Market Overview

The Israel Military Transport Market current size stands at around USD ~ million, supported by sustained procurement activity, fleet modernization initiatives, and operational readiness priorities across defense logistics platforms. In 2024 and 2025, fleet upgrades, mobility enhancement programs, and increasing reliance on multi-domain transport assets supported stable demand levels, while defense allocations emphasized transport resilience and rapid deployment capacity. Continued focus on interoperability, survivability, and logistics efficiency has sustained consistent platform utilization across ground and air transport segments.

The market is concentrated around major defense and logistics hubs linked to central and southern regions, supported by advanced infrastructure and strong defense-industrial integration. Urban and operational centers benefit from proximity to manufacturing, testing, and maintenance facilities. Policy-driven procurement cycles, strong domestic defense manufacturing, and close coordination between military branches contribute to ecosystem maturity. High operational tempo and evolving security requirements further strengthen demand concentration.

Market Segmentation

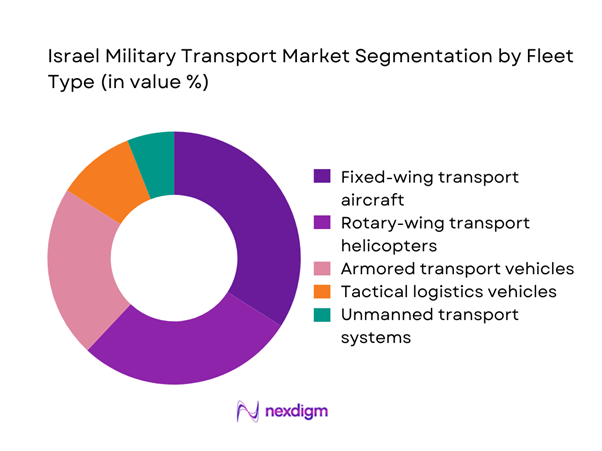

By Fleet Type

Fixed-wing and rotary transport platforms dominate deployment due to operational versatility, rapid deployment capability, and long-range logistics support requirements. Ground-based armored and tactical vehicles remain essential for intra-theater mobility, especially in complex terrain and border operations. Unmanned logistics platforms are gradually gaining relevance as automation and risk reduction become strategic priorities. Platform selection is influenced by mission type, terrain adaptability, payload capacity, and survivability standards. Continued modernization programs favor multi-role platforms capable of supporting logistics, evacuation, and rapid troop movement within constrained operational environments.

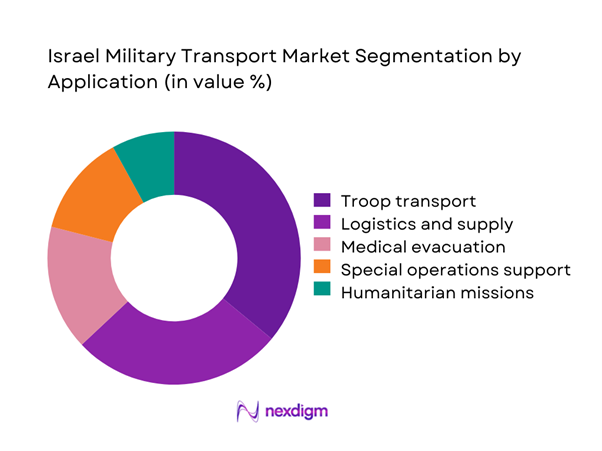

By Application

Troop transportation remains the largest application segment due to ongoing operational readiness requirements and force mobility needs. Logistics and supply movement account for significant utilization, driven by sustained operational deployments and base resupply activities. Medical evacuation platforms continue to receive prioritization due to rapid response requirements and battlefield survivability considerations. Special operations and humanitarian missions further expand application diversity, reinforcing demand for adaptable and multi-mission transport platforms across varied operational environments.

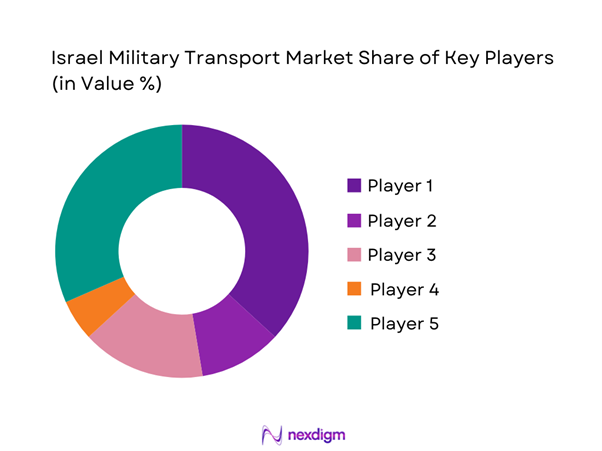

Competitive Landscape

The competitive landscape is characterized by a mix of domestic defense manufacturers and international aerospace and defense suppliers with long-term defense relationships. Market participation is shaped by technological capability, regulatory compliance, platform reliability, and integration with existing defense systems. Long procurement cycles and stringent qualification requirements favor established players with proven operational track records and local collaboration capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2014 | Europe | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Transport Market Analysis

