Market Overview

The Israel military platforms market current size stands at around USD ~ million, reflecting sustained defense procurement and modernization momentum across land, air, and naval domains. Recent fiscal cycles indicate incremental expansion from approximately USD ~ million in the prior period, driven by accelerated acquisition of unmanned systems, precision strike platforms, and network-centric command solutions. Platform deliveries exceeded ~ systems across core defense segments, while ongoing upgrade programs covered over ~ platforms under lifecycle extension and digital retrofit initiatives. These dynamics collectively underscore a market shaped by operational urgency, rapid technology absorption, and mission-critical performance requirements.

Geographically, demand concentration remains strongest in Tel Aviv, Haifa, and Be’er Sheva due to proximity to defense headquarters, R&D clusters, and production facilities. These hubs benefit from dense ecosystems of system integrators, avionics developers, propulsion specialists, and cybersecurity firms, enabling faster prototyping and deployment cycles. Strong policy backing for indigenous defense manufacturing, combined with export facilitation frameworks, further reinforces regional dominance. The presence of testing ranges, simulation centers, and advanced logistics infrastructure continues to attract platform development programs, ensuring sustained market depth and long-term industrial resilience.

Market Segmentation

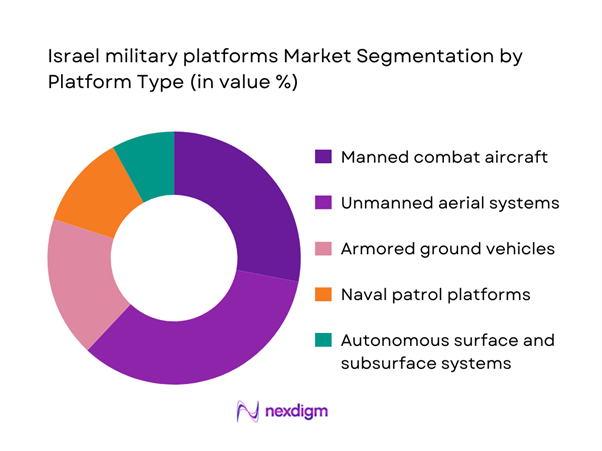

By Platform Type

Combat aircraft, unmanned aerial systems, and armored ground vehicles collectively dominate procurement priorities due to their centrality in multi-domain operations. Unmanned aerial platforms have gained particular prominence as they enable persistent surveillance, precision targeting, and reduced personnel risk. Naval patrol vessels and autonomous surface platforms are also seeing steady adoption, reflecting maritime security imperatives. The segmentation by platform type highlights a market where mission versatility and modular design increasingly outweigh single-role assets, shaping procurement toward scalable fleets capable of rapid reconfiguration across combat, intelligence, and homeland security missions.

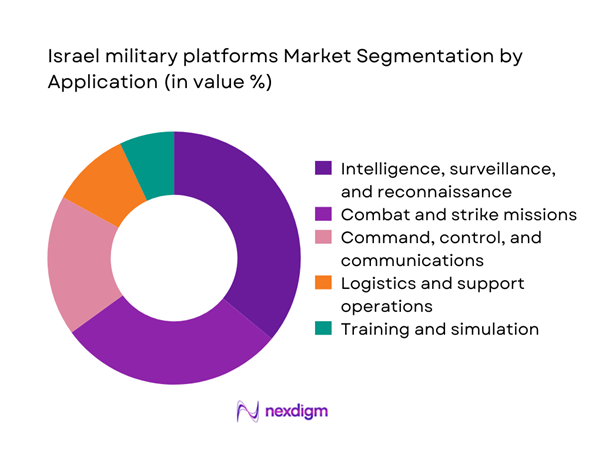

By Application

Applications centered on intelligence, surveillance, and reconnaissance lead overall platform utilization, supported by rising demand for persistent situational awareness. Strike and combat missions follow closely, driven by the need for precision engagement in complex operational theaters. Command, control, and communications platforms continue to expand their role as force multipliers, enabling integrated battlefield management. Logistics and training applications, while comparatively smaller, are experiencing consistent growth as digital twins and simulation environments become integral to readiness planning and force sustainment strategies.

