Market Overview

The Israel Military Power Solutions market current size stands at around USD ~ million, reflecting sustained defense modernization activity and accelerated adoption of advanced energy and power management systems across operational domains. Recent procurement cycles added close to USD ~ million in new system value, supported by deployment of ~ systems across land, air, and naval platforms. Installed base expansion exceeded ~ units, while average program ticket sizes remained near USD ~ million, indicating steady platform-level investments and continued prioritization of resilient battlefield energy architectures.

Regional dominance is concentrated around Tel Aviv, Haifa, and Be’er Sheva, driven by dense clusters of defense R&D centers, system integrators, and military command infrastructure. These locations benefit from proximity to procurement agencies, testing ranges, and secure logistics corridors, enabling faster deployment and lifecycle support. The ecosystem maturity in these hubs is reinforced by strong policy alignment, long-term defense planning frameworks, and a well-established supplier network that supports rapid innovation, certification, and field integration of power solutions.

Market Segmentation

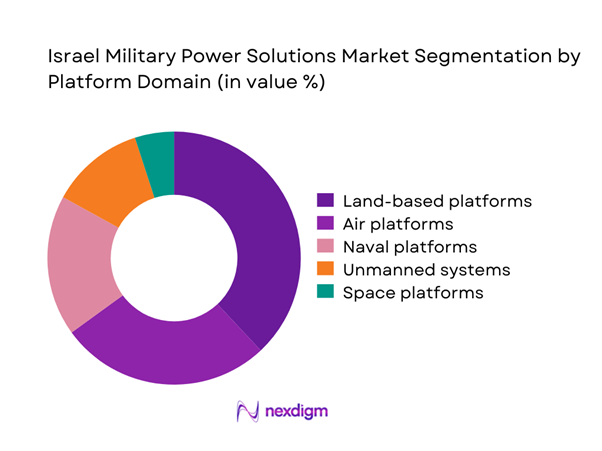

By Platform Domain

The land-based domain continues to dominate the Israel Military Power Solutions market due to extensive modernization of armored vehicles, mobile command units, and tactical energy systems supporting border security and rapid response forces. Demand is reinforced by the need for silent mobility, extended operational endurance, and modular power packs that can be reconfigured across mission profiles. Air platforms follow closely, supported by upgrades in unmanned aerial systems and electronic warfare aircraft requiring high-density power units. Naval platforms show steady adoption driven by coastal surveillance and missile defense integration. Space and satellite programs, while smaller in scale, demonstrate rising strategic importance as power reliability becomes critical for ISR continuity and secure communications.

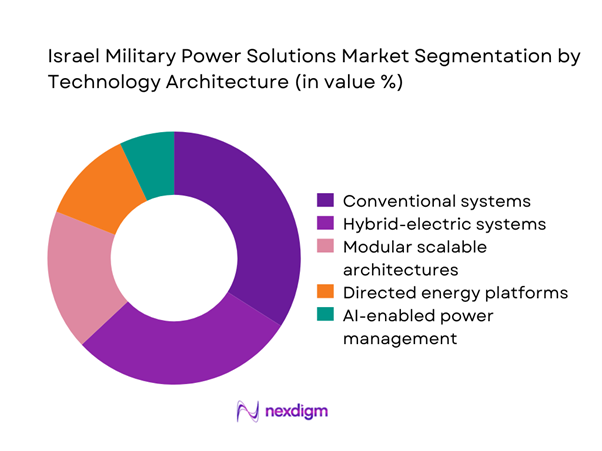

By Technology Architecture

Hybrid-electric and modular power architectures are increasingly shaping the competitive dynamics of the Israel Military Power Solutions market. These systems offer flexibility in deployment, improved fuel efficiency, and lower acoustic signatures, making them suitable for modern combat scenarios. Conventional propulsion-based solutions retain a strong installed base due to legacy fleet dependence, yet new procurement favors scalable designs that integrate energy storage and intelligent distribution. Directed energy and laser-enabled architectures are gaining traction for air defense and counter-drone missions, while AI-enabled power management platforms are emerging as differentiators by enabling predictive maintenance and optimized load balancing across mission-critical systems.

