Market Overview

The Israel military multirole aircraft market current size stands at around USD ~ million, reflecting sustained defense modernization programs and active fleet renewal initiatives. Recent procurement and upgrade activity has supported annual spending levels of approximately USD ~ million, with cumulative platform acquisition volumes nearing ~ units. Operational readiness investments account for close to USD ~ million, while avionics and mission systems upgrades represent nearly USD ~ million in additional defense allocation across the current planning cycle.

The market is predominantly centered in Tel Aviv, Beersheba, and Haifa due to the concentration of air bases, defense manufacturing clusters, and advanced aerospace R&D facilities. These regions benefit from strong integration between the air force, domestic OEMs, and technology partners. High operational tempo, continuous pilot training demand, and a mature maintenance ecosystem further reinforce regional dominance, supported by a policy environment that prioritizes indigenous capability development and long-term defense self-reliance.

Market Segmentation

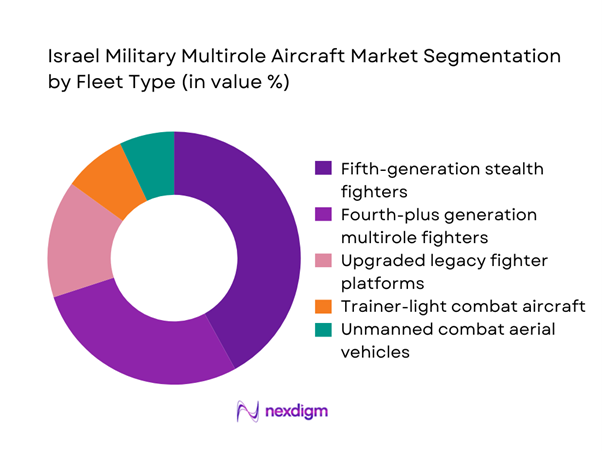

By Fleet Type

Fifth-generation stealth fighters dominate the Israel military multirole aircraft market, driven by strategic emphasis on air superiority, survivability, and deep-strike capability. These platforms receive the highest share of modernization budgets due to their advanced sensor fusion, low observability, and network-centric warfare roles. Fourth-plus generation fighters retain relevance through extensive upgrade programs that extend service life and integrate new mission systems. Upgraded legacy platforms continue to serve in secondary combat and training roles, while light combat aircraft address cost-efficient patrol and border security needs. The growing adoption of unmanned combat aerial vehicles complements manned fleets, enhancing operational flexibility and reducing pilot risk in high-threat environments.

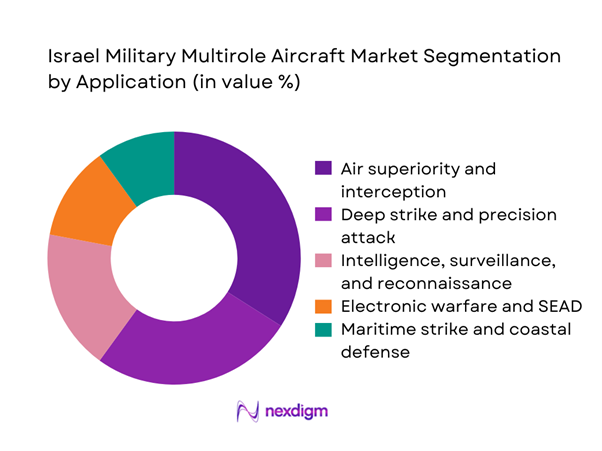

By Application

Air superiority and interception remain the primary application focus, driven by persistent regional security challenges and the need for rapid response capabilities. Precision strike missions follow closely, reflecting the increasing reliance on surgical operations and long-range engagement. Intelligence, surveillance, and reconnaissance applications benefit from advanced sensor payloads and data fusion, strengthening situational awareness across multiple theaters. Electronic warfare and suppression of enemy air defenses gain prominence as airspaces become more contested, while maritime strike roles grow in importance due to offshore infrastructure protection and coastal security requirements. This diversified application mix underscores the multirole nature of modern combat aircraft in Israel’s defense strategy.

Competitive Landscape

The Israel military multirole aircraft market is moderately concentrated, characterized by the presence of a few global aerospace leaders alongside strong domestic defense manufacturers. Strategic partnerships, technology transfer agreements, and long-term support contracts define competitive positioning, while high entry barriers related to certification, security clearances, and lifecycle service capability limit new participants.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense, Space & Security | 2002 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Multirole Aircraft Market Analysis

Growth Drivers

Accelerated modernization of Israel Air Force combat fleet

Accelerated fleet modernization continues to drive sustained demand for advanced multirole aircraft, with annual capital allocation exceeding USD ~ million across recent procurement cycles. Replacement of aging platforms has resulted in the induction of nearly ~ new systems, while upgrade programs for existing aircraft account for an additional USD ~ million in avionics and mission system investments. Maintenance and sustainment budgets have expanded to approximately USD ~ million annually, supporting high operational readiness levels. These modernization initiatives are further reinforced by infrastructure expansion at key air bases, where support facility development has reached close to ~ operational assets across major squadrons.

