Market Overview

The market size for military simulation and training is based on the recent assessments of both domestic and international defense budgets. The market is primarily driven by the growing investments in defense technologies, increasing demand for realistic training simulations, and the need for efficient, cost-effective training solutions for military personnel. The adoption of advanced technologies, such as virtual reality, augmented reality, and AI-driven training modules, has played a crucial role in expanding the market’s scope. Global military spending continues to increase, pushing the demand for more sophisticated training solutions that can improve preparedness and operational efficiency.

The dominance of countries like the United States, Israel, and China in this market is driven by their significant defense spending and the continuous enhancement of their armed forces. These nations focus on high-tech military training programs, ensuring the readiness of personnel to face modern combat situations. Israel, for example, is a leader in developing and implementing cutting-edge simulation technologies, which is reinforced by its strategic partnerships and ongoing investment in defense innovation. These countries also have robust defense sectors, which further accelerate the adoption of military simulation and training solutions.

Market Segmentation

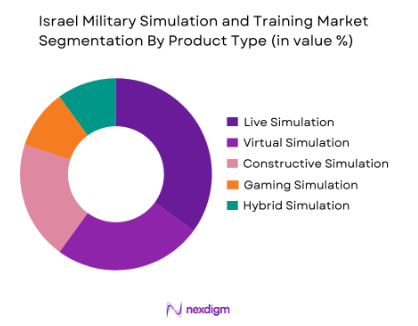

By Product Type

The military simulation and training market is segmented by product type into live simulation, virtual simulation, constructive simulation, gaming simulation, and hybrid simulation. Among these, the live simulation segment holds a dominant market share, driven by the increasing preference for real-world training environments that provide highly immersive and interactive experiences. This sub-segment has garnered significant investment due to its effectiveness in mimicking real-life combat scenarios, allowing military personnel to engage in practical, hands-on training. The continuous advancements in technology, including real-time feedback mechanisms and enhanced realism, contribute to the growing demand for live simulation systems in the market.

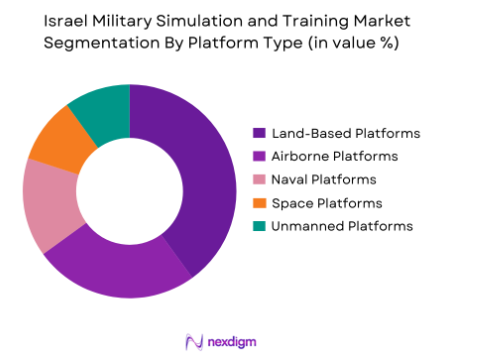

By Platform Type

The market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, space platforms, and unmanned platforms. The land-based platforms sub-segment holds the largest share of the market due to the diverse range of training applications across various terrains and environments. These platforms are widely used for training soldiers in a variety of combat scenarios, from urban warfare to combat in rugged terrains. As these platforms allow for the highest level of customization and flexibility, they are the most adopted by defense forces globally.

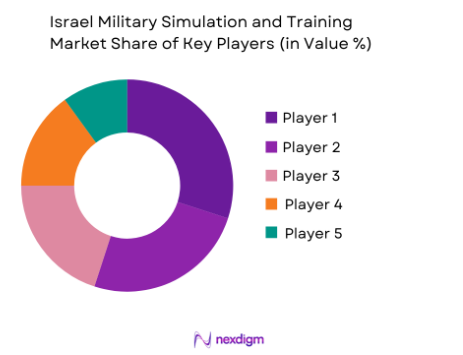

Competitive Landscape

The military simulation and training market is highly competitive, characterized by significant consolidation and the dominance of major players in the defense industry. Key players are focusing on the development of next-generation simulation technologies that integrate AI, virtual reality, and data analytics to enhance training experiences. These players are also expanding their product portfolios to meet the increasing demand for more sophisticated and immersive simulation systems. Strategic mergers, acquisitions, and partnerships are prevalent in the market, enabling companies to leverage each other’s technological expertise and strengthen their market position.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Elbit Systems | 1966 | Haifa, Israel | Virtual Reality, AI | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | AI, Autonomous Systems | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | Simulation Systems | ~ | ~ | ~ | ~ |

| Simlat | 2001 | Israel | Simulation Solutions | ~ | ~ | ~ | ~ |

| MIND Technologies | 1996 | Herzliya, Israel | VR, Augmented Reality | ~ | ~ | ~ | ~ |

Israel Military Simulation and Training Market Analysis

Growth Drivers

Increasing Adoption of Virtual Reality in Training

Virtual reality (VR) has become a key driver of growth in the military simulation and training market. VR enables realistic and immersive training experiences without the need for physical assets or real-world risks, making it an ideal solution for combat readiness training. Military forces globally are adopting VR to create highly detailed, scenario-based environments where soldiers can practice complex operations, such as urban warfare or high-intensity combat, in a safe and controlled setting. This adoption is spurred by the need to reduce costs associated with traditional training methods while ensuring a high level of realism. Furthermore, the ongoing development of VR technologies, including improvements in hardware and software, continues to enhance the effectiveness of these systems in preparing military personnel for combat scenarios.