Competitive Landscape

The Israel Military Power Solutions market exhibits a moderately concentrated structure, led by a small group of domestic defense primes supported by global aerospace and defense corporations. Competitive intensity is shaped by long-term government contracts, high entry barriers linked to security clearances, and strong emphasis on technology depth and system integration capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Power Solutions Market Analysis

Growth Drivers

Rising defense budget allocations and modernization priorities

Rising defense budget allocations and modernization priorities have translated into consistent multi-year procurement pipelines, enabling large-scale upgrades of tactical power systems and mission-critical energy platforms. Recent acquisition programs supported deployment of ~ systems across armored units and aerial squadrons, representing cumulative contract values near USD ~ million. Modernization roadmaps emphasize replacement of aging power units in ~ vehicles and ~ naval assets, driving sustained demand for high-efficiency architectures. These initiatives also include infrastructure investments of around USD ~ million in testing facilities and integration centers, ensuring that power solutions remain aligned with evolving operational doctrines and future combat readiness objectives.

Expansion of multi-domain operations requiring resilient power systems

Expansion of multi-domain operations requiring resilient power systems has intensified demand for integrated energy solutions capable of supporting synchronized land, air, naval, cyber, and space missions. Recent operational doctrines call for deployment of ~ networked power nodes and ~ mobile energy units to support real-time data exchange and electronic warfare capabilities. This shift has led to allocation of approximately USD ~ million toward development of redundant and hardened power architectures. The growing reliance on unmanned platforms has further increased requirements for compact, high-density batteries, with annual integration volumes exceeding ~ units across surveillance and strike applications.

Challenges

High development and lifecycle costs of advanced power systems

High development and lifecycle costs of advanced power systems remain a significant barrier, particularly for next-generation hybrid and directed energy platforms. Initial R&D programs often require funding levels close to USD ~ million per system family, while long-term maintenance and upgrade cycles can add another USD ~ million over operational lifetimes. The cost burden is amplified by limited economies of scale, as annual production rarely exceeds ~ units for specialized platforms. These financial constraints affect procurement pacing and can delay fleet-wide adoption, forcing defense planners to balance performance gains against affordability and total ownership cost considerations.

Complex integration with legacy military platforms

Complex integration with legacy military platforms continues to challenge deployment timelines and system performance. A large portion of the existing fleet, estimated at ~ vehicles and ~ aircraft, was designed around older power architectures, making retrofit programs technically demanding. Integration efforts typically require ~ months of engineering validation and cost close to USD ~ million per platform type. Compatibility issues also extend to software and control systems, necessitating additional investments of around USD ~ million in interface development and testing. These complexities slow modernization cycles and increase operational risk during transition phases.

Opportunities

Localization of advanced power system manufacturing

Localization of advanced power system manufacturing presents a strategic opportunity to enhance supply security and reduce dependence on imported components. Establishing domestic production lines for batteries, converters, and control modules could support annual output of ~ units, backed by capital investments nearing USD ~ million. Local manufacturing also shortens lead times by ~ weeks per order cycle and enables closer collaboration between defense agencies and technology developers. Over time, this approach can lower unit costs by USD ~ million across major procurement programs while strengthening national industrial capabilities and workforce specialization in high-value defense engineering.

Export potential to allied defense markets

Export potential to allied defense markets offers significant growth avenues as demand for interoperable and resilient power solutions increases globally. Recent defense cooperation frameworks open access to programs valued at approximately USD ~ million, covering supply of ~ systems for land and air platforms. Standardization efforts aligned with allied operational requirements reduce customization costs by nearly USD ~ million per contract and accelerate certification timelines. By leveraging proven domestic deployments, suppliers can position Israel-origin power solutions as reliable benchmarks for advanced battlefield energy management, expanding their footprint across strategic partner nations.

