Market Overview

The Israel military sensors market current size stands at around USD ~ million, reflecting sustained procurement momentum across land, air, naval, and space defense programs. In the most recent year, overall market value expanded from approximately USD ~ million, supported by rising deployments of electro-optical, radar, and multispectral sensing systems. Installed active platforms crossed ~ systems, while annual shipments exceeded ~ units, driven by modernization cycles and urgent operational requirements. Average system realization remained near USD ~ million per program.

Regional dominance within the market is shaped by the concentration of defense manufacturing and system integration capabilities in central Israel, supported by advanced testing ranges and proximity to military headquarters. Southern operational zones drive demand for border surveillance and counter-intrusion sensors, while maritime hubs along the Mediterranean coastline strengthen naval sensor adoption. A mature supplier ecosystem, strong public procurement frameworks, and sustained government focus on indigenous defense technologies further reinforce nationwide leadership in military sensing solutions.

Market Segmentation

By Technology Architecture

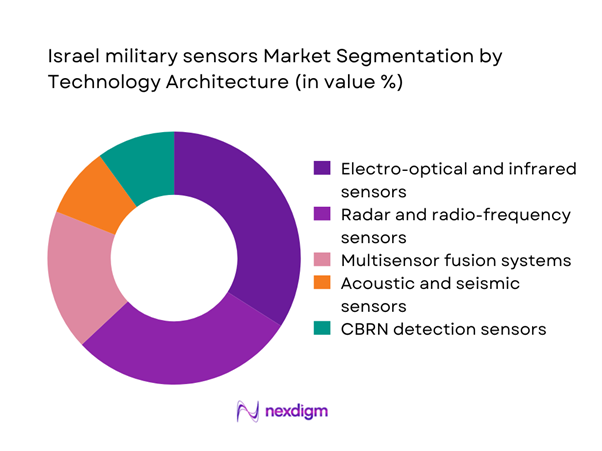

Electro-optical, radar, and multisensor fusion systems dominate the Israel military sensors market due to their central role in surveillance, targeting, and force protection. Electro-optical and infrared solutions remain essential for real-time situational awareness across land and aerial platforms, while radar-based architectures support air defense, maritime monitoring, and early warning networks. The fastest momentum is observed in AI-enabled multisensor fusion, where data from acoustic, magnetic, and CBRN sensors is integrated for faster operational decisions. Growing investment in autonomous platforms further elevates demand for compact, power-efficient sensor architectures, positioning advanced sensing technologies as the backbone of next-generation Israeli defense capabilities.

By Application

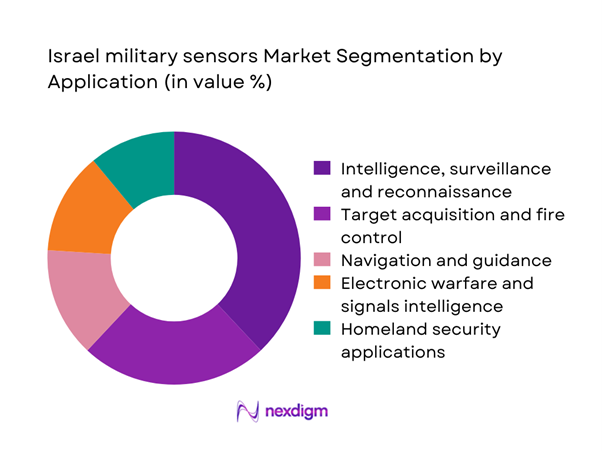

Intelligence, surveillance, and reconnaissance applications account for the largest share of sensor deployments, driven by persistent border monitoring and regional security operations. Target acquisition and fire control follow closely, supported by the modernization of armored platforms, naval combat systems, and air defense networks. Navigation and guidance sensors are gaining prominence in unmanned aerial and ground systems, while electronic warfare and signals intelligence applications are expanding due to rising electromagnetic spectrum threats. Homeland security use cases, including critical infrastructure protection, also contribute steadily, reflecting the dual-use nature of several military-grade sensing technologies in Israel’s broader national security framework.

