Market Overview

The Israel Military Gas Mask market is growing steadily, with a market size valued at approximately USD ~ billion in 2025, driven primarily by increasing defense budgets and rising geopolitical tensions in the region. Israel’s proactive defense policies, which focus on the protection of its armed forces against chemical, biological, radiological, and nuclear (CBRN) threats, fuel demand for advanced personal protective equipment (PPE). The expansion of CBRN defense systems and Israel’s leadership in innovation and military technology have further bolstered the market, positioning the country as a key player in the global defense sector.

Israel remains the dominant player in the military gas mask market due to its sophisticated defense infrastructure and ongoing investments in CBRN defense. The country’s expertise in military innovation and the high demand for protective gear among its armed forces create a strong market for military gas masks. Other regions, particularly the Middle East and North Africa, also exhibit high demand due to geopolitical tensions. Israel’s alliances and export agreements with countries such as the United States and European nations further consolidate its role in the global market.

Market Segmentation

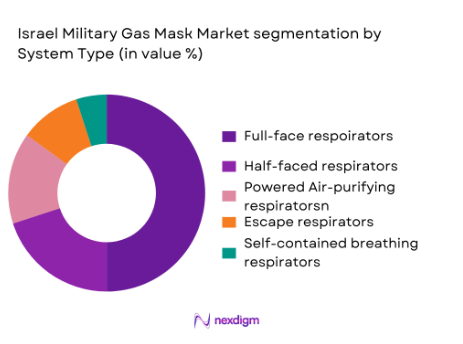

By System Type

The Israel Military Gas Mask market is segmented by system type into full-face respirators, half-face respirators, powered air-purifying respirators (PAPR), escape respirators, and self-contained breathing apparatus (SCBA). Full-face respirators dominate the market, as they provide superior protection against airborne contaminants and are widely used by military personnel in high-risk environments. These masks cover the entire face, providing protection against a broader range of chemical, biological, and radiological threats. The increasing prevalence of full-face respirators is due to the growing demand for comprehensive protection in both military and civilian defense applications. Their use has expanded beyond the military to security forces and emergency response units, as the need for advanced protection against hazardous environments has become more pressing.

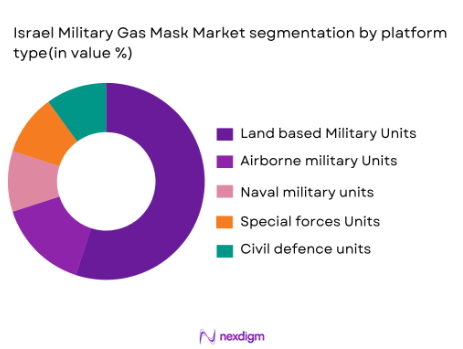

By Platform Type

In the Israel Military Gas Mask market, the segmentation by platform type includes land-based military units, airborne military units, naval military units, special forces & tactical units, and civil defense units. Land-based military units hold the largest share, as they account for the bulk of Israel’s defense forces and their associated protective gear needs. These units require reliable, long-lasting protection systems, including gas masks, to safeguard soldiers from chemical, biological, and radiological threats in combat situations. The ongoing modernization of Israel’s ground forces further strengthens the demand for military gas masks, especially among infantry and armored units, ensuring the continued dominance of this segment.

Competitive Landscape

The Israel Military Gas Mask market is dominated by a mix of domestic and international players, with companies like Israel Military Industries (IMI) and Rafael Advanced Defense Systems leading the charge. The competitive landscape highlights the strong influence of these key companies due to their long-established relationships with Israel’s defense forces, as well as their technological innovations in protective gear. In addition, global companies like Honeywell and 3M, known for their expertise in respiratory protection, have also made significant inroads into the market, offering advanced systems that cater to the defense sector’s rigorous requirements.

| Company Name | Establishment Year | Headquarters | Product Innovation | Market Focus | Export Reach | Technology Integration |

| Israel Military Industries (IMI) | 1933 | Israel | – | – | – | – |

| Rafael Advanced Defense Systems | 1958 | Israel | – | – | – | – |

| Honeywell International | 1906 | USA | – | – | – | – |

| 3M | 1902 | USA | – | – | – | – |

| Avon Protection | 1885 | UK | – | – | – | – |

Israel Military Gas Mask Market Dynamics

Growth Drivers

Rising geopolitical tensions driving demand for enhanced protective gear

Geopolitical tensions in the Middle East and global instability have heightened the need for advanced protective gear, particularly for military personnel in high-risk environments. Israel, given its strategic position, has seen increasing defense allocations to protect against potential chemical, biological, radiological, and nuclear (CBRN) threats. In 2023, Israel’s defense expenditure reached approximately $26 billion, with a significant portion allocated to modernizing protective equipment like military gas masks. Similarly, the Middle East as a whole saw a rise in defense spending, totaling $85 billion in 2023, further pushing the demand for gas masks and other protective gear.

Ongoing development of chemical, biological, radiological, and nuclear (CBRN) defense capabilities

The ongoing development of CBRN defense capabilities in Israel has been a key driver for the market of military gas masks. In recent years, Israel has significantly advanced its CBRN defense systems, investing over $3.5 billion in 2023 for further research and technological development in this area. This includes the enhancement of gas masks, decontamination technologies, and protective suits. Israel’s military is also focusing on upgrading its existing CBRN protection systems, ensuring that all personnel are equipped with the latest and most effective protective gear. These advancements are critical in maintaining preparedness for potential CBRN threats.