Rising regional security threats and asymmetric warfare dynamics

Persistent security challenges have intensified operational deployment rates, driving the need for higher fleet availability and rapid response capability. Annual sortie generation has increased by nearly ~ missions, necessitating additional aircraft readiness investments of around USD ~ million. The growing complexity of asymmetric threats has accelerated spending on electronic warfare and defensive systems, now representing close to USD ~ million in cumulative upgrades. Enhanced border security operations have also expanded patrol coverage by approximately ~ operational zones, increasing demand for multirole platforms capable of both combat and reconnaissance roles within a single mission profile.

Challenges

High capital expenditure and long procurement cycles

The acquisition of next-generation multirole aircraft requires significant upfront investment, with single-platform procurement values often exceeding USD ~ million. Long development and delivery timelines, extending across ~ planning phases, constrain rapid fleet expansion. Annual defense budgeting must accommodate not only acquisition costs but also lifecycle expenses nearing USD ~ million for sustainment and upgrades. These financial pressures can delay modernization schedules, particularly when competing defense priorities demand allocation of an additional USD ~ million toward missile defense and cyber capabilities, reducing flexibility for aviation programs.

Export control and international regulatory constraints

Strict export control regimes and cross-border compliance requirements introduce complexity into aircraft acquisition and technology integration. Regulatory approval processes can extend over ~ review cycles, delaying platform induction and system upgrades. Compliance-related administrative and legal costs now represent close to USD ~ million annually for defense aviation programs. Restrictions on sensitive subsystems also necessitate alternative sourcing strategies, increasing integration timelines by nearly ~ months and adding logistical overhead valued at approximately USD ~ million, ultimately affecting operational readiness targets.

Opportunities

Development of indigenous avionics and mission systems

Expanding domestic development of avionics and mission systems presents a strategic opportunity to enhance self-reliance and reduce dependency on foreign suppliers. Current investment in indigenous aerospace electronics exceeds USD ~ million, supporting the deployment of nearly ~ locally developed subsystems across active fleets. These initiatives shorten upgrade cycles by approximately ~ integration stages and improve customization for mission-specific requirements. Over recent periods, locally produced systems have already reduced external procurement expenditure by close to USD ~ million, demonstrating strong economic and strategic value for future multirole aircraft programs.

Expansion of upgrade and retrofit programs for legacy fleets

Upgrade and retrofit programs offer a cost-effective pathway to extend platform service life while maintaining combat relevance. Annual retrofit spending now approaches USD ~ million, covering avionics refresh, structural reinforcement, and weapons integration for nearly ~ aircraft. These programs deliver capability enhancements at a fraction of full replacement costs, saving approximately USD ~ million per platform. By increasing fleet availability through ~ additional operational cycles, retrofit initiatives strengthen force readiness and provide a scalable solution during periods of constrained acquisition budgets.

Future Outlook

The Israel military multirole aircraft market is expected to remain strategically important through the coming decade as defense priorities continue to emphasize air dominance and technological superiority. Ongoing modernization programs, combined with greater integration of unmanned and manned systems, will shape future procurement strategies. Policy support for domestic aerospace innovation and deeper collaboration with allied defense partners will further strengthen market resilience. Overall, the outlook reflects sustained investment momentum and a continued shift toward advanced, network-enabled combat aviation capabilities.

Major Players

- Lockheed Martin

- Boeing Defense, Space & Security

- Northrop Grumman

- Dassault Aviation

- Saab

- Airbus Defence and Space

- BAE Systems

- Leonardo

- Elbit Systems

- Israel Aerospace Industries

- General Dynamics

- Sukhoi

- Chengdu Aircraft Industry Group

- Mitsubishi Heavy Industries

- Korea Aerospace Industries

Key Target Audience

- Israel Ministry of Defense Procurement Directorate

- Israel Air Force Headquarters and Operational Commands

- Directorate of Defense Research and Development

- Foreign Military Sales coordination offices

- Defense-focused investments and venture capital firms

- Government export control and regulatory bodies such as the Defense Export Controls Agency

- Aerospace maintenance, repair, and overhaul service providers

- Strategic defense technology integrators and system suppliers

Research Methodology

Step 1: Identification of Key Variables

Assessment of platform types, mission profiles, and operational requirements shaping demand. Mapping of procurement cycles, upgrade schedules, and lifecycle management practices. Identification of regulatory, geopolitical, and technology adoption factors influencing market structure.