Competitive Landscape

The Israel military sensors market is moderately concentrated, with a small group of domestic defense leaders complemented by select international technology partners. Competitive positioning is shaped by long-term defense contracts, deep system integration expertise, and strong alignment with national security priorities. Barriers to entry remain high due to regulatory controls, intellectual property intensity, and the need for sustained R&D investment, resulting in a stable but innovation-driven competitive environment.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Israel military sensors Market Analysis

Growth Drivers

Rising defense budgets driven by regional security threats

Sustained defense allocations have translated into consistent procurement of advanced sensing technologies across land, air, and maritime domains. Over the last two years, annual program funding for sensor modernization exceeded USD ~ million, enabling the induction of ~ systems across border surveillance and air defense networks. Active operational platforms equipped with next-generation sensors expanded to ~ units, improving detection ranges and response times. This steady fiscal commitment supports long-term supplier contracts and accelerates technology refresh cycles, ensuring that sensing capabilities remain aligned with evolving regional threat dynamics.

Expansion of unmanned and autonomous military platforms

The rapid deployment of unmanned aerial, ground, and maritime systems has significantly increased demand for compact, power-efficient sensors. In the most recent period, more than ~ autonomous platforms were integrated with electro-optical and navigation sensors, representing investments of nearly USD ~ million in subsystem upgrades. Annual shipment volumes of lightweight sensor modules reached ~ units, driven by fleet expansion programs. This structural shift toward autonomy continues to reshape procurement priorities, positioning sensor manufacturers at the center of future force transformation strategies.

Challenges

Stringent export controls and international regulatory scrutiny

Export compliance requirements impose structural constraints on market expansion, particularly for dual-use and high-sensitivity sensing technologies. Over the past two years, delayed approvals affected contracts valued at approximately USD ~ million, limiting shipment volumes by ~ units across select international programs. Regulatory vetting processes extend sales cycles by several months, increasing working capital exposure and inventory holding costs. These compliance pressures necessitate dedicated legal and policy resources, raising operational overheads for manufacturers and sometimes restricting access to high-growth overseas defense markets.

High development costs for advanced sensing technologies

R&D intensity in multispectral imaging, AI-enabled fusion, and cyber-resilient architectures continues to escalate. Recent development programs for next-generation sensors required investments of more than USD ~ million per platform, with prototype production volumes often limited to ~ units during early validation stages. Such capital intensity stretches internal budgets and elevates breakeven timelines. Smaller suppliers face greater barriers in sustaining long innovation cycles, reinforcing market concentration while increasing dependency on government-backed funding and long-term procurement assurances.

Opportunities

Expansion of space-based and satellite sensor programs

Israel’s growing focus on space domain awareness creates a substantial growth avenue for advanced optical and radar payloads. In the last two years, satellite sensor integration programs attracted funding of nearly USD ~ million, resulting in the deployment of ~ systems in low-earth orbit platforms. Annual production volumes of space-grade sensors reached ~ units, opening new revenue streams beyond traditional terrestrial defense markets. This expansion enhances strategic autonomy while providing suppliers with access to high-value, long-duration contracts tied to national space security initiatives.

Development of counter-UAS and anti-drone sensing solutions

The rising frequency of low-cost aerial threats has accelerated investment in detection and neutralization technologies. Recent procurement cycles allocated approximately USD ~ million toward counter-UAS sensor suites, enabling the installation of ~ systems across border and critical infrastructure sites. Shipment volumes of radar and RF detection modules exceeded ~ units, driven by urgent operational needs. This segment offers strong scalability potential, as modular sensor architectures can be rapidly deployed and upgraded to address evolving threat profiles.

Future Outlook

The Israel military sensors market is set to remain on a steady expansion path through the next decade, supported by continuous defense modernization and rising adoption of autonomous platforms. Increasing emphasis on space, cyber-resilient architectures, and multisensor fusion will reshape product development priorities. Strategic collaborations with allied defense programs are expected to enhance export opportunities while sustaining domestic innovation momentum. Overall, the market outlook reflects long-term stability anchored in national security imperatives.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- ELTA Systems

- Thales Group

- Leonardo S.p.A.

