Market Overview

The Israel military radars market current size stands at around USD ~ million, supported by defense allocations of USD ~ million in recent cycles and active deployment of ~ systems across air, land, and naval forces. Operational modernization programs have driven annual system upgrades of ~ units, while maintenance and lifecycle support spending reached USD ~ million. Technology refresh initiatives in the last cycle added ~ systems to active duty, reinforcing the role of advanced surveillance in national security architecture.

The market is dominated by operational hubs in central and southern Israel, where dense defense infrastructure, mature command networks, and proximity to aerospace clusters accelerate deployment cycles. Concentrated demand from air defense and border security units sustains steady procurement pipelines, while close coordination between defense agencies and domestic manufacturers strengthens ecosystem maturity. A supportive policy environment emphasizing self-reliance and export readiness further anchors long-term market stability.

Market Segmentation

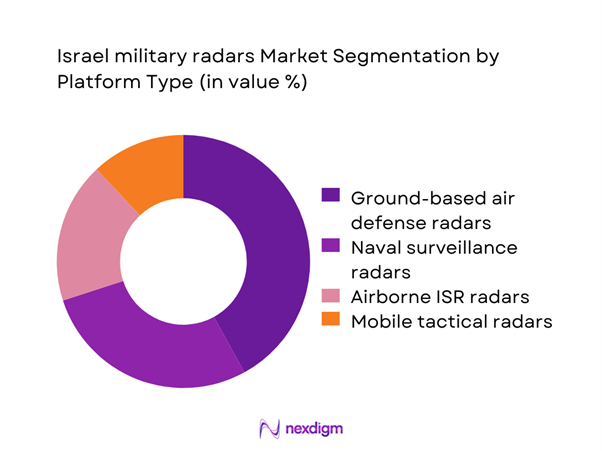

By Platform Type

Ground-based and naval platforms dominate this segmentation due to sustained border surveillance and maritime security priorities. Deployment programs have added ~ systems in recent cycles, with lifecycle spending reaching USD ~ million across core fleets. Centralized command integration and high system uptime requirements drive preference for multi-function radar platforms capable of operating across diverse terrains. Continued replacement of legacy units with digitally enhanced systems sustains procurement momentum, while mobility and rapid deployment capability strengthen adoption across tactical units.

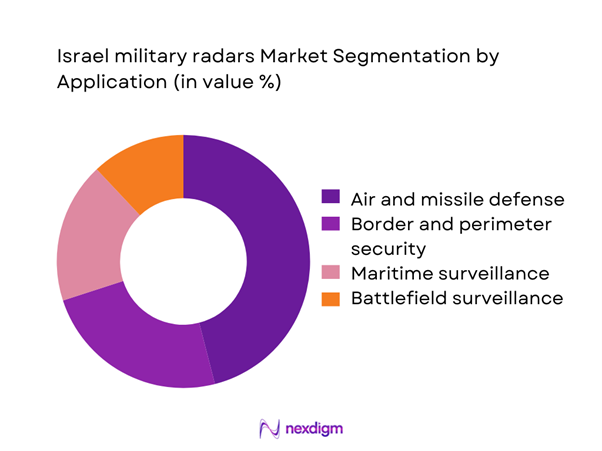

By Application

Air and missile defense remains the dominant application, supported by consistent investment of USD ~ million in layered protection architectures. Border security and maritime surveillance follow closely, driven by operational needs across multiple fronts. Demand concentration in these applications reflects the need for continuous situational awareness and rapid threat identification. Technology upgrades across command centers have supported the integration of ~ systems into unified networks, reinforcing application-led procurement strategies.

Competitive Landscape

The Israel military radars market shows a moderately concentrated structure, led by a few dominant domestic and international defense technology providers. Strong local manufacturing capabilities and long-term defense contracts shape competitive positioning, while export opportunities influence strategic partnerships and technology investments.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Israel military radars Market Analysis

Growth Drivers

Rising missile and UAV threats driving multi-layered radar deployment

Operational data from recent defense cycles shows deployment of ~ systems annually to counter evolving aerial threats, with associated program allocations of USD ~ million. Border security operations recorded ~ incident detections requiring radar-supported interception, reinforcing the role of layered surveillance. Naval patrol zones added ~ platforms equipped with advanced radar suites, while air defense commands integrated ~ units into centralized networks. These measurable increases in operational activity underline how threat intensity directly sustains radar procurement and upgrade cycles.