Step 2: Market Analysis and Construction

Compilation of defense spending patterns, fleet composition data, and modernization programs. Structuring of market segments based on fleet type and operational application. Alignment of qualitative insights with quantitative indicators to ensure balanced analysis.

Step 3: Hypothesis Validation and Expert Consultation

Engagement with defense aviation specialists and operational planners for scenario validation. Cross-verification of technology adoption trends and procurement priorities. Refinement of assumptions through iterative feedback and domain expertise.

Step 4: Research Synthesis and Final Output

Integration of strategic, operational, and financial insights into a cohesive narrative. Standardization of findings to ensure consistency across all sections. Final validation of conclusions to support actionable decision-making.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, multirole aircraft platform taxonomy across fighter and strike roles, market sizing logic by fleet strength and procurement cycles, revenue attribution across aircraft deliveries upgrades and MRO services, primary interview program with defense operators OEMs and integrators, data triangulation validation assumptions and limitations)

- Definition and scope of multirole combat aircraft within Israel’s defense aviation framework

- Evolution of Israel’s air power doctrine and platform modernization cycles

- Operational use cases across air superiority, strike, ISR, and homeland defense missions

- Defense aerospace ecosystem structure including OEMs, MROs, and avionics suppliers

- Domestic and international supply chain dynamics and offset frameworks

- Defense procurement policies and export control environment

- Growth Drivers

Accelerated modernization of Israel Air Force combat fleet

Rising regional security threats and asymmetric warfare dynamics

Growing emphasis on air dominance and long-range strike capabilities

Government prioritization of defense self-reliance and technology leadership

Expansion of joint programs with allied air forces

Increasing adoption of network-centric and AI-enabled combat systems - Challenges

High capital expenditure and long procurement cycles

Export control and international regulatory constraints

Supply chain vulnerabilities for advanced avionics and engines

Rising lifecycle and sustainment costs of next-generation platforms

Skilled workforce shortages in advanced aerospace engineering

Geopolitical risks affecting international collaboration programs - Opportunities

Development of indigenous avionics and mission systems

Expansion of upgrade and retrofit programs for legacy fleets

Export potential to allied and emerging air forces

Growth in MRO and lifecycle support services

Integration of unmanned teaming concepts with manned fighters

Participation in multinational fighter development initiatives - Trends

Shift toward fifth-generation and stealth-capable aircraft

Increased use of digital twins and predictive maintenance

Adoption of open-systems architecture for rapid upgrades

Growing role of electronic warfare and cyber capabilities

Integration of manned-unmanned teaming doctrines

Emphasis on sustainability and fuel efficiency in military aviation - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fifth-generation stealth fighters

Fourth-plus generation multirole fighters

Upgraded legacy fighter platforms

Trainer-light combat aircraft

Unmanned combat aerial vehicles - By Application (in Value %)

Air superiority and interception

Deep strike and precision attack

Intelligence, surveillance, and reconnaissance

Electronic warfare and suppression of enemy air defenses

Maritime strike and coastal defense - By Technology Architecture (in Value %)

Stealth-optimized airframes

Open-architecture avionics suites

Sensor fusion and AI-enabled mission systems

Advanced propulsion and thrust vectoring

Integrated electronic warfare and cyber-resilience systems - By End-Use Industry (in Value %)

Air force combat aviation units

Joint forces and special operations commands

Defense training and evaluation squadrons

Export and allied cooperation programs - By Connectivity Type (in Value %)

Secure line-of-sight datalinks

Beyond-line-of-sight satellite communications

Network-centric warfare integration platforms

Cloud-enabled mission planning systems - By Region (in Value %)

Israel domestic defense procurement

North America defense collaboration

Europe strategic partnerships

Asia-Pacific export markets

Middle East allied modernization programs

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (combat radius, payload capacity, avionics maturity, electronic warfare capability, unit acquisition cost, lifecycle cost, delivery lead time, local industrial participation)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Boeing

Northrop Grumman

Dassault Aviation

Saab

Airbus Defence and Space

BAE Systems

Leonardo

Elbit Systems

Israel Aerospace Industries

General Dynamics

Sukhoi

Chengdu Aircraft Industry Group

Mitsubishi Heavy Industries

Korea Aerospace Industries

- Demand and utilization drivers within national defense strategy

- Procurement and tender dynamics in defense acquisition programs

- Buying criteria and vendor evaluation frameworks

- Budget allocation cycles and defense financing preferences

- Implementation risks and operational integration barriers

- Post-purchase support, upgrades, and service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035