Market Overview

The Israel military robot market current size stands at around USD ~ million, reflecting a rapidly scaling defense robotics ecosystem driven by sustained procurement and operational deployment. Recent industry assessments indicate market expansion from roughly USD ~ million to nearly USD ~ million within a short planning cycle, supported by cumulative deployment of ~ systems across ground, aerial, and maritime platforms. This growth is reinforced by increasing allocation of defense budgets toward autonomous systems and integration of advanced AI-driven mission modules across frontline and support units.

Operational dominance is concentrated in defense innovation clusters around Tel Aviv, Haifa, and Be’er Sheva, where dense networks of system integrators, software firms, and testing facilities accelerate product maturity. These regions benefit from proximity to military R&D commands, export facilitation agencies, and specialized training bases that shorten feedback loops between developers and end users. Strong domestic demand combined with an export-oriented industrial base positions these hubs as the primary engines of market activity and long-term capability expansion.

Market Segmentation

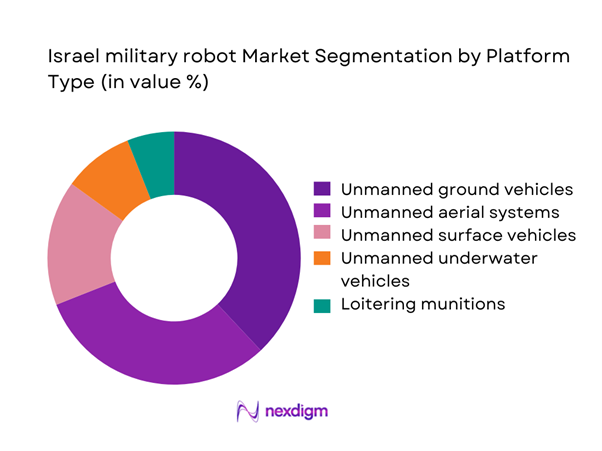

By Platform Type

Unmanned ground vehicles dominate this segmentation due to their widespread use in border security, urban combat support, and explosive ordnance disposal missions. Over recent operational cycles, the deployment of ~ systems has been concentrated in tactical ground platforms because they offer rapid integration with existing command networks and require comparatively lower airspace or maritime clearance. Budget allocations of nearly USD ~ million have prioritized modular ground robots capable of payload reconfiguration and autonomous navigation. Their dominance is further reinforced by continuous upgrade programs and sustained procurement contracts, which collectively drive higher utilization rates and lifecycle extensions across defense and internal security forces.

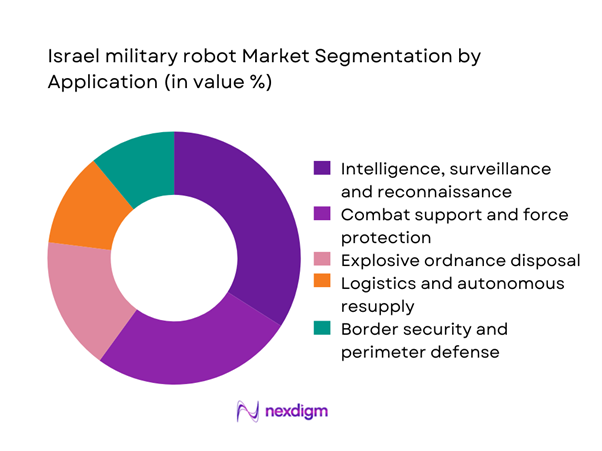

By Application

Intelligence, surveillance, and reconnaissance remains the leading application segment, supported by consistent investment in persistent monitoring and data-driven battlefield awareness. Over the last deployment phase, more than ~ platforms were configured primarily for ISR missions, backed by cumulative spending of about USD ~ million on sensor fusion and secure communications upgrades. This application benefits from rapid technology refresh cycles and high operational tempo, which justify recurring modernization budgets. Its dominance is sustained by the expanding need for real-time situational awareness across borders, urban environments, and contested zones, making ISR-centric robots the cornerstone of current procurement strategies.