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- RTX Corporation

- Saab AB

- Hensoldt AG

- L3Harris Technologies

- Teledyne FLIR

- ASELSAN

Key Target Audience

- Ministry of Defense procurement divisions

- Israel Defense Forces technology and logistics directorates

- Border security and homeland protection agencies

- Naval and maritime security authorities

- Aerospace and defense system integrators

- Cybersecurity and electronic warfare units

- Investments and venture capital firms

- Government and regulatory bodies including the Israeli Export Control Agency and the Ministry of Public Security

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, technology adoption patterns, and procurement structures were mapped to define the analytical framework. Key performance indicators were aligned with operational deployment metrics and budgetary flows. Stakeholder priorities across defense and homeland security were incorporated to ensure relevance.

Step 2: Market Analysis and Construction

Historical performance trends were assessed using deployment volumes and program funding benchmarks. Segment-level demand scenarios were constructed to reflect platform modernization cycles. Regulatory and policy environments were evaluated to contextualize market constraints.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through structured discussions with industry practitioners and defense planners. Assumptions on technology trajectories were stress-tested against operational realities. Feedback loops ensured analytical rigor and scenario robustness.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a cohesive market narrative aligned with strategic decision needs. Quantitative and qualitative findings were integrated to support actionable conclusions. Final outputs were structured to meet consulting-grade publication standards.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military sensor taxonomy across electro optical radar and acoustic systems, market sizing logic by platform deployment and upgrade cycles, revenue attribution across equipment sales spares and support services, primary interview program with defense operators OEMs and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and deployment pathways

- Defense ecosystem structure

- Supply chain and system integration landscape

- Regulatory and export control environment

- Growth Drivers

Rising defense budgets driven by regional security threats

Expansion of unmanned and autonomous military platforms

Increasing demand for multi-domain situational awareness

Modernization of border surveillance and homeland security systems

Adoption of AI-enabled sensor fusion for faster decision cycles

Growing export demand for Israeli defense technologies - Challenges

Stringent export controls and international regulatory scrutiny

High development costs for advanced sensing technologies

Supply chain disruptions in critical electronic components

Cybersecurity risks to networked sensor systems

Integration complexity across legacy and next-generation platforms

Talent shortages in advanced electronics and AI engineering - Opportunities

Expansion of space-based and satellite sensor programs

Development of counter-UAS and anti-drone sensing solutions

Growth in maritime domain awareness technologies

Increased collaboration with allied defense forces

Commercialization of dual-use sensor technologies

Adoption of predictive maintenance and health monitoring sensors - Trends

Shift toward multispectral and hyperspectral imaging systems

Integration of AI and machine learning at the sensor edge

Miniaturization and weight reduction for unmanned platforms

Growth of network-centric and data-driven warfare concepts

Rising focus on cyber-resilient sensing architectures

Increased use of digital twins and simulation in sensor design - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land combat platforms

Naval vessels and submarines

Manned aircraft

Unmanned aerial systems

Missile and air defense systems

Fixed-site border and perimeter systems - By Application (in Value %)

Intelligence, surveillance and reconnaissance

Target acquisition and fire control

Navigation and guidance

Force protection and situational awareness

Electronic warfare and signals intelligence

Homeland security and critical infrastructure protection - By Technology Architecture (in Value %)

Electro-optical and infrared sensors

Radar and radio-frequency sensors

Acoustic and seismic sensors

Magnetic and gravimetric sensors

Chemical, biological, radiological and nuclear sensors

Multisensor fusion and AI-enabled sensing - By End-Use Industry (in Value %)

Defense forces and military agencies

Homeland security and border protection

Intelligence services

Aerospace and defense manufacturing

Naval and maritime security organizations - By Connectivity Type (in Value %)

Wired secure networks

Tactical wireless communications

Satellite-linked sensing systems

Mesh and ad-hoc battlefield networks

Standalone and offline sensor nodes - By Region (in Value %)

Central Israel defense industrial hubs

Northern Israel security zones

Southern Israel border and desert regions

Offshore and maritime operational areas

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (sensor performance range, detection accuracy, system integration capability, cybersecurity resilience, lifecycle support, export compliance, pricing competitiveness, innovation pipeline strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

ELTA Systems

Thales Group

Leonardo S.p.A.

BAE Systems

Lockheed Martin

Northrop Grumman

RTX Corporation

Saab AB

Hensoldt AG

L3Harris Technologies

Teledyne FLIR

ASELSAN

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and lifecycle support expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035