Future Outlook

The Israel Military Power Solutions market is expected to maintain steady momentum through the coming decade as defense planners align energy systems with multi-domain operational strategies. Continued emphasis on autonomy, resilience, and sustainability will shape procurement priorities, while deeper collaboration between defense agencies and technology developers will accelerate innovation cycles. As modernization programs mature, power solutions will increasingly become a central pillar of force readiness and strategic deterrence.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- ELTA Systems

- Aeronautics Group

- Lockheed Martin

- Boeing Defense, Space & Security

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- Thales Group

- Leonardo

- Saab

- General Dynamics

- L3Harris Technologies

Key Target Audience

- Israeli Ministry of Defense Procurement Directorate

- Directorate of Defense Research and Development

- Israel Defense Forces logistics and technology units

- Aerospace and naval system integrators

- Homeland security agencies and border protection forces

- Defense-focused investments and venture capital firms

- Advanced energy and battery technology developers

- Military maintenance, repair, and overhaul providers

Research Methodology

Step 1: Identification of Key Variables

The study identifies core demand drivers, technology pathways, and procurement mechanisms shaping the Israel Military Power Solutions market. It maps platform-level requirements across land, air, naval, and space domains. Key operational, regulatory, and industrial variables are structured to define analytical boundaries.

Step 2: Market Analysis and Construction

Market sizing models are built using deployment patterns, procurement cycles, and installed base dynamics. Demand scenarios are developed across multiple operational contexts. Technology adoption curves are aligned with defense modernization roadmaps.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings are tested through structured discussions with defense planners and system engineers. Operational assumptions are refined based on platform integration feedback. Strategic alignment with long-term defense policies is validated.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative insights are consolidated into a unified framework. Scenario outcomes are stress-tested for consistency and relevance. Final outputs are structured to support strategic and investment decision-making.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military power solution taxonomy across onboard and deployable energy systems, market sizing logic by platform deployment and modernization cycles, revenue attribution across equipment upgrades spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and deployment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense budget allocations and modernization priorities

Expansion of multi-domain operations requiring resilient power systems

Increasing deployment of unmanned and autonomous platforms

Growing emphasis on energy efficiency and battlefield sustainability

Heightened regional security threats and readiness requirements

Rapid adoption of AI-enabled power management technologies - Challenges

High development and lifecycle costs of advanced power systems

Complex integration with legacy military platforms

Supply chain vulnerabilities and component dependency risks

Regulatory and export control constraints

Skilled workforce shortages in advanced defense engineering

Cybersecurity risks in networked power architectures - Opportunities

Localization of advanced power system manufacturing

Export potential to allied defense markets

Integration of renewable and hybrid energy solutions

Upgrades of legacy fleets with modular power units

Public-private partnerships in defense energy innovation

Growth in space and satellite power solutions - Trends

Shift toward hybrid-electric and silent mobility systems

Increased use of directed energy and laser platforms

Adoption of digital twins for power system optimization

Expansion of battlefield energy storage technologies

Greater focus on survivability and redundancy in power design

Rising investment in autonomous energy management - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land-based combat platforms

Naval combat and patrol vessels

Manned aerial platforms

Unmanned aerial systems

Space and satellite platforms - By Application (in Value %)

Border surveillance and homeland security

Air and missile defense

Intelligence, surveillance, and reconnaissance

Cyber defense and electronic warfare

Force modernization and readiness - By Technology Architecture (in Value %)

Conventional propulsion systems

Hybrid-electric power systems

Directed energy and laser-based systems

Autonomous and AI-enabled power management

Modular and scalable power architectures - By End-Use Industry (in Value %)

Defense forces and armed services

Homeland security agencies

Aerospace and space programs

Naval and maritime security organizations

Defense research institutions - By Connectivity Type (in Value %)

Standalone power systems

Network-enabled power management systems

Integrated battlefield energy networks

Cloud and edge-enabled monitoring platforms - By Region (in Value %)

Central Israel defense hubs

Northern defense zones

Southern border and desert operations

Naval bases and coastal regions

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology depth, system reliability, integration capability, lifecycle cost, local manufacturing footprint, export compliance, after-sales support, innovation pipeline)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

ELTA Systems

Aeronautics Group

Lockheed Martin

Boeing Defense, Space & Security

Northrop Grumman

Raytheon Technologies

BAE Systems

Thales Group

Leonardo

Saab

General Dynamics

L3Harris Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035