Market Overview

The Israel Military Helmet and Helmet Mounted Display Systems market current size stands at around USD ~ million, reflecting steady expansion from earlier levels near USD ~ million driven by modernization cycles and elevated operational readiness requirements. Recent procurement programs have supported the deployment of ~ systems across frontline and reserve units, while cumulative installed base has crossed ~ systems nationally. Annual capital allocation linked to wearable combat technologies has reached USD ~ million, underpinned by consistent upgrade cycles in aviation and special operations forces.

Demand concentration remains strongest around Tel Aviv, Haifa, and Beersheba due to proximity to major defense primes, air bases, and advanced R&D clusters. These regions benefit from dense integration between military units, avionics laboratories, and optoelectronics manufacturing hubs. Mature testing infrastructure, rapid prototyping ecosystems, and streamlined defense procurement channels reinforce regional dominance. Policy alignment toward indigenous innovation and export readiness further strengthens local adoption, making these centers the primary drivers of system integration and lifecycle support.

Market Segmentation

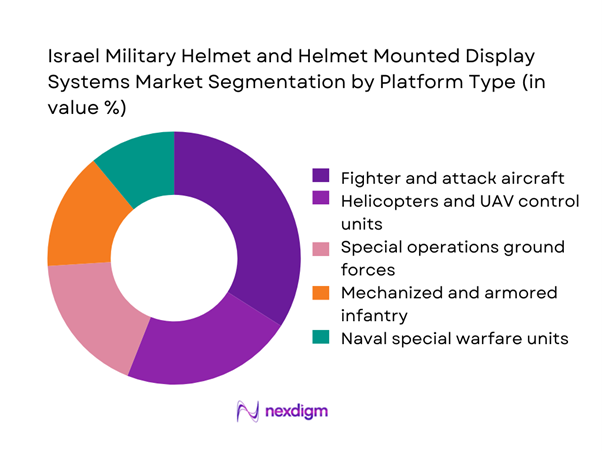

By Platform Type

The market is dominated by air and special operations platforms, where advanced helmet mounted display systems are critical for mission success in complex threat environments. Fighter and rotary-wing aviation units account for a substantial portion of total deployments, driven by the integration of sensor fusion, night vision, and precision cueing into pilot helmets. Ground forces, particularly special operations and urban warfare units, are also increasing adoption as wearable displays become lighter and more ergonomic. Ongoing replacement of legacy optical systems with digital and augmented reality-enabled helmets is accelerating penetration across elite units. With ~ systems added annually through modernization programs, platform-based demand continues to skew toward high-performance operational segments rather than mass infantry deployment.

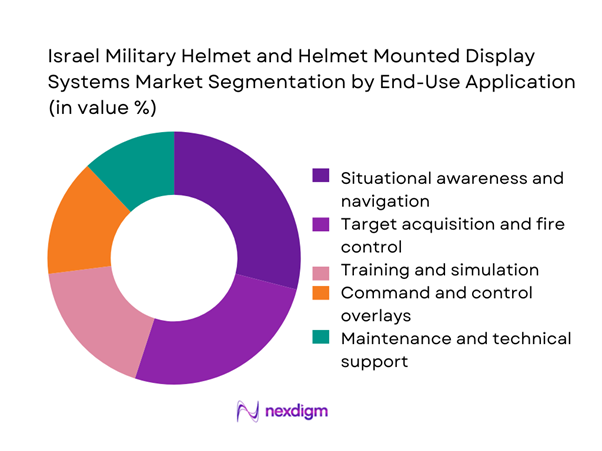

By End-Use Application

Operational use cases centered on situational awareness and targeting dominate overall adoption patterns. Helmet mounted displays are increasingly deployed to enable real-time battlefield visualization, reducing response times and improving coordination across units. Training and simulation applications are also gaining traction, as defense institutions invest in immersive environments to shorten learning curves and improve mission readiness. Command and control overlays for urban and asymmetric warfare are emerging as a high-growth segment, supported by network-centric doctrine. With annual deployment volumes exceeding ~ units across active formations, application-driven demand is shifting from basic vision enhancement to advanced decision-support roles, positioning the technology as a core component of digital soldier and pilot ecosystems.

