Market Overview

The Israel military helicopter MRO market is valued at approximately USD ~ billion based on a recent historical assessment. The growth of this market is primarily driven by Israel’s strong defense sector, which maintains a robust fleet of military helicopters. The increasing demand for high-performance, maintenance-intensive helicopters has amplified the need for specialized MRO services. With ongoing conflicts in the region, the necessity for top-tier helicopter maintenance services has surged, contributing significantly to the market’s expansion. Furthermore, Israel’s reputation as a technological hub for military aviation and MRO solutions enhances its position in the global market.

Countries like Israel, the United States, and several European nations dominate the market due to their substantial military infrastructure and advanced aviation technology. Israel, being home to key players in the MRO industry, benefits from its strategic location in the Middle East, which drives demand for its services across the region. The U.S. military’s continued reliance on Israeli-made helicopters further strengthens the country’s market position. European countries with active military engagements, such as the U.K. and France, also rely heavily on Israel’s MRO services, further solidifying its dominance in the market.

Market Segmentation

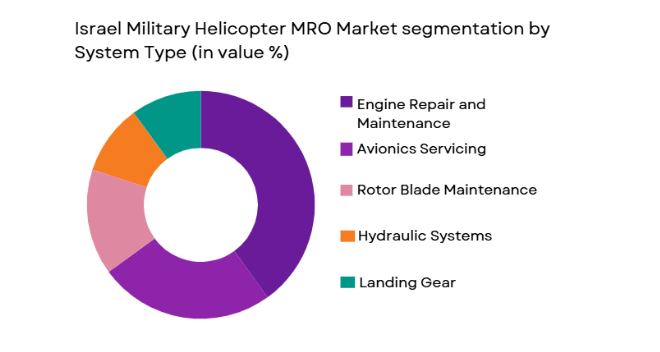

By System Type

Israel military helicopter MRO market is segmented by system type into engine repair and maintenance, avionics servicing, rotor blade maintenance, hydraulic systems, and landing gear. Recently, engine repair and maintenance has the dominant market share due to the critical need for high-quality, reliable engines in military helicopters. These engines, being the heart of any helicopter, require regular servicing to ensure operational readiness, especially in high-stress environments like military operations. The demand for specialized engine repair services has significantly increased with the growing fleet size of helicopters used by Israel and other countries in the Middle East. Furthermore, the focus on improving fuel efficiency and reducing maintenance costs has made engine servicing a priority in the military helicopter MRO market, pushing its dominant market share in this segment.

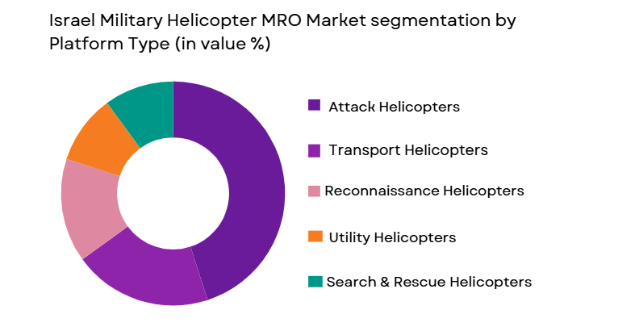

By Platform Type

Israel military helicopter MRO market is segmented by platform type into attack helicopters, transport helicopters, reconnaissance helicopters, utility helicopters, and search & rescue helicopters. Recently, the attack helicopter sub-segment has seen a dominant market share due to Israel’s heavy investment in attack helicopters such as the Apache AH-64 and the Israeli-produced Yas’ur. These helicopters are crucial in military operations and require intensive MRO services to maintain their combat readiness. The need for rapid repairs and upgrades to maintain these helicopters’ advanced capabilities, especially in high-threat environments, has driven their dominance in the market. As global military tensions rise, the demand for attack helicopters—and consequently for MRO services—remains high, securing this platform type’s leading position.

