Market Overview

The Israel Military Navigation Systems Market current size stands at around USD ~ million, reflecting sustained procurement momentum and modernization cycles across defense platforms. In the most recent assessment periods, annual spending on navigation subsystems reached approximately USD ~ million, while cumulative deployments exceeded ~ systems across air, land, and naval forces. Ongoing upgrades of mission-critical platforms supported incremental additions of ~ systems annually, reinforcing the market’s stable demand base and long-term technology refresh trajectory.

Market activity is concentrated in defense technology clusters around Tel Aviv, Haifa, and Beersheba, where mature aerospace, electronics, and cybersecurity ecosystems support advanced navigation system development. These regions benefit from dense supplier networks, proximity to military testing facilities, and strong alignment with national defense priorities. Policy emphasis on indigenous capability building, combined with export-oriented defense manufacturing frameworks, has further strengthened local production and system integration capabilities, reinforcing Israel’s role as a regional hub for military navigation innovation.

Market Segmentation

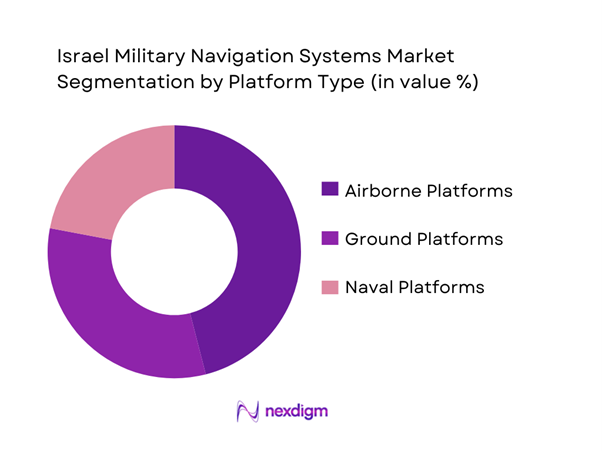

By Platform Type

Airborne platforms dominate demand in the Israel Military Navigation Systems Market due to sustained investments in fighter aircraft upgrades, unmanned aerial vehicles, and intelligence, surveillance, and reconnaissance fleets. These platforms require highly resilient navigation solutions capable of operating in contested environments, driving higher system value per deployment. Ground forces represent the second-largest segment, supported by modernization of armored vehicles and tactical mobility units. Naval applications continue to expand steadily, particularly in coastal defense and submarine navigation, but overall value concentration remains strongest in aerial deployments due to higher integration complexity and mission-critical performance requirements.

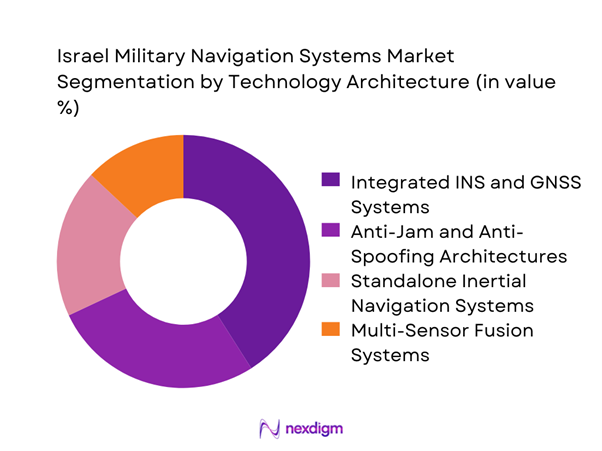

By Technology Architecture

Integrated inertial and satellite-assisted navigation systems account for the largest share of market adoption, driven by the need for operational continuity in electronic warfare environments. Anti-jam and anti-spoofing enabled architectures have seen accelerated uptake as defense planners prioritize mission reliability under signal-denied conditions. Standalone inertial navigation solutions maintain relevance in specialized applications, while emerging multi-sensor fusion architectures are gaining traction in autonomous platforms. The technology mix reflects a gradual shift from conventional GNSS-dependent systems toward layered, resilient navigation frameworks aligned with modern battlefield requirements.