Competitive Landscape

The market is moderately concentrated, led by a small group of defense technology leaders with deep integration into national military programs and strong export pipelines. High entry barriers related to certification, avionics integration, and cybersecurity compliance limit new competition, reinforcing the dominance of established players with proven operational track records and long-term defense contracts.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Helmet and Helmet Mounted Display Systems Market Analysis

Growth Drivers

Rising emphasis on soldier situational awareness and survivability

Enhanced battlefield complexity has driven the deployment of ~ advanced helmet and display systems across frontline units, with operational programs supporting the integration of digital vision, threat alerts, and real-time navigation aids. National defense budgets have allocated USD ~ million annually toward wearable combat technologies, enabling the rollout of ~ systems for infantry, aviation, and special forces. Field exercises involving ~ personnel each year increasingly rely on helmet mounted displays to reduce reaction times and improve mission coordination. This operational shift has elevated demand for lightweight, ruggedized systems capable of functioning in extreme environments while maintaining uninterrupted data flow across tactical networks.

Modernization of combat aviation and helicopter fleets

Fleet upgrade initiatives involving ~ aircraft platforms have accelerated adoption of next-generation helmet mounted displays in both fixed-wing and rotary segments. Aviation modernization programs have directed USD ~ million toward cockpit digitization, with helmet-based cueing systems becoming standard for navigation and targeting. Each new aircraft induction cycle supports the installation of ~ helmet systems, expanding the installed base across squadrons. Training pipelines processing ~ pilots annually now incorporate advanced display helmets as a core requirement, reinforcing demand continuity. This modernization trajectory positions aviation as the largest single contributor to system upgrades over the medium term.

Challenges

High unit costs and constrained defense budgets

Advanced helmet mounted display systems involve per-unit expenditures near USD ~ million for fully integrated configurations, limiting large-scale deployment across conventional forces. Annual procurement cycles typically support only ~ systems due to competing priorities such as armored vehicles, missiles, and cyber defense. Budgetary trade-offs have delayed replacement schedules, extending the service life of ~ legacy helmets beyond optimal operational thresholds. Smaller units often face allocation gaps, reducing uniformity of equipment across formations. These fiscal constraints slow penetration in non-elite segments despite clear operational benefits.

Complex integration with legacy platforms and avionics

Integration challenges persist as ~ aircraft and armored platforms continue to operate on legacy avionics architectures incompatible with modern display interfaces. Retrofitting requires system-level upgrades costing USD ~ million per platform, adding to program timelines and certification complexity. Each integration cycle can involve ~ months of testing and validation, delaying field deployment. In ground forces, ~ communication standards remain fragmented, complicating seamless data flow to helmet displays. These technical hurdles increase project risk and deter rapid scaling across mixed-generation fleets.

Opportunities

Next-generation augmented reality and AI-assisted displays

The shift toward augmented reality and AI-enabled cueing opens pathways for the deployment of ~ advanced helmet systems capable of predictive threat identification and automated navigation guidance. Development programs have attracted USD ~ million in annual innovation funding focused on sensor fusion and machine learning overlays. Pilot trials involving ~ operators demonstrate measurable improvements in task completion times and situational accuracy. As computing modules shrink and power efficiency improves, next-generation helmets are expected to reach broader units, creating sustained demand for upgrades and new installations.

Upgrades and retrofits for existing pilot and soldier fleets

With an installed base exceeding ~ helmet systems across services, retrofit programs represent a major growth avenue. Upgrade packages priced near USD ~ million per batch enable the addition of night vision, thermal imaging, and secure connectivity without full system replacement. Annual retrofit cycles covering ~ units allow defense planners to extend asset lifecycles while improving operational capability. This approach reduces capital strain and accelerates adoption of incremental innovations, positioning retrofits as a strategic lever for modernization in budget-constrained environments.

Future Outlook

The market is set to evolve toward fully networked, AI-enabled wearable combat systems that integrate seamlessly with national digital battlefield architectures. Over the coming decade, procurement strategies will increasingly favor modular upgrades and software-driven capability expansion. Export demand is expected to reinforce domestic production volumes, while collaboration with allied defense programs will shape technology standards. As operational doctrines emphasize speed, precision, and survivability, helmet mounted display systems will remain central to force modernization initiatives.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- L3Harris Technologies

