Market Overview

The Israel Military Ground Vehicle Actuators market is valued at approximately USD ~ billion in 2024. The market growth is driven by technological advancements in the defense sector, specifically the need for high-performance actuators in military ground vehicles. These systems are crucial for enhancing mobility, precision, and operational efficiency of various military platforms, including armored vehicles, tanks, and logistics vehicles. Israel’s robust defense industry, alongside growing demand for advanced military systems, supports this growth trajectory. The actuation systems market benefits from Israel’s significant investments in defense technology, along with increased regional security concerns that prompt modernizations in defense equipment.

Several countries, including Israel, the United States, and major European nations, dominate the market. Israel holds a prominent position due to its highly developed defense sector, spearheaded by companies like Elbit Systems and Rafael Advanced Defense Systems. The nation’s continued focus on military innovation and modernization, coupled with its strategic geopolitical positioning in the Middle East, makes it a key player in the military actuators market. Israel’s continuous investment in advanced defense technologies ensures that the country remains a global leader in the development and implementation of ground vehicle actuators for military purposes.

Market Segmentation

By System Type

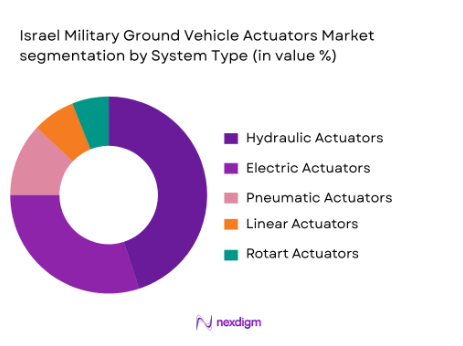

The Israel Military Ground Vehicle Actuators market is segmented by system type into hydraulic actuators, electric actuators, pneumatic actuators, linear actuators, and rotary actuators. Among these, hydraulic actuators dominate the market due to their high power density and reliability in extreme operational environments. Hydraulic actuators are preferred in military ground vehicles for their ability to manage high loads and provide robust performance in combat situations. Their efficiency in power transmission and durability under harsh conditions makes them the go-to choice for heavy-duty military applications, especially in tanks and armored vehicles. Additionally, the growing demand for increased maneuverability and operational performance in military vehicles further fuels the dominance of hydraulic actuators in this market.

By Platform Type

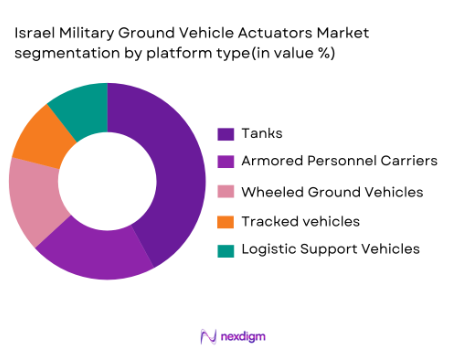

The market is also segmented by platform type into tanks, armored personnel carriers, wheeled ground vehicles, tracked vehicles, and logistics support vehicles. Tanks dominate the market share in the platform type category due to their high demand for advanced actuation systems that enhance their combat capabilities. Hydraulic actuators, in particular, are essential for the operation of critical systems such as turret movement, gun elevation, and suspension adjustments in tanks. Israel’s focus on improving tank mobility and precision, especially in terms of advanced targeting and weapon systems, ensures the continued reliance on actuators in this platform. Additionally, military spending by Israel and allied nations for tank upgrades contributes to the platform’s dominance in the market.

Competitive Landscape

The Israel Military Ground Vehicle Actuators market is highly competitive, with key players including both local and international defense contractors. Israel’s defense industry is characterized by the presence of major companies such as Elbit Systems and Rafael Advanced Defense Systems, which are at the forefront of actuator technology development for military vehicles. International players like Lockheed Martin and General Dynamics also have a significant presence in the market, given their global footprint and expertise in military vehicle systems.