Continuous modernization of Israel’s integrated air defense network

Modernization initiatives over recent cycles included upgrades of ~ legacy systems and commissioning of ~ new-generation platforms, supported by USD ~ million in technology refresh spending. Command-and-control centers integrated ~ networked radar nodes, enhancing response coordination across multiple domains. Training programs certified ~ personnel for next-generation system operation, reflecting institutional commitment to digital transformation. These concrete modernization steps translate into sustained demand for advanced radar solutions.

Challenges

High system acquisition and lifecycle maintenance costs

Recent procurement cycles recorded acquisition outlays of USD ~ million for advanced radar platforms, while annual maintenance commitments reached USD ~ million. Lifecycle management requires refurbishment of ~ systems each cycle, straining budget allocations across competing defense priorities. Spare part logistics for ~ deployed units further elevate operational costs, creating pressure on long-term sustainment planning. These financial realities constrain procurement pacing despite strategic necessity.

Export control restrictions and international compliance barriers

Compliance frameworks have delayed approval timelines for ~ export programs, affecting delivery schedules for ~ systems. Regulatory alignment efforts required administrative expenditure of USD ~ million across documentation and certification processes. Restrictions on sensitive technologies limited access to ~ international tenders, narrowing market expansion avenues. Such barriers influence revenue stability and complicate international partnership strategies.

Opportunities

Upgrades and mid-life modernization of existing radar fleets

Fleet audits identified ~ operational systems suitable for mid-life upgrades, with projected refurbishment spending of USD ~ million. Digital retrofit programs extended service life for ~ platforms, reducing replacement urgency while enhancing performance. Training upgrades prepared ~ technicians for modular system maintenance, enabling smoother transition to software-defined architectures. These measurable upgrade pathways create sustained opportunity for system integrators.

Export potential to allied nations seeking proven defense systems

Recent defense cooperation frameworks opened access to ~ new markets, supporting negotiation pipelines valued at USD ~ million. Demonstration deployments of ~ systems strengthened credibility in allied defense circles, while joint exercises involved ~ integrated radar units. Such tangible engagement milestones position domestic manufacturers to scale international presence through validated operational performance.

Future Outlook

The Israel military radars market is set to remain strategically critical through the next decade, supported by continuous defense modernization and evolving regional security dynamics. Policy emphasis on technological self-reliance and export competitiveness will reinforce domestic innovation. As integrated command networks mature, demand will increasingly favor adaptable, software-driven radar platforms that enhance multi-domain operational readiness.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- Thales Group

- Leonardo S.p.A.

- RTX

- Lockheed Martin

- Northrop Grumman

- Saab AB

- Hensoldt

- Indra Sistemas

- BAE Systems

- L3Harris Technologies

- ASELSAN

- Rohde & Schwarz

Key Target Audience

- Israeli Ministry of Defense procurement divisions

- Israel Defense Forces technology and logistics directorates

- Directorate of Defense Research and Development

- Naval and Air Force systems integration units

- Homeland Security and Border Police technology departments

- Defense-focused investments and venture capital firms

- Export control and regulatory bodies including the Defense Export Controls Agency

- Prime contractors and subsystem integrators in the defense sector

Research Methodology

Step 1: Identification of Key Variables

Core variables covering system deployment cycles, upgrade frequency, and maintenance spending were mapped. Demand indicators such as active fleet size and operational readiness metrics were aligned with procurement patterns. Policy and compliance frameworks were reviewed to establish regulatory influence on market flow.

