Market Overview

The Israel military radars market is valued at approximately USD ~, supported by sustained domestic defense procurement and export-oriented radar production. Defense expenditure stood at USD ~, while radar-related electronics and sensor exports exceeded USD ~, according to SIPRI and Israel Ministry of Defense disclosures. Market expansion is driven by continuous investments in air and missile defense, counter-UAS systems, border surveillance radars, and multi-mission AESA platforms integrated into national layered defense architectures.

The market is dominated by Haifa, Tel Aviv, and Lod, supported by Israel’s concentrated defense-industrial ecosystem and proximity to air force and naval command centers. Israel dominates globally due to its operational combat experience, rapid deployment cycles, and indigenous radar innovation capability. The United States and selected European countries also influence the market through joint development programs and procurement partnerships, driven by Israel’s reputation for combat-proven radar technologies and export-ready modular designs.

Market Segmentation

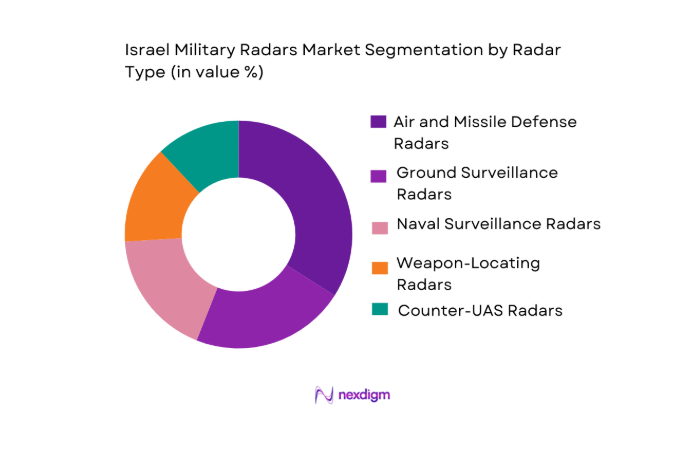

By Radar Type

The Israel military radars market is segmented by radar type into air and missile defense radars, ground surveillance radars, naval surveillance radars, weapon-locating radars, and counter-UAS radars. Recently, air and missile defense radars dominate this segmentation due to Israel’s layered defense doctrine and continuous deployment of systems such as Arrow, David’s Sling, and Iron Dome. These radars require high-resolution tracking, discrimination, and engagement capabilities. Persistent regional threats and integration with interceptor systems reinforce procurement priority, ensuring sustained dominance of this sub-segment.

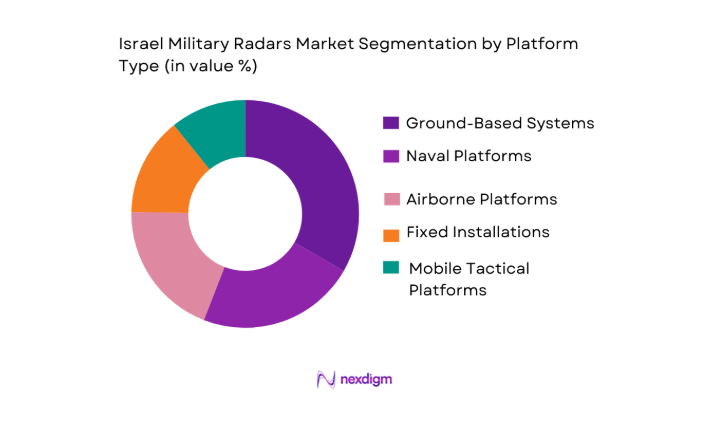

By Platform Type

The market is segmented by platform type into ground-based systems, naval platforms, airborne platforms, fixed installations, and mobile tactical platforms. Ground-based platforms hold a dominant share due to permanent border surveillance, early-warning stations, and air defense batteries deployed nationwide. These systems offer long operational life, scalable upgrades, and integration with command-and-control networks. Continuous modernization of ground radar infrastructure and replacement of legacy systems further reinforce dominance in this segment.

