Market Overview

The Israel Military Satellite market is valued at USD ~billion, based on a five-year historical analysis. This market is driven by the country’s strategic emphasis on security and defense, including increasing investments in satellite technology for national defense. Government initiatives and international partnerships also contribute significantly to market growth, with advancements in satellite communication and reconnaissance boosting demand. Israel’s cutting-edge technological capabilities in space infrastructure further enhance the market’s potential.

The dominance of countries like Israel, the United States, and Russia in the military satellite market is due to their significant investments in satellite technologies and defense applications. Israel’s advanced defense technology, specifically in satellite communications and surveillance, positions it as a key player. The U.S. and Russia lead with substantial defense budgets, while Israel’s integration of satellite technology with real-time surveillance and intelligence plays a central role in its dominance.

Market Segmentation

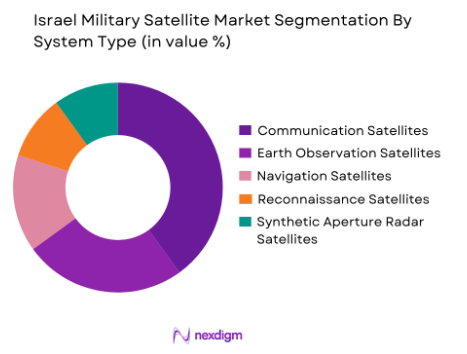

By System Type

The Israel Military Satellite market is segmented by system type into communication satellites, earth observation satellites, navigation satellites, reconnaissance satellites, and synthetic aperture radar satellites. Communication satellites dominate the market share due to their crucial role in secure, real-time communications for defense operations. Israel has developed advanced communication satellites that integrate cutting-edge technologies, enhancing military effectiveness. This focus on secure and reliable communication systems has led to the segment’s market leadership.

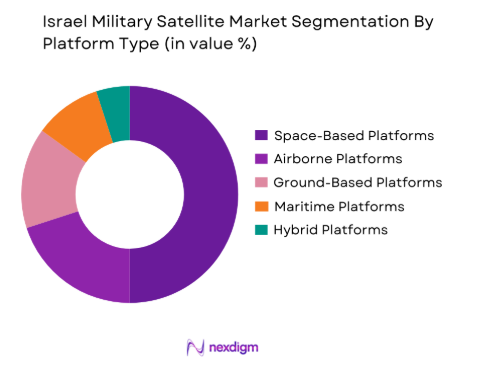

By Platform Type

The Israel Military Satellite market is also segmented by platform type, which includes space-based platforms, airborne platforms, ground-based platforms, maritime platforms, and hybrid platforms. Space-based platforms dominate the market due to their ability to provide continuous and real-time surveillance and communication capabilities, especially for military purposes. Israel’s integration of satellite systems into its space-based platforms has significantly contributed to the platform’s dominance in the market.

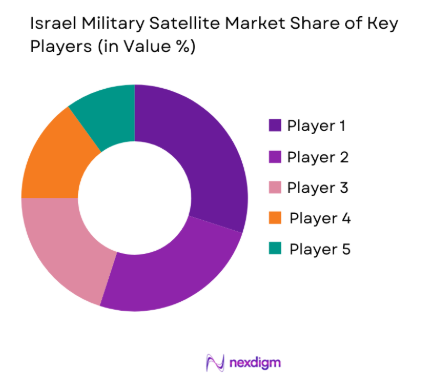

Competitive Landscape

The Israeli Military Satellite market is characterized by a few major players, each contributing significantly to technological advancements. These companies have established strong positions in the global market by securing government contracts and fostering international collaborations.

| Company | Establishment Year | Headquarters | Defense Tech Expertise | Export Orientation | Platform Integration | R&D Intensity | Strategic Alliances |

| Israel Aerospace Industries | 1953 | Lod, Israel | High | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | High | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | High | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | Very High | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | Very High | ~ | ~ | ~ | ~ |

Israel Military Satellite Market Analysis

Growth Drivers

Increasing Defense Budgets and Military Modernization

Israel’s commitment to maintaining a cutting-edge military forces contributes significantly to the growth of the military satellite market. The nation’s defense budget, which has seen consistent increases, ensures that technological advancements, such as satellite systems for communication, surveillance, and reconnaissance, remain a priority. As the country modernizes its military infrastructure, particularly its space-based assets, the demand for sophisticated satellite systems is expected to grow. The Israeli government’s strategic emphasis on high-tech solutions for defense operations further drives investment into satellite technologies, ensuring continued growth in this sector.

Technological Advancements in Satellite Systems

Israel’s military satellite market is benefiting from rapid advancements in satellite technology. The country’s leadership in high-tech innovation has allowed for the development of small, more efficient, and cost-effective satellite systems. These innovations provide enhanced functionality, such as real-time communication and intelligence gathering, which are crucial for military operations. Israel’s ability to design and deploy advanced satellite systems, including synthetic aperture radar (SAR) and reconnaissance satellites, strengthens the market’s growth prospects as these systems offer superior capabilities in both defense and strategic operations.