Competitive Landscape

The Israel Military Navigation Systems Market exhibits a moderately concentrated structure, led by a small group of defense technology firms with deep integration capabilities and long-standing relationships with military procurement agencies. Entry barriers remain high due to stringent certification requirements, export control compliance, and the need for advanced electronic warfare resilience, reinforcing the dominance of established players with proven operational track records.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1935 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Navigation Systems Market Analysis

Growth Drivers

Rising demand for precision strike and maneuver warfare capabilities

Operational doctrines increasingly emphasize precision engagement and rapid maneuver, elevating the strategic importance of reliable navigation systems. Between recent assessment periods, deployments of advanced navigation suites increased by ~ systems annually across strike aircraft and mobile ground units. Defense allocations for mission-critical avionics reached around USD ~ million per year, reinforcing sustained procurement cycles. Expanded integration of navigation into fire control and targeting workflows has supported higher system density per platform, with average installations rising by ~ systems across upgraded fleets, strengthening long-term demand fundamentals.

Modernization of armored vehicles and combat aircraft fleets

Fleet renewal programs across air and land forces have accelerated the adoption of next-generation navigation architectures. Over the past few assessment cycles, modernization initiatives covered ~ vehicles and ~ aircraft platforms, each incorporating upgraded navigation modules as standard equipment. Program-level investments in avionics and mission systems exceeded USD ~ million, reflecting the centrality of navigation performance in survivability and operational effectiveness. This replacement-driven demand continues to generate consistent order volumes, reinforcing market stability even during broader defense budget realignments.

Challenges

High development costs for anti-jam and anti-spoofing technologies

The shift toward resilient navigation solutions has significantly increased research and engineering expenditures. Development programs for electronic warfare-resistant modules typically require funding of USD ~ million per product cycle, placing financial strain on suppliers. Prototype validation often involves testing across ~ systems before operational clearance, extending timelines and escalating costs. These capital-intensive requirements limit the number of qualified vendors and constrain rapid technology diffusion, creating structural pressure on pricing flexibility and program scalability across the market.

Complex integration with legacy combat platforms

A substantial share of Israel’s operational fleet relies on legacy architectures, complicating the integration of advanced navigation systems. Retrofit programs commonly involve upgrades across ~ vehicles or aircraft per cycle, each requiring customized interfaces and certification protocols. Integration budgets often exceed USD ~ million for mid-scale programs, reflecting engineering complexity and extended testing phases. These challenges slow deployment velocity and can defer procurement decisions, impacting near-term adoption rates despite strong underlying operational demand.

Opportunities

Growth in autonomous ground and aerial combat systems

The rapid expansion of autonomous platforms presents a significant growth avenue for navigation system suppliers. Recent deployment cycles added ~ systems across unmanned aerial and ground vehicles, each requiring high-precision, low-latency navigation capabilities. Program funding dedicated to autonomous platform navigation exceeded USD ~ million, underscoring institutional commitment to this segment. As autonomy becomes embedded across reconnaissance, logistics, and strike missions, navigation systems are positioned to capture higher value per platform through advanced sensing and redundancy features.

Adoption of multi-sensor fusion navigation architectures

Defense modernization strategies increasingly favor multi-sensor fusion to enhance accuracy and resilience. Over recent assessment periods, integration of fusion-based navigation solutions expanded to ~ systems across diverse platforms, supported by incremental investments of USD ~ million in software and sensor integration. These architectures combine inertial, satellite, terrain-referenced, and visual navigation inputs, enabling robust performance in contested environments. This transition creates sustained opportunities for solution providers offering modular, upgradeable architectures aligned with long-term digital defense strategies.

Future Outlook

The Israel Military Navigation Systems Market is set to evolve toward highly resilient, software-defined navigation architectures aligned with autonomous warfare and electronic countermeasure realities. Continued emphasis on indigenous technology development and export-oriented defense programs will reinforce long-term demand stability. As integration between navigation, command systems, and sensor fusion deepens, suppliers capable of delivering adaptive and secure solutions will remain central to future procurement strategies through the next decade.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elta Systems

