Market Overview

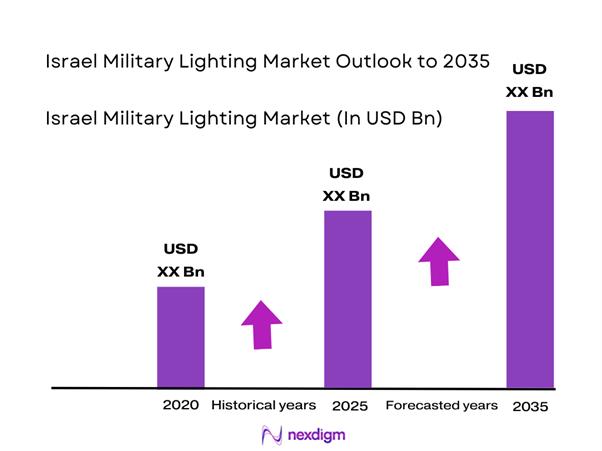

The Israel Military Lighting Market market current size stands at around USD ~ million, reflecting steady expansion driven by platform modernization and operational readiness programs. Recent periods recorded spending levels of USD ~ million and USD ~ million across new installations and retrofit activities. Deployment volumes reached ~ systems annually, supported by ~ units of portable and vehicle-mounted lighting entering service. Investments in ruggedized LED and infrared-compatible solutions accounted for USD ~ million, while average contract values stabilized near USD ~ million across multi-year procurement cycles.

The market shows strong concentration in major defense and aerospace hubs, where advanced manufacturing clusters and defense procurement offices drive sustained demand. Dominance stems from mature defense infrastructure, high operational intensity, and an ecosystem of integrators, electronics suppliers, and certification bodies. Policy emphasis on indigenous capability development and rapid deployment readiness further accelerates adoption. Close coordination between armed forces, domestic manufacturers, and technology partners strengthens the value chain and ensures consistent demand for next-generation military lighting systems.

Market Segmentation

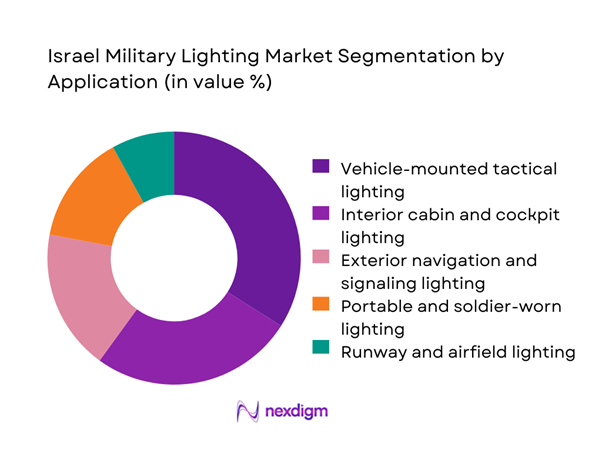

By Application

Vehicle-mounted tactical lighting dominates the Israel Military Lighting Market due to continuous fleet modernization and the need for enhanced visibility in complex operational environments. Demand is reinforced by increasing deployment of armored vehicles, patrol units, and rapid-response platforms that require robust, low-signature lighting systems. Interior cockpit and cabin lighting also maintains strong uptake, supported by ongoing upgrades across aviation and naval fleets. The emphasis on soldier safety and situational awareness drives steady procurement of portable and wearable lighting solutions. Infrastructure investments in airfields and naval bases further sustain demand for runway and deck lighting, consolidating application-based leadership across land, air, and maritime domains.

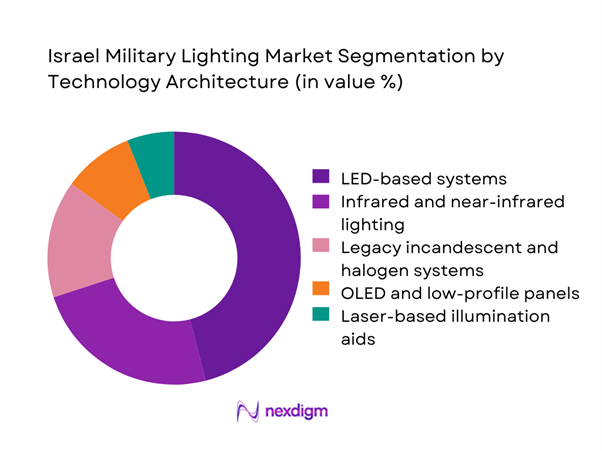

By Technology Architecture

LED-based systems lead the Israel Military Lighting Market as defense agencies prioritize energy efficiency, extended service life, and reduced maintenance cycles. The rapid replacement of legacy incandescent and halogen units continues to reshape procurement strategies, with solid-state lighting becoming the default choice across platforms. Infrared and near-infrared lighting solutions hold strong relevance due to widespread night-vision operations, particularly in border security and special forces missions. Emerging interest in modular and low-profile lighting architectures supports gradual adoption of OLED panels in confined cockpit and cabin environments. This technology-driven shift aligns with long-term defense objectives focused on resilience, interoperability, and reduced logistical burden.