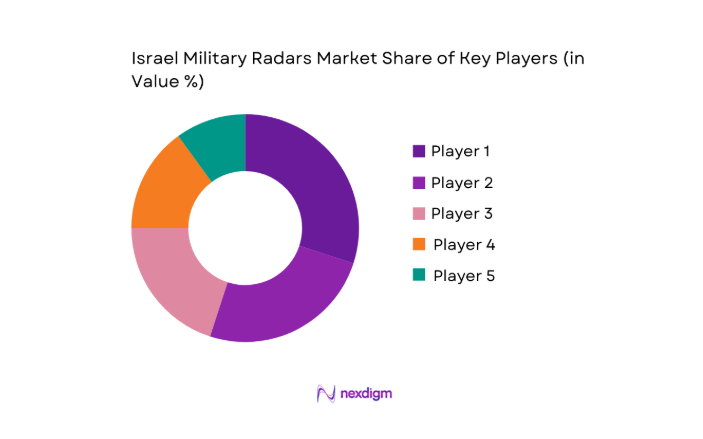

Israel Military Radars Competitive Landscape

The Israel military radars market is highly consolidated and dominated by a small number of technologically advanced defense firms with strong domestic integration and global export reach. These companies benefit from long-term government contracts, close coordination with the Israel Defense Forces, and proven battlefield performance. The market structure enables rapid innovation cycles, while export contracts with allied nations reinforce financial stability and technological leadership.

| Company | Established | Headquarters | Radar Specialization | Export Orientation | R&D Intensity | Platform Coverage | Integration Capability | Combat Proven |

| ELTA Systems | 1967 | Ashdod | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod | ~ | ~ | ~ | ~ | ~ | ~ |

| CONTROP Precision Technologies | 1978 | Netanya | ~ | ~ | ~ | ~ | ~ | ~ |

Israel military radars Market Analysis

Growth Drivers

Expansion of layered air and missile defense sensor coverage across national airspace

Israel’s layered air and missile defense posture sustains continuous radar demand because national airspace coverage depends on persistent surveillance, early warning, and fire-control quality tracks that can be fused across multiple echelons. Macro capacity to fund high-end sensor procurement is supported by Israel’s GDP of USD ~ and GDP per capita of USD ~, which underpin sustained public spending headroom for defense electronics programs that typically require multi-year sustainment, spares, depot calibration, and software baselines. Fiscal prioritization is evidenced by a national expenditure budget of about NIS ~ and a defense allocation of 110 billion shekels approved for the state budget cycle, which directly supports radar recapitalization, integration into national C2, and continuity of air-defense readiness through maintenance and upgrades. The same macro base also supports the domestic defense-industrial ecosystem that produces and upgrades radar families used in air-defense networks, enabling Israel to refresh sensors rather than rely exclusively on imports for complete systems.

Rising demand for counter-UAS detection and tracking integrated with kinetic and EW effectors

Counter-UAS demand in Israel’s radar market is structurally linked to a broader surge in operational spending and rapid acquisition cycles that prioritize detection, classification, and track continuity against small, low-RCS aerial threats. The macroeconomic and fiscal context points to the scale of defense activity and the resulting pull-through for sensor programs: reported military expenditure reached USD ~ during the conflict-heavy period, and the defense budget framework set the defense budget at ~ shekels for the following fiscal cycle, supporting procurement that includes airspace surveillance, base protection, and low-altitude detection layers that are typically radar-led and then fused with electro-optical and command networks. On the supply side, Israel’s export-driven defense electronics base reinforces counter-UAS radar investment because export revenues fund R&D refresh cycles and production learning curves; Israel’s Ministry of Defense reported defense exports of over USD ~, creating a strong incentive to field and continuously improve counter-UAS-capable radars as part of integrated air-defense and base-defense packages.