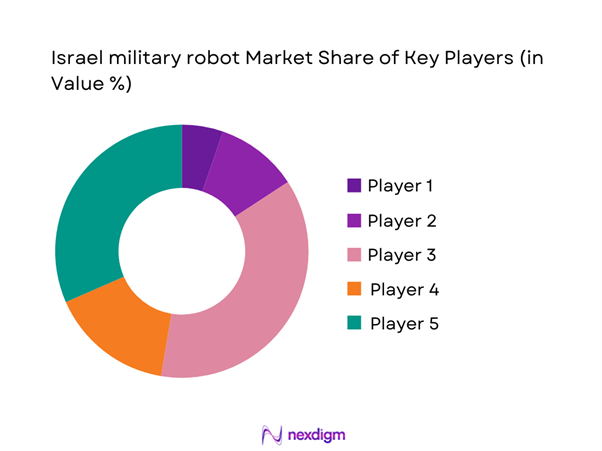

Competitive Landscape

The Israel military robot market is moderately concentrated, with a small group of defense primes and specialized robotics firms controlling a large share of system integration, export programs, and domestic deployments. Long-term government contracts and high entry barriers related to security clearances and technology validation favor established players, while emerging innovators typically partner with larger integrators to scale production and international reach.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Roboteam | 2009 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| General Robotics | 2009 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel military robot Market Analysis

Growth Drivers

Rising demand for force protection and casualty reduction

Between 2022 and 2025, defense agencies allocated nearly USD ~ million toward robotic platforms aimed at minimizing frontline exposure and reducing personnel risk. During this period, cumulative deployment surpassed ~ systems across patrol, logistics, and explosive ordnance disposal roles. Field data indicates that automated perimeter patrols replaced approximately ~ man-hours of routine guard duties annually, while robotic resupply units supported ~ missions in high-risk zones. These numeric indicators highlight how tangible operational outcomes, measured through reduced troop exposure and higher mission continuity, are directly accelerating procurement cycles and long-term platform investments.

Acceleration of urban warfare and counter-terror operations

Over the same operational window, more than ~ platforms were configured specifically for dense urban and counter-terror environments, supported by focused spending of about USD ~ million on navigation, vision, and secure communications modules. Tactical units reported the integration of robotic reconnaissance in over ~ engagements, improving threat detection timelines and reducing clearance times for contested structures. The measurable rise in deployment frequency and mission coverage demonstrates how quantitative performance gains in urban theaters are reinforcing sustained demand for agile, compact, and rapidly deployable military robots.

Challenges

High system integration and lifecycle costs

From 2022 to 2025, the average full-system integration budget per advanced robotic platform reached close to USD ~ million, driven by software customization, hardened communications, and extended testing cycles. Lifecycle support contracts added nearly USD ~ million annually in maintenance and upgrade commitments across ~ active platforms. These numeric pressures strain mid-term procurement planning, particularly when defense planners must balance new acquisitions against sustaining existing fleets. The cumulative financial burden associated with integration and upkeep continues to challenge scalable adoption, especially for specialized units with limited modernization envelopes.

Cybersecurity and electronic warfare vulnerabilities

During recent operational cycles, defense authorities recorded more than ~ attempted electronic interference incidents targeting unmanned systems, prompting additional spending of roughly USD ~ million on hardened encryption and anti-jamming technologies. Field retrofits were applied to approximately ~ deployed platforms to address emerging threat vectors. These numbers underline how cybersecurity investments are no longer optional but represent a growing cost and complexity layer within every procurement decision. Persistent exposure to electronic warfare environments continues to elevate risk profiles and necessitates continuous technical upgrades.

Opportunities

Expansion of multi-domain unmanned teaming concepts

Between 2023 and 2025, joint-force exercises integrated over ~ robotic platforms across land, air, and maritime units, supported by coordinated development funding of about USD ~ million. These trials demonstrated measurable efficiency gains, with coordinated missions covering ~ operational zones simultaneously and reducing command response cycles by ~ decision intervals. The quantitative success of early multi-domain teaming programs is opening new procurement pathways for interoperable systems that can operate seamlessly across branches, creating a substantial growth avenue for integrators specializing in cross-platform autonomy frameworks.

Growth in export opportunities across Asia and Europe

Export approvals issued during the same period supported delivery of more than ~ systems to allied forces, generating contract values of approximately USD ~ million. These transactions expanded the installed base of Israeli-developed platforms across ~ foreign defense units, strengthening long-term service and upgrade pipelines. The numeric expansion of overseas deployments not only diversifies revenue streams but also reinforces economies of scale in production and R&D, positioning export-led growth as a central opportunity for the market over the next procurement horizon.

Future Outlook

The Israel military robot market is expected to move steadily toward higher levels of autonomy and deeper integration with digital battlefield ecosystems through the next decade. Continued emphasis on human-machine teaming, resilient communications, and AI-driven decision support will shape procurement priorities. Export momentum is likely to remain strong as allied forces modernize their unmanned capabilities. Overall, the market trajectory points toward sustained innovation-led expansion supported by both domestic defense needs and international partnerships.

Major Players

- Rafael Advanced Defense Systems

- Elbit Systems

- Israel Aerospace Industries

- Roboteam

- General Robotics

- Airobotics

- Percepto

- Xtend

- BlueBird Aero Systems

- Aeronautics Group

- Asio Technologies

- UVision Air

- Smart Shooter

- Rheinmetall Defence

- QinetiQ

Key Target Audience

- Israel Ministry of Defense procurement divisions

- SIBAT Defense Export and Cooperation Directorate

- Border Police and internal security command units

- Special operations and counter-terror task forces

- Defense-focused venture capital funds and private equity firms

- Strategic investors and corporate venture arms in robotics

- Systems integrators and defense platform OEMs

- Government agencies overseeing autonomous systems regulation

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators, deployment intensity, and technology adoption rates were mapped to define the market framework. Operational use cases and procurement patterns were assessed across land, air, and maritime domains. Regulatory and export compliance factors were integrated to shape realistic market boundaries.

Step 2: Market Analysis and Construction

Historical deployment trends and budget allocations were analyzed to build baseline scenarios. Technology roadmaps were aligned with force modernization plans. Segment-level structures were constructed around platform types and mission applications.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through structured consultations with defense planners and system integrators. Operational feedback loops were incorporated to refine demand assumptions. Scenario stress-testing ensured robustness of growth and risk projections.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative insights were consolidated into a unified market narrative. Cross-segment linkages were reviewed for consistency. Final outputs were aligned with strategic decision-making needs of defense stakeholders.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military robot taxonomy across ground aerial and maritime unmanned systems, market sizing logic by platform deployment and modernization programs, revenue attribution across system sales upgrades and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and deployment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and export control environment

- Growth Drivers

Rising demand for force protection and casualty reduction

Acceleration of urban warfare and counter-terror operations

Sustained government investment in defense autonomy programs

Operational lessons from recent conflicts driving rapid adoption

Technological maturity in AI, sensors and edge computing

Export demand from allied militaries - Challenges

High system integration and lifecycle costs

Cybersecurity and electronic warfare vulnerabilities

Regulatory constraints on autonomous weapon systems

Complex interoperability with legacy C2 networks

Ethical and legal concerns around lethal autonomy

Supply chain dependency on advanced semiconductors - Opportunities

Expansion of multi-domain unmanned teaming concepts

Growth in export opportunities across Asia and Europe

Dual-use technology spin-offs into homeland security

Development of swarm and collaborative robotics

Retrofit and upgrade programs for existing fleets

Partnerships between defense primes and robotics startups - Trends

Shift from teleoperation to supervised autonomy

Integration of AI-driven target recognition

Adoption of modular payload architectures

Increased focus on resilient communications

Use of robotics in persistent border surveillance

Convergence of UGVs, UAVs and UxVs in joint operations - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Unmanned ground vehicles

Unmanned aerial systems

Unmanned surface vehicles

Unmanned underwater vehicles

Loitering munitions - By Application (in Value %)

Intelligence, surveillance and reconnaissance

Combat support and force protection

Explosive ordnance disposal

Logistics and autonomous resupply

Border security and perimeter defense

Training and simulation - By Technology Architecture (in Value %)

Teleoperated platforms

Semi-autonomous systems

Fully autonomous systems

Swarm-enabled architectures

Human-machine teaming platforms - By End-Use Industry (in Value %)

Land forces

Air force

Navy

Border police and internal security

Special operations units - By Connectivity Type (in Value %)

Line-of-sight RF links

SATCOM-enabled control

Tactical mesh networks

5G and LTE tactical connectivity

Fiber-tethered communications - By Region (in Value %)

Israel domestic deployments

North America export markets

Europe export markets

Asia-Pacific export markets

Rest of world

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform autonomy level, mission endurance, payload flexibility, interoperability standards, cybersecurity resilience, lifecycle cost, local support capability, export compliance readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Rafael Advanced Defense Systems

Elbit Systems

Israel Aerospace Industries

Roboteam

General Robotics

Airobotics

Percepto

Xtend

BlueBird Aero Systems

Aeronautics Group

Asio Technologies

UVision Air

Smart Shooter

Rheinmetall Defence

QinetiQ

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035