Market Overview

The Israel military transport market is valued at approximately USD ~ billion in 2025, driven by the country’s commitment to upgrading its defense systems and ensuring regional dominance. This market is primarily supported by Israel’s defense budget, which stands at USD ~ billion in 2024, accounting for 5.1% of its GDP. The market is further fueled by Israel’s strategic needs, including the modernization of its fleet of military transport aircraft and the integration of advanced technologies. The country’s geopolitical location and the focus on maintaining defense capabilities in response to regional conflicts play a pivotal role in the steady demand for transport solutions.

Israel dominates the military transport market due to its robust defense sector, cutting-edge aerospace capabilities, and strategic position in the Middle East. Major cities like Tel Aviv and Haifa are home to advanced military manufacturers, such as Israel Aerospace Industries (IAI) and Elbit Systems, which are key players in the market. Israel’s strong defense alliances, particularly with the United States, further strengthen its position in the global defense market. The country’s focus on self-reliance in defense technology and its ability to produce both tactical and strategic military transport solutions ensure its dominance.

Market Segmentation

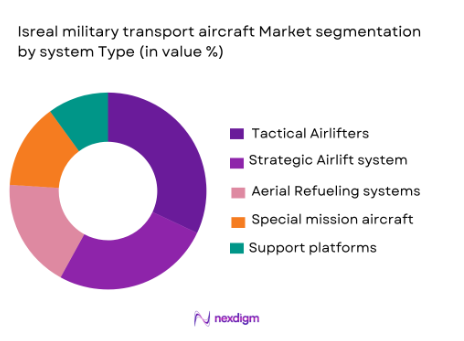

By System Type

The Israel military transport market is segmented by system type into tactical airlifters, strategic airlift systems, aerial refueling systems, special mission aircraft, and support platforms. Among these, tactical airlifters hold the dominant market share. The Lockheed Martin C-130 Hercules remains a critical platform in Israel’s airlift capabilities, allowing for flexible rapid deployments and humanitarian missions. The high demand for this system stems from its versatility in supporting Israel’s defense strategies, including logistics, airborne operations, and rapid troop movement, enhancing its position as the dominant system type.

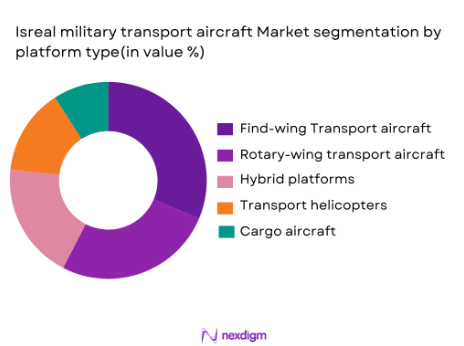

By Platform Type

The market is also segmented by platform type, including fixed-wing transport aircraft, rotary-wing transport aircraft, hybrid platforms, transport helicopters, and cargo aircraft. Fixed-wing transport aircraft, particularly the C-130 Hercules and Boeing KC-135 Stratotanker, dominate the market, providing Israel with the capacity for long-range operations, rapid deployment, and re-supply missions. These platforms are integral to Israel’s defense strategy, offering the necessary range, load-carrying capacity, and durability for complex military operations in challenging environments.

Competitive Landscape

The Israel military transport market is characterized by the presence of a few key players, including local companies and global defense manufacturers. Israel’s strong defense industry, led by entities like Israel Aerospace Industries (IAI) and Elbit Systems, ensures a high level of competition in the market. These companies are leaders in the development and production of advanced transport aircraft, both for local defense requirements and for export to allied countries.

| Company Name | Establishment Year | Headquarters | Military Transport Expertise | Export Orientation | Platform Integration | R&D Investment | Certification |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv | – | – | – | – | – |

| Elbit Systems | 1966 | Haifa | – | – | – | – | – |

| Lockheed Martin | 1912 | Bethesda | – | – | – | – | – |

| Boeing | 1916 | Chicago | – | – | – | – | – |

| Airbus | 1970 | Toulouse | – | – | – | – | – |

Israel Military Transport Market Dynamics

Growth Drivers

Increased military spending and defense modernization initiatives

Israel’s military expenditure climbed to USD ~ billion in 2025, up from USD ~ billion in 2024, reflecting the steepest annual increase since 1967 according to SIPRI data. This surge in defense outlay directly supports modernization of transport fleets, including tactical and strategic airlift platforms, logistics support, and sustainment infrastructure required for the Israel Defense Forces. Higher defense budgets also facilitate acquisition of integrated mission systems and secure communications suites for transport aircraft. Defense export activity, which reached USD ~ billion in 2025, further underwrites ongoing investment into in‑country military aviation capabilities. This macro growth in defense spending and export performance signals robust capital available for upgrading transport aircraft, support avionics, and logistics networks required for strategic mobility.

