Market Overview

The Israel Military Simulation and Training market current size stands at around USD ~ million, supported by sustained defense modernization programs and continuous investment in multi-domain readiness. Recent periods recorded procurement volumes of ~ systems across air, land, and cyber training environments, alongside cumulative service contracts valued at USD ~ million. Operational training hours supported by advanced simulators crossed ~ million sessions, while lifecycle support spending reached USD ~ million, reflecting the strategic role of simulation in force preparedness and cost-efficient capability development.

Central Israel remains the primary hub for simulation development and deployment due to dense defense infrastructure, proximity to major system integrators, and access to specialized engineering talent. Southern command zones lead in large-scale field training adoption driven by expansive training ranges and operational testing facilities. Northern regions demonstrate growing uptake in networked command training systems supported by secure communication backbones. The concentration of defense innovation clusters, rapid procurement cycles, and mature export-oriented ecosystems further reinforce regional dominance across the national training landscape.

Market Segmentation

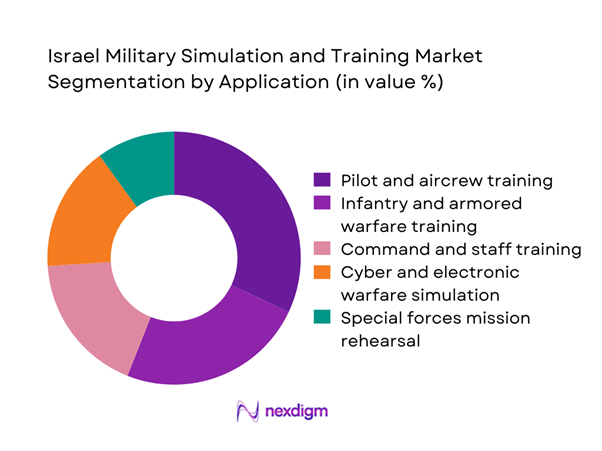

By Application

Aircrew and pilot training continues to dominate application demand due to sustained fleet modernization and the increasing complexity of mission profiles. The growing use of advanced mission rehearsal platforms has expanded simulator deployment across fighter, transport, and unmanned aviation units, supported by cumulative investments of USD ~ million in recent periods. Infantry and armored warfare training also shows strong momentum as urban operations and asymmetric conflict scenarios drive demand for immersive environments. Cyber and electronic warfare simulation has emerged as a fast-expanding segment, fueled by the need to replicate real-time threat vectors. Command and staff training adoption is accelerating as joint-force doctrines require synchronized decision-making across domains, reinforcing long-term application diversification.

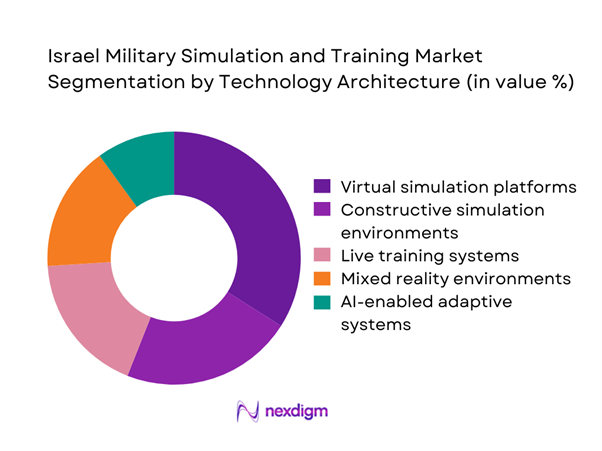

By Technology Architecture

Virtual simulation platforms hold a leading position driven by scalability, lower operational disruption, and broad applicability across training tiers. Recent deployments exceeded ~ systems, supported by cumulative contracts worth USD ~ million for software upgrades and scenario libraries. Constructive simulation environments maintain strong relevance for large-scale force planning and doctrine validation, while live training systems remain essential for high-fidelity weapons integration. Mixed reality solutions are gaining traction as forces seek immersive yet cost-efficient training formats, with recent installations reaching ~ units. AI-enabled adaptive systems are emerging as a strategic differentiator, enabling personalized training pathways and automated performance assessment, setting the foundation for next-generation synthetic training ecosystems.