Competitive Landscape

The Israel military helicopter MRO market is characterized by moderate consolidation, with a few major players dominating the market. These players have a significant influence on the market, driven by their technological expertise, government contracts, and strategic partnerships. Consolidation is expected to continue as companies seek to expand their capabilities through mergers and acquisitions, particularly to access advanced maintenance technologies and expand their service offerings to global markets. As a result, competition remains intense, with players focusing on providing comprehensive maintenance services to meet the complex needs of military helicopter fleets.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ |

Israel Military Helicopter MRO Market Analysis

Growth Drivers

Increasing Demand for Helicopter Fleet Modernization

The growing demand for advanced military capabilities and operational readiness is driving the market for military helicopters and their MRO services. Israel, along with other nations, is investing heavily in modernizing its military helicopter fleets to ensure they remain effective in the face of emerging threats such as drones and advanced missile systems. Modern helicopters require highly specialized maintenance to maintain their complex systems, including avionics, engines, and structural components. As a result, the need for MRO services has increased, with Israel serving as a key player in the global market due to its technological expertise in helicopter manufacturing and MRO. Additionally, the development of more sophisticated helicopters has also created demand for more advanced MRO services, ensuring that fleets can operate at peak performance levels. The increasing focus on fleet modernization is one of the primary drivers of growth in the Israel military helicopter MRO market.

Technological Advancements in Helicopter Systems

The continuous technological advancements in helicopter systems, such as improved engines, avionics, and rotor technologies, have significantly contributed to the growth of the military helicopter MRO market. These advancements have led to longer maintenance intervals and higher performance standards, which in turn create the need for specialized MRO services that can handle the increasing complexity of military helicopters. Israel has been a pioneer in developing cutting-edge helicopter technologies, particularly in the areas of military avionics, weapons systems, and flight control systems. As military forces worldwide continue to demand more advanced helicopters with higher operational capabilities, the need for technologically sophisticated MRO services has risen, further fueling market growth.

Market Challenges

High Cost of MRO Services

One of the key challenges facing the Israel military helicopter MRO market is the high cost of maintenance, repair, and overhaul services. Military helicopters, particularly those used in high-performance and combat roles, are equipped with expensive and complex systems that require specialized MRO services. These services often involve high labor costs, expensive replacement parts, and prolonged downtime for repairs. As military budgets tighten and governments seek to reduce operational costs, this high expense poses a significant barrier to the growth of the MRO market. Furthermore, while advanced helicopters require more sophisticated MRO, they also need constant upgrades and repairs, which increases the cost of keeping them operational. As a result, governments and defense contractors are constantly seeking cost-effective MRO solutions, and the challenge of managing these costs while maintaining high service standards remains significant.

Shortage of Skilled Labor in MRO

Another significant challenge in the Israel military helicopter MRO market is the shortage of skilled labor required to perform complex maintenance tasks on advanced helicopters. The need for highly trained technicians and engineers, particularly in specialized areas such as avionics, rotor systems, and engine repair, has grown substantially. However, there is a limited supply of workers with the necessary skills and expertise to meet the increasing demand for military helicopter MRO services. This shortage of skilled labor not only drives up labor costs but also results in longer repair times, which affects the operational readiness of military fleets. The difficulty in recruiting and retaining highly qualified personnel is a critical challenge that could impact the market’s growth and operational efficiency in the coming years.

Opportunities

Growth in Military Helicopter Leasing

As defense budgets become more constrained, the trend toward military helicopter leasing has opened up new opportunities in the Israel military helicopter MRO market. Leasing allows military organizations to acquire high-performance helicopters without the upfront capital investment required for outright purchase. This model has been particularly attractive for nations with limited defense budgets but still need to maintain a robust military fleet. Helicopter leasing companies, in turn, require extensive MRO services to keep their fleets operational, creating an ongoing demand for maintenance contracts. Israel’s expertise in military aviation and MRO services positions it as a key provider of leasing solutions and maintenance services to international clients. As the leasing market expands, MRO services related to leased helicopters are expected to grow, providing significant opportunities for Israeli MRO providers to capitalize on this emerging trend.

Expansion of Defense Partnerships in the Asia-Pacific Region

The Asia-Pacific region is experiencing increased military spending, particularly in nations like India, Japan, and South Korea, due to rising security concerns. These countries are modernizing their military fleets, including helicopters, to enhance their defense capabilities. Israel, with its advanced helicopter MRO technology and expertise, is well-positioned to benefit from this growth in the region. Expanding defense partnerships and increasing helicopter fleet size in Asia-Pacific present substantial opportunities for Israeli companies to provide MRO services to new markets. As the region’s military forces continue to prioritize operational readiness, the demand for high-quality MRO services will rise, presenting a valuable opportunity for Israeli firms to expand their footprint in Asia-Pacific.