Expansion of regional operational capabilities and alliances

Israel’s geopolitical environment and security commitments have driven expanded operational reach and alliance coordination, necessitating enhanced transport aircraft capabilities. In 2024, Israel set a record USD ~ billion in defense exports, with Europe accounting for the majority of contracts, illustrating deepening military partnerships and interoperability requirements that extend to transport and logistics platforms. The broader Middle East military expenditure landscape reached USD ~ billion, indicating regional emphasis on mobility and force projection. As alliance exercises, joint logistics missions, and multinational contingencies increase, Israel’s military transport market benefits from investment in upgraded airlift, in‑flight refueling adaptations, tactical transport variants, and associated support systems. These expanded alliances and operational commitments manifest in procurement demand for platforms capable of long‑distance redeployment and integrated coalition operations.

Market Challenges

Regulatory barriers to foreign equipment procurement

Transport aircraft acquisitions in Israel are influenced by stringent export control and end‑use regulations from partner nations, particularly the United States, which supplies many base aircraft types used by the Israel Defense Forces. U.S. International Traffic in Arms Regulations (ITAR) constrain how foreign military sales can be structured, often requiring additional certification steps and compliance documentation before systems can be delivered or modified. These regulatory hurdles extend to avionics, secure communications, and mission systems that are integrated into transport platforms, slowing procurement timelines and increasing administrative overhead across legislative and defense export control agencies. For example, complex approvals are required for each export license when incorporating U.S.‑origin components into Israeli modified airframes, lengthening cycle times and elevating compliance costs. These regulatory constraints challenge fleet modernization and sustainment schedules in a market where rapid readiness is strategically prioritized.

Complex integration of advanced mission systems

Military transport aircraft in Israel increasingly require integration of sophisticated mission systems, including secure tactical communications, defensive aids, and advanced avionics suites tailored to regional threat environments. Integrating these systems creates technical complexity that requires extended certification and interoperability testing. Each new integrated subsystem must meet stringent defense standards, ensuring compatibility with existing ISR (intelligence, surveillance, reconnaissance) and command networks. The engineering hours and verification cycles for integrating assorted sensor, navigation, and defensive technologies add to development timeframes and extend aircraft modification schedules. This complexity can slow retrofit programs on legacy airframes and delay entry into service for upgraded transport platforms, constraining operational deployment force readiness.

Market Opportunities

Localization of aircraft production and service capabilities

Israel’s robust defense industrial base, which contributed to a record USD ~ billion in defense exports in 2025, offers an opportunity to localize maintenance, modification, and assembly capabilities for military transport assets. Leveraging existing aerospace firms such as Israel Aerospace Industries and Elbit Systems, the country can expand in‑country depot‑level sustainment and system integration for tactical airlifters and strategic transports. Localization reduces dependence on foreign maintenance facilities, shortens turnaround times, and builds domestic technical capacity. Israel’s aerospace manufacturing sector also benefits from macroeconomic conditions manufacturing value added was a notable share of output in 2024 creating a skilled engineering workforce capable of servicing complex aircraft systems. Enhancing local production and service capabilities will support long‑term fleet readiness and reduce lifecycle support costs.

Technological advancements in hybrid and UAV transport platforms

Emerging technologies in hybrid propulsion and unmanned logistics aircraft present opportunities to augment traditional military transport fleets in Israel. While conventional fixed‑wing aircraft remain core to force mobility, defense research and development increasingly explores hybrid electric propulsion and autonomous logistics UAVs to complement manned platforms for supply missions. Israel’s advanced defense technology ecosystem—evidenced by high defense exports and strong aerospace engineering capacity—positions it to pilot integrate such innovations into existing transport paradigms. As satellite communications and autonomous control systems mature, hybrid and unmanned logistics platforms can reduce operating costs for low‑risk resupply tasks and extend reach beyond conventional airfields. Israeli defense technology companies are well placed to collaborate on such platforms, addressing future operational requirements while leveraging high‑value tech exports.