Market Challenges

High costs of advanced gas mask technologies and systems

The costs associated with developing and manufacturing advanced gas mask systems remain a significant challenge for Israel’s defense sector. In 2023, Israel allocated a substantial portion of its defense budget to upgrade its existing gas mask inventory, with costs exceeding $200 million for the procurement of new systems. These high costs are a result of integrating cutting-edge filtration technologies, improving comfort and fit, and meeting the stringent standards required for military operations. The complexity of these systems, along with ongoing technological advancements, drives up both production and maintenance costs, making it a continuous financial challenge for military agencies.

Supply chain disruptions for critical materials and components

The global supply chain disruptions of critical materials and components have adversely impacted the production of military gas masks and related protective gear. In 2023, global supply chain issues led to delays in the procurement of specialized filtration materials and components essential for producing high-performance gas masks. This has resulted in production backlogs, forcing delays in equipping military personnel with necessary gear. Furthermore, issues such as the scarcity of high-grade rubber and specialized plastics have caused a rise in prices for military-grade protective gear, complicating procurement for Israel’s armed forces.

Market Opportunities

Expansion of military contracts and international defense sales

Israel’s strong defense capabilities and its growing influence in global defense markets offer significant opportunities for expanding military contracts and international sales. In 2022, Israel signed defense contracts worth over $11 billion, including significant exports of military protective gear, including gas masks, to NATO allies and countries in the Middle East. Israel’s advanced technologies and its leadership in CBRN defense have driven international demand for its products, and the country is expected to continue expanding its market share, especially in regions with escalating geopolitical risks. International defense partnerships will play a key role in propelling the demand for Israeli-made gas masks and other defense-related products.

Growing focus on integrating advanced filtration technologies in gas masks

The growing focus on integrating advanced filtration technologies into military gas masks is an exciting opportunity for the market. In 2023, Israel’s Ministry of Defense allocated over $250 million to research and development in the field of filtration technologies. These developments include the integration of next-generation particulate filters, chemical and biological agents filters, and advanced powered air-purifying respirators (PAPR) into military masks. The increased focus on such innovations reflects a growing need for more efficient and adaptable protective gear, ensuring that Israel’s defense forces stay ahead of potential CBRN threats. This growing focus on technological advancements will increase demand for advanced gas masks with superior filtration capabilities.

Future Outlook

Over the next decade, the Israel Military Gas Mask market is expected to experience steady growth, driven by continued technological advancements in protective gear, a focus on CBRN defense, and rising demand from both military and civilian defense sectors. Increasing regional conflicts and global efforts to bolster defense against biological and chemical warfare will sustain market demand. Additionally, Israel’s strategic alliances with other nations will likely foster greater global market penetration, ensuring a positive outlook for the coming years.

Major Players

- Israel Military Industries (IMI)

- Rafael Advanced Defense Systems

- Honeywell International

- 3M

- Avon Protection

- Drägerwerk AG

- MSA Safety

- Scott Safety

- Cameron International

- Sundström Safety

- MedEng Systems

- Aearo Technologies

- Trelleborg AB

- Birnberg Medical

- Avon Rubber

Key Target Audience

- Defense Ministries

- Military Units

- Security Agencies

- CBRN Defense Contractors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Emergency Response Units

- International Defense Allies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map of the Israel Military Gas Mask market. This will identify major stakeholders, including manufacturers, government bodies, and end-users. Data is gathered using a combination of secondary research and proprietary databases to define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical market data, including penetration rates, demand for various product types, and regional spending on defense protection systems. The market is segmented based on system type, platform type, and procurement channels.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through in-depth consultations with industry experts, including military procurement officials and gas mask manufacturers. These consultations will provide operational insights that will help refine market data.

Step 4: Research Synthesis and Final Output

The final phase will engage with key manufacturers to acquire insights into product development, consumer preferences, and future growth trends. This will complement bottom-up analysis and ensure accurate and validated data.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions driving demand for enhanced protective gear

Increasing defense budgets and modernization programs

Ongoing development of chemical, biological, radiological, and nuclear (CBRN) defense capabilities - Market Challenges

High costs of advanced gas mask technologies and systems

Supply chain disruptions for critical materials and components

Challenges in meeting international compliance and certification standards - Market Opportunities

Expansion of military contracts and international defense sales

Growing focus on integrating advanced filtration technologies in gas masks

Collaborative initiatives between governments and private sector for CBRN defense advancements - Trends

Shift towards lightweight, portable, and more efficient respiratory protection systems

Integration of smart technology and monitoring systems in gas masks

Increasing emphasis on multi-purpose protective gear for all military personnel

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Full-Face Respirators

Half-Face Respirators

Powered Air-Purifying Respirators (PAPR)

Escape Respirators

Self-Contained Breathing Apparatus (SCBA) - By Platform Type (In Value%)

Land-Based Military Units

Airborne Military Units

Naval Military Units

Special Forces & Tactical Units

Civil Defense Units - By Fitment Type (In Value%)

Standard Fitment

Custom Fitment

Replacement Filters and Accessories

Flexible Fitment

Modular Fitment - By End User Segment (In Value%)

Military Forces

Civilian Defense Agencies

Government & Security Agencies

International Defense Allies - By Procurement Channel (In Value%)

Direct Government Procurement

Military Contractors

OEM Manufacturers

Third-party Distributors

Collaborative Procurement

- Market Share Analysis

- Cross Comparison Parameters (Price, Technology Integration, Product Durability, Global Reach, Military Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Israel Military Industries (IMI)

Rafael Advanced Defense Systems

Elbit Systems

Saab AB

Honeywell International

3M

Scott Safety

MSA Safety

Avon Protection

Drägerwerk AG

Gentex Corporation

MedEng Systems

Cameron International

Sundström Safety

Boeing

- Rising demand for advanced gas masks in international military alliances

- Growth in civilian defense procurement driven by regional threats

- Specialized needs of defense agencies for high-performance gas masks

- Investment in next-gen gas masks by Israel’s defense forces and allies

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035