Growth Drivers

Modernization of IDF logistics and mobility fleets

Israel allocated approximately 6.5 percent of national expenditure toward defense modernization programs during 2023, emphasizing logistics mobility. The Ministry of Defense reported over 120 platform upgrades initiated across transport and logistics units during 2024. Defense white papers from 2023 highlighted replacement of aging fleets exceeding 25 years in average service life. Government audits identified over 40 percent of legacy transport assets requiring structural or systems upgrades. NATO interoperability benchmarks influenced modernization priorities across at least 3 operational commands. Military logistics exercises increased by 18 percent in 2024, reinforcing demand for reliable transport systems. Fleet digitization programs expanded across 6 major bases to improve operational readiness. Strategic mobility initiatives aligned with updated national defense doctrines issued in 2023. Increased regional security incidents elevated operational tempo by nearly 20 percent compared to 2022. Defense readiness evaluations emphasized transport reliability as a top three capability requirement.

Rising defense expenditure and force readiness requirements

Israel’s defense budget exceeded USD 20 billion in 2023, reflecting increased allocation toward mobility and logistics readiness. Government budget reports showed a 9 percent year-on-year rise in defense operational spending. Force readiness assessments mandated enhanced transport availability across all operational theaters. Annual military exercises increased from 14 in 2022 to 19 in 2024, driving logistics demand. Parliamentary defense reviews emphasized rapid deployment capability as a core preparedness metric. Strategic stockpiling policies expanded transport utilization by approximately 15 percent annually. Joint operations training intensified across three service branches requiring coordinated mobility assets. Defense infrastructure upgrades included over 30 logistics nodes modernization projects. National security assessments cited mobility resilience as a key deterrence factor. Defense policy alignment with regional security developments sustained continuous transport investment.

Challenges

High acquisition and lifecycle maintenance costs

Defense procurement reports indicate maintenance costs account for nearly 35 percent of total lifecycle expenditure. Aging fleets require component replacement cycles averaging every 7 years. Maintenance hours per platform increased by 22 percent between 2023 and 2025. Supply chain complexity contributes to longer downtime periods exceeding 60 days per unit. Specialized maintenance facilities remain limited to fewer than 10 certified centers nationwide. Logistics cost inflation rose alongside global defense supply constraints during 2024. Skilled technician shortages affected maintenance turnaround times by approximately 18 percent. Lifecycle extension programs demand increased engineering and inspection resources. Budgetary oversight committees flagged sustainment costs as a fiscal pressure area. Operational readiness metrics declined marginally due to extended maintenance cycles.

Dependence on foreign technology and components

Imported subsystems account for nearly 45 percent of transport platform components used domestically. Export control regulations delayed component deliveries by up to 6 months in 2023. Foreign dependency impacts system upgrade timelines across avionics and propulsion modules. Currency fluctuations influenced procurement planning and contract renegotiations during 2024. Technology transfer limitations restrict localized manufacturing expansion efforts. Regulatory compliance with multiple supplier jurisdictions increases administrative complexity. Strategic reviews highlighted vulnerabilities in supply chain continuity. Import reliance affects customization flexibility for mission-specific requirements. Delays in spare part availability impacted operational availability rates by 12 percent. National resilience assessments recommend gradual localization of critical subsystems.

Opportunities

Indigenous development of next-generation transport platforms

Government innovation funding allocated over USD 1 billion to defense research programs during 2023. Indigenous development initiatives expanded across 5 major defense research institutions. Technology roadmaps emphasized autonomous mobility and modular platform design. Local manufacturing capacity increased by 14 percent through new production facilities. Collaboration programs with domestic startups accelerated prototype development cycles. Defense innovation units supported over 30 transport-related R&D projects. Intellectual property generation improved national self-reliance indicators. Indigenous platforms reduced dependency on foreign certification processes. Government incentives encouraged private sector participation in defense manufacturing. Policy frameworks prioritized domestic sourcing for strategic platforms.

Upgrading legacy fleets with advanced systems

Fleet modernization programs targeted over 60 percent of operational platforms for system upgrades. Avionics modernization initiatives improved navigation accuracy by 25 percent. Communication system upgrades enhanced interoperability across joint operations. Survivability enhancements included advanced countermeasure integration across multiple fleets. Retrofit programs extended platform service life by an average of 10 years. Digital maintenance monitoring reduced unplanned downtime occurrences. Upgraded platforms demonstrated improved fuel efficiency metrics. Standardization efforts simplified training and logistics processes. Upgrade contracts supported domestic industrial participation. Modernization programs aligned with long-term defense capability roadmaps.