- Thales Group

- BAE Systems

- Collins Aerospace

- Honeywell Aerospace

- Gentex Corporation

- Safran Electronics & Defense

- Leonardo

- Rheinmetall Defence

- Aselsan

- Hensoldt

- Teledyne FLIR Defense

Key Target Audience

- Israel Ministry of Defense procurement divisions

- Israeli Defense Forces ground, air, and naval command units

- Defense electronics and avionics manufacturers

- Homeland security and border protection agencies

- Export control and defense trade authorities

- System integrators and MRO providers

- Investments and venture capital firms focused on defense technology

- Government and regulatory bodies including SIBAT and the Defense Export Controls Agency

Research Methodology

Step 1: Identification of Key Variables

Assessment of operational deployment patterns, modernization cycles, and procurement volumes across air, land, and naval forces. Mapping of technology adoption rates for helmet mounted displays and wearable combat electronics. Evaluation of funding flows and policy priorities shaping defense equipment upgrades.

Step 2: Market Analysis and Construction

Compilation of installation volumes, installed base estimates, and upgrade frequencies across major platforms. Structuring of demand scenarios based on fleet renewal and retrofit pathways. Alignment of market boundaries with operational and budgetary frameworks.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with defense technology specialists and former procurement officers. Validation of integration timelines, certification barriers, and lifecycle cost dynamics. Cross-checking of demand assumptions with field deployment realities.

Step 4: Research Synthesis and Final Output

Integration of quantitative indicators with qualitative operational insights. Development of coherent market narratives and strategic implications. Final validation to ensure consistency across segmentation, analysis, and outlook.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military helmet and HMD system taxonomy across pilot and ground soldier applications, market sizing logic by force modernization programs and unit deployment, revenue attribution across equipment upgrades spares and support services, primary interview program with defense forces OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and mission usage pathways

- Defense ecosystem structure

- Supply chain and procurement channel structure

- Regulatory and export control environment

- Growth Drivers

Rising emphasis on soldier situational awareness and survivability

Modernization of combat aviation and helicopter fleets

Integration of network-centric warfare and digital battlefield concepts

Increased special operations and urban warfare requirements

Government focus on indigenous defense technology development

Export demand for Israeli-developed helmet and HMD solutions - Challenges

High unit costs and constrained defense budgets

Complex integration with legacy platforms and avionics

Cybersecurity and data integrity risks in networked systems

Weight, ergonomics, and user fatigue concerns

Supply chain dependence on advanced optics and semiconductors

Stringent export control and international compliance barriers - Opportunities

Next-generation augmented reality and AI-assisted displays

Upgrades and retrofits for existing pilot and soldier fleets

Growing demand from allied and partner nations

Dual-use applications in homeland security and law enforcement

Modular open-architecture systems for faster customization

Lifecycle service, MRO, and software upgrade revenues - Trends

Shift toward panoramic and wide field-of-view HMDs

Increasing use of sensor fusion and AI-based threat cueing

Adoption of lightweight composite and smart materials

Expansion of simulation-linked training helmets

Move toward open systems architecture and interoperability

Greater emphasis on cyber-hardened wearable electronics - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Infantry ground forces

Special operations forces

Armored and mechanized units

Army aviation units

Air force fast-jet squadrons

Naval and maritime special units - By Application (in Value %)

Day and night situational awareness

Target acquisition and fire control cueing

Pilotage and navigation

Training and simulation

Command and control integration

Augmented reality mission overlays - By Technology Architecture (in Value %)

Monocular HMD systems

Binocular and panoramic HMD systems

Optical see-through displays

Video see-through displays

Hybrid AR display architectures

Integrated sensor-fused helmets - By End-Use Industry (in Value %)

Army and ground combat units

Air force and combat aviation

Naval forces and special warfare

Homeland security and border protection

Defense training institutions - By Connectivity Type (in Value %)

Wired tethered systems

Wireless low-latency RF systems

Mesh network-enabled helmets

Platform-integrated avionics links

Edge-compute enabled systems - By Region (in Value %)

Northern Command

Central Command

Southern Command

Air bases and aviation commands

Naval bases and maritime zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (field of view, system weight, sensor fusion capability, night vision integration, latency performance, ruggedization standards, interoperability with C4ISR, lifecycle support model)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

L3Harris Technologies

Thales Group

BAE Systems

Collins Aerospace

Honeywell Aerospace

Gentex Corporation

Safran Electronics & Defense

Leonardo

Rheinmetall Defence

Aselsan

Hensoldt

Teledyne FLIR Defense

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035