Step 2: Market Analysis and Construction

Data points from recent defense cycles were consolidated to structure market sizing logic. Technology adoption trends and platform modernization paths were integrated into the analytical framework. Scenario modeling helped define baseline and alternative demand trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on procurement continuity and export potential were tested through expert consultations. Operational commanders and system integrators validated deployment patterns and lifecycle cost dynamics. Feedback loops refined opportunity and risk assessments.

Step 4: Research Synthesis and Final Output

Insights from quantitative modeling and qualitative validation were synthesized into a cohesive market narrative. Key drivers, constraints, and opportunity pathways were aligned with strategic defense priorities. Final outputs were structured for decision-ready interpretation.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military radar taxonomy across air defense surveillance and fire control systems, market sizing logic by platform deployment and modernization cycles, revenue attribution across equipment upgrades spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution in Israel’s multi-layered air and missile defense architecture

- Operational and deployment pathways across land, air, and naval forces

- Defense ecosystem structure and domestic-industry integration

- Supply chain and defense procurement channel structure

- Regulatory, export control, and security compliance environment

- Growth Drivers

Rising missile and UAV threats driving multi-layered radar deployment

Continuous modernization of Israel’s integrated air defense network

Expansion of naval surveillance needs in the Eastern Mediterranean

Increased investment in border security and counter-infiltration systems

Growing emphasis on real-time situational awareness and network-centric warfare

Strong domestic defense manufacturing and export-led innovation - Challenges

High system acquisition and lifecycle maintenance costs

Export control restrictions and international compliance barriers

Cybersecurity risks in networked radar architectures

Integration complexity across legacy and next-generation platforms

Budgetary pressure from competing defense modernization priorities

Supply chain constraints for advanced semiconductor components - Opportunities

Upgrades and mid-life modernization of existing radar fleets

Export potential to allied nations seeking proven defense systems

AI-enabled radar data processing and autonomous threat detection

Growth in counter-UAS and hypersonic threat detection solutions

Public–private collaboration in dual-use radar technologies

Expansion of maritime and offshore energy asset protection - Trends

Shift toward fully digital AESA radar platforms

Integration of radar with electro-optical and SIGINT systems

Adoption of software-defined radar architectures

Increased use of mobile and rapidly deployable radar units

Rising focus on low-probability-of-intercept radar technologies

Greater interoperability with allied defense networks - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Ground-based air defense radars

Naval surveillance and fire-control radars

Airborne early warning and ISR radars

Border security and perimeter surveillance radars

Counter-battery and artillery locating radars - By Application (in Value %)

Air and missile defense

Maritime domain awareness

Border and critical infrastructure protection

Battlefield surveillance and target acquisition

Electronic warfare support and situational awareness - By Technology Architecture (in Value %)

Active electronically scanned array (AESA) radars

Passive electronically scanned array (PESA) radars

Solid-state S-band and X-band radars

Multi-function radar systems

Phased-array 3D surveillance radars - By End-Use Industry (in Value %)

Army and ground forces

Air force and aerospace command

Navy and coastal defense forces

Homeland security and border police

Intelligence and electronic warfare units - By Connectivity Type (in Value %)

Standalone radar systems

Networked C4ISR-integrated radars

Cloud-enabled command center connectivity

Secure tactical data link integration

Satellite-augmented radar networks - By Region (in Value %)

Northern command region

Southern command region

Central command region

Naval and offshore operational zones

Strategic airspace monitoring zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (radar range performance, target detection accuracy, system mobility, network integration capability, electronic counter-countermeasures strength, lifecycle support model, upgrade scalability, export compliance readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Israel Aerospace Industries (Elta Systems)

Rafael Advanced Defense Systems

Elbit Systems

Hensoldt

Thales Group

Leonardo S.p.A.

RTX (Raytheon)

Lockheed Martin

Northrop Grumman

Saab AB

Indra Sistemas

BAE Systems

L3Harris Technologies

ASELSAN

Rohde & Schwarz

- Demand and operational readiness drivers

- Defense procurement and classified tender dynamics

- Technical performance and lifecycle cost as buying criteria

- Budget allocation cycles and multi-year defense planning

- Deployment risks and integration challenges

- After-sales support, training, and system upgrade expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035