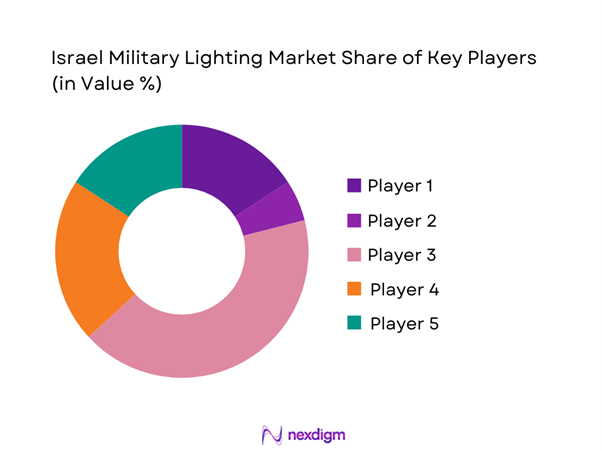

Competitive Landscape

The Israel Military Lighting Market exhibits a moderately concentrated structure, characterized by a mix of large defense integrators and specialized aerospace electronics manufacturers. Competitive positioning is shaped by long-term defense contracts, platform integration capabilities, and compliance with stringent military standards, creating high entry barriers for new participants.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Lighting Market Analysis

Growth Drivers

Rising modernization of Israeli defense platforms

The Israel Military Lighting Market benefits from sustained investment in upgrading land, air, and naval platforms, with recent modernization programs allocating USD ~ million toward avionics, vehicle electronics, and mission-critical subsystems. In the latest operational cycles, ~ systems of next-generation lighting were integrated into armored vehicles and patrol fleets, while aviation upgrades accounted for ~ units of cockpit and exterior illumination modules. These modernization efforts increased annual deployment volumes by ~ units across multiple service branches, strengthening demand continuity and reinforcing the role of lighting systems as essential components in platform lifecycle upgrades.

Expansion of night operations and low-visibility missions

Operational requirements for enhanced night-time effectiveness have driven the adoption of infrared-compatible and low-signature lighting solutions. Recent defense readiness programs deployed ~ systems of night-vision compatible lighting across border surveillance units and special operations teams. Annual procurement budgets for tactical illumination reached USD ~ million, supporting ~ units of portable and vehicle-mounted systems optimized for low-visibility conditions. The growing frequency of night patrols and rapid-response missions continues to elevate the strategic importance of advanced military lighting, ensuring consistent replacement and upgrade cycles within the Israel Military Lighting Market.

Challenges

High qualification and certification costs for military-grade lighting

Compliance with stringent military standards significantly raises development and certification expenditures. Recent product qualification cycles required USD ~ million in testing and validation spending, while certification timelines extended across ~ months for complex lighting assemblies. These costs impact smaller suppliers disproportionately, limiting market entry and slowing innovation cycles. Annual compliance-related expenses for established manufacturers exceed USD ~ million, affecting pricing flexibility and procurement timelines. The cumulative financial burden of meeting ruggedization, electromagnetic compatibility, and safety benchmarks remains a structural challenge across the Israel Military Lighting Market.

Lengthy defense procurement and approval cycles

Defense acquisition processes involve multi-layered evaluations, often extending procurement timelines by ~ months from tender release to contract award. In recent cycles, approval delays affected ~ units of planned lighting deployments across land and naval platforms. Administrative and technical review stages added operational costs of USD ~ million annually, creating cash flow pressures for suppliers. Extended procurement windows also slow technology refresh rates, limiting rapid adoption of advanced lighting architectures and constraining responsiveness to evolving mission requirements within the Israel Military Lighting Market.

Opportunities

Retrofit and upgrade programs for aging fleets

A significant portion of operational platforms continues to rely on legacy lighting systems, creating strong retrofit potential. Recent upgrade initiatives allocated USD ~ million to replace ~ units of outdated incandescent and halogen fixtures with modern LED and infrared-compatible alternatives. Ground vehicle programs alone accounted for ~ systems retrofitted annually, while naval and aviation fleets followed with parallel upgrade schedules. These retrofit cycles extend platform service life and improve operational safety, positioning the Israel Military Lighting Market to benefit from steady aftermarket demand.

Rising adoption of smart and adaptive lighting solutions

The integration of adaptive brightness control, sensor-linked illumination, and platform network connectivity is opening new growth avenues. Recent pilot deployments introduced ~ systems of smart lighting across training and operational units, supported by investments of USD ~ million in digital integration and software interfaces. These solutions reduce power consumption and enhance situational awareness, particularly in multi-domain operations. As defense agencies scale digital battlefield initiatives, demand for intelligent lighting architectures is expected to accelerate across the Israel Military Lighting Market.