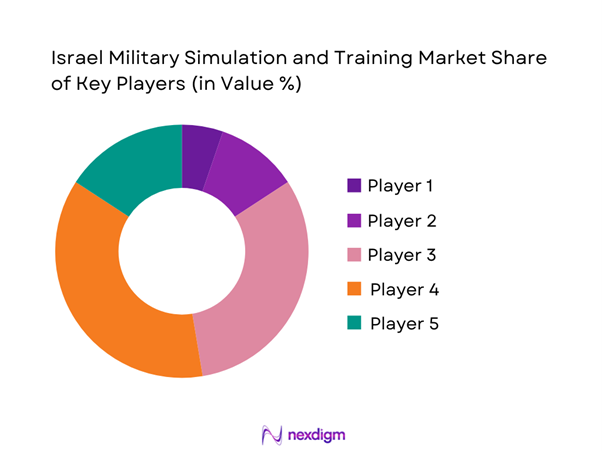

Competitive Landscape

The market features a moderately concentrated structure with a small group of large defense integrators complemented by specialized technology providers. Long-term government contracts, high security clearances, and system interoperability requirements create significant entry barriers, reinforcing the dominance of established players. Competition centers on system fidelity, integration depth, and lifecycle service capability rather than price-based positioning, leading to multi-year framework agreements and repeat procurement cycles.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| CAE | 1947 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Simulation and Training Market Analysis

Growth Drivers

Rising operational tempo and multi-domain threat environment

Sustained regional volatility has increased the frequency and complexity of training cycles, driving higher utilization of simulation assets across air, land, sea, and cyber domains. Recent operational periods recorded more than ~ million simulated mission hours, supported by the deployment of ~ systems across major training bases. Defense authorities allocated USD ~ million toward expanding synthetic training capacity to reduce live-training risks and equipment wear. The growing need to prepare forces for simultaneous engagements across multiple theaters has reinforced reliance on integrated simulation platforms that can replicate real-time threat convergence, enabling faster readiness cycles and continuous force posture optimization.

Modernization of IDF training doctrine toward network-centric warfare

The transition toward network-centric operations has accelerated investments in interconnected training ecosystems. Recent procurement cycles added ~ systems capable of joint-force interoperability, backed by cumulative spending of USD ~ million on secure networking and data fusion layers. Training doctrines increasingly emphasize synchronized decision-making, prompting expanded use of command-level constructive simulations and distributed mission rehearsal environments. This modernization has also driven the integration of cyber and electronic warfare scenarios into conventional training pipelines, increasing demand for multi-layered simulation architectures that support doctrinal alignment and rapid capability assimilation across operational units.

Challenges

High capital costs of advanced simulation infrastructure

The deployment of high-fidelity simulators and secure networking frameworks requires substantial upfront expenditure, creating budgetary pressure even within prioritized defense programs. Recent acquisition cycles involved capital outlays of USD ~ million for system integration, facility upgrades, and specialized hardware. Annual maintenance and software refresh commitments added recurring costs of USD ~ million, constraining the pace of large-scale rollouts. Smaller training units face difficulties justifying investments exceeding ~ systems per site, leading to phased deployments and extended replacement cycles that slow overall market expansion despite strong operational demand.

Cybersecurity risks in networked training environments

The rapid shift toward connected simulation platforms has heightened exposure to cyber threats, making system resilience a critical procurement criterion. Recent security audits identified vulnerabilities across ~ network nodes, prompting emergency remediation investments of USD ~ million. Protecting sensitive operational data and training scenarios now requires continuous monitoring infrastructure, adding recurring expenditures of USD ~ million annually. These requirements complicate vendor selection and extend certification timelines, delaying deployment schedules and increasing total program costs while elevating the complexity of lifecycle management for simulation ecosystems.

Opportunities

Expansion of AI-driven adaptive and personalized training

The integration of artificial intelligence into simulation platforms presents a major opportunity to enhance training efficiency and outcome measurement. Recent pilot programs deployed ~ AI-enabled modules capable of dynamically adjusting scenarios based on trainee performance, supported by development funding of USD ~ million. Early results show reductions in instructor workload by ~ units of training time per cycle and improved skill retention across specialized units. Scaling these systems across national training centers could unlock long-term operational savings while creating export-ready solutions for allied forces seeking advanced digital training transformation.

Export growth to allied and partner militaries

International demand for proven training solutions offers a strong growth pathway for domestic suppliers. Recent export agreements involved delivery of ~ systems to partner forces, generating contract values of USD ~ million and multi-year service revenues of USD ~ million. As allied militaries seek to modernize cost-effectively, turnkey simulation packages with embedded cybersecurity and interoperability features are gaining traction. Expanding foreign military sales channels and joint training programs can further amplify market reach, positioning Israel-based providers as key contributors to global defense training ecosystems.