Future Outlook

The Israel military helicopter MRO market is poised for steady growth over the next five years, driven by the increasing demand for advanced helicopter systems and the expanding fleet of military helicopters worldwide. Technological advancements in avionics, engines, and rotor systems will continue to play a pivotal role in shaping the MRO landscape. In addition, rising defense budgets, particularly in Asia-Pacific and the Middle East, will drive demand for high-quality MRO services. Furthermore, collaborations between governments and defense contractors will support innovation in maintenance technologies, ensuring that military helicopters remain operational at peak performance levels. The increasing focus on sustainability and efficiency will also lead to the development of more cost-effective MRO solutions, making the market increasingly competitive.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Lockheed Martin

- Boeing

- Airbus Helicopters

- Sikorsky

- MD Helicopters

- Bell Helicopter

- General Electric Aviation

- Pratt & Whitney

- L3 Technologies

- Honeywell Aerospace

- Rolls-Royce

- Thales Group

- Northrop Grumman

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense ministries

- Helicopter operators

- Military fleet managers

- Aircraft maintenance organizations

- Leasing companies

Research Methodology

Step 1: Identification of Key Variables

Understanding the factors that influence the market, including technological, economic, and political elements, is the first step.

Step 2: Market Analysis and Construction

The next step involves gathering historical data and trends to construct the market model, considering all potential influencing factors.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions are sought to verify assumptions and refine market projections, ensuring accuracy.

Step 4: Research Synthesis and Final Output

The final market report is compiled, synthesizing data from all sources to provide a comprehensive analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Defense Expenditures

Technological Advancements in Helicopter Systems

Rising Military Helicopter Fleet Modernization

Enhanced Demand for Specialized MRO Services

Geopolitical Tensions Driving Helicopter Usage - Market Challenges

High Cost of Advanced Helicopter Components

Limited Availability of Skilled Labor

Complex Regulatory Compliance Standards

Supply Chain Disruptions

Long Lead Times for Helicopter Part Deliveries - Market Opportunities

Expansion of Helicopter Fleets in Developing Countries

Growth in Military Helicopter Leasing

Increasing Focus on Sustainable Aviation Technologies - Trends

Adoption of Digitalization and Automation in MRO

Integration of AI for Predictive Maintenance

Trend Toward More Efficient Turboshaft Engines

Increase in Helicopter Fleet Sustainability

Collaborations Between OEMs and MRO Providers - Government Regulations & Defense Policy

Stringent Helicopter Maintenance and Safety Standards

Government Initiatives for Defense Industry Growth

Regulations Supporting Defense Industry Innovation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Turboshaft Engines

Rotor Blades

Avionics

Landing Gear

Fuel Systems - By Platform Type (In Value%)

Attack Helicopters

Transport Helicopters

Reconnaissance Helicopters

Utility Helicopters

Search and Rescue Helicopters - By Fitment Type (In Value%)

OEM Services

Aftermarket Services

Upgrades and Refurbishments

Maintenance, Repair & Overhaul

Component Repair Services - By EndUser Segment (In Value%)

Government Agencies

Military Contractors

Private Defense Contractors

Civil Aviation Contractors

MRO Service Providers - By Procurement Channel (In Value%)

Direct Sales

Indirect Sales

Government Tenders

Partnerships and Alliances

Distribution Networks - By Material / Technology (In Value%)

Composite Materials

Metal Alloys

Advanced Aerodynamics

Fuel-Efficient Technologies

Flight Control Technologies

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Cost, Service Range, Technology Innovation, Geographic Presence, Lead Time, Fleet Maintenance Capacity, Customer Relationship, Aftermarket Services, Pricing Models, Partnership Agreements)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Lockheed Martin

Boeing

Raytheon Technologies

Northrop Grumman

Airbus Helicopters

Sikorsky

MD Helicopters

Bell Helicopter

General Electric Aviation

Pratt & Whitney

L3 Technologies

Honeywell Aerospace

Rolls-Royce

- Increasing Need for Rapid Response Capabilities

- Growing Demand for Specialized Aircraft

- Focus on Operational Efficiency in Helicopter Fleets

- Strategic Importance of Helicopter Maintenance for National Security

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035