Future Outlook

The Israel Military Lighting Market is set to progress steadily as defense modernization, digital battlefield initiatives, and operational readiness priorities converge. Continued emphasis on night operations and platform upgrades will sustain demand across land, air, and maritime segments. Localization of production and stronger public-private collaboration are expected to enhance supply chain resilience. Over the coming decade, smart and adaptive lighting technologies will increasingly shape procurement strategies and competitive differentiation.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- BAE Systems

- L3Harris Technologies

- Collins Aerospace

- Honeywell Aerospace

- Safran Electronics & Defense

- Thales Group

- Rheinmetall Defence

- Astronics Corporation

- Cobham Aerospace Communications

- AMETEK Aerospace & Defense

- General Dynamics Mission Systems

- Astronautics Corporation of America

Key Target Audience

- Defense ministries and armed forces procurement divisions

- Border security and internal security agencies

- Aerospace and naval platform integrators

- Military vehicle and equipment manufacturers

- Maintenance, repair, and overhaul organizations

- Investments and venture capital firms focused on defense technologies

- Ministry of Defense Procurement Administration

- Israel Defense Forces Technology and Logistics Directorate

Research Methodology

Step 1: Identification of Key Variables

Key demand indicators were mapped across platform modernization, operational intensity, and technology adoption. Supply-side variables included manufacturing capacity, certification cycles, and integration capabilities. Regulatory and compliance frameworks were incorporated to assess entry barriers and cost structures.

Step 2: Market Analysis and Construction

Historical deployment patterns and procurement cycles were analyzed to establish baseline demand. Segment-level performance was evaluated across application and technology architectures. Ecosystem linkages between defense agencies and suppliers were examined to define value flows.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through structured discussions with defense procurement specialists. Technology adoption pathways were cross-checked with system integrators and maintenance units. Operational feedback loops were incorporated to refine demand projections.

Step 4: Research Synthesis and Final Output

Quantitative and qualitative insights were consolidated into a unified market framework. Strategic implications were derived for stakeholders across the value chain. Findings were structured to support decision-making and long-term planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military lighting system taxonomy across aircraft vehicle and soldier borne applications, market sizing logic by platform modernization programs and unit deployment, revenue attribution across equipment upgrades spares and support services, primary interview program with defense forces OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care and usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising modernization of Israeli defense platforms

Expansion of night operations and low-visibility missions

Shift toward energy-efficient and long-life LED systems

Increasing integration of lighting with ISR and C4ISR platforms

Growing demand for ruggedized and MIL-STD compliant equipment

Higher focus on soldier safety and situational awareness - Challenges

High qualification and certification costs for military-grade lighting

Lengthy defense procurement and approval cycles

Budget constraints and shifting defense priorities

Supply chain risks for specialized electronic components

Compatibility issues with legacy platforms

Export restrictions and compliance with international regulations - Opportunities

Retrofit and upgrade programs for aging fleets

Rising adoption of smart and adaptive lighting solutions

Export potential to allied defense forces

Growth in unmanned systems requiring specialized lighting

Integration with wearable technologies for soldiers

Public-private partnerships for defense innovation - Trends

Transition from incandescent to solid-state lighting

Increased use of infrared-compatible lighting for NVG operations

Development of modular and scalable lighting architectures

Focus on lightweight and compact form factors

Greater emphasis on cybersecurity in connected lighting systems

Localization of production to strengthen defense supply chains - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Army and ground forces

Naval forces

Air force and aviation units

Special operations forces

Homeland security and border protection - By Application (in Value %)

Interior cabin and cockpit lighting

Exterior navigation and signaling lighting

Vehicle-mounted tactical lighting

Runway and airfield lighting

Portable and soldier-worn lighting - By Technology Architecture (in Value %)

LED-based systems

OLED and low-profile lighting panels

Laser-based illumination and targeting aids

Infrared and near-infrared lighting for night operations

Legacy incandescent and halogen systems - By End-Use Industry (in Value %)

Defense forces and armed services

Paramilitary and internal security agencies

Aerospace maintenance and retrofit organizations

Naval shipyards and maritime integrators

Defense training and simulation centers - By Connectivity Type (in Value %)

Standalone lighting systems

Wired networked systems

Wireless and remote-controlled lighting

Vehicle and platform-integrated bus systems - By Region (in Value %)

Domestic market Israel

North America

Europe

Asia Pacific

Middle East and Africa

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, MIL-STD compliance, NVG compatibility, power efficiency, ruggedization level, integration capability, local content, lifecycle support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Astronautics Corporation of America

BAE Systems

L3Harris Technologies

Collins Aerospace

Honeywell Aerospace

Safran Electronics & Defense

Thales Group

Rheinmetall Defence

Cobham Aerospace Communications

Astronics Corporation

General Dynamics Mission Systems

AMETEK Aerospace & Defense

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035