Market Challenges

Export control and security constraints limiting component availability and foreign collaboration pathways

Israel’s radar supply chain faces constraints because advanced radar subsystems depend on specialized semiconductors, RF components, and secure modules that are often controlled through stringent export and end-use regimes, complicating sourcing and collaboration. The challenge is amplified by the scale of Israel’s dependence on imported goods in the broader economy: Israel’s total imports reached USD ~ million, indicating a large import footprint that can expose high-end defense electronics programs to external licensing, shipping lead times, and supplier prioritization dynamics when global supply tightens. At the same time, Israel’s defense sector is highly export-oriented, with defense exports reported at over USD ~, which increases compliance burdens because export programs must align with multiple jurisdictions’ licensing conditions and security requirements. This can delay radar subcomponent availability, constrain joint development, and force redesign cycles when parts become restricted or unavailable.

High integration complexity across C2 networks, datalinks, IFF, and legacy intercept architectures

Radar modernization and new radar fielding in Israel routinely face integration complexity because radars are not procured as standalone sensors; they must operate within national C2, connect via datalinks, comply with secure IFF modes, and feed multiple effectors across a layered defense system. This complexity grows as fiscal scale expands and multiple urgent programs run in parallel. The approved expenditure budget of about NIS 755.9 billion and the defense allocation of ` shekels illustrate the magnitude of state activity and defense programming that must be orchestrated through synchronized integration, acceptance testing, and operational certification cycles. Integration complexity is also reinforced by the export-driven nature of the sector: defense exports of over USD ~ mean Israeli radar systems are frequently delivered in configurations tailored to different user architectures, which increases the engineering overhead for software baselines, encryption handling, and interface compatibility—capabilities that still must remain consistent with domestic network standards.

Opportunities

Software-defined radar upgrades enabling rapid waveform and mode updates without full hardware replacement

Software-defined radar upgrade pathways represent a high-impact opportunity in Israel because they allow capability expansion—new detection modes, improved classification, better clutter rejection, and integration enhancements—without the disruption and supply-chain exposure associated with full hardware replacement. The opportunity is supported by the scale of Israel’s defense investment environment: the defense allocation of ~ shekels within the broader expenditure budget of about NIS ~ provides room for sustained sustainment-led modernization, where software drops and processor refreshes can be funded as recurring programs rather than occasional recapitalizations. It is also supported by the export-driven industrial logic: defense exports over USD ~ create strong incentives for Israeli radar OEMs to maintain common software baselines across domestic and export fleets, improving economies of scale in development, testing, and certification while accelerating feature rollout.

Multi-static and passive sensing architectures to improve survivability against anti-radiation threats

Multi-static and passive sensing architectures offer a future-facing growth pathway for Israel’s military radars ecosystem because they improve survivability and continuity of sensing by distributing detection functions across multiple nodes and leveraging emissions-of-opportunity, reducing reliance on a single high-power emitter. This opportunity aligns with Israel’s demonstrated ability to commercialize defense electronics at scale: the Ministry of Defense reported defense exports of over USD~, indicating sustained international demand for Israeli sensor and air-defense-related solutions that can incorporate survivability-enhancing architectures as part of integrated packages. It also aligns with the state’s demonstrated willingness to finance advanced defense capabilities: the defense budget framework set defense spending at ~ shekels for the next fiscal cycle, supporting R&D, trials, and integration work that would be necessary to field distributed sensing architectures within national C2.

Future Outlook

Over the coming decade, the Israel military radars market is expected to expand steadily, driven by persistent regional security challenges and continued modernization of national air and missile defense networks. Integration of artificial intelligence, software-defined radar architectures, and multi-sensor fusion will enhance detection accuracy and survivability. Export demand from allied nations seeking combat-proven radar solutions will further support market growth. The forecasted CAGR for 2026–2035 is approximately 6.4%, supported by long-term procurement programs and technology refresh cycles.