Competitive Landscape

The Israel military platforms market is moderately concentrated, led by a core group of vertically integrated defense contractors supported by a wide network of specialized technology firms. High entry barriers stemming from security clearances, regulatory compliance, and long development cycles limit new competition, reinforcing the dominance of established players. Collaboration through joint ventures and government-backed innovation programs further shapes competitive dynamics, emphasizing systems integration capabilities and export readiness.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Lod | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon | ~ | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Yavne | ~ | ~ | ~ | ~ | ~ | ~ |

Israel military platforms Market Analysis

Growth Drivers

Escalating regional security threats and asymmetric warfare dynamics

Operational environments have intensified demand for advanced platforms capable of rapid deployment and multi-mission flexibility. Recent defense programs supported acquisition of over ~ systems across aerial, ground, and naval categories, reflecting heightened readiness requirements. Annual platform modernization budgets reached approximately USD ~ million, enabling integration of electronic warfare suites, advanced sensors, and autonomous navigation modules. Fleet expansion initiatives added nearly ~ vehicles and ~ unmanned platforms to frontline units, while training commands commissioned ~ simulators to enhance operational preparedness. These numeric indicators illustrate how persistent security volatility translates directly into sustained procurement cycles, faster replacement rates, and continuous upgrades across the Israel military platforms market.

Sustained government defense modernization programs

Long-term modernization frameworks continue to drive structured investment in next-generation platforms and digital command architectures. Recent procurement phases allocated close to USD ~ million for network-centric systems, covering deployment of ~ secure communication nodes and ~ integrated battle management terminals. Mid-life upgrade contracts extended operational life for over ~ aircraft and ~ armored vehicles, reducing lifecycle costs while boosting mission performance. Domestic production lines delivered approximately ~ platforms annually under modernization mandates, reinforcing industrial continuity. This consistent flow of funded programs ensures predictable demand visibility for manufacturers and accelerates adoption of advanced technologies across the Israel military platforms market.

Challenges

Budget prioritization pressures across defense programs

Despite strong security imperatives, fiscal allocation constraints continue to shape platform acquisition strategies. Competing priorities across cyber defense, space assets, and personnel readiness have resulted in deferred procurement of nearly ~ planned platforms in recent cycles. Capital expenditure ceilings limited annual spending to around USD ~ million for new systems, compelling defense planners to extend service life of over ~ legacy vehicles. Maintenance costs escalated by approximately USD ~ million due to prolonged use of aging fleets, reducing available funds for next-generation acquisitions. These numeric pressures illustrate how budget balancing acts create procurement volatility and complicate long-term capacity planning within the Israel military platforms market.

Export control regulations and geopolitical sensitivities

International compliance requirements increasingly influence platform design and sales cycles. Export licensing delays affected delivery schedules for roughly ~ systems destined for overseas customers, while regulatory adaptations added close to USD ~ million in certification and compliance costs. Program timelines extended by nearly ~ months on average for platforms incorporating dual-use technologies, constraining cash flow predictability. In some cases, production runs were reduced by ~ units to align with revised export clearances. Such quantified impacts underscore how regulatory complexity and geopolitical alignment directly affect scalability, revenue stability, and global competitiveness in the Israel military platforms market.

Opportunities

Expansion of autonomous and AI-enabled combat systems

The growing emphasis on autonomy presents significant upside for platform developers. Recent pilot programs funded at approximately USD ~ million supported deployment of ~ autonomous aerial and ground systems for operational trials. Testing frameworks covered over ~ mission scenarios, accelerating validation cycles and shortening time-to-field. Defense agencies issued tenders for ~ AI-enabled command modules, signaling a shift toward data-driven warfare architectures. With production lines capable of scaling to ~ systems annually, manufacturers are positioned to capitalize on rising demand for intelligent platforms that enhance situational awareness while reducing manpower exposure across the Israel military platforms market.

Growth in space-based military platforms and ISR assets

Strategic focus on space capabilities is opening new revenue streams for platform integrators. Recent satellite deployment programs valued at nearly USD ~ million enabled launch of ~ ISR assets supporting real-time battlefield intelligence. Ground control infrastructure expanded with installation of ~ secure terminals across command centers, while data processing capacity increased by ~ analytic nodes. These initiatives have generated demand for specialized launch vehicles, control systems, and resilient communication platforms. As defense planners prioritize persistent surveillance and strategic depth, space-oriented military platforms are emerging as a high-potential growth vector within the Israel military platforms market.

