fleets has been a significant driver for the military frigates market, ensuring demand for advanced frigates, anti-ship missile systems, and related naval combat technologies.

Technological advancements in naval combat systems

Technological advancements in military systems are driving the demand for high-tech naval frigates. The rise in AI, cyber-attack resilience, and advanced radar systems has led to an increasing need for frigates equipped with modernized systems. Israel’s Ministry of Defense has notably increased its focus on enhancing these technologies, as seen in the upgrades to its Sa’ar-class frigates. By 2023, Israel’s defense sector invested an estimated $3.5 billion in research and development for next-generation defense systems, including autonomous weapons, advanced radar, and cybersecurity infrastructure for naval vessels. Furthermore, the country has adopted cutting-edge technologies in combat management systems, artificial intelligence for decision-making, and electronic warfare capabilities, pushing the demand for increasingly sophisticated frigates. With the continued evolution of these technologies, the defense budget is expected to further emphasize tech-focused naval platforms.

Market Challenges

High operational and maintenance costs

While Israel continues to modernize its naval forces, the high operational and maintenance costs of military frigates present a significant challenge. In 2022, Israel allocated nearly $1.8 billion to sustain and maintain its fleet, which includes high maintenance expenditures for naval platforms and combat systems. With an aging fleet, the cost of maintaining and upgrading these vessels continues to rise, resulting in budgetary constraints. As a result, the operational life of older frigates becomes a financial burden, leading to delays in fleet modernization. Moreover, the increasing complexity of new systems, such as radar and missile defense systems, adds to the operational overhead. In response, Israel is gradually shifting towards modular upgrade options to control rising costs, but it remains a significant challenge for continued fleet expansion.

Political instability in the region

Geopolitical instability, particularly with neighboring countries, has led to an unpredictable security environment in the Middle East, directly affecting defense procurement and strategic planning. In 2022, Israel faced an escalation of tensions with adversaries, leading to a rise in defense-related activities, but also presenting significant challenges in long-term strategic planning. The political volatility not only complicates defense planning but also affects procurement decisions, as there is a constant need to remain adaptable to potential shifts in regional alliances and threats. This political uncertainty has sometimes delayed defense procurements and fleet modernization programs, as there is reluctance to make substantial investments under unstable political conditions. Additionally, sanctions and embargoes from some regional actors further complicate procurement channels.

Market Opportunities

Expansion of international defense partnerships

The expansion of international defense partnerships is a significant growth opportunity for Israel’s military frigates market. Israel has long been a key player in global defense alliances, providing its advanced naval solutions to countries in Europe, Asia, and beyond. In 2022, Israel signed several defense contracts with nations like Greece and India to supply advanced naval vessels and systems, marking a strong trend of increasing export activity. The Israeli government’s strategic partnerships have allowed the country to penetrate more international markets, with defense exports in 2022 reaching approximately $11.5 billion. This opens the door for Israeli manufacturers to expand the reach of their frigates and related naval systems, including advanced combat management and missile defense systems, creating significant demand for next-generation military vessels.

Investment in autonomous naval combat technologies

The growing demand for autonomous naval combat technologies presents a tremendous growth opportunity for the military frigates market. The global trend towards unmanned vessels, combined with Israel’s robust expertise in autonomous systems, has set the stage for a new era of naval warfare. In 2023, Israel’s defense sector allocated $1.2 billion for the development of unmanned surface vessels (USVs) and advanced autonomous naval systems. This investment is expected to drive future demand for frigates equipped with cutting-edge autonomous capabilities, such as remotely piloted operations and automated combat systems. With the increasing focus on reducing human risk and operational costs, Israel’s push to integrate autonomous technologies into its naval platforms will likely lead to expanded market opportunities for advanced frigates.

Future Outlook

The Israel Military Frigates Market is expected to grow significantly over the next decade, driven by continuous investments in advanced naval technologies, strategic defense collaborations, and a focus on multi-role frigates capable of performing diverse defense functions. The modernization of Israel’s naval fleet, particularly through the Sa’ar 6-class frigates, will play a key role in ensuring the country remains a leading force in naval defense in the Mediterranean and beyond. Additionally, technological advancements in radar, missile systems, and naval automation are expected to further boost demand for high-tech frigates. The market will be shaped by both domestic requirements and international collaborations aimed at enhancing naval capabilities.

Major Players in the Israel Military Frigates Market

- Israel Shipyards Ltd.

- Israel Aerospace Industries (IAI)

- Thyssenkrupp Marine Systems

- Lockheed Martin

- BAE Systems

- Naval Group

- Fincantieri

- Huntington Ingalls Industries

- General Dynamics

- L3 Technologies

- Kongsberg Gruppen

- Raytheon Technologies

- Northrop Grumman

- Austal

- Leonardo

Key Target Audience

- Israeli Ministry of Defense

- Israeli Navy

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Israeli Government Contractors

- Regional Defense Contractors

- Global Defense Manufacturers

- International Defense Alliances

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables influencing the Israel Military Frigates Market, including government defense policies, procurement strategies, and defense budget allocation. This phase incorporates secondary data sources, including government reports, defense publications, and industry insights.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data regarding the Israel Military Frigates Market. This involves assessing trends in naval procurement, market penetration by key players, and evaluating revenue generation potential across different platforms and system types.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and tested with industry experts, including military professionals, defense analysts, and key decision-makers within the Israeli defense sector. These consultations provide operational insights and validate the data collected.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the collected data and confirming findings with relevant stakeholders. Direct engagement with manufacturers and end-users will provide a comprehensive view of product segments, sales performance, and evolving defense requirements, ensuring that the research output is accurate and comprehensive.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing naval defense budgets in the Middle East

Technological advancements in naval combat systems

Escalating geopolitical tensions and maritime security concerns - Market Challenges

High operational and maintenance costs

Political instability in the region

Supply chain and manufacturing delays - Market Opportunities

Expansion of international defense partnerships

Investment in autonomous naval combat technologies

Growth in upgrading and retrofitting existing fleets - Trends

Increased focus on cyber-attack resilience in naval defense systems

Emerging naval warfare strategies and tactical innovations

Integration of AI and machine learning in combat management systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Anti-Ship Missiles

Radar Systems

Weapons Control Systems

Combat Management Systems

Electronic Warfare Systems - By Platform Type (In Value%)

Surface Combatants

Multi-role Frigates

Anti-Submarine Warfare (ASW) Frigates

Air-Defence Frigates

Coastal Defence Frigates - By Fitment Type (In Value%)

Shipyard Integration

Onboard Refits

New Build Systems

Modular Upgrades

Integrated Combat Systems - By End User Segment (In Value%)

Naval Forces

Coastal Defence Forces

Security Agencies

International Defense Alliances - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contractors

Third-party Distributors

Collaborative Procurement

OEM Channels

- Market Share Analysis

- Cross Comparison Parameters (Price, Technology Integration, Fleet Size, Combat Capability, International Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Israel Shipyards Ltd

Rafael Advanced Defense Systems

IAI (Israel Aerospace Industries)

Elbit Systems

Saab AB

Navantia

Thales Group

Lockheed Martin

Northrop Grumman

Boeing

General Dynamics

DCN (Direction des Constructions Navales)

L3 Technologies

BAE Systems

Huntington Ingalls Industries

- Expanding need for advanced naval defense systems in allied countries

- Growing modernization of coastal defense forces

- Demand for multi-role and versatile naval platforms

- Emphasis on long-range, anti-submarine, and anti-missile systems

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035