Future Outlook

Over the next decade, the Israel military transport market is expected to witness steady growth driven by advancements in technology, geopolitical factors, and increasing defense budgets. Israel’s investment in modernizing its military transport aircraft fleet, including the integration of next-generation systems like unmanned aerial vehicles (UAVs) for logistical support, is expected to shape the future of the market. Additionally, ongoing partnerships with key defense allies and the strategic need for rapid deployment capabilities will ensure that Israel remains at the forefront of military transport innovations.

Major Players in the Israel Military Transport Market

- Israel Aerospace Industries

- Elbit Systems

- Lockheed Martin

- Boeing

- Airbus

- Northrop Grumman

- Raytheon Technologies

- Thales Group

- Leonardo

- Saab Group

- General Dynamics

- Sikorsky Aircraft

- Textron Aviation

- Bell Helicopter

- Embraer

Key Target Audience

- Investments and Venture Capitalist Firms

- Israel Ministry of Defense

- Israel Aerospace Industries

- Israel Defense Forces

- U.S. Department of Defense

- Government and regulatory bodies

- Aerospace Manufacturers

- International Defense Alliances

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key drivers of the Israel Military Transport market, focusing on defense expenditure, fleet modernization, and geopolitical factors that influence demand. This step includes extensive desk research and analysis of defense budgets and military strategic objectives.

Step 2: Market Analysis and Construction

Data from government publications and defense sector reports will be analyzed to quantify market size and segmentation. This includes evaluating the production, procurement, and operational patterns of military transport systems, with special emphasis on platform types, system tiers, and procurement strategies.

Step 3: Hypothesis Validation and Expert Consultation

Insights from interviews with defense experts, military manufacturers, and procurement officers will help validate hypotheses around future growth drivers, technological integration, and operational requirements. Expert consultations will refine the understanding of market dynamics and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the gathered data into a comprehensive market report, with feedback from military entities and key manufacturers helping to corroborate the findings. Data will be cross-verified with current market trends and expert consultations to ensure robust conclusions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased military spending and defense modernization initiatives

Expansion of regional operational capabilities and alliances

Demand for enhanced mobility and rapid deployment readiness - Market Challenges

Regulatory barriers to foreign equipment procurement

Complex integration of advanced mission systems

High operational and maintenance costs for specialized transport fleets - Market Opportunities

Localization of aircraft production and service capabilities

Technological advancements in hybrid and UAV transport platforms

Increased reliance on military airlift for humanitarian and peacekeeping missions - Trends

Shift toward multi-role and adaptable transport platforms

Integration of advanced avionics and defensive systems

Growing collaboration in joint multinational defense operations

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Tactical Airlifters

Strategic Airlift Systems

Aerial Refueling Systems

Special Mission Aircraft

Support Platforms - By Platform Type (In Value%)

Fixed-Wing Transport Aircraft

Rotary-Wing Transport Aircraft

Hybrid Platforms

Transport Helicopters

Cargo Aircraft - By Fitment Type (In Value%)

New Platform Procurement

Retrofit and Modernization

Upgraded Platforms

Standard Systems

Mission-Specific Systems - By End User Segment (In Value%)

National Defense Forces

Foreign Military Sales

International Partnerships

Aerospace Manufacturers

Civil Aviation Support - By Procurement Channel (In Value%)

Direct Government Procurement

OEM Partnerships

International Defense Alliances

Local Manufacturing Channels

Third-Party Integration

- Market Share Analysis

- Cross Comparison Parameters (Aircraft Performance, Military Budget Allocation, Technology Integration, Regional Partnerships, Manufacturing Capacity)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Lockheed Martin

Boeing

Airbus

General Dynamics

Northrop Grumman

Thales Group

Leonardo

Sikorsky Aircraft

Textron Aviation

Bell Helicopter

Saab Group

Boeing Defense

- National Defense Forces demand for expanded airlift capabilities

- International demand through military export programs

- Collaborations with foreign defense forces for joint transport solutions

- Rise of multi-national peacekeeping and humanitarian missions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035