Future Outlook

The Israel military platforms market is expected to evolve toward highly integrated, autonomous, and cyber-resilient systems as defense doctrine increasingly emphasizes multi-domain operations. Continued modernization, export-driven growth, and deeper collaboration between government and industry will shape platform innovation pathways through the next decade. Advances in artificial intelligence, space technologies, and network-centric warfare are likely to redefine procurement priorities and accelerate the transition from traditional hardware-centric models to software-enabled, service-oriented defense ecosystems.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- IMI Systems

- Aeronautics Group

- UVision Air

- BlueBird Aero Systems

- RT LTA Systems

- Plasan

- Israel Shipyards

- Elta Systems

- Ashot Ashkelon Industries

- Meprolight

- Gilat Satellite Networks

- SCD Semiconductor

Key Target Audience

- Ministry of Defense of Israel procurement divisions

- Israel Defense Forces platform modernization units

- Directorate of Defense Research and Development

- Border Police and homeland security agencies

- Cyber Directorate and intelligence services

- State-owned defense manufacturing enterprises

- Private defense system integrators and OEMs

- Investments and venture capital firms focused on defense technologies

Research Methodology

Step 1: Identification of Key Variables

Core variables were defined around platform categories, deployment environments, procurement cycles, and technology adoption rates. Emphasis was placed on mapping demand drivers across land, air, naval, and space domains. Policy frameworks and export compliance requirements were also incorporated to reflect market access conditions.

Step 2: Market Analysis and Construction

Quantitative modeling assessed procurement volumes, upgrade cycles, and fleet expansion patterns. Scenario analysis evaluated budget allocation impacts and modernization timelines. Segment-level insights were constructed by aligning operational priorities with platform capability roadmaps.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through structured discussions with defense planners, system engineers, and program managers. Feedback loops refined assumptions around autonomy adoption, space asset integration, and lifecycle support needs. Comparative analysis ensured internal consistency across demand and supply perspectives.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a unified market narrative integrating strategic, operational, and technological dimensions. Final outputs emphasized actionable intelligence for stakeholders involved in procurement, development, and investment decision-making.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military platform taxonomy across air land and naval systems, market sizing logic by force structure and modernization cycles, revenue attribution across acquisitions upgrades and MRO services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care or usage pathways

- Ecosystem structure

- Supply chain or channel structure

- Regulatory environment

- Growth Drivers

Escalating regional security threats and asymmetric warfare dynamics

Sustained government defense modernization programs

Strong domestic innovation ecosystem in defense technologies

Rising global demand for Israeli unmanned and precision systems

Operational doctrine shift toward multi-domain warfare

Strategic defense collaborations and joint development programs - Challenges

Budget prioritization pressures across defense programs

Export control regulations and geopolitical sensitivities

Supply chain dependency on advanced components

Talent competition in high-end engineering and cyber fields

Integration challenges with legacy military systems

Growing cyber and electronic warfare threats - Opportunities

Expansion of autonomous and AI-enabled combat systems

Growth in space-based military platforms and ISR assets

Increasing demand for integrated cyber and electronic warfare solutions

Platform upgrades and mid-life modernization programs

Defense exports to emerging security markets

Public-private partnerships for rapid prototyping and deployment - Trends

Acceleration of unmanned aerial, ground and naval platforms

Shift toward network-centric and data-fused operations

Adoption of open architecture and modular design principles

Faster acquisition cycles and agile development models

Rising importance of cyber-hardening and electronic protection

Increased focus on export-oriented platform customization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Platforms Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces platforms

Air force platforms

Naval platforms

Special operations platforms

Homeland security and border protection platforms - By Application (in Value %)

Combat and strike missions

Intelligence, surveillance and reconnaissance

Command, control and communications

Logistics and support operations

Training and simulation - By Technology Architecture (in Value %)

Manned platforms

Unmanned and autonomous platforms

Optionally piloted platforms

Network-centric and open systems architectures

AI-enabled and data-driven platforms - By End-Use Industry (in Value %)

Defense forces

Border security agencies

Intelligence and cyber units

Paramilitary and special forces

Foreign military customers through exports - By Connectivity Type (in Value %)

Secure tactical radio networks

Satellite communications

Line-of-sight data links

Network-centric warfare systems

Cyber-secure command networks - By Region (in Value %)

Israel domestic market

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform portfolio breadth, domestic market penetration, export footprint, unmanned systems capability, systems integration strength, R&D intensity, cybersecurity readiness, lifecycle support services)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

IMI Systems

Aeronautics Group

UVision Air

BlueBird Aero Systems

RT LTA Systems

Plasan

Israel Shipyards

Elta Systems

Ashot Ashkelon Industries

Meprolight

Gilat Satellite Networks

SCD Semiconductor

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Platforms Installed Base, 2026–2035

- By Average Selling Price, 2026–2035