Major Players

- ELTA Systems

- Rafael Advanced Defense Systems

- Elbit Systems

- Israel Aerospace Industries

- CONTROP Precision Technologies

- Tadiran Telecom

- Aeronautics Group

- BIRD Aerosystems

- SCD Semiconductor Devices

- Bental Industries

- Northrop Grumman

- Lockheed Martin

- Thales Group

- Saab AB

- HENSOLDT

Key Target Audience

- Defense ministries and armed forces procurement divisions

- Homeland security and border protection agencies

- Air and missile defense command authorities

- Naval forces and maritime security commands

- Aerospace and defense system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Export control and defense trade authorities

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the Israel military radars ecosystem, identifying manufacturers, defense agencies, integrators, and exporters. Extensive desk research using SIPRI, defense white papers, and procurement disclosures is conducted to define key market variables influencing demand and supply.

Step 2: Market Analysis and Construction

Historical procurement trends, radar deployment volumes, and export values are analyzed to construct market size estimates. Platform penetration, system lifecycle, and replacement cycles are evaluated to validate revenue consistency and demand continuity.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with defense electronics specialists, former procurement officials, and radar system engineers. These interactions refine system-level segmentation and confirm technology adoption patterns.

Step 4: Research Synthesis and Final Output

Data from bottom-up and top-down approaches are synthesized and cross-verified with industry sources. Final outputs are structured to ensure accuracy, reliability, and relevance for strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope,Industry Assumptions, Market Sizing Approach,Primary & Secondary Research Framework,Data Collection & Verification Protocol,Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Expansion of layered air and missile defense sensor coverage across national airspace

Rising demand for counter-UAS detection and tracking integrated with kinetic and EW effectors

Continuous modernization of multi-mission radar fleets for improved range, discrimination, and resilience - Market Challenges

Export control and security constraints limiting component availability and foreign collaboration pathways

High integration complexity across C2 networks, datalinks, IFF, and legacy intercept architectures

Electronic attack and contested-spectrum conditions driving costly hardening, testing, and certification cycles - Opportunities

Software-defined radar upgrades enabling rapid waveform and mode updates without full hardware replacement

Multi-static and passive sensing architectures to improve survivability against anti-radiation threats

Co-development and integration programs aligned to allied air defense networks and interoperability standards - Trends

Increased adoption of GaN-based transmit/receive modules for higher power density and efficiency

Convergence of radar and EO/IR fusion within common air picture and fire-control workflows - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Active Electronically Scanned Array radars

Passive Electronically Scanned Array radars

Counter-battery and weapon locating radars

Air and missile defense engagement radars

Maritime surveillance and surface search radars - By Platform Type (In Value%)

Ground-based air defense batteries

Fixed site early warning installations

Naval surface combatants and patrol vessels

Fighter and rotary-wing airborne platforms

Unmanned aerial systems and aerostats - By Fitment Type (In Value%)

New platform installation

Mid-life upgrade and retrofit

Capability insertion for mission system modernization

Replacement of obsolete subsystems

Depot-level refurbishment and life extension - By EndUser Segment (In Value%)

Air and missile defense units

Air force air defense and base protection commands

Navy maritime domain awareness and ship self-defense units

Army maneuver forces and border security formations

Defense intelligence and strategic early warning organizations - By Procurement Channel (In Value%)

Direct government procurement

Domestic prime contractor integrator awards

- Market Share Analysis

- Cross Comparison Parameters (Detection range and track capacity, ECCM and LPI performance, Integration with C2 and datalinks, Mobility and deployment time, GaN AESA maturity and upgradeability, Lifecycle support and sustainment footprint)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

ELTA Systems

Rafael Advanced Defense Systems

Elbit Systems

Israel Aerospace Industries

Tadiran Telecom

Aeronautics Group

BIRD Aerosystems

CONTROP Precision Technologies

SCD Semiconductor Devices

Bental Industries

General Dynamics Mission Systems

Northrop Grumman

Lockheed Martin

Thales Group

Saab AB

- Air defense operators prioritize high-availability radars with rapid cueing, sector coverage optimization, and redundancy for sustained alert status

- Air force users emphasize networked sensor fusion, low-latency track quality, and integration with national C2 and airborne assets

- Naval end users require compact, salt-fog hardened radars with fast update rates for littoral clutter performance and ship self-defense

- Army and border security formations favor mobile radars with quick emplacement, counter-fire functionality, and resilient comms backhaul

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035