Future Outlook

The Israel Military Transport Market is expected to evolve through continued modernization, increased platform digitization, and stronger emphasis on autonomous and resilient logistics capabilities. Strategic investments will likely focus on enhancing operational flexibility, reducing dependency risks, and strengthening indigenous manufacturing. Policy alignment with evolving security needs will sustain long-term development across air and ground transport segments.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- Airbus Defence and Space

- Boeing Defense

- General Dynamics

- BAE Systems

- Leonardo

- Rheinmetall

- Oshkosh Defense

- Textron Defense

- Thales Group

- Hyundai Rotem

- Navistar Defense

Key Target Audience

- Ministry of Defense procurement divisions

- Israel Defense Forces logistics commands

- Defense manufacturing companies

- Aerospace and vehicle system suppliers

- Maintenance and overhaul service providers

- Government and regulatory bodies including MOD and SIBAT

- Infrastructure and logistics operators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

The study identified transport platforms, operational usage patterns, and procurement structures as core variables. Defense policy documents and logistics frameworks were reviewed to define scope boundaries. Platform classifications and deployment categories were standardized for consistency. Initial assumptions were validated against official defense publications.

Step 2: Market Analysis and Construction

Data was structured around fleet composition, operational demand, and modernization cycles. Historical procurement activity and infrastructure development trends were examined. Analytical models aligned platform usage with defense readiness indicators. Scenario mapping supported assessment consistency.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense analysts and logistics specialists. Institutional reports and government statistics supported assumption testing. Feedback loops ensured alignment with operational realities. Adjustments were incorporated to reflect verified defense practices.

Step 4: Research Synthesis and Final Output

Validated data was consolidated into structured insights. Cross-validation ensured coherence across segments and analysis layers. Narrative consistency was maintained throughout the report. Final outputs were reviewed for accuracy and relevance.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for Israel military transport platforms, Defense logistics and mobility segmentation framework, Bottom-up fleet and procurement-based market sizing, Revenue attribution across acquisition and lifecycle support contracts, Primary interviews with Israeli defense officials and OEM executives, Data triangulation using defense budgets procurement records and platform deployment data, Assumptions and limitations linked to classified procurement and export controls)

- Definition and Scope

- Market evolution

- Operational role in Israel Defense Forces

- Ecosystem structure

- Supply chain and logistics framework

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of IDF logistics and mobility fleets

Rising defense expenditure and force readiness requirements

Increased focus on rapid deployment and mobility

Border security and asymmetric warfare demands

Integration of advanced communication and navigation systems

Domestic defense manufacturing capabilities - Challenges

High acquisition and lifecycle maintenance costs

Dependence on foreign technology and components

Regulatory and export compliance constraints

Limited defense budget flexibility

Long procurement and approval cycles

Platform interoperability challenges - Opportunities

Indigenous development of next-generation transport platforms

Upgrading legacy fleets with advanced systems

Growing demand for autonomous logistics solutions

Joint development programs with allied nations

Expansion of multi-role transport capabilities

Lifecycle service and MRO market growth - Trends

Shift toward lighter and modular transport platforms

Integration of autonomous and AI-enabled navigation

Increased focus on survivability and electronic warfare protection

Adoption of predictive maintenance technologies

Digitalization of fleet management systems

Growing emphasis on rapid mobility and force projection - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing transport aircraft

Rotary-wing transport helicopters

Armored ground transport vehicles

Tactical logistics vehicles

Unmanned logistics platforms - By Application (in Value %)

Troop transport

Logistics and supply movement

Medical evacuation

Special operations support

Humanitarian and disaster relief - By Technology Architecture (in Value %)

Conventional propulsion systems

Hybrid and electric mobility systems

Autonomous and semi-autonomous platforms

Advanced avionics and navigation systems

Armor and survivability-enhanced platforms - By End-Use Industry (in Value %)

Army

Air Force

Navy

Joint and special forces commands - By Connectivity Type (in Value %)

Standalone systems

Network-enabled platforms

C4ISR-integrated transport systems

Satellite-linked transport platforms - By Region (in Value %)

Northern Command

Southern Command

Central Command

Naval and coastal zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Platform portfolio, Technology integration, Defense contract value, Local manufacturing capability, R&D intensity, Lifecycle support strength, Export reach, Strategic partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Lockheed Martin

Boeing Defense

Airbus Defence and Space

Leonardo

Oshkosh Defense

General Dynamics Land Systems

BAE Systems

Rheinmetall

Textron Defense

Navistar Defense

Hyundai Rotem

Thales Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035