Future Outlook

The market is expected to advance steadily through the coming decade as defense forces deepen reliance on synthetic environments for readiness, safety, and cost control. Continued emphasis on multi-domain operations will accelerate demand for integrated and secure simulation platforms. Export opportunities and AI-enabled innovation are likely to reshape competitive dynamics, while policy support for domestic defense technology development will sustain long-term ecosystem growth.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- CAE

- L3Harris Technologies

- Thales Group

- Lockheed Martin

- Boeing Defense

- Northrop Grumman

- BAE Systems

- Rheinmetall Defence

- Leonardo

- Saab

- Cubic Defense

- QinetiQ

Key Target Audience

- Israel Defense Forces procurement directorates

- Ministry of Defense, Directorate of Defense Research and Development

- National Cyber Directorate and security agencies

- Defense system integrators and prime contractors

- Training command and doctrine development units

- Export control authorities and foreign military sales offices

- Defense-focused investments and venture capital firms

- Government and regulatory bodies including SIBAT and the Ministry of Public Security

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators were mapped across training intensity, platform complexity, and doctrinal shifts influencing simulation adoption. Supply-side variables included system interoperability, cybersecurity readiness, and lifecycle service depth. Policy and export dynamics were incorporated to assess long-term structural drivers.

Step 2: Market Analysis and Construction

Historical procurement patterns were analyzed alongside deployment trends across major commands. Quantitative modeling integrated masked financial and system data to establish baseline market structure. Segment-level insights were constructed using application and technology architecture lenses.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through structured discussions with defense training planners and system architects. Operational feedback loops refined assumptions on utilization rates and upgrade cycles. Scenario testing assessed resilience under varying budget and threat conditions.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a unified analytical framework. Consistency checks ensured alignment between segmentation, competitive mapping, and outlook assumptions. Final outputs were structured to support strategic decision-making and investment planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military simulation and training taxonomy across live virtual and constructive systems, market sizing logic by platform deployment and training seat demand, revenue attribution across software licenses hardware simulators and support services, primary interview program with defense training commands OEMs and integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Training and readiness pathways

- Ecosystem structure

- Supply chain and delivery models

- Defense regulatory and security environment

- Growth Drivers

Rising operational tempo and multi-domain threat environment

Modernization of IDF training doctrine toward network-centric warfare

Increasing complexity of platforms and weapon systems

Demand for cost-efficient alternatives to live training

Expansion of cyber and electronic warfare preparedness

Growth of defense exports and allied training programs - Challenges

High capital costs of advanced simulation infrastructure

Cybersecurity risks in networked training environments

Integration complexity across legacy and next-generation platforms

Budgetary constraints and competing defense priorities

Limited interoperability standards across coalition partners

Long procurement cycles and regulatory compliance hurdles - Opportunities

Expansion of AI-driven adaptive and personalized training

Export growth to allied and partner militaries

Integration of digital twins for platform and mission rehearsal

Public-private partnerships in defense training innovation

Development of urban warfare and asymmetric conflict simulators

Use of simulation for reserve and homeland security forces - Trends

Shift toward immersive mixed-reality training environments

Adoption of data analytics for performance assessment

Increasing use of cloud-secured simulation ecosystems

Emphasis on joint-force and multi-domain training

Growth in cyber range and EW simulation platforms

Lifecycle service contracts replacing one-time system sales - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Contract Value, 2020–2025

- By Fleet Type (in Value %)

Land forces training systems

Air force simulation platforms

Naval warfare simulators

Joint and combined arms simulation

Homeland security and reserve forces systems - By Application (in Value %)

Pilot and aircrew training

Infantry and armored warfare training

Command, control, and staff training

Cyber and electronic warfare simulation

Special forces mission rehearsal

Disaster response and civil defense training - By Technology Architecture (in Value %)

Live training systems

Virtual simulation platforms

Constructive simulation environments

Mixed reality and synthetic training environments

AI-enabled adaptive training systems - By End-Use Industry (in Value %)

Israel Defense Forces

Defense training academies

Defense contractors and integrators

Government security agencies

Export and allied military customers - By Connectivity Type (in Value %)

Standalone offline systems

Networked on-premise systems

Secure private cloud-based simulation

Hybrid cloud-edge architectures

Interoperable NATO-standard networks - By Region (in Value %)

Central Israel defense hubs

Southern Israel training zones

Northern Israel operational commands

Overseas export markets

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (simulation fidelity, interoperability standards, cybersecurity compliance, lifecycle support capability, AI integration level, export readiness, training throughput capacity, total cost of ownership)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems Training and Simulation

RADA Electronic Industries

TAT Technologies

Aeronautics Group

Cognata

XTEND Reality Expansion

Cymulate

NSO Technologies Training Division

CAE

L3Harris Technologies

Thales Group

Lockheed Martin

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Contract Value, 2026–2035