Market Overview

The Israel military robot market is valued at USD~ billion, driven by technological advancements in robotics and increasing defense budgets. The demand for autonomous systems to enhance military capabilities, including surveillance, reconnaissance, and combat applications, is fuelling the growth. The market is also supported by government initiatives focused on enhancing defense automation and modernizing military technologies.

Countries such as Israel, the United States, and Russia are key players in the military robotics market due to their strong defense infrastructure and continuous investment in cutting-edge technologies. Israel leads the market, leveraging its advanced defense technologies and innovations in robotics, such as autonomous ground and aerial robots, for strategic military operations.

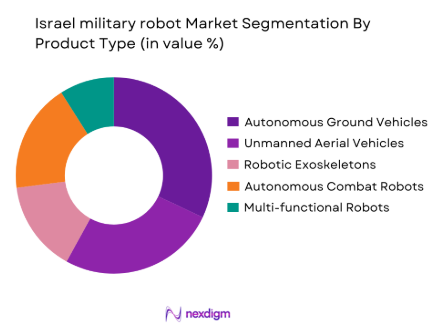

Market Segmentation

By Product Type

The Israel military robot market is segmented by product type into autonomous ground vehicles (UGVs), unmanned aerial vehicles (UAVs), robotic exoskeletons, autonomous combat robots, and multi-functional robots. Autonomous ground vehicles are dominating the market, owing to their broad applications in surveillance, reconnaissance, and mine detection, as well as their ability to operate in hazardous environments, reducing risk to human soldiers.

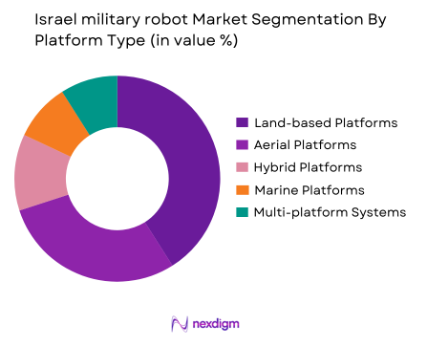

By Platform Type

The market is segmented by platform type into land-based platforms, aerial platforms, hybrid platforms, marine platforms, and multi-platform systems. Land-based platforms, particularly autonomous ground vehicles, are dominating the market share, as they are widely used in defense operations for land surveillance, supply transportation, and bomb disposal tasks, increasing their demand among military forces.

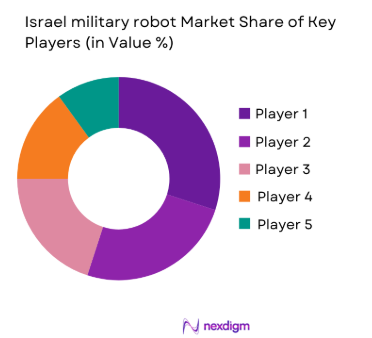

Competitive Landscape

The Israel military robot market is highly competitive, with several key players dominating the landscape. Israel’s domestic defense manufacturers, such as Elbit Systems and Rafael Advanced Defense Systems, are at the forefront, contributing significantly to technological innovation. Their strong presence in the defense sector, along with international collaborations, has led to Israel’s dominance in military robotics.

| Company | Establishment Year | Headquarters | Product Portfolio Breadth | Technological Innovation | Export Orientation | R&D Intensity | Platform Integration | Market Reach |

| Elbit Systems | 1966 | Haifa, Israel | High | Very High | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | High | High | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | Very High | Very High | ~ | ~ | ~ | ~ |

| General Robotics | 2007 | Israel | Moderate | High | ~ | ~ | ~ | ~ |

| Robot team | 2009 | Israel | High | High | ~ | ~ | ~ | ~ |

Israel military robot Market Analysis

Growth Drivers

Technological Advancements in Robotics and AI

The development of cutting-edge technologies in artificial intelligence (AI) and robotics is a key driver for the growth of the Israel military robot market. Autonomous robots equipped with AI capabilities are enhancing operational effectiveness by providing real-time surveillance, data analysis, and decision-making. The increasing demand for advanced robotic systems, including unmanned ground vehicles (UGVs) and unmanned aerial vehicles (UAVs), is being fuelled by advancements in machine learning, AI algorithms, and autonomous navigation. These technologies enable military forces to operate with increased precision while minimizing risks to human soldiers. Israel, with its robust technological infrastructure, is leading the charge in integrating AI-driven robots into its defense systems, ensuring an efficient and scalable robotic solution for defense and surveillance.

Rising Defense Budgets and Military Modernization

A significant growth driver in the Israel military robot market is the ongoing investment in defense budgets and the modernization of military capabilities. Israel’s commitment to strengthening its defense posture is evident in its increased allocation for technological innovations and military automation. With a focus on bolstering defense systems to face modern warfare challenges, the Israeli government continues to allocate substantial funds for the research, development, and deployment of advanced robotic technologies. This has created a strong demand for military robots that can conduct missions autonomously, perform reconnaissance, and handle high-risk operations, ensuring reduced human casualties. The country’s defense strategy emphasizes automation to enhance operational efficiency and support long-term strategic objectives, further boosting market growth.

Market Challenges

High Costs of Research and Development (R&D)

One of the significant challenges for the Israel military robot market is the high cost associated with research and development (R&D) of autonomous robotic systems. Developing military-grade robots that meet stringent performance and security standards requires substantial financial investment. This includes the costs of advanced sensors, AI integration, real-time data processing, and other cutting-edge technologies necessary for the operational efficiency of military robots. Additionally, continuous upgrades and maintenance are required to keep the systems functional and secure, making the R&D process even more expensive. Smaller defense contractors, in particular, face challenges in securing sufficient funding to keep pace with advancements, limiting market competition and growth potential.

Integration with Existing Military Infrastructure

Integrating military robots into existing defense infrastructures presents a significant challenge. The integration process is often complex due to the need for robots to work seamlessly with traditional military platforms, such as vehicles, command and control systems, and legacy communication networks. Many defense forces are still heavily reliant on established systems that were not designed to accommodate the latest autonomous technologies. This results in technical and operational challenges related to interoperability, compatibility, and data sharing between automated systems and legacy military hardware. Overcoming these integration issues requires not only technological advancements but also considerable efforts to re-engineer existing platforms, which can slow down the adoption of new robotic technologies in military operations.

Opportunities

Global Export Potential and Strategic Partnerships

The Israel military robot market has a significant opportunity for growth through export to allied nations. Israel has long been a key supplier of advanced defense technologies, and its expertise in military robotics is sought after globally. With the growing emphasis on autonomous systems and robotics in defense, Israel’s innovative technologies are in high demand, particularly from countries looking to modernize their military forces. Strategic partnerships with other defense contractors and governments offer opportunities for Israeli companies to expand their market presence internationally. Additionally, collaboration with NATO and other defense alliances can provide a stable channel for Israeli military robot exports, enhancing the country’s position in the global defense market.

Multi-Functional and Non-Combat Applications

Another opportunity lies in expanding the use of military robots for non-combat and multi-functional applications. While current military robots are primarily designed for combat or surveillance, there is increasing potential for them to be used in logistics, medical evacuation, and explosive ordnance disposal. By diversifying the applications of military robots, Israel can tap into new markets within defense and security sectors that demand multifunctional automation. This includes areas such as humanitarian missions, disaster response, and border security. The use of robots in such non-combat scenarios would further enhance the utility and adoption of these systems, presenting a significant growth opportunity in the coming years.

Future Outlook

Over the next decade, the Israel military robot market is expected to experience significant growth driven by continuous advancements in robotics, an increasing emphasis on defense automation, and the rising demand for autonomous military systems. Additionally, Israel’s continuous investment in its defense capabilities and strategic partnerships with global defense contractors will further support market expansion.

Key Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- General Robotics

- Roboteam

- Boeing

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Kongsberg Gruppen

- Boston Dynamics

- Clearpath Robotics

- Oshkosh Corporation

- BAE Systems

- General Dynamics

Key Target Audience

- Defense Ministries

- Military Forces

- Government Agencies

- Government and Regulatory Bodies

- Defense Contractors

- Investments and Venture Capitalist Firms

- Military Research Institutes

- Armed Forces Logistics and Supply Units

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical variables that influence the market dynamics of military robotics in Israel. This will be achieved through secondary research from government and defense reports, focusing on technology adoption rates, budget allocations, and emerging defense strategies.

Step 2: Market Analysis and Construction

Market construction involves analysing existing market conditions and historical data related to Israel’s defense budget, military strategies, and technological advancements in robotics. This analysis will provide insights into growth trends and segment performance.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends and future growth will be validated through consultations with industry experts, including defense contractors and military technology providers. Insights from these experts will refine the data and validate market predictions.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing data from primary and secondary sources to produce an accurate and comprehensive market analysis. Engaging with military organizations and manufacturers will ensure the reliability and relevance of the findings.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing military demand for autonomous systems

Technological advancements in AI and robotics

Government investment in defense automation - Market Challenges

High development and operational costs

Complex integration with existing defense systems

Regulatory barriers and certification delays - Market Opportunities

Rising demand for unmanned defense solutions

Technological collaboration with private sector

Export opportunities in emerging defense markets - Trends

Increased integration of AI for autonomous operation

Development of multi-functional robots

Growing use of robotics for surveillance and reconnaissance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Unmanned Ground Vehicles

Unmanned Aerial Vehicles

Autonomous Underwater Vehicles

Robotic Arms for Military Applications

Combat Robots - By Platform Type (In Value%)

Land-based Platforms

Aerial Platforms

Maritime Platforms

Hybrid Platforms

Remote-Controlled Platforms - By Fitment Type (In Value%)

Standard Fitment

Custom Fitment

Modular Fitment

Upgradable Fitment

Retrofit Fitment - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Research Agencies

Security Agencies

Law Enforcement - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contractors

International Defense Relations

Public-Private Partnerships

Commercial Procurement

- Market Share Analysis

- Cross Comparison Parameters (Price Competitiveness, Technological Advancement, System Complexity, End-User Adoption, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Aeronautics Ltd.

Guardium

Pillbox Technologies

Roboteam

Motorola Solutions

Aerovironment

Digi International

Kongsberg Gruppen

L3 Technologies

FLIR Systems

Harris Corporation

Northrop Grumman

- Emerging adoption of robotic systems by military forces

- Shift towards autonomous systems for battlefield support

- Increased reliance on robots for high-risk operations

- Collaborations between governments and private sectors for advanced systems

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035