Technological Advancements in Training Simulation

Technological advancements in simulation systems have driven significant growth in the military training market. The integration of artificial intelligence (AI), machine learning, and real-time data analytics has enhanced the capabilities of military simulators, making them more interactive, adaptive, and effective in training scenarios. These technologies enable military forces to create dynamic training environments that adjust to real-time actions, providing soldiers with a more realistic and challenging experience. Furthermore, AI-driven simulators can assess a soldier’s performance, provide instant feedback, and adapt scenarios based on their skill level, helping to optimize the training process. The continued innovation in simulation technologies ensures that military training remains effective in preparing personnel for modern warfare.

Market Challenges

High Development and Maintenance Costs

One of the significant challenges in the military simulation and training market is the high cost of developing and maintaining advanced simulation systems. The integration of cutting-edge technologies, such as VR, AI, and high-fidelity simulation software, requires significant investments in both hardware and software. Additionally, maintaining and upgrading these systems to keep up with technological advancements can add further financial strain. This can make it difficult for smaller defense forces or countries with limited defense budgets to invest in these training solutions. The high initial costs associated with these systems can deter some military organizations from adopting them, despite their long-term benefits in terms of cost savings and improved training outcomes.

Regulatory Hurdles and Compliance Issues

Military training simulators are subject to stringent regulations and compliance standards, which can vary across countries and regions. These regulatory hurdles can significantly delay the development and deployment of simulation systems. Military organizations must adhere to these regulations to ensure that their training systems meet the required safety and operational standards. This process can involve extensive testing, certification, and ongoing compliance checks, which add time and cost to the implementation of new training technologies. Moreover, as technologies evolve, ensuring that simulators continue to meet the latest regulatory requirements can be a complex and costly process.

Opportunities

Growing Demand for Simulation in Homeland Security

As nations continue to face a wide range of security threats, the demand for military simulation and training systems is extending beyond traditional defense applications. Homeland security agencies are increasingly adopting simulation technologies to prepare for domestic threats such as terrorism, cyber-attacks, and natural disasters. These agencies require high-level training to respond quickly and effectively to emergencies, and simulation systems provide a safe and efficient way to rehearse different scenarios. The growing recognition of the need for enhanced homeland security capabilities is creating significant opportunities for military simulation providers to expand their customer base and diversify their product offerings.

Rise of Autonomous Systems in Training

The increasing use of autonomous systems in defense operations is creating a new area of opportunity in the military simulation market. Training systems that simulate the operation of unmanned aerial vehicles (UAVs), autonomous ground vehicles, and other robotic systems are becoming increasingly important as these technologies become more integral to modern warfare. Military forces are adopting these systems to train personnel in operating and maintaining autonomous technologies, which are expected to play a larger role in combat operations in the future. The rise of autonomous systems is opening up new revenue streams for simulation providers as they develop specialized training solutions for these emerging technologies.

Future Outlook

The future of the military simulation and training market looks promising, with expected advancements in technology and increased defense spending driving demand. Over the next five years, we can anticipate a growth in the adoption of immersive technologies such as augmented reality and virtual reality. Regulatory support for enhanced training programs, coupled with rising security concerns, will further propel the market. The demand for more cost-effective, adaptive, and realistic training solutions will continue to drive technological innovation, particularly in AI, robotics, and autonomous systems, solidifying the role of simulation systems in modern military strategies.

Major Players

- Elbit Systems

- Israel Aerospace Industries (IAI)

- Rafael Advanced Defense Systems

- Simlat

- MIND Technologies

- Leonardo

- Saab

- Boeing

- Northrop Grumman

- Lockheed Martin

- Thales Group

- BAE Systems

- CAE Inc.

- L3Harris Technologies

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace companies

- Homeland security agencies

- Research and development institutions

- Technology developers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical factors affecting the military simulation and training market, including technological trends, market drivers, and regulatory influences.

Step 2: Market Analysis and Construction

The market is analysed using historical data, current market conditions, and expert opinions to develop a comprehensive market model and forecast.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated by consulting with industry experts, stakeholders, and end-users to ensure the accuracy and relevance of the market analysis.

Step 4: Research Synthesis and Final Output

The final market report is synthesized, combining the insights gathered from various sources to provide a detailed, actionable market overview and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for advanced military training solutions

Increase in defense spending by Israel and regional countries

Technological advancements in simulation and virtual reality - Market Challenges

High cost of simulation systems

Integration of legacy systems with new technologies

Regulatory and compliance challenges in military procurement - Market Opportunities

Increased adoption of simulation for homeland security

Growing market for unmanned vehicle training solutions

Development of more cost-effective training simulators - Trends

Rise in the use of artificial intelligence in military simulations

Advancements in immersive technologies for training

Integration of cloud-based platforms in military training programs

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Live Simulation

Virtual Simulation

Constructive Simulation

Gaming Simulation

Hybrid Simulation - By Platform Type (In Value%)

Land-Based Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Unmanned Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Defense Contractors

Research Institutions - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Retailers

Government Contracts

Third-Party Vendors

- Market Share Analysis

- Cross Comparison Parameters (Market Penetration, Technology Adoption, Pricing Strategies, Product Offerings, Distribution Channels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Simlat

MIND Technologies

MAGAL Security Systems

VR Simulation Ltd.

Tadiran Group

Aeronautics Ltd.

Israel Military Industries

Daronmont Technologies

Novatron Systems

Elsecure

T-Systems International

SimiGon

- Growing reliance on simulations for strategic defense training

- Shift towards more realistic virtual and hybrid training solutions

- Rising use of simulations for multi-domain operations

- Expanding adoption of simulation technologies by defense contractors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035