Market Challenges

High Development and Operational Costs

A significant challenge in the Israel Military Satellite market is the high cost of satellite development, launch, and maintenance. Israel’s military satellite systems are often highly specialized and technologically advanced, which increases the overall cost of production and operation. The cost of deploying and maintaining satellites in space, especially in the face of international competition, presents financial challenges. While these satellites provide exceptional capabilities, the associated costs can limit the scope of expansion for both governmental and private sector participants.

Vulnerability to Cybersecurity Threats and Space Debris

As military satellites become integral to national security operations, they also face growing risks from cyber threats and space debris. Satellites are prime targets for cyber-attacks aimed at disrupting military communications and intelligence systems. Additionally, the increasing volume of space debris poses a significant risk to satellite operations. Collisions with space debris can cause irreversible damage, leading to costly repairs or the loss of valuable satellites. Israel’s reliance on its satellite infrastructure exposes it to these vulnerabilities, challenging the continued smooth operation and longevity of its satellite assets.

Opportunities

Global Collaboration and Export Potential

The growing demand for satellite technology in defense sectors worldwide presents Israel with significant opportunities to expand its military satellite offerings. Israel is well-positioned to engage in international collaborations, particularly with countries seeking to modernize their defense infrastructure. With a robust export market for military technology, Israel’s satellite solutions, particularly in surveillance and communications, are in high demand. By partnering with foreign governments and defense organizations, Israel can further cement its role as a global leader in satellite technology, driving both market growth and international recognition.

Small Satellite and Constellation Development

The development and deployment of small satellite constellations represent a key opportunity for the Israel Military Satellite market. These smaller, cost-efficient satellites allow for increased operational flexibility, improved data relay, and more frequent launches. Israel’s expertise in miniaturizing satellite systems gives it a competitive edge in the small satellite market. With the growing need for global surveillance, reconnaissance, and communications capabilities, small satellite constellations provide an efficient solution for military operations. This opportunity is expected to drive growth, particularly in areas like real-time intelligence and border surveillance.

Future Outlook

Over the next decade, the Israel Military Satellite market is expected to show significant growth driven by continued advancements in satellite technology, increasing investments in national security, and a rise in international collaborations. With Israel’s strategic focus on modernizing its defense infrastructure, the demand for satellite-based communication, surveillance, and reconnaissance will drive market expansion. The growing need for secure communication channels and intelligence capabilities further supports the positive outlook for the market.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Thales Group

- Lockheed Martin

- Boeing Defense, Space & Security

- Northrop Grumman

- Airbus Defense and Space

- SpaceX

- Raytheon Technologies

- Maxar Technologies

- L3Harris Technologies

- SES S.A.

- Inmarsat

- Ball Aerospace

Key Target Audience

- Defense Ministries

- Military Contractors

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Military Technology Integrators

- Aerospace & Defense Research Organizations

- National Intelligence Agencies

- Private Satellite Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Israel Military Satellite Market. This step uses secondary research and proprietary databases to identify the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data about the Israel Military Satellite Market will be compiled, including market penetration, revenue generation, and service quality statistics. An evaluation of the defense spending on satellite technologies will help ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts. This step is vital for refining and corroborating the market data gathered from secondary research.

Step 4: Research Synthesis and Final Output

The final phase includes direct consultations with satellite manufacturers and defense integrators to acquire detailed insights into the industry’s product segments, sales performance, and future trends. This interaction will complement the data gathered from previous phases, ensuring a comprehensive and accurate analysis of the Israel Military Satellite market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets and military modernization programs

Growing need for advanced surveillance and reconnaissance capabilities

Rising adoption of satellite communication for secure defense operations - Market Challenges

High cost of satellite development and maintenance

Complex regulatory approvals and certification procedures

Vulnerability to cyber-attacks and space debris risks - Market Opportunities

Advancements in satellite miniaturization technologies

Increasing international collaborations and partnerships

Emerging markets for satellite-based communication systems - Trends

Increased focus on multi-satellite constellations for defense applications

Shift towards smaller and more cost-effective satellite systems

Growing demand for real-time data analytics in military operations

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Communication Satellites

Earth Observation Satellites

Navigation Satellites

Reconnaissance Satellites

Synthetic Aperture Radar Satellites - By Platform Type (In Value%)

Space-Based Platforms

Airborne Platforms

Ground-Based Platforms

Maritime Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Military Communication Fitment

Surveillance Fitment

Signal Intelligence Fitment

Global Positioning Fitment

Geospatial Intelligence Fitment - By End User Segment (In Value%)

Government & Defense Agencies

Private Contractors

Satellite Service Providers

Research Institutions

International Alliances - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Third-Party Procurement

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters (Technology Integration, Procurement Models, Global Reach, Innovation Rate, Partnership Networks)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Thales Group

Lockheed Martin

Boeing Defense, Space & Security

Airbus Defense and Space

Northrop Grumman

Ball Aerospace

SpaceX

Raytheon Technologies

Maxar Technologies

L3Harris Technologies

SES S.A.

Inmarsat

- Demand from national defense organizations for secure communications

- Expansion of satellite-based intelligence for border security

- Collaborations with international defense forces for joint satellite missions

- Private contractors integrating satellite data into national defense strategies

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035