- Elbit Systems Elisra

- Aeronautics Group

- Honeywell Aerospace

- Northrop Grumman

- L3Harris Technologies

- Thales Group

- Collins Aerospace

- BAE Systems

- Safran Electronics and Defense

- Leonardo

- Saab

Key Target Audience

- Ministry of Defense of Israel procurement divisions

- Israel Defense Forces logistics and technology units

- Defense platform OEMs and system integrators

- Unmanned systems developers and prime contractors

- Naval shipyards and aerospace maintenance organizations

- Export control and compliance authorities

- Investments and venture capital firms focused on defense technology

- Government and regulatory bodies including SIBAT and the Israel Export Control Agency

Research Methodology

Step 1: Identification of Key Variables

Assessment of core demand drivers, platform modernization cycles, and technology adoption patterns across air, land, and naval forces. Mapping of procurement structures and lifecycle replacement dynamics influencing system demand. Identification of regulatory, security, and export compliance variables shaping market access.

Step 2: Market Analysis and Construction

Compilation of deployment trends, upgrade programs, and system integration pathways. Evaluation of technology architectures and resilience requirements in contested environments. Development of baseline market structure across key platform segments.

Step 3: Hypothesis Validation and Expert Consultation

Structured interactions with defense procurement stakeholders and system integrators.

Validation of adoption timelines and budget allocation patterns. Cross-checking of technology transition assumptions against operational requirements.

Step 4: Research Synthesis and Final Output

Integration of quantitative and qualitative insights into a cohesive market framework. Refinement of demand scenarios and competitive positioning logic. Finalization of strategic implications for stakeholders across the value chain.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military navigation system taxonomy across GPS INS and hybrid solutions, market sizing logic by platform deployment and upgrade cycles, revenue attribution across equipment upgrades spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and scope

- Market evolution

- Operational usage pathways across platforms

- Defense ecosystem structure

- Supply chain and integration architecture

- Regulatory and export control environment

- Growth Drivers

Rising demand for precision strike and maneuver warfare capabilities

Modernization of armored vehicles and combat aircraft fleets

Expansion of unmanned and autonomous defense platforms

Increasing electronic warfare threats driving resilient navigation needs

Government focus on indigenous defense technology development

Export-oriented defense production and co-development programs - Challenges

High development costs for anti-jam and anti-spoofing technologies

Complex integration with legacy combat platforms

Dependence on sensitive components and export-restricted technologies

Rapid obsolescence due to fast-evolving electronic warfare tactics

Stringent military qualification and certification timelines

Cybersecurity risks to networked navigation systems - Opportunities

Growth in autonomous ground and aerial combat systems

Adoption of multi-sensor fusion navigation architectures

Rising defense exports to Asia-Pacific and European allies

Upgrades of legacy platforms with digital navigation suites

Co-development with allied defense primes

Expansion of naval and maritime surveillance programs - Trends

Shift toward GNSS-denied environment navigation solutions

Integration of AI for adaptive navigation and fault correction

Miniaturization of navigation modules for drones and loitering munitions

Increased use of encrypted and resilient satellite services

Convergence of navigation with C4ISR architectures

Lifecycle-based service and upgrade contracts - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land-based armored and tactical vehicles

Naval surface combatants and submarines

Fixed-wing aircraft

Rotary-wing aircraft

Unmanned aerial systems

Missile and precision-guided munitions - By Application (in Value %)

Positioning and navigation

Targeting and fire control

Situational awareness and battle management

ISR and reconnaissance missions

Autonomous and semi-autonomous operations - By Technology Architecture (in Value %)

Inertial navigation systems

GNSS-enabled military receivers

Anti-jam and anti-spoofing solutions

Integrated INS/GNSS systems

Celestial and terrain-referenced navigation - By End-Use Industry (in Value %)

Army and ground forces

Air force

Navy

Special operations forces

Defense R&D and test establishments - By Connectivity Type (in Value %)

Standalone navigation systems

Network-centric integrated systems

Satellite-linked navigation platforms

Secure data-link enabled systems - By Region (in Value %)

Northern Command region

Central Command region

Southern Command region

Naval and offshore operational zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (navigation accuracy, anti-jam capability, system integration level, platform compatibility, lifecycle support, cybersecurity resilience, cost competitiveness, export compliance readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elta Systems

Elbit Systems Elisra

Aeronautics Group

Honeywell Aerospace

Northrop Grumman

L3Harris Technologies

Thales Group

Collins Aerospace

BAE Systems

Safran Electronics & Defense

Leonardo

Saab

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035