The competitive landscape is marked by heavy investments in R&D, with companies focusing on developing more efficient, durable, and compact actuators for military applications. The emphasis on innovation is vital for companies aiming to meet the stringent performance requirements of modern military ground vehicles. Additionally, government contracts, joint ventures, and strategic partnerships play a crucial role in the competition within this market.

| Company Name | Establishment Year | Headquarters | Product Focus | Market Focus | R&D Investment | Government Contracts |

| Elbit Systems | 1966 | Haifa, Israel | – | – | – | – |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | – | – | – | – |

| Lockheed Martin | 1912 | Bethesda, USA | – | – | – | – |

| General Dynamics | 1952 | Falls Church, USA | – | – | – | – |

| BAE Systems | 1999 | London, UK | – | – | – | – |

Israel Military Ground Vehicle Actuators Market Dynamics

Growth Drivers

Increasing defense budgets in Israel and other regional countries

In recent years, defense budgets in Israel have significantly increased. In 2023, Israel’s defense budget was USD ~ billion, which is nearly 5.7% of its GDP. The defense spending in the country is largely driven by the need for advanced technologies, including military actuators for ground vehicles. This growth is also reflected in neighboring countries, where defense spending continues to rise amidst geopolitical tensions. The Middle East defense budget for 2023 totaled approximately USD ~ billion, with countries like Saudi Arabia and the UAE leading this surge. These investments highlight the growing importance of advanced military systems, such as actuators, to enhance the operational efficiency of military ground vehicles.

Technological advancements in actuator systems

Technological advancements in actuator systems are driving market growth by offering enhanced performance in military ground vehicles. In 2023, defense contractors in Israel and abroad have focused on integrating smart actuators that provide better fuel efficiency, more precise movements, and increased durability in challenging conditions. The adoption of AI in actuators is particularly noteworthy, as it supports the integration of autonomous features in military vehicles. For example, the Israeli defense contractor Rafael Advanced Defense Systems has advanced its actuator technologies, making them integral to the modern military vehicle systems. These advancements are catalyzed by the increasing focus on high-performance actuators and are backed by significant government-funded R&D efforts in Israel.

Market Challenges

High cost of advanced actuators

The high cost of advanced actuators remains a significant challenge in the military ground vehicle actuators market. The production of high-precision actuators requires specialized materials and manufacturing processes, making them expensive. In 2023, the cost of military-grade actuators increased due to higher raw material costs, particularly in the global semiconductor and metal markets. Israel’s defense industry, which is heavily reliant on imports for certain raw materials, is feeling the pressure of these rising costs. The cost of electronic components used in actuators has been rising steadily by 10-12% annually, contributing to the overall expense of defense equipment, including actuators. This challenge affects procurement and may delay the adoption of next-gen actuator technologies in some regions.

Supply chain disruptions in defense manufacturing

Global supply chain disruptions have impacted the timely delivery of military equipment, including actuators, to the defense sector. Since the COVID-19 pandemic, supply chain instability has continued, particularly affecting the procurement of critical raw materials for actuator manufacturing, such as metals and semiconductors. In 2023, a survey by the Israeli Ministry of Defense indicated that over 30% of defense contractors faced delays due to disruptions in the supply of these critical materials. The war in Ukraine has further strained European and Middle Eastern defense supply chains, leading to delayed production timelines for military vehicles, including those that require sophisticated actuator systems. These disruptions have become a key obstacle to scaling up actuator systems’ deployment in military platforms.

Market Opportunities

Growing need for unmanned ground vehicles

The growing need for unmanned ground vehicles (UGVs) is expected to be a key opportunity for the military ground vehicle actuators market. UGVs are increasingly used in defense operations for tasks such as reconnaissance, logistics, and bomb disposal. As of 2023, the Israeli military’s use of autonomous vehicles has expanded significantly, with the IDF (Israeli Defense Forces) investing in platforms such as the “Guardium,” an autonomous ground vehicle. The global shift towards unmanned systems is supported by advancements in actuator technologies, which allow for more precise control and movement in autonomous military platforms. In 2023, the defense budget for autonomous vehicle development in Israel was estimated at USD 1.5 billion, highlighting the potential for further growth in actuator demand driven by this sector.

Emerging demand from foreign defense markets

Israel’s advanced military technology is gaining international recognition, with several countries in Asia, Europe, and North America showing increased interest in acquiring Israeli-made military systems. In 2023, Israel’s defense exports reached USD 12 billion, with a significant portion directed toward ground vehicle systems, including those requiring sophisticated actuators. Many of these nations, particularly those in the Middle East and Eastern Europe, are looking to modernize their defense capabilities amid rising regional tensions. The demand for Israeli actuators and military technology is expected to rise, as foreign governments increasingly seek reliable, high-performance solutions for their military fleets. These international contracts present a significant opportunity for Israel’s actuator manufacturers to expand their global footprint.

Future Outlook

The Israel Military Ground Vehicle Actuators market is expected to see significant growth over the next decade, driven by increased defense spending, technological advancements in actuator systems, and the ongoing demand for more efficient and advanced military vehicles. As military modernization programs continue to evolve, the need for advanced actuator systems in ground vehicles will rise. Furthermore, geopolitical tensions in the Middle East and Israel’s position as a defense technology leader will drive investments into the development of next-generation actuators. The market is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2026 to 2035.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- General Dynamics

- BAE Systems

- Northrop Grumman

- Thales Group

- L3 Technologies

- KMW

- Oshkosh Corporation

- General Electric

- Honeywell International

- Rockwell Collins

- Parker Hannifin Corporation

- Moog Inc.

Key Target Audience

- Military and Defense Ministries (e.g., Israel Ministry of Defense)

- Defense Contractors

- Vehicle Manufacturers

- Military Technology Integrators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- System Integrators

- Military Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and mapping the key stakeholders in the Israel Military Ground Vehicle Actuators market. This is achieved through comprehensive secondary research using industry reports, government publications, and proprietary databases. The goal is to define the critical variables that influence market trends, such as technological advancements, military budgets, and defense strategies.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to understand market penetration and growth. This includes evaluating the adoption rates of actuator systems in military vehicles, and the impact of geopolitical factors on defense procurement. A combination of qualitative and quantitative data is used to project future market developments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through in-depth interviews and consultations with industry experts, including representatives from military vehicle manufacturers, defense contractors, and technology providers. These consultations help refine the market data and ensure the reliability of projections.

Step 4: Research Synthesis and Final Output

The final phase includes engaging directly with manufacturers and defense agencies to verify product performance data and market trends. This step ensures that the findings are accurate and reflect the latest developments in the industry, providing a comprehensive overview of the market dynamics and forecasted growth.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets in Israel and other regional countries

Technological advancements in actuator systems

Demand for enhanced vehicle mobility and survivability - Market Challenges

High cost of advanced actuators

Supply chain disruptions in defense manufacturing

Regulatory complexities and certification hurdles - Market Opportunities

Growing need for unmanned ground vehicles

Emerging demand from foreign defense markets

Advancements in electric actuator technology - Trends

Shift towards automation and autonomous systems

Integration of smart actuators with AI and machine learning

Development of multi-functional and hybrid actuators

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Hydraulic Actuators

Electric Actuators

Pneumatic Actuators

Linear Actuators

Rotary Actuators - By Platform Type (In Value%)

Tanks

Armored Personnel Carriers

Wheeled Ground Vehicles

Tracked Vehicles

Logistics Support Vehicles - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Upgraded Systems

Custom Fitment - By End User Segment (In Value%)

Defense Ministries

Military Vehicle Manufacturers

Vehicle Maintenance Contractors

System Integrators

Weapon System Providers - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement through Defense Contractors

Government-to-Government Sales

Indirect Procurement via Third Parties

Military Auctions and Bidding

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Pricing Strategies, Product Innovation, Geographic Reach, Customer Segments)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Plasan

TAAS

Stryker

General Dynamics

BAE Systems

KMW

Oshkosh Corporation

Northrop Grumman

Lockheed Martin

Thales Group

Raytheon Technologies

L3 Technologies

- High demand from the Israeli Defense Forces (IDF)

- Procurement trends based on military modernization programs

- Increased interest in joint military operations with allied nations

- Growing emphasis on vehicle system upgrades and retrofits

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035