Market Overview

The Israel Military Satellite market current size stands at around USD ~ million, reflecting sustained defense investment cycles and long-term space capability programs. Recent procurement activity and ongoing platform upgrades have driven annual spending to approximately USD ~ million across satellite manufacturing, payload integration, and mission operations. Defense modernization initiatives, combined with growing emphasis on space-based intelligence and communications resilience, continue to expand the scope of national military satellite programs and associated support infrastructure.

Israel’s military satellite ecosystem is primarily concentrated around Tel Aviv, Haifa, and Be’er Sheva, where aerospace manufacturing clusters, defense R&D centers, and space command facilities are co-located. These regions benefit from mature supplier networks, high-security testing infrastructure, and close coordination between government agencies and private defense firms. Strong policy backing for sovereign space assets and integrated civil-military collaboration further reinforces regional dominance and accelerates innovation cycles.

Market Segmentation

By Application

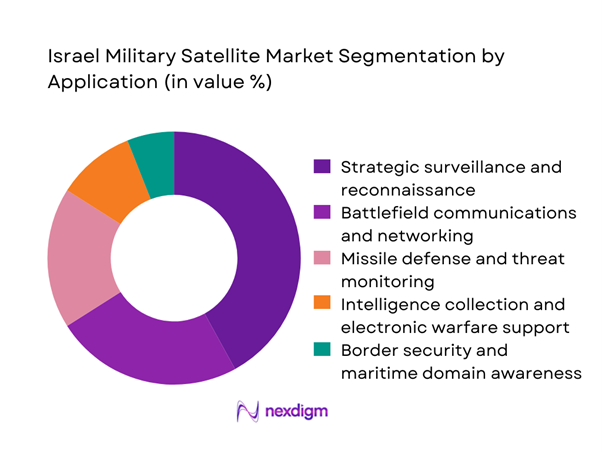

Strategic surveillance and reconnaissance dominates the Israel Military Satellite market due to the country’s sustained focus on real-time intelligence and threat monitoring. Continuous border security requirements, coupled with evolving asymmetric warfare dynamics, have elevated demand for high-resolution imaging and persistent ISR coverage. Battlefield communications and missile defense applications also hold significant importance, driven by the need for secure data links and early warning systems. The growing integration of space-based assets into joint operations across air, land, sea, and cyber domains has further expanded the relevance of multi-mission satellites. This application mix reflects Israel’s defense doctrine that prioritizes rapid situational awareness, autonomous decision-making support, and uninterrupted operational continuity.

By Technology Architecture

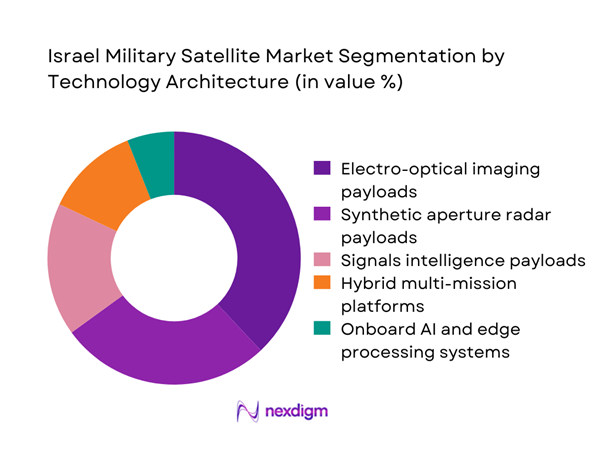

Electro-optical imaging platforms remain the most widely deployed technology architecture in Israel’s military satellite programs, supported by continuous upgrades in sensor resolution and onboard processing. Synthetic aperture radar systems follow closely, providing all-weather and day-night surveillance capability that is critical for persistent monitoring. Signals intelligence payloads are gaining importance as electronic warfare and cyber-enabled operations expand. Hybrid multi-mission platforms are increasingly favored, enabling flexible tasking and cost optimization. The rapid adoption of onboard AI and edge processing architectures is reshaping satellite design priorities, allowing faster data exploitation and reduced dependency on ground infrastructure, which enhances operational resilience in contested environments.

Competitive Landscape

The Israel Military Satellite market is moderately concentrated, with a small group of domestic defense primes dominating system integration and mission control, supported by a network of specialized technology providers and international partners. Long development cycles, strict security clearances, and government-driven procurement frameworks create high entry barriers, reinforcing the position of established players while limiting rapid new entrant expansion.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2014 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Satellite Market Analysis

Growth Drivers

Rising regional security threats and asymmetric warfare risks

Escalating security pressures have intensified reliance on space-based surveillance and communications systems across national defense operations. Over recent years, defense allocations for satellite-enabled intelligence and early warning capabilities have reached around USD ~ million annually, reflecting the urgency of maintaining continuous situational awareness. Deployment of additional reconnaissance and monitoring platforms has increased by approximately ~ systems, supporting border protection and rapid response readiness. This sustained focus on countering asymmetric threats has reinforced satellite programs as a strategic pillar, ensuring uninterrupted command visibility and reinforcing deterrence through advanced space-enabled defense infrastructure.

Expansion of space-based ISR in national defense doctrine

The formal integration of space-based intelligence, surveillance, and reconnaissance into defense doctrine has elevated satellite systems from support assets to mission-critical enablers. Investments in ISR payload development and ground processing infrastructure have approached USD ~ million over recent program cycles, accompanied by the activation of around ~ operational platforms dedicated to intelligence missions. These assets enable faster threat detection, precision targeting, and real-time operational planning. The institutionalization of space ISR across military branches continues to drive long-term demand for advanced sensors, secure data relay, and integrated command architectures.

Challenges

High development and launch costs for defense satellites

The capital intensity of military satellite programs remains a key constraint, with single mission development and deployment expenditures often reaching USD ~ million. Budget allocation pressures are amplified by competing defense priorities, limiting the pace of constellation expansion. Recent procurement cycles indicate that around ~ planned platforms experienced scheduling delays due to funding and cost-optimization reviews. These financial barriers slow modernization timelines and restrict experimentation with emerging technologies, placing additional emphasis on lifecycle cost management and multi-mission system designs to maximize return on investment.

Long procurement cycles and complex defense tender processes

Extended acquisition timelines continue to challenge timely deployment of next-generation satellite systems. Program approval and contracting phases frequently span over ~ months, delaying operational readiness and technology refresh cycles. During recent defense planning periods, approximately ~ systems remained in pre-deployment stages longer than initially forecast due to procedural and regulatory reviews. These delays reduce the agility of defense space programs and complicate synchronization with rapidly evolving threat environments, making procurement reform and accelerated decision frameworks increasingly critical.

Opportunities

Growth in smallsat and microsatellite defense constellations

The shift toward smallsat architectures presents a significant opportunity to enhance coverage while controlling costs. Recent pilot programs have allocated close to USD ~ million for the development of compact defense satellites, enabling the deployment of around ~ platforms within shorter timeframes. These constellations improve redundancy, resilience, and revisit rates for surveillance missions. Their modular design supports faster technology upgrades and reduces dependency on single high-value assets, aligning well with evolving defense strategies that prioritize distributed and resilient space capabilities.

Public-private partnerships in defense space programs

Collaboration between government agencies and private aerospace firms is creating new pathways for innovation and capacity expansion. Joint initiatives have mobilized approximately USD ~ million in combined funding to accelerate payload development, launch services, and ground segment modernization. These partnerships have facilitated the introduction of around ~ new subsystems into active programs, enhancing technological diversity and shortening development cycles. The growing role of private sector expertise strengthens the national defense space ecosystem while enabling more flexible program execution models.

Future Outlook

The Israel Military Satellite market is expected to remain a strategic priority through the next decade, driven by sustained security demands and continued integration of space assets into core defense operations. Advances in resilient satellite architectures, AI-enabled mission systems, and allied space cooperation frameworks will shape future program design. As procurement models evolve and public-private collaboration deepens, the market is likely to see greater emphasis on agility, redundancy, and multi-domain operational integration.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Spacecom

- ImageSat International

- NSLComm

- Gilat Satellite Networks

- SatixFy

- Orbit Communication Systems

- Airbus Defence and Space

- Thales Alenia Space

- Lockheed Martin

- Northrop Grumman

- L3Harris Technologies

- Boeing Defense, Space & Security

Key Target Audience

- Ministry of Defense of Israel and Directorate of Defense Research and Development

- Israel Space Agency and national space command units

- Air Force intelligence and surveillance divisions

- Naval operations and maritime security agencies

- Cyber and space warfare directorates

- Defense system integrators and aerospace OEMs

- Secure communications and satellite service providers

- Investments and venture capital firms focused on aerospace and defense technologies

Research Methodology

Step 1: Identification of Key Variables

Assessment of mission requirements, platform lifecycles, and defense budget allocation patterns. Evaluation of technology maturity levels across payloads, launch systems, and ground infrastructure. Mapping of regulatory and security constraints influencing program execution.

Step 2: Market Analysis and Construction

Development of market structure based on satellite classes, applications, and end-use profiles. Integration of procurement cycles and deployment trends into demand modeling. Alignment of segmentation frameworks with operational defense priorities.

Step 3: Hypothesis Validation and Expert Consultation

Validation of assumptions through structured interactions with defense program managers and system architects. Cross-checking of deployment patterns with operational command requirements. Refinement of opportunity areas through scenario-based assessments.

Step 4: Research Synthesis and Final Output

Consolidation of qualitative and quantitative insights into a unified market narrative. Alignment of findings with strategic defense space trends. Final review to ensure analytical consistency and policy relevance.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military satellite taxonomy across communication navigation and ISR missions, market sizing logic by constellation size and launch cadence, revenue attribution across satellite manufacturing launch and ground segment services, primary interview program with defense agencies OEMs and integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and mission usage pathways

- Defense space ecosystem structure

- Supply chain and integration model

- Regulatory and national security environment

- Growth Drivers

Rising regional security threats and asymmetric warfare risks

Expansion of space-based ISR in national defense doctrine

Modernization of missile defense and early warning systems

Increasing demand for secure, resilient military communications

Government prioritization of sovereign space capabilities

Integration of AI and real-time analytics in satellite missions - Challenges

High development and launch costs for defense satellites

Long procurement cycles and complex defense tender processes

Technology export restrictions and regulatory constraints

Space debris and orbital congestion risks

Cybersecurity threats to space-based assets

Dependence on limited launch and manufacturing capacity - Opportunities

Growth in smallsat and microsatellite defense constellations

Public-private partnerships in defense space programs

Export potential of Israeli military satellite technologies

Dual-use applications in civil security and disaster response

Advances in reusable launch and rapid deployment systems

Integration with allied space situational awareness networks - Trends

Shift toward resilient multi-orbit satellite architectures

Adoption of software-defined payloads and reconfigurable platforms

Increasing role of commercial space providers in defense missions

Emphasis on space domain awareness and counter-space capabilities

Miniaturization of high-performance ISR payloads

Growing use of AI-driven mission planning and data fusion - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Unit Economics, 2020–2025

- By Fleet Type (in Value %)

Earth observation and reconnaissance satellites

Communication and secure SATCOM satellites

Early warning and missile detection satellites

Signals intelligence and electronic intelligence satellites

Navigation and timing support satellites - By Application (in Value %)

Strategic surveillance and reconnaissance

Battlefield communications and networking

Missile defense and threat monitoring

Intelligence collection and electronic warfare support

Border security and maritime domain awareness - By Technology Architecture (in Value %)

Electro-optical imaging payloads

Synthetic aperture radar payloads

Signals intelligence payloads

Hybrid multi-mission platforms

Onboard AI and edge processing systems - By End-Use Industry (in Value %)

Air force and aerospace command

Army intelligence and surveillance units

Naval operations and coastal security forces

National intelligence agencies

Cyber and space command divisions - By Connectivity Type (in Value %)

X-band and Ka-band military SATCOM

Secure optical inter-satellite links

UHF and L-band tactical communications

Hybrid terrestrial-satellite integrated networks - By Region (in Value %)

Israel domestic defense programs

Middle East strategic cooperation partners

North America defense collaboration

Europe defense and security alliances

Asia-Pacific security partnerships

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (satellite payload capability, launch readiness, system integration expertise, secure communications performance, lifecycle cost efficiency, government contracting experience, export compliance strength, innovation pipeline depth)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Spacecom

ImageSat International

NSLComm

Gilat Satellite Networks

SatixFy

Orbit Communication Systems

Airbus Defence and Space

Thales Alenia Space

Lockheed Martin

Northrop Grumman

L3Harris Technologies

Boeing Defense, Space & Security

- Demand and utilization drivers

- Procurement and classified tender dynamics

- Buying criteria and system integration requirements

- Budget allocation and long-term defense financing models

- Implementation barriers and operational risk factors

- Post-deployment support and lifecycle